MMM20

Member-

Posts

1,870 -

Joined

-

Last visited

-

Days Won

10

Content Type

Profiles

Forums

Events

Everything posted by MMM20

-

This (plus the whole floating rate thing) is a critical point in today’s world. Many loans up to 80-90% LTV could be permanently impaired now. Cap rates and attachment points got way too tight and high in retrospect. To Buffetts point yesterday, commercial real estate valuations are essentially driven by how much lenders will lend to a sponsor without requiring recourse to the parent. In my experience there are probably more bull market geniuses in real estate than any other market. A guy like Tom Barrack is the poster child but there are dozens of others… all prob still holding out hope that the day of reckoning will never come and they’ll never have to mark stuff down. Another example of FFH managing their affairs prudently over the past few years and coming out smelling like roses.

-

Buffett again today talked about the superiority of float when it is cost free (or negative cost). It can't disappear in a hurry and it finances the asset side in the same way as costly equity or debt. Berkshire has $165 billion of float vs just shy of $1T in assets = ~17%. Fairfax has ~$30B of float vs ~$60B in assets = ~50%. I’m not normally a bold/underline guy but FFH has ~3x the float of BRK, adjusted for size. Much of BRK’s outperformance during Buffett’s early/middle decades was a direct result of zero cost float leverage. This is not a knock on Buffett as recognizing this dynamic decades ahead of the crowd was probably his biggest stroke of genius. For FFH, float has become a huge and still misunderstood / undervalued structural advantage. Float growth driven by well-timed acquisitions ahead of the recent hard market has been incredible, to echo @Viking. As a result, FFH going forward should generate mid-teens shareholder returns — so an expected return of a double every ~5-6 years on average, even if zero multiple expansion — with only decent mid-high single digit investment returns. Ok, I’m a broken record

-

I enjoyed this one. I feel like he was more open and candid b/c it’s a Nebraska Furniture Mart podcast.

-

@Viking What I'm most worried about as I plan to hold FFH indefinitely (absent an overnight 3x spike ) is related to #5. Are we heading for an ugly "Succession"-like scenario if Prem doesnt end up with, let's say, the intellectual longevity of a Buffett/Munger, but others at Fairfax don't actually have the power to force a change? Maybe FFH buys back enough stock for Prem to regain majority voting control and just never gives up the reins, even if he should. Shareholders might be blind to this sort of dynamic for a while b/c the shareholder communication (while recently improved IMHO) is always been a bit awkward and fumbling, the letters somewhat disorganized and rambling compared to a BRK or a MKL. Will the top executives actually stick around if Prem's still in his seat 5-10 years from now, even if he continues to delegate various responsibilities? Maybe a bunch of those folks will get picked off by competitors and slowly erode FFH's talent base as the strong recent performance becomes clear to the market. I really don't think we'll end up with a senile shell of Prem and and some weak puppet successor slowly running FFH into the ground, but hopefully you get my point. Anyway, another great post...thanks @Vikingfor sharing so much of your work.

-

“Two of its businesses, Berkshire Hathaway Energy and BNSF Railway, account for more than 90 percent of the company’s fossil fuels consumption; each discloses its carbon footprint and a timeline for reduction. Berkshire Energy, which serves 12 million customers, says half of its electricity stems from noncarbon fuels. (About 40 percent of electricity in the United States is generated using zero-carbon fuels.) Berkshire Energy has invested more than $30 billion in renewables, much of it on infrastructure to, as Mr. Buffett puts it, get power from where the wind blows to where people live. Meanwhile, it has been shuttering coal facilities.” Berkshire might literally be doing the most of any single corporation to *actually* decarbonize the US, but clearly not doing the most to virtue signal and that’s the real problem for these people. ESG ratings remain a complete sham.

-

https://rogerlowenstein.substack.com/p/the-oracle-of-omaha-takes-on-progressives Can’t get enough of Roger Lowenstein or Buffett. The combo is gold.

-

It's pretty incredible that they missed selling BB at ~$25 b/c they were locked up at exactly the worst time - and oh BTW also took off their shorts at basically exactly the peak of all the insanity - and still sit here today with FFH having ~2x'd and still trading at like 6x earnings and seemingly on a clear path to 2-3x'ing over the next few years with just decent execution. Epitome of how a few big good decisions can far outweigh mistakes and bad luck.

-

I would say “submit this to VIC” but I’m happy to let FFH take out as many shares as they can at 6x earnings.

-

We’ll have to agree to disagree!

-

4.8% to 5.0% market share is statistical noise. A rounding error. Very different than a insurtech startup going from 0 to 10% in a few years and blowing up spectacularly. Worth monitoring with a Digit but I believe an unfair criticism of FFH as a whole… no new kid on the block.

