BG2008

Member-

Posts

3,039 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Events

Everything posted by BG2008

-

In the dense urban areas, warehouse traditional has the "flour" that multi-family developers turn into "bread" So in cities in NYC, SF, and SoCal, warehouse and warehouse land is actually being depleted. That's why urban warehouses trade for, gasp, 2.5% cap rate. I know that's crazy. But if you have 4% cap upon lease renewal in a market with supply depleting, it may not be all that crazy. Add in the fact that warehouses have much lower cap ex than MF and Offices, more of the NOI dollars goes to the owner. In regions like LeHigh Valley where it seems like there are land everywhere, the bottleneck is on the local residents hesitancy on having 18 wheelers throttling their 2 lane roads. Sure the jobs are good and pay more than retail or fast food, but many of the people in these communities want a nice pleasant farming community. As more warehouses get built and the road capacities start to suffer and traffic start to appear, there will be more oppositions against new supply. Ranking NIMBYism, it goes something like this Chemical Plants > Waste Management > Rock Quarries > Prison > Self Storage > Warehouses > Affordable Housing > Offices, retail, apartments > parks and amenities The order goes from least desirable to most desirable NIMBYism score is one of the top 5 analysis that I do when analyzing a real asset investment

-

After deal close Yes. I think IFF was held down because of the RMT transaction in 2020 as some people were likely long DD and short IFF. There was a nice pop in early 2021 when the deal was about to close. I have sold since. But if you swapped DD shares for IFF, that was a nice outcome. I tendered 40% and was pro-rated about half.

-

Yeah DD merged its nutrition biz with IFF in a RMT. IFF took off pretty quickly after the deal.

-

Lots of China experts here. How many lived there and speak Chinese? Beerbaron has the view that I agree with the most.

-

@Gregmal You are a beast with those private purchases. We should probably create a CLPR thread. Generally, people get to buy NYC at a discount every 10 years or so. 9/11, GFC, and Covid. Rhythm is about right.

-

You know it's a bunch of dudes talking real estate when the conversation revolves around which neighborhoods has the best dating prospects. God forbid someone starts talking about depreciation.

-

I think I know your too illiquid to mention deep value stock. It's not for me due to family dynamics and illiquidity. That's a hilarious take. The Brighton Beach take is "do you want to mess with the Russian mobs"

-

I think with $CLPR, I recommend buying some puts in AVB and EQR. I do this across the board. I own INDT in size and buy puts in PLD. It is to hedge out overall market and sector risk and interest rate risk. After that I can see a small chance that Delta variant causing issues. But everyone is masking up in NYC and went to dinner last night and they asked for the vaccination proof. I know this will piss off people. But it probably also mean that Delta may surge less in NYC. When they regulate your rent, asking for proof of vaccination status comes with the territory. I am personally for it as it will make me and my kids safer. But this may open a can of worms more than I would like to get involved with. So let's just stop the debate there and focus on $CLPR's fundamentals. The other dynamic is that $CLPR is a family controlled company. So far they have been good people. I spoke with a long term holder and he told me they have been straight. But I just want to point out the >50% ownership. That's kind of sums up all the important risk factors that I can think of. If Delta becomes a huge deal, I think the puts in AVB and EQR will help. Frankly, if it goes to $6 or 7 again, you can create your own share buyback. I agree that I am less enamored with ALX or VNO or PGRE as it's been almost 2 years now and we are not back to the office. As @thepupil said these young kids want to go to NYC because they want to "get paid and get laid." Just giving credit where credit is due.

