All Activity

- Past hour

-

Trying to stay on course, Bloomberg had an interesting article on Canadians buying Canadian. I think the same thing is happening in Europe to a lesser degree. Tesla is the most obvious 'franchise' as risk. A lot of my neighbours in Denmark drive Tesla. I don't think anyone would buy one today given Elon. I wonder if this is what finally breaks Teslas' share price. It seems to me like he's alienating his very customer base while appealing to a lot of folks who probably prefer their gas guzzlers. At the same time, there are finally plenty of good alternatives. Something like Starbucks at 40x earnings and -4% SSS could be at risk as well - there are good coffee alternatives most places in the world today. It's iconic American brand which would be easy to boycott in Canada and Europe. And then you might have increased consumer weakness in the US if tariffs increases inflation and DOGE leads to meaningful layoffs.

-

I Need a Laugh. Tell me a Joke. Keep em PC.

crs223 replied to doughishere's topic in General Discussion

- Today

-

What about this idea: Suppose you are like me, who’s already 75% net-worth invested in brk. One could sell 100 shares of Brk atm put with strike $500 and 1 year expiration, and pocket about $2000-2500 put premium. At the same time you put $50000 in Tbills earning 4%. One year later, if Brk is higher than current price. You have earned 8% (2000+ 2000/50k). If Brk is lower, you will spend the 50k to buy Brk stocks. HOWEVER, you can sell these stocks immediately if you want - you will lose some money but since you already have a huge BrK existing holdings that has already appreciated a lot, it’s probably not a big deal to feel bad about. You can also keep the stock of course. It could also be better to sell the two years put. The amount of the puts to sell can be capped at 10% of your existing brk shares (so you will increase your brk shares in portfolio by 10% if brk dont go up any in two years) What u guys think?

-

In the US, Coinbase is the most convenient for new ones. Outside of US, it's Binance. Both Coinbase/Binance are Centralize Exchange. Try Uniswap if you want to exp with Decentralize Exchange. https://apps.apple.com/us/app/uniswap-crypto-nft-wallet/id6443944476

-

I Need a Laugh. Tell me a Joke. Keep em PC.

