gfp

Member-

Posts

5,335 -

Joined

-

Last visited

-

Days Won

10

Content Type

Profiles

Forums

Events

Everything posted by gfp

-

Are others having a lot of trouble with this site recently? Its been a week or more of slow loading, occasionally timing out, and a lot of the message below: "Too many connections" Has this place outgrown the servers? Am I the only one getting these? (loading site from United States)

-

Apple has gone and hit a new all time high today. Berkshire's 907.56 million shares are worth more than $143 Billion (pretax) this afternoon.

-

Berkshire has repurchased $38.2 Billion in the past 5 quarters.

-

There are two separate pension funds, each purchasing the same amount of the new security. 4.995% interest each, for a total of just under 10% of Odyssey. A few media reports have mis-stated the deal in headlines. I read one that said $1 Billion for 4.995% for instance. From your quoted press release, just include the few words before your quote for clarity: " to which each of CPPIB Credit Investments and OMERS will acquire 100% of a new series of securities representing a 4.995% interest in Odyssey Group"

-

Think of it like preferred equity - a high coupon but it isn't debt. Whoever called it going to the pawn shop has it right. They do these deals all the time and it is a good deal for the pension funds. Fair and friendly with the pension funds for sure. I would be shocked it this required them to mark up Odyssey to $9B and I wouldn't pencil in that number informally either. But someday, sure

-

Can anyone clear up this question on share count of FFH: In the Q3 press release they state " At September 30, 2021 there were 25,876,369 common shares effectively outstanding." In today's announcement they state: "Fairfax’s 26,986,170 total issued and outstanding Shares," Why the difference / increase?

-

His office address is the MT&O office at 355 S. Grand Ave., 34th Floor, Los Angeles CA 90071

-

I would assume that most of the higher profile position reductions are due to the Riverstone divestment and are not actually sales since FFH effectively retained the risk/reward for the transferred positions. https://www.dataroma.com/m/holdings.php?m=FFH

-

I don't think Gates has had to file details of the foundation sales recently but I could be wrong. Back in 2018 this was the type of daily volume they were selling - something like 1.75 million B shares per month during this 2 month period. Gates Foundation doesn't sell A-shares, of course, as Warren only donates B-shares to the foundations. https://www.sec.gov/Archives/edgar/data/0000902012/000110465918059501/a18-36147_1ex99d1.htm#EXHIBIT99_1_031539

-

Warren did finally comment on the two new board member appointments in his local (no longer owned) newspaper - https://omaha.com/business/local/warren-buffett-says-adding-daughter-to-board-will-help-preserve-berkshires-culture/article_380cbffa-3d85-11ec-9ae5-7bba9b76c4a8.html

-

Here is an updated BRK Energy financial presentation from a Nov. 2021 conference for those interested - https://www.brkenergy.com/assets/pdf/eei-presentations/2021-eei-presentation.pdf The presentation shows they have firmed up new growth Capex projects and now show increasing capex for 2022 and 2023: " Berkshire Hathaway Energy and its subsidiaries will spend approximately $24.4 billion(1) from 2021 – 2023 for growth and operating capital expenditures, which primarily consist of new wind generation project expansions, repowering of existing wind facilities, and electric transmission and distribution capital expenditures" Additionally, here are the links to the Burlington Northern 10Q and the BRK Energy 10Q. BNSF distributed $1.4 Billion to Berkshire parent for the second consecutive quarter. BRK Energy also gave Berkshire back $1.45 Billion in July when the second part of the pipeline deal didn't go through. Berkshire had funded the Dominion deals by purchasing 4% perpetual preferred from BRK Energy, so BHE redeemed some of that when the money wasn't used for the pipeline purchase. Railroad 10Q: https://www.sec.gov/ix?doc=/Archives/edgar/data/0000934612/000093461221000021/bni-20210930.htm Energy 10Q: https://www.sec.gov/ix?doc=/Archives/edgar/data/0001081316/000108131621000037/bhe-20210930.htm