-

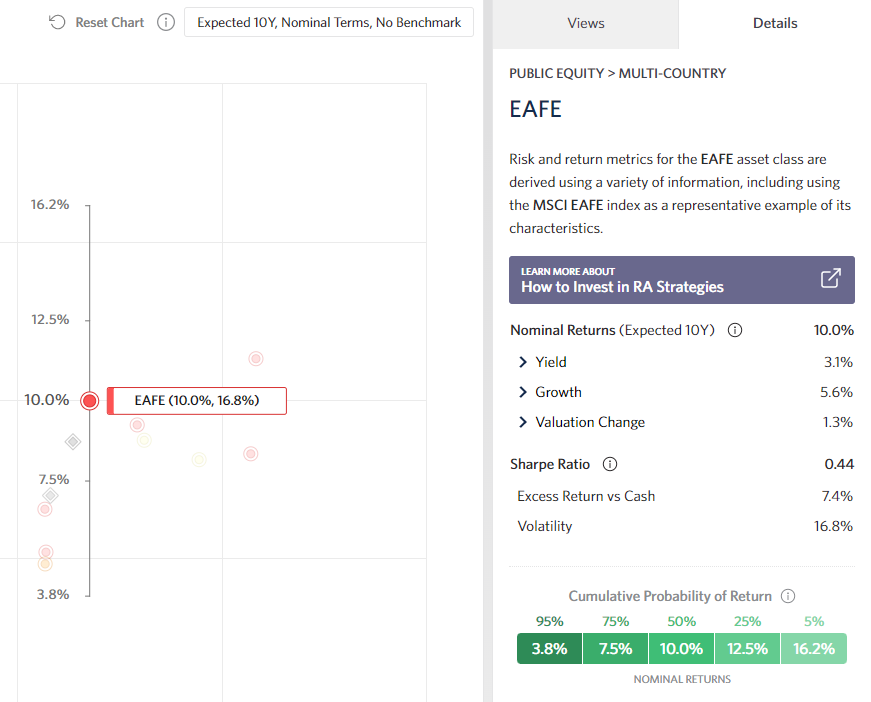

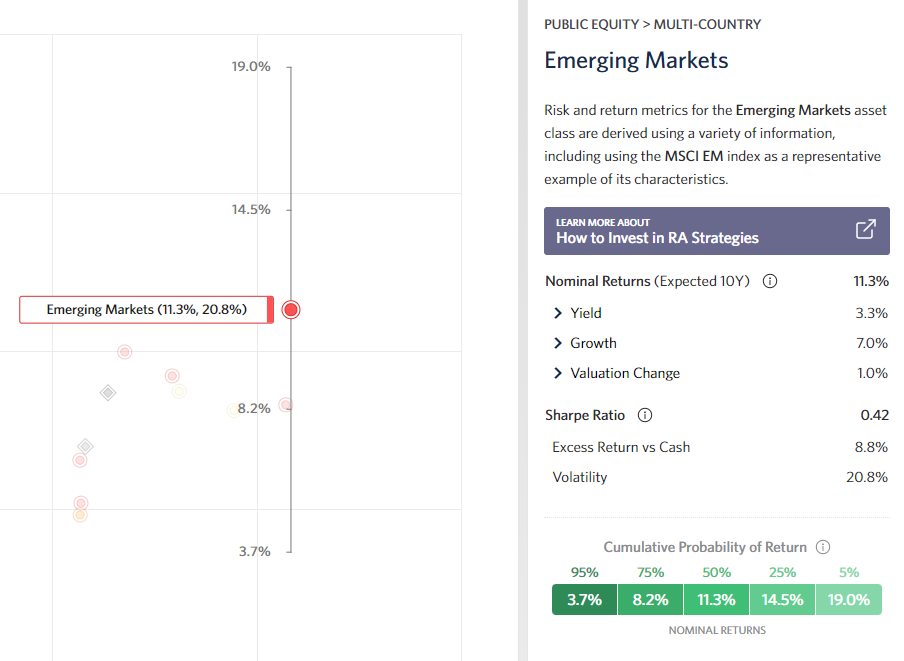

I put zero stock in my own personal view on that. But I do think Research Affiliates estimates and confidence intervals above are better than nothing in framing asset allocation decisions. I also think FFH has earned shareholders trust on that front. Frankly I would look at what they’re doing rates+credit and let that inform my own positioning. Clearly it’s prudent to assume reversion to the mean on insurance growth and profitability. But that doesn’t mean things are about to fall apart tomorrow or that float will shrink, just that this piece will prob grow much slower over the next few years than the last few. I think the most important thing is that FFH has built up a big structural advantage in that float over the last 5-7 years with smart acquisitions and organic growth. And now we really need no additional insurance growth - just good management - and only ok investment results for FFH to compound at 2-3x the returns of a 60/40 index portfolio from this starting point. I think that’s true whether we end up with 1% or, idk, 8% returns from cash+fixed income.