-

@gregmal I think you are missing one of the best opportunities in $CLPR and I want to jokingly call you a village idiot for some of the commentary about recent price performance. Look, I bailed on $LAACZ right before it popped. It was mostly because I was just clipping a coupon for 3-4 years and there were little price gain. The same can be said about $CLPR. They IPO at $13.50 which is the right price, but then ran into that pesky rent law in 2019 and Covid. Also it wasn't a great acquisition environment in 2016-2017. But they built scale. The NOI is now $60-65mm in run rate but likely going to $80mm when recovered. Sometimes value stocks just don't work for a few years. Then they get scale (GRIF/INDT) and numbers start inflecting (LAACZ) and the negatives clears and people start to actually like a stock. You trade more than I do. I am more of a long term and tend to focus more on a single company at a time. The $LAACZ K-1s were just killing me. So I bailed last year and what do I get the stock goes to over $3,000. I think $CLPR is on the verge of comping double digits in NOI and FFO for the next 2-3 years. The results may look at Sunbelt rental growth in the next 1-3 years. This is my gut feel. Go on Twitter and just lurk on some of the commentary. People are getting into bidding wars on rentals. Apartments are going over ask. Renters are paying for broker fees again. No one is given out concessions anymore. I suspect that $CLPR will trade at 12x P/FFO when stabilized at $80mm of NOI. You get 5% yield to wait for that to happen. The best is that you got EQR and AVB working already. The market is telling you that they believe in coastal high price rentals. Now you got a smaller market cap trading at 4.7% cap rate but with a ton of room to grow rent and FFO. If you are worried about overall market cap rates etc, may be long CLPR and buy some cheap OTM puts in EQR and AVB. It's a way for me to hedge out market and interest rate risk. Regarding the population. NYC was already at 7.9mm population in 1950. Yes, that's right, 7.9mm in 1950 some 70 years ago. It went down in the 1970s to a low of 7.1mm in early 1980. So that population growth in the last decade is actually very impressive!! How is this possible? Well, when you are literally on an island (Manhattan, Statement Island, Queens and BK are geographically part of Long Island), you can't freaking build outwards like a Dallas, Tampa, or Phoenix! NYC is like Harvard as in there are only so many slots here for the best and the brightest. Yes, I know I sound super elitist, but 20 years in a the RE business on the private side, you start to appreciate all the people that comes through NYC each year. It is an impressive roster of Ivy, Stanford, MIT, every year. Having an Ivy degree in most industries is mere table stakes. It does not set you apart. Oh, you went to school in Ithaca or Boston. Who gives a rats ass? Are you any good? Give me a stock pitch in 2 minutes or GTFO. https://data.cityofnewyork.us/City-Government/New-York-City-Population-by-Borough-1950-2040/xywu-7bv9 Regarding leverage. First of all, they went through 2020 and didn't go broke, that should tell you something. They did a cash out refi of $100mm IIRC around May 2020. That's just baller. People say "Geez that leverage is ridiculous" First of all, if own 4% cap rate assets, 50% LTV is 12x NOI approximately. So if you think the run rate NOI is $80mm, that $1.0bn of non-recourse mortgage is about 50% LTV. Also, nothing comes due till 2027 IIRC. So this thing can't break until then when you will likely have rent growth and maybe $90-100mm of NOI. The bigger REITs just want 6-8x debt/EBITDA for MF assets. But these are scrappy and competent family operators. So they put 50% LTV which allows for better long term compounding. Replacement cost - 20 years in this biz. Let me tell you something, it gets harder and harder to build in NYC. When I bought my first property, it was $250/sqft all in including land, construction, time cost, and developer profit. Today, it probably cost $150/sqft for the land and $300 for construction, plus time and developer profit and there are less land now. If you want to build anything, you buy a lot with a house on it, tear it down and risk pissing off the neighbor and getting into law suit. That's why the only thing you build in NYC are $2,000-10,000/sqft luxury condos. This portfolio trades at $400/sqft. This is absurd! Their Tribeca was bought for $1,200/sqft IIRC and their cost in their Dumbo building was $1,500/sqft. Flatbush Garden is probably only worth $300/sqft and is half of the portfolio. If you just blindly say the non-Flatbush is $900/sqft and the Flatbush is $300/sqft, you get a blended $600/sqft and you buy it at $400 today. I'm ball parking it. But debt is $300 and you get to buy $300/sqft of equity for $100 or so. Do I want to bet that replacement cost goes up in NYC in 5, 10 years, you bet your sweet ass I do!!! If anything construction cost goes up probably 2% more each year in NYC than elsewhere. To summarize, you're buying at roughly 30% off market price on an unlevered basis and you get to put 50% LTV on it. The discount to private market EV is 30% and the discount to equity is likely 60-70%. I feel like we are sitting on one of the best bargain and people just don't appreciate all the nuances of NYC multifamily dynamics. Generally, you get a shot at buying cheap in NYC every 10 years or so. The last time things were this cheap was in 2009. Cost arb - Now that the Sunbelt rent is getting pricey. The arb of living in Tampa or Dallas is getting tighter. So if you are a 25 year old smoke show or a tech dude, do you chose Tampa and pay $2,000 for a 2 bed or do you pay $3,500-4,000 for a 2 bed with a friend? Yes, you save a bunch, but you have to live in Tampa! Optionality - $CLPR has $100mm of cash (roughly) and they are developing 1010 Pacific Ave and they own 500k to 1.0mm of development rights in Flatbush Garden. 1010 Pacific will likely add $6mm of NOI and $4mm of FFO. They own some air rights near Central Park West. The Amish market tenant went broke. So there is no rent income there. If they lease that space, it is likely $50-100/sqft even though NYC street level retail has been absolutely obliterated. Just writing this out gets me a little pumped. I actually really like it when the common sentiment is negative or not understanding all the nuances. @gregmal I love you bro. You're like the brother from a different mother! Your post on APTS and some of the sunbelt exposures opened my eyes to a lot of the trends in the industry. I should have paid more attention to it. I totally missed $NXRT with my measly <1% allocation. But it may just be $CLPR's turn. I can see a situation where $CLPR trades to $20/share, but it will take 2-3 years. I think they can actually raise dividend to $0.60 in the long run and after 2-3 years of comping double digit NOI and FFO growth, market may actually want to pay 3% yield for it. At 300mm market cap, no one wants to own this thing. At a $1bn market cap, it will be in every institution's book. Don't believe me, look at $INDT!! Lastly, management said that new leases on their Tribeca is averaging $78/sqft. This is 10% more than Pre-Covid average. The rate that younger kids flooded back into NYC after Covid should tell you something. My brother-in-law was chomping to move out of my FIL house. He is super happy to get a place with 3 of his friends in a duplex 4 bed near Barcaly's Center. He's living life now. If he waited another 2-3 months, he would have been shit out of luck. That's how NYC operates. 1-2% vacancy is the norm. When it got really bad, it was only 5-6% vacancy and people thought it was the end of the world. But going from 1-2% vacancy to 5-6% meant 20% rent drops. But closing that gap also means that rent spikes like crazy. In the 7-8 years after GFC, apartment rent in NYC was up probably 4-5% a year. Local dynamics matters a lot as one area's rent spikes, it drives people out of the neighborhood further away from Manhattan.