-

Not counting debs - just a quick look at common shares from dataroma. Here is the full quarterly report: https://s1.q4cdn.com/579586326/files/doc_financials/2021/FFH-2021-Q3-Interim-Report-(Final).pdf (page 68 shows the composition of the unrealized losses for the quarter) I think the gains and losses on the swaps on FFH's own shares are actually counted as realized each quarter. They lost $42 million on stocks, $106 million on convertible bonds, and $292.4 million on "other equity derivatives," which include: Other equity derivatives include long equity total return swaps, equity warrants and options and the Asset Value Loan Notes ("AVLNs") entered with RiverStone Barbados. (2) Gains and losses on equity total return swaps that are regularly renewed as part of the company's long term risk management objectives are presented in net change in unrealized gains (losses).

-

"net unrealized losses from convertible bonds and long equity total return swaps" Fairfax's own stock price was down in the quarter, which accounts for ~$85 million of the total return swaps unrealized losses. Blackberry was also down something like $115 million for them. Remember they do not mark to market some of their big positions like Resolute, Atlas and Eurobank, so unrealized gains on associates aren't available to offset the unrealized losses (although it doesn't appear those three would have produced much of a gain). I don't know what convertible bonds they own but that looks to be where most of the losses occurred. (unless they have a new equity position that declined)

-

If the constraints say they only have a 161,600 square foot footprint of space available and are limited to 9 residential floors (11 floors total) in height and they have a need to house 4500 students and the number one thing they want is that every child gets a private bedroom, there is no way all 4536 rooms are going to have a real window. You can sharpen your pencil and try to put in some atriums or something, where windows stare across at another window or a wall but atriums waste a ton of space. The requirement was for density and private bedrooms and there is no extra space on the campus. The windows on my dorm room were bolted shut to prevent suicides and smoking anyway. Of course an artificial window isn't actually "better" than a real window - but a real window was never on the menu given the requirements. You can't really compare a freshman dorm to a room at the 4 seasons and feel outraged that the freshman dorm is way worse.

-

Charlie spoke to CNN about that dorm and a few additional topics - https://edition.cnn.com/2021/11/02/investing/charlie-munger-buybacks-tax/index.html?utm_content=2021-11-03T01%3A31%3A05&utm_medium=social&utm_source=twCNN&utm_term=linktm_term=link https://markets.businessinsider.com/news/stocks/charlie-munger-warren-buffett-windowless-dorm-inflation-stock-buyback-tax-2021-11 "When an ignorant man leaves, I regard it as a plus, not a minus," Munger said. edit: I found the video of their interview with Charlie over Zoom: https://www.cnn.com/videos/business/2021/11/02/munger-hall-ucsb-dorm-controversy-gr-orig.cnn

-

Right. Berkshire will not have a "huge adjustment to book" from the Nubank IPO (or the PayTM IPO). A single day's random fluctuation in AAPL or BAC stock is more material to Berkshire's book value than any of these private tech bets. BYD worked out well for sure. Either way, those IPOs weren't in Q3 - we are assuming they go off before the end of the year.

-

I would expect GEICO to report a pretty bad quarter. Ida and other industry trends will be tough but over time both Progressive and GEICO will adjust pricing. It will be interesting to see what they show for Cat losses, with Ida being a very expensive storm. It will be a good window into how much Cat reinsurance they are actually writing these days. I'll bet not nearly as much as the size of Berkshire's overall insurance biz would have you assume. But GEICO is going to put up an ugly quarter for sure.

