gfp

Member-

Posts

5,335 -

Joined

-

Last visited

-

Days Won

10

Content Type

Profiles

Forums

Events

Everything posted by gfp

-

When Buffett is gone, BRK might sell at a discount to book, like most conglomerates. I'd be surprised to see P/B expand from here. Yeah when I first read this my thought was: I don't see it happening but what a gift that would be to his successors.

-

You can cross reference his buying behavior at a given book value per share multiple with this interesting curve provided by Jim over on the fool board (an outstanding contributor to that board for decades). Another post I found interesting if not surprising - https://boards.fool.com/the-future-will-be-different-34770194.aspx Someday price to bvps multiple will not be as useful, but it has been a very easy tool in the past

-

This article describes a recent trip Greg Abel and BHE CEO William Fehrman made to the Klamath River where their boat was stopped by a blockade of activists across the river. Sounds like everyone handled it well enough despite some tense moments. https://kymkemp.com/2021/03/04/fight-of-the-river-people-the-generational-push-that-brought-berkshire-hathaway-to-the-table-and-put-dam-removal-back-on-track/

-

Saw this Rational Walk post linked on another board and there is a very good spreadsheet showing the entire (recent) history of Berkshire share repurchases all in one place. Of course we already know there have been additional purchases after this spreadsheet through 2/16. Thought some here would find it interesting - https://cdn.substack.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2F63ba108e-5fe7-4b69-aaa2-a27919aec005_1658x1076.png

-

Berkshire basically facilitated the transfer of Sokol's stock to Abel by financing Abel's purchase of stock. That's how Abel was able to afford a block of stock currently worth over $500 million. Abel's BHE shares are convertible into BRK.B shares and that is what I ultimately expect to happen once Greg is CEO of Berkshire.

-

You are correct - not sure what went wrong with my calculation but 304,946 / A share does indeed correspond to 203.3 / B share.

-

203.3 on the B-shares (corrected calculation error) 80,998 A share equivalents for $24.7 Billion. 5.2% share count reduction for calendar year 2020. December average basis was 225.73 and he was willing to pay higher average prices, continuing through the first month and a half of 2021.

-

Annual Report and 13F differ on number of Apple shares?

gfp replied to manuelbean's topic in Berkshire Hathaway

Could you please explain it as if I were 3? Berkshire Hathaway files two different 13-Fs, which means the holdings reported by CNBC, dataroma and others are often incomplete because many sites only pull data from one of Berkshire's 13Fs. General Re New England Asset Management also files a 13F and some of the holdings on that 13F are owned by Berkshire. Others are not. The Berkshire positions on Gen Re NEAM's 13F are noted with an ownership code corresponding to Berkshire. Berkshire's 10Qs, 10Ks and 13G filings list the correct share ownership / closing value for the date of the report. Further complicating things, some 13Gs would also include pension fund holdings, which are not owned by Berkshire shareholders and not included in 10Qs, 10Ks or 13-Fs. Usually the pension fund stuff only comes up with smaller positions taken by Ted or Todd. Apple was a rare case of overlap between one of the Ts and Warren. The Ted/Todd position has been sold and the remaining position is presumably all Warren. Warren has also sold some Apple from his stash recently. These are the NEAM 13F filings: https://www.sec.gov/cgi-bin/browse-edgar?CIK=1004244 On the NEAM filings linked above, when "01 02" appears in Column 7, that is a position owned by Berkshire Hathaway shareholders. All others are not owned by Berkshire shareholders directly (they are probably part of an investment product marketed to customers of NEAM). There are Berkshire holdings of AAPL, BK, BAC, DEO and USB on the most recent NEAM 13-F. -

Annual Report and 13F differ on number of Apple shares?

gfp replied to manuelbean's topic in Berkshire Hathaway

Berkshire also filed a 13G on the same day as the 13F that shows the accurate ownership of AAPL shares - https://www.sec.gov/Archives/edgar/data/320193/000119312521044816/d107461dsc13ga.htm As mentioned above, the Berk 13F doesn't always capture all of the shares. Gen Re NEAM 13F shows the rest. -