-

Before this turns into a circle jerk for FRPH. I'll say this. FRPH was a 23% at cost for me in late 2016. Sold everything in 2018 when it traded at about 85-90% of NAV. Last year, let's just say it is a more than 23% after it became obvious that 1) 40% of market cap is in cash. 2) Dock 79 and The Maren leasing well. 3) Possibility of infrastructure plan 4) Homebuilding surprisingly strong 5) and good management team that I know for 6 years 6) Share buyback at 50% of NAV roughly and 7) Good thematic play on homebuilding, DC MF, and infrastructure. It is not a 5 bagger. But it is back the truck up and buy hands over fist. Imagine if there is a billionaire family in your town with a diversified collection of asset. They go "hey, you can buy into my portfolio at 1/2 price." This is the situation. It's not a 10 bagger like Carvanna from March 2020 lows. But when MLM, Vulcan, and even US Lime have all hit all time highs and EQR and Avalonbay hit high and you can still pick it up for low to mid $40, you just have to be greedy and back up the truck. Greg and I probably put 30-40% of our net worth into our first private RE property. That's with leverage and single tenant concentration likely. Here you can buy a good portfolio with little leverage, 40% excess cash and a good operator. That was the moment. These are rare. Unlike Pupil and Greg who seem to be able to find multiple companies. I am a little stunted. I can only find 1 company a year. Typically 2-3 year doubles. But I tend to bet over 10% each time.

-

Does anyone know the typical SPAC players and dynamics in 2021? I've been investing in the space for the past decade. But the recent vintages have been very different than previous iterations. A lot of SPACs have lost momentum lately. Do people typically hold 2-3x exposure? The PIPE features are also interesting. Just trying to get a little smarter and figure out the players, structure, and capital flow dynamic. Thanks in advance.

-

Gregmal, 1) Don't under estimate how handsome you are. You devilish good looking man with wicked sense of humor. The rest of us don't have your game. 2) I think today, Sunbelt is at 3 handle cap rate and NYC is a 5 cap. It has inverted. 3) Higher taxes affects 20 year old less than old stodgy dudes like you and me with kids 4) Most 20 year old willingly spend all salary and just contribute to 401K with matching. I did that and I have no regrets even if that $1,000 will become $1mm of 2060 money or whatever. 5) Big law, entry tech, IB, etc don't migrate well outside of NYC. Once you have built a reputation as smart with 10 years of experience, Miami, Tampa, Dallas, and Phoenix look a lot more attractive. Differences in opinions make markets. I would've made more money if I bought more NXRT and PCYO. But not complaining about my current picks. Although, I have sold out of VNO and PGRE and kept some ALX.

-

One area of incremental demand that I have not heard of people talk about is wealth empty nesters selling their large homes in the burbs and moving into the city and wanting Class A apartments. This is increasingly a trend among folks who are 60+ as they do not want to maintain a 3-4k sqft house and want the convenience of living in a big city in a doorman building with high walkability scores and access to arts and culture. Cities are generally still safer than 30 years ago. First order thinking is all the millenials decamp to the burbs. But there is likely a swap between a family of 3 with an empty nester who is wealthier. Maybe this is just wishful thinking on my end.

