gfp

Member-

Posts

5,347 -

Joined

-

Last visited

-

Days Won

10

Content Type

Profiles

Forums

Events

Everything posted by gfp

-

Look at that.. You CAN buy JPM if Todd's on the board, since it wasn't Todd buying the shares. He's getting his banks after all. Better late than never!

-

Really great to hear Malone just chat for almost an hour with a decent interviewer (Faber). I even got a text from my Mother, in her 70's, who is on an island somewhere in Greece at the moment, that she was watching John Malone live on CNBC.

-

Baupost filing is posted - Still adding to that Fox position. Rough day for him in PCG. Entered a position in Liberty Global, Univar, YPF, Tribune, Altaba. Always interesting to follow Seth. Biggest equity position by far is FOX, FOXA -> https://www.dataroma.com/m/holdings.php?m=BAUPOST

-

I apologize - I recently replied to a few political threads after never posting in them for years. My posts had nothing to do with investing or the economy. I don't like to mute topics or posters because that's how I know about who I am reading stuff from. An investment idea from a person with strong bias and blind spots can be evaluated in that context. (I do pilfer ideas form this forum occasionally) I wish good investing ideas to you all

-

Yes. Well said

-

One thing I've heard is that families with over a billion dollars tend to know other families with huge wealth and they are well acquainted with just how bad it can get - whether it's a few generations down the line or your own kids. They've heard stories. Charlie and Warren have talked about it. They do a lot of 'elephant-bumping' and people like to gossip. There are quite a few 'signers' of the giving pledge that are wealthy enough that this little token 1-10% that does make it to the next generation (tax free) is far from re-setting the monopoly board. Even the Buffetts will have dynastic wealth (probably practically forever) because there is just so much money sloshing around the family. And Warren is the poster child for the movement... -------- Cigarbutt, that was an interesting quote on page 5 of your linked document - Obama said something similar once. And Warren Buffett says something similar quite often. Only Obama gets pilloried for the sentiment, primarily by people willfully taking what he said out of context:

-

Yeah, Berkshire's involvement was in the IPO prospectus (which doesn't help you get a lower price - wonder why they did that?) The Walton family VC vehicle Madrone owned a lot and added 2.75m shares in the IPO and management at Madrone told Todd Combs about it and Todd decided to invest. There are some 3G principals invested in it as well - I believe from an earlier round.

-

Another Obamacare success story! Glad to hear it is working out for you DD. Is this "zip" as in not eligible for ACA exchanges because you would qualify for Medicaid and get all your healthcare for free?

-

Bought Arconic shares today. Seems they are about to be sold. Likely to Apollo

-

Don Graham article on the recent accounting changes that result in goofy net income figures at Berkshire: https://www.wsj.com/articles/i-cant-see-berkshires-bottom-line-1541636012?mod=searchresults&page=1&pos=1

-

Greg Abel already running the place! https://www.bloomberg.com/news/articles/2018-11-08/berkshire-s-egan-nabs-a-more-delicious-position-at-see-s-candies

-

Thanks Cigarbutt, I appreciate the thoughtful reply

-

I have a quick question. So in July Fairfax put $264.6 million into Brit as a capital contribution and Brit used that to purchase an 11.2% ownership interest form OMERS (and pay OMERS an accrued dividend owed). So it's like a share repurchase / retirement, where Fairfax's ownership goes up, but so does the ownership of the other remaining minority owners - right? Why wouldn't Fairfax buy the shares from OMERS, which would increase Fairfax's ownership only? Is the net effect the same? As in, the capital contribution raised FFH's ownership percentage and then the share cancellation resulted in the same percentage ownership dynamics for all parties as would have been the case if FFH just bought OMERS's shares directly?

-

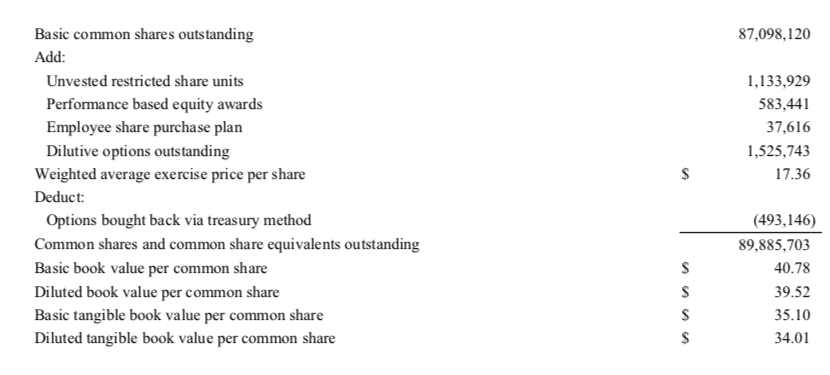

I suppose some of the rise could be associated with the Allied World acquisition. Maybe a call to IR would shed some light. From the final Allied World Annual Report (attached) **Edit: I guess not, upon reading the merger agreement it sounds like all Allied World share based awards, RSU's, performance based share awards, options, etc ... were accelerated to fully vested and paid in cash or treated as shares under the merger agreement. I guess Fairfax just started giving out stock as compensation a lot more heavily in the last few years. seems like they should have gone a little bit easier with the Teledyne references if they were going to handle issuance/repurchases this way. Setting yourself up for disappointment.