DooDiligence replied to doughishere's topic in General Discussion

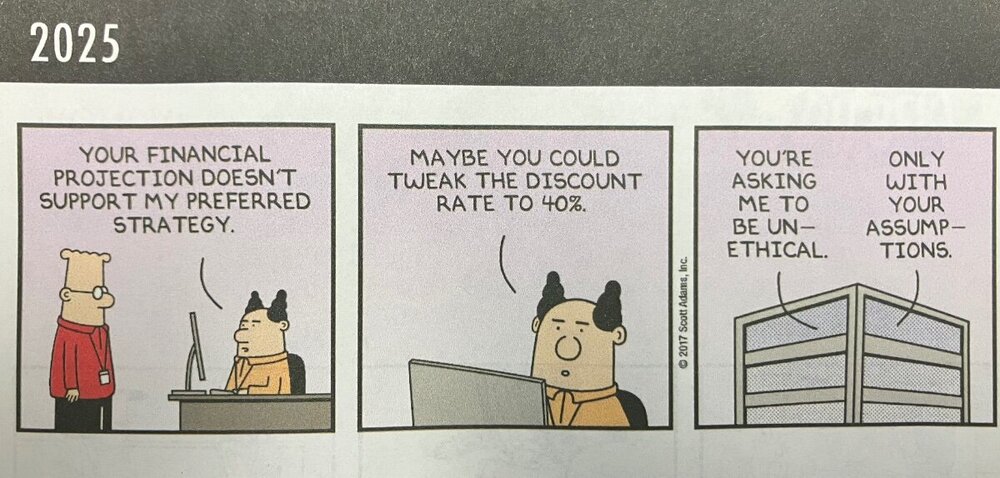

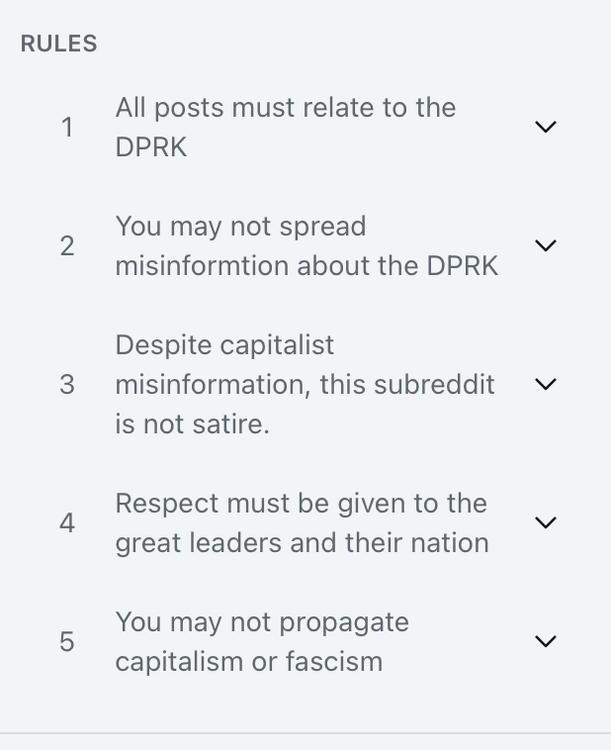

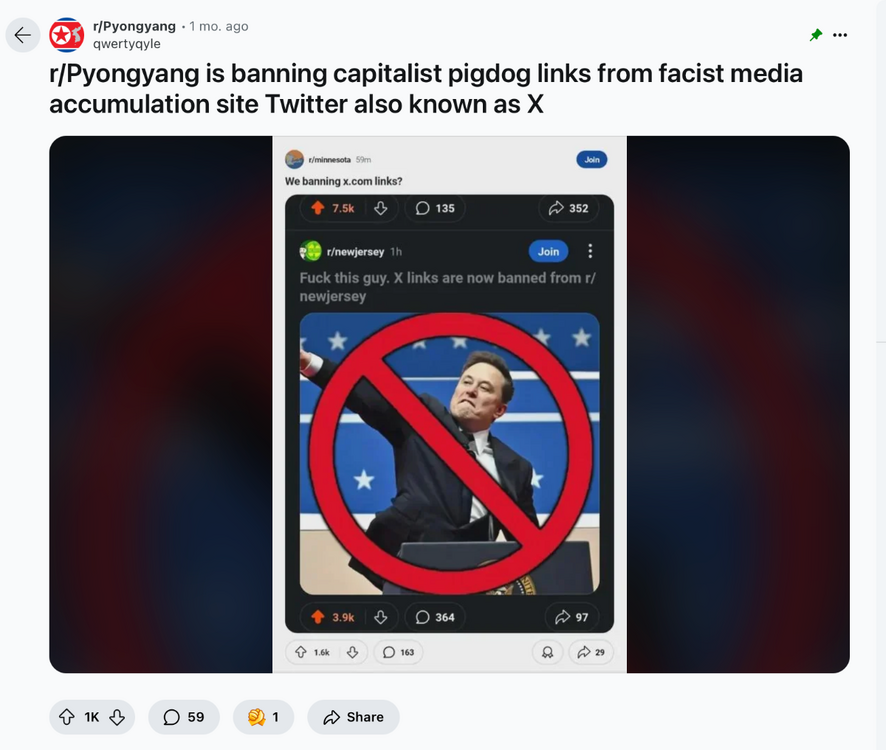

Somebody hipped me up to this sub r/pyongyang (not gonna do an actual link here 'cause I'm not sure we'd want anyone backtracking it) and at first glance I thought it was satire. Then I read Rule #3 and damn near passed an entire grilled cheese sandwich through my nose. This is one of the headline posts: Pyongyang says, "I fart in your general direction" edit: I know this may be a slippery slope and I hope this post is not viewed as political because I don't think it is, and it's definitely not intended to stir up shit. I don't care who you are this is just straight up funny. Delete it if it ain't kosher, or tell me and I will. -

This is really important, and I was thinking exactly that on my dog-walk this morning. For them to forward forecast 15% returns on Tangible Book, they must be pretty confident in something a little higher. Also means there was no skeleton’s in Hellenic’s closet. Well played Eurobank team.