-

I think you're referring to the Bloomberg article referencing the Miller report

-

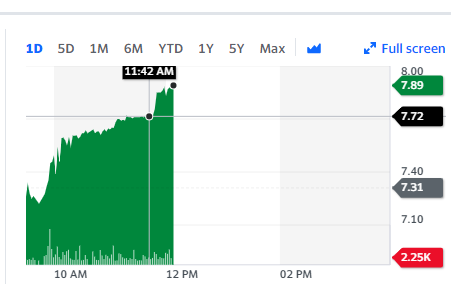

So you complain about not making money and Boom, it's up 8% 2 hours later. I'll tell you what I own and you can bitch about it and we'll split the gain at 4%!

-

What did you do? Up 8% on a day when everything is down and about 2.5x average daily volume by noon?

-

Thank you for the valuable data point. Seems like the better neighborhoods are already back to 2019 levels.

-

Guys, I have been hearing that NYC apartment rent has really firmed up lately with concession gone. Any NYC residents here that can share their recent lease renewal or apartment hunting experience? My former intern just got a pretty awesome duplex in Brooklyn by Barclays for $4,500 for 4 people. He got a really good deal.

-

Even if interest rates were to go up, if you have advantageous financing such as 30 year fixed rate mortgage on your house or some of the Liberty Complex' crazy 30-60 year debt at sub 5% interest rate, those are actually assets in that kind of environment. This assumes that the operating business or RE assets' ability to generate EBITDA-Cap Ex remains the same or even go up. If you have to keep rolling 5 year debt, it is a different conversation. These are strategies that BAM, Blackstone, and everyday American homeowners can participate in. The housing bubble was very different. You literally have meatheads going "I bought a house and flip it for $30-50k profit in one week" Meathead #2 "That doesn't make sense." Meathead #1 "Dude, that's just the market!" RE markets, bank lending, systemic risk, blah blah blah. The RE side is much healthier. Only the best credit gets approval. SFH has an affordability issue. But the existing homeowners are in much better shape.

-

Cancelation of Homeowners Policies in Florida

BG2008 replied to DooDiligence's topic in General Discussion

Insurance Costs Threaten Florida Real-Estate Boom https://www.wsj.com/articles/insurance-costs-threaten-florida-real-estate-boom-11619343002 MIAMI—Florida’s property-insurance market is in trouble, as mounting carrier losses and rising premiums threaten the state’s booming real-estate market, according to insurance executives and industry analysts. Longtime homeowners are getting socked with double-digit rate increases or notices that their policies won’t be renewed. Out-of-state home buyers who have flocked to Florida during the pandemic are experiencing sticker shock. Insurers that are swimming in red ink are cutting back coverage in certain geographic areas to shore up their finances. -

Bill Brewster's Pod is very entertaining and I find Bill's open mindedness to be refreshing

-

My wife and I were fine after the first Moderna shot. After the second dose we both had effects, her's much worse than mine. We had gotten our shots in the morning and I didn't sleep well that night. I think I woke up 20 times and could not get comfortable. The next day I woke with a headache and felt like I was coming down with something, but I could function. The second day I was much better, the effects about 10% of what they were the day before. For my wife she didn't feel well for two days with her symptoms being more severe than mine. This is a well known side effect profile (more side effects, more pronounced and lasting longer) with the second dose. It's actually a sign that your immune response (protection) is building. An interesting feature in many places is that (given the spread that has occurred) many people who are being vaccinated have been exposed to the virus already and it is expected that such a pre-exposed population is more likely to suffer from side effects. An interesting aspect which is being documented with the CV vaccines is that the increased delay (vs studied delay and initial recommendations) between the two doses is actually associated with a stronger (and likely longer lasting) immunity ('booster' effect). Local reactions to vaccines can be quite marked (pain and skin changes at injection site) for certain vaccines (ie tetanus shot) when immunity is already present. Keep a record for your next emergency room visit. There are 'biological' explanations behind this phenomenon but it's basically the inverse of the law of diminishing returns (on certain incremental capital). I have been waiting for the side effects of the second shot and it hasn't materialize yet. The first shot had more side effects.

-

You made a put position 5% of your capital?

-

Life is What You Make It: Find Your Own Path to Fulfillment - Peter Buffett

BG2008 replied to boilermaker75's topic in Books

What makes this a good book in your opinion?