-

I get how options can be anti-dilutive, but how are share awards ever anti-dilutive?

-

Buffett buybacks: Could Berkshire tender stock?

gfp replied to alwaysinvert's topic in Berkshire Hathaway

He doesn't want to influence the price of the stock very much. It is possible the price ceiling on the repurchase plan is tied to last reported book value, in which case it could be as high as 218 per B share currently. But it is equally possible that the ceiling remains at 208 or whatever it is and Warren is just wanting to buy the stock cheaper than others believed. The limiting factor on repurchases in the 3rd quarter was the price. He would have repurchased a lot more stock if the price had stayed below the floor and their trader was able to be active every single trading day of the quarter. As it happened, the trader was only able to purchase shares for 14 trading days during the 3rd quarter. -

Buffett buybacks: Could Berkshire tender stock?

gfp replied to alwaysinvert's topic in Berkshire Hathaway

I guess my point is that $1 retained is worth more than $1 any time Berkshire trades for more than book value. And if it trades close to or below book value, he would buy back as much stock as he could get his hands on. If the company trades at 1.01x book value, by definition a dollar retained is worth more than a dollar paid out (not even taking taxation into account) -

I don't think they are options. I think they are restricted share awards - so the company does not receive any proceeds as they vest. They are amortized or whatever over their vesting periods and included as a compensation expense over time.

-

Buffett buybacks: Could Berkshire tender stock?

gfp replied to alwaysinvert's topic in Berkshire Hathaway

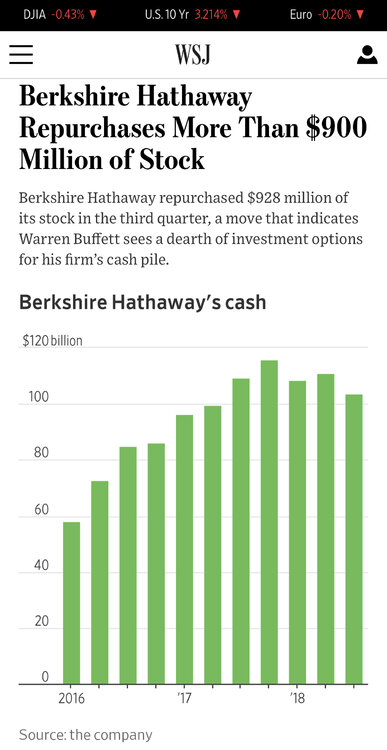

It really does seem like Warren's been really clear in pointing out that cash dividends do not make sense with Berkshire trading above book value. A dollar of after-tax earnings is worth less than a dollar if sent out in a cash dividend, or more than a dollar if retained. Despite there bing a ceiling price on their repurchase plan, I do think repurchases are the way he will go. And, of course, cash hasn't piled up the way many would have expected. We're still here at $100 Billion. One of these days he's going to buy a decent sized company. -

Article on coming Q4 Michael loss estimates at BRK: https://www.reinsurancene.ws/berkshire-hathaway-pegs-hurricane-michael-loss-at-up-to-550m/

-

Who knows. I doubt any of the equities are actually thought of as permanent holdings. He's tried to clarify that through updates to the 'owners manual' over the years. It's all available for sale if the business changes or the opportunity outweighs the benefit of the interest free loan from the government on the unrealized gains. The bar would be even lower now under current tax rates

-

So here's my math: 9/30/2018 share count was 1,642,269 A share equivalents [2,463,403,858 B share equivalents] - from page 23 of the Q3 10Q 10/25/2018 share count was 1,641,681 A share equivalents [2,462,520,906 B share equivalents] - from front cover of Q3 10Q So subsequent to quarter-end, they resumed repurchases and it was about $181 million worth of stock through 10/25. Which means they didn't stop in August because of a black-out period - they stopped because they have a ceiling price on their purchase plan. * [sorry, should have included the difference, about 588 A share equivalents repurchased in Q4 up to 10/25, or 882,900 B shares eq.]

-

BK, USB and GS were all being accumulated the previous quarter and are logiical bets. Maybe something new. It’s funny the headlines saying stuff like this Rolfe quote from the WSJ: No mention of the huge purchases of equities in the quarter or explanation of why the cash balance is declining and didn’t print $120 billion this quarter like it would have, absent massive buying of investments... Just look at the equity portfolio’s growth in the past 12 months. They have been buying a lot to keep cash at $100 Billion ----------- in other news, BNSF continues to roll over debt at extremely attractive rates. Look at this 30 year issuance from Q3 - Seems like all the borrowing lately is 2048-49 stuff - And the entire bond portfolio for a company with $736 Billion in invested assets is $17.8 billion at cost ($18.3 at market). An insurance company with a 2.5% allocation to fixed income.

-

Don’t use average as quarter end

-

Interesting... Call options on JBGS ?