-

Lets reframe this a little. The rhetoric you get is how they want to save 60m, 6b, 60b. So far they've wasted way more than 6m (i think it is closer to 60m) sending the dumb give me 5 points email. The actual savings have yet to be demonstrated. Oh and courts rules that the govt now might need to bring all the people thru fired and most likely with back pay. The govt is losing qualified people some of whom will fond employment in provate industry domestic or foreign. Some leadership.

-

He would be a billionaire in rupees or pesos, right?

-

I'm excited about this new opportunity. How do I buy some?

-

From Stripe Annual Report: Stablecoins: Room-temperature superconductors for financial services. Stablecoins have four important properties relative to the status quo. They make money movement cheaper, they make money movement faster, they are decentralized and open-access (and thus globally available from day one), and they are programmable. Everything interesting follows from these characteristics. https://assets.stripeassets.com/fzn2n1nzq965/2pt3yIHthraqR1KwXgr98U/df10795aac0205789956c89e0dfc4f1a/Stripe-annual-letter-2024.pdf

-

Hi, tks for asking. I hold many assets: equity, real estate, crypto assets... For crypto, Yes. I'm a big proponent of Ethereum Ecosystem. Why do I post all those information about Crypto and Ethereum? To Pump ETH? That's not a realistic goal for me. I share those info because: 1. That's a good way for me to learn faster, deeper about Crypto and Ethereum which is very new topic. 2. To invalidate my bias about Ethereum. I need counter arguments about why Ethereum is bad. 3. To spread correct information(imo) about Crypto and Ethereum. In my view, Ethereum culture deserve better understanding: inclusive, liberty, economic freedom, real world application, tech innovation... After Bitcoin, all crypto innovations like Stablecoin, DeFi, NFT come from Ethereum. Yet, many people think XRP is best long term Blockchain Tech. I think that is kind of disinformation for many users. I should note that there are many investing opportunities in Ethereum Ecosystem beside ETH coin. For example: - Get high yield by farming stablecoin USDC, USDT... - Maker Token: Stablecoin issuer. - UNI Token: Decentralize Exchange (NASDAQ onchain). - AAVE/Morpho Token: Lending Platform. - GMX: Perp Trading Platform. ... All those tokens have revenue, many have positive cash flow, some have dividend or buy back. You can even apply many other classic strategies from Warren Buffett like Arbitrage, Liquidation... from time to time in Crypto. But most of the time, the main strategy is very similar to venture investing.

-

Well played Brits A second state visit invitation by HRM Someone should tell Trump that Charles III is also head of state of Canada.

-

Yup, all the man is trying to do is answer one question: "What the hell happened to the money?"

-

@nwoodman , I agree... what an exceptional year. Its interesting... over a 12 month period (July 2024 to July 2025), Eurobank will have 'provided' Fairfax with about $450 million in proceeds ($250 million in dividends and $200 million from sale of shares - rough math). Fairfax's equity investments are increasingly becoming significant sources of cash for Fairfax. That is an important development. The Eurobank management team is best-in-class. One of the things I really like is they underpromise and over-deliver. Below is the slide for 2024. The middle column is what they promised at the start of the year. The column to the right is what they delivered. https://www.eurobankholdings.gr/-/media/holding/omilos/enimerosi-ependuton/enimerosi-metoxon-eurobank/oikonomika-apotelesmata-part-01/2025/fy-2024/4q2024-results-presentation.pdf

-

I’m just happy the conversation is around whether they’ve cut $60m, $6b or $60b. I much prefer this conversation vs the usual: “we spent more money on this project than any government has ever spent before.”