-

Something like 4-6% on cash/fixed income, 10-12% on all equities, and little to no growth in insurance but an aggregate 98-100% combined ratio Excess cash -> buy back stock and minority interests, then more stuff like their recent JAB investment as opposed to early 2010s era rescue financings That pencils out to ~15-17% EPS CAGR = ~4-5x EPS growth over a decade… valuation on earnings doubles or better to a fair 12x+ multiple = ~8-10x MOIC Just one scenario and guaranteed to be precisely wrong, but IMHO no heroic assumptions…those are just market beta type e(r)s, and seems like the insurance side still has runway to “top 10” status from this position of strength (and/or might sustainably underwrite to 97% or better combined) I continue to believe 12-15x earnings (yes, 2x+ BV) is quite clearly much fairer than 6x if looking forward instead of backward… still not holding my breath I was just trying to point out the potential power of so much ~0% cost float leverage (and a low starting point for valuation) if they continue to execute well

-

Data below is from Research Affiliates...IMHO one good way to frame expected returns and the range of outcomes from the top down to supplement the bottoms up work that @Viking and others have laid out so well here. ~7.5% asset level return with about half financed with ~0 cost leverage and a shrinking share count (and minority interests) = ~15%+ total shareholder return, even if valuation stays at mid single digits on earnings.

-

~7-8% return on investments would be a home run b/c it translates to ~15%+ return for FFH shareholders b/c of leverage. Rough numbers, roughly right. If FFH underwrites at breakeven, that equates to borrowing at a 0% interest rate on roughly half the asset base at the current size of the insurance operations. This is why the intelligent growth in the insurance side over the last 5-7 years is such a big deal even if they “only” break even longer term. Buffett has talked about that power of insurance float for 60 years and it is still widely misunderstood IMHO… at least in the Fairfax case. FWIW, that float leverage is a big absolute *and relative* advantage for well managed insurance companies again, with borrowing costs for other industries back off the zero bound. Also, as they flip to highly cash generative, the share count and minority interests should continue to shrink. From this valuation starting point, that all could translate to a ~8-10x return over the next decade with mid teens EPS growth (even with zero growth on the insurance side) if the “exit” multiple expands to a fair low-to-mid teens multiple of earnings. Haters would be in shambles not investment advice

-

Same question. I would’ve thought Prem’s kids would get the most pushback.

-

Right. At this point, ~$800M for GIG is about one quarter (maybe two) of sustainable and growing free cash flow. Stock still screams cheap to me every day it trades below US$1000 if not US$1500.

-

I’m never quite sure how meaningful “PV-10” is when I see it in oil/gas. Just means a 10% discount rate, right? I easily get to $2,000+ share PV-10 value for Fairfax itself, so we’ve got that going for us.

-

-

https://rationalwalk.substack.com/p/berkshire-hathaways-2023-proxy-statement Rather than insulting the reader’s intelligence with meaningless self-congratulatory verbiage and virtue signaling hypocrisy related to various trendy political and social issues, Berkshire’s proxy focuses on matters that are actually relevant to shareholders. The company refuses to engage in typical corporate “diversity” initiatives and rightfully focuses on merit and skin in the game rather than the color of one’s skin: Berkshire does have women and minorities on the board, but rather than insult them by treating these highly accomplished individuals as props to generate a checkmark on some diversity grid, the proxy emphasizes that they were selected due to what they bring to the table in terms of experience and ownership. In response to a shareholder proposal that is intended to force Berkshire into the practices of most other large companies, the proxy responds with the following statement: Readers of the biographies covering Mr. Buffett’s life know that he was an advocate for civil rights from the earliest days of the civil rights movement of the 1960s. He has also made numerous comments over the years about the loss to individual businesses and to society as a whole when women are discriminated against in employment markets. None of this seems to matter to politically driven pressure campaigns intended to intimidate businesses to elevate skin color, gender, and sexual orientation over ownership and business acumen when it comes to corporate governance.

-

Lots of interest rate prognosticators with a clear crystal ball on here, apparently. Idk why Fairfax would lock in anything below 5% with any sort of duration when they should be able to do twice that (and with less inflation risk) in other areas of the portfolio. Hopefully Prem has truly internalized Buffetts lesson to take what the market gives you and 3-4% rates are still insanely low in the long arc of history. Cash and cheap stocks are still looking much better to me. Even 7%+ mortgages with the ability to foreclose and own the properties it comes to that… IMHO makes a lot more sense for an insurer (and basically anyone else) than lending to the government with similar duration at half that return in a best case scenario.