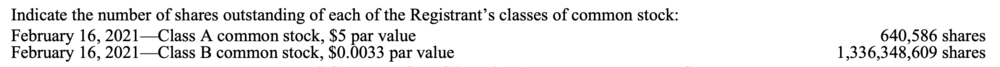

Cover page of 10-K, which follows chairman's letter in the Annual Report pdf released this morning. Estimate around $4.3 Billion in 2021 repurchase activity in the first 1 1/2 months - consistent with the $9 Billion / quarter recent rate. We'll see how prices influence repurchase volume if Berkshire shares rise from recent highs. Screenshot attached

-

Interesting that for the first time he basically lets us know what he values BNSF at currently. In listing the big 4, he points out that P&C Insurance is the largest and most valuable (but gives no value. certainly higher than the $138 Billion year-end float). But then he basically equates the value of BNSF to Berkshire's 5.4% position in Apple. -------- Insurance float up another $3 Billion for the quarter to $138 B. - this has been very healthy growth in float. A billion extra in cash flowing into Berkshire each month to be allocated.

-

Sold Jun 18th 2021 22.5 strike Puts on PSTH at $2.00 and $2.20

-

I opened the short position at the close when they joined the S&P at 695 / share. I added to the short from time to time to end up with an average basis of about 836. I don't want to hold large short positions in individual stocks and much prefer to be short an index or ETF. Obviously I still think Tesla is valued far too richly but I am happy to close out the risk for now. I would not be surprised at all if Tesla continued down much lower.

-

Covered a Tesla short. I do not have diamond hands.

-

https://www.dataroma.com/m/holdings.php?m=SA

-

Verizon and Chevron LOL!

-

Berkshire has recently sold shares of Davita (a Ted Weschler holding) into their tender offer. So its not Davita. It won't be a security that was listed on the 13-F. The mystery security was, by definition, "omitted." Which I guess means it could technically be Costco, which disappeared from the 13-F and has been presumed sold.

-

He wouldn't need confidential treatment from the SEC for PetroChina or other large companies with primary listings overseas. We know that the company fits into the "Commercial, Industrial and Other" category, so it isn't a finance company or a consumer products company. Berkshire seems to group tech with Commercial Industrial and Other so tech is still a possibility. Maybe we will know this evening, maybe not.

-

Some may find this article on former Berkshire subsidiary Applied Underwriters and CEO Steve Menzies interesting - https://www.insurancebusinessmag.com/us/news/breaking-news/applied-underwriter-ceo-on-firms-uk-acquisition-246554.aspx

-

We may not get to know what the new investment is on Friday or Monday if Berkshire is again granted confidential treatment. Each earnings release I wish it was a return to Disney but its anyone's guess. Brookfield? General Electric? Disney? Google? CVS? Another boring pharma? I doubt it will be Boeing or Microsoft. I don't think he wants the heat from a major position in Suncor.

-

I remember thinking it was probably a $4-5 Billion position in the quarter at cost basis but even that reasoning ignored the possibility of part of that number being separate additional purchases of foreign securities (like the Japanese trading company basket, potential European Pharma for his basket, etc) People were comparing the new purchases of equities figure for the quarter with the disclosed new purchases in the 13-F. Of the $16.5 Billion difference you note, approx. $3.6 Billion is accounted for at General Re NEAM, $3 Billion for the BYD value at quarter end, and then whatever other foreign securities they hold, japan, europe, etc..

-

I don't think its as cut and dry as that to guess the size of the undisclosed purchase because a.) Berkshire owns foreign securities that are included in the 10-Q equities but not listed in a 13-F; and b.) Berkshire files two 13-F filings, the one you reference and certain portions of the 13-F for General Re New England Asset Management. Long story short - I don't think the undisclosed equity investment was as large as you think it was at quarter end.

-

Sure sounds like Brookfield to me. Rod, Care to share your ideas? Private messages open. Anyone who's got 3 positions in RE and Infrastracture as their complete portfolio, I want to get to know.

-

Selling out of some of my February BRK.B calls, keeping March calls (and the stock of course). Mid-day spike from someone coming on CNBC to talk up Berkshire. Same guy on CNBC every few months saying same thing. This time its an all-time high so you've got that helping it out...

-

But that is exactly where they will go after him. By saying that he IS a designated investment professional. He was a registered broker with Finra, and also a CFA. But I agree with you that he should not be punished and did nothing wrong. But that doesn't mean he didn't break rules of his profession that leave him open to having to deal with this shit.