-

Marc Adee is one of those fantastic CEO’s who you have never heard of. Extremely intelligent and a real quiet leader. He joined C&F when it was basically dead and navigated through years of adverse development to finally get back to operating at a CR less than 100. Once he successfully got the underwriting back under control, he has turned his attention to raising the profile of C&F and letting people know what a great company and great place to work it is. Well done Marc! Fairfax is lucky to have him at the helm of C&F

- Yesterday

-

+1 I'm reminded of Michael Lewis' description of Germany's civil servants: He is a type familiar in Germany but absolutely freakish in Greece—or for that matter the United States: a keenly intelligent, highly ambitious civil servant who has no other desire but to serve his country. His sparkling curriculum vitae is missing a line that would be found on the résumés of men in his position most anywhere else in the world—the line where he leaves government service for Goldman Sachs to cash out. When I asked another prominent German civil servant why he hadn’t taken time out of public service to make his fortune working for some bank, the way every American civil servant who is anywhere near finance seems to want to do, his expression changed to alarm. “But I could never do this,” he said. “It would be illoyal!” https://www.vanityfair.com/news/2011/09/europe-201109#gotopage1 Those better men didn't protect them from the GFC. Instead: I do not believe that the solution to our problem is simply to elect the right people. The important thing is to establish a political climate of opinion which will make it politically profitable for the wrong people to do the right thing. Unless it is politically profitable for the wrong people to do the right thing, the right people will not do the right thing either, or it they try, they will shortly be out of office. ― Milton Friedman Change the assumption that nothing can be done about government waste and fraud and politicians will do something about it.

-

I got lucky when I bought EW LEAP's after taking an equity position in 2012. The company was battling Medtronic over TAVR patent infringement. Edward's prevailed and was set up to win more cases, which they did. The price of the stock shot up and I made out like a bandit on the LEAPS. I tried to recreate this with Alcoa and another one that I can't remember and lost on both attempts. I won't say never again but I am more cautious now. Been tempted to try this a few times and thankfully passed. TBF, I'm simply not good at predicting directional moves.

-

Interview with C&F CEO: https://www.insuranceinsider.com/article/2eh1w9cjvqzlvuewo2upt/insider-on-air/crum-forster-a-cautionary-tale-and-a-redemption-story-adee?zephr_sso_ott=5JWMyr Imagine living thru' a period of 200CR!

-

I don’t know about beating SP, but I do assume it’s viable. My friend “FIRE” for close to 7 years now, and he’s being doing options to sustain his retirement. He shared some strategies but while I don’t mind boosting my performance, it’s just too much for me. Plus I do assume being better at buy and hold would lead to better performance over time. I did ask him to manage some money with his strategy but he declined. Among reason was that sizing makes a difference for what he does. Not sure of his overall performance but I assume not bad because … even with FIRE he’s not cheap when we hang out and picks up a fair share of the tab.

-

At least interesting to us, if one does the naked - heads down - analysis, Eric [ @cwericb ], Extremely hard to discuss anything if one apriori is met by insults, name calling, deragoratory, foul and condescending language from a - the major - reprsenentative - of the United States of America. - - - o 0 o - - - There exist so many forms for opening discussions about things and for change in a construtuctive way.

-

I recall coming across that book - I'm sure many of the respective theories overlap. This issue is far too elaborate for this forum but I'd be glad to discuss by DM if you wish. I've been using options professionally for decades but not all in the traditional sense.

-

When i worked at an option market making desk at credit suisse (now long gone, hahaha), this is the book i was asked to read: Option Volatility and Pricing: Advanced Trading Strategies and Techniques, 2nd Edition https://a.co/d/4uNGXPC

-

Like I said - you are totally disingenuous @cwericb All this was so easy to find, it took me about 3 minutes - mainly because it happened over and over. But keep pretending it never happened. Anyway - I am moving this conversation to other threads, to obey Parsad's ban on politics. But keep playing the perpetual victim and hating the United States. It's not a good look.