-

Oh it's not so bad. Remember what a typical undergraduate dorm looks like. Mine was a concrete cell with no privacy and double occupancy. Restrooms shared for an entire floor, no kitchens, period. Quite a bit of detail in this presentation: https://drive.google.com/file/d/1IgEAYCEphg6x6WDQ8NQGuILqN31SA6LP/view?__source=newsletter|warrenbuffettwatch

-

Oh Charlie... And now Munger defends his design (with a graphic of the 8 bedroom clusters) ---> https://www.bloomberg.com/news/articles/2021-10-29/charlie-munger-defends-design-for-dorm-bashed-by-architect

-

Not sure where to put this as it doesn't have anything to do with Berkshire and there aren't many recent Charlie Munger threads, but here is an article that is critical of Charlie's new dorms: https://gizmodo.com/architect-says-billionaires-dystopian-dorm-design-is-a-1847964193

-

So...... now that it looks like they might be actually getting a bill together that includes a 15% minimum tax on large corporations - there has been some discussion that this would be a 15% minimum tax on "book" income, or GAAP reported net income. As in, when Berkshire reports a GAAP net income that includes $30 or $40 Billion in unrealized stock market gains that weren't previously taxed under the previous regime but have to be reported through the income statement under GAAP, who here thinks Berkshire will be on the hook for the cash tax payments under this new plan? I assume they will need to carve out a bunch of exemptions and maybe insurance companies will be one of those - but it is being put together in a hurry and it seems like there will be a lot of hasty decisions that they will have to 'fix in post' so to speak. On the other hand, I'm sure Berkshire will benefit from some of the extensions of utility tax credits.

-

I don't know why it was decided to add Susie to the Board of Directors but I would bet that, if asked, Warren would say that Susie is tasked with saying something when Warren is "losing his marbles" so to speak. He has talked for many years about how hard it is for directors - or even Warren & Charlie - to speak up and make a change when a CEO is starting to slip cognitively. Susie spends more time with Warren than just about anybody and he probably recognizes that she is his best option as far as feeling comfortable enough to speak up when it's time to make the call. Another possibility is that Howard is not particularly healthy, but I would place my bet on the first theory. I wouldn't necessarily expect Susie to stay on the board once Greg Abel is CEO but what do I know? The timing of the announcement was probably just based on the death of Walter Scott. Obviously they added two and only lost one - but there was likely some debate on who to add and what the pros and cons were and maybe they just said lets chose more than one. Warren is getting old and working from home was not particularly good for someone who likes to tap dance to work.

-

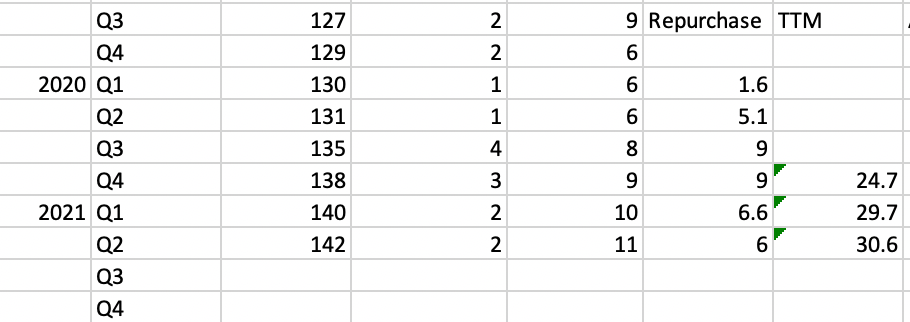

Those figures don't look correct. What is the source? For instance, the figure for Q3 2020 should be $9 Billion.

-

I'm not sure where an up to date spreadsheet-style list exists at the moment. A bloomberg terminal might be able to spit one out. You can save yourself some time by using the spreadsheet graphic in this article to capture the older data (up to 2019) and then just update the data manually yourself for the last couple years. https://rationalwalk.com/buffett-loosens-the-purse-strings-for-repurchases/ I don't have a file with the prices paid but here are the last few quarters of dollar-amount repurchases and a TTM figure. The trailing figure will almost certainly decline unless Warren is willing to resume $9+ Billion per quarter of repurchases. ( the other figures in this screenshot are Float, Float growth for the Q, and trailing 4 quarters float growth )

-

The way I use the board is to click "Activity" at the top of the page (next to "Browse"). This will show the most recent posts regardless of topic/category. If you visit infrequently that may not be the best method, but it will always show you the most recent posts on the site.