-

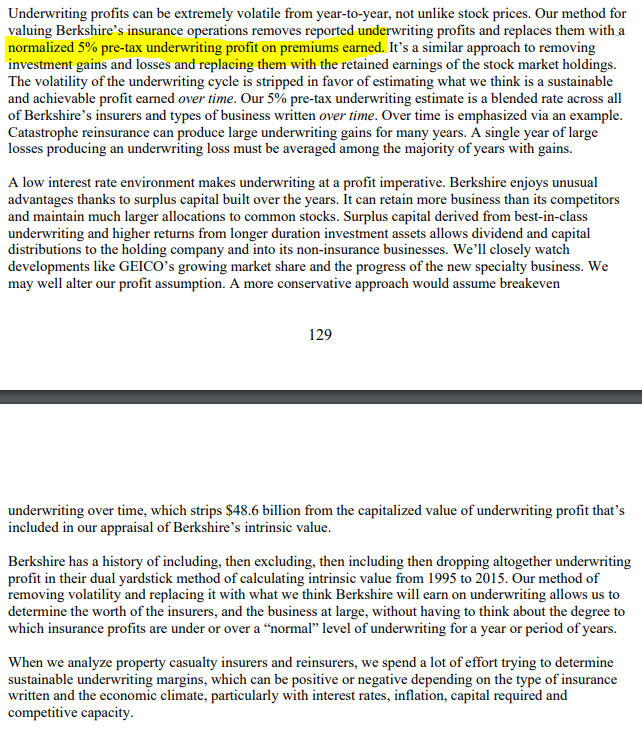

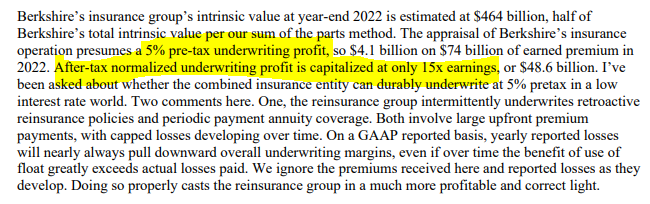

Circling back on the normalized u/w profit discussion after reading Chris Bloomstran's latest letter. I get to ~$5-10B for the capitalized value of FFH's own normalized u/w profit using more conservative assumptions than his on BRK. That's ~$200-400 IV per share for FFH from underwriting alone. FFH IV/share is ~$2,000+ using essentially the same methodology as Chris's BRK valuation. With more conservative inputs for the investment portfolio returns and multiples on economic profits... appropriately. We are almost getting FFH's entire $40B cash/fixed income portfolio for free. Or we are getting FFH's entire private+public equity portfolio for free twice or three times over. So no more whining about Blackberry, please FFH is not BRK… IV will prob grow at a similar clip from here, but with wider dispersion in the range of outcomes for a host of reasons… but, FWIW, FFH (~$700 vs ~$2,000) is prob ~2x cheaper to IV than BRK (~$300 vs ~$400). And FFH is not exactly looking like a value trap either as they’ve seemingly flipped to highly cash generative and buying back stock in big chunks. Someone check my math, I often need it...

-

Q for @Viking @Parsad and any others with a large % of their portfolios in FFH… if anything kept you up at night about holding FFH for the next 5-10+ years, what would it be? Is there some blowup risk I’m missing? I have a really hard time seeing how more float is a bad thing. In all time worst catastrophe scenarios, well, they have a massive cash+fixed income portfolio to draw on to fund losses, survive, and enter the next hard market. Meanwhile, they have clearly structurally improved the insurance side and underwriting profitably - a massive asset, not a drawback - especially with borrowing costs otherwise off the zero bound. I get that it is more leverage, but seems to me it is basically the best kind of leverage - probably 0 or negative borrowing costs and not adding incremental blowup risk. What am i missing?

-

I’ve accepted the idea that FFH might attract only an extremely small niche within the already small niche of buffett / value nerds. Most will probably always prefer BRK or MKL, even at 2-3x the valuation…like 2 years ago… and even when things seem to be lining up especially well over the next couple years for FFH in particular and BVPS might be ~40-50% higher 2 years from now without heroic assumptions. I’m OK with that if Prem can take out, like, half the share count at high incremental returns over the next decade.

-

Sorry, didn't mean to turn this into a Chris Bloomstran thread. @Viking does an even better job in the weeds on FFH than Chris on BRK anyway. Bottom line is that to the extent it's true that the blowup risk is higher in FFH than in many peers - which I might push back on - I think we are getting paid more than adequately to take that risk with the current setup. A reasonable base case IV/share ~2 years out is ~30-40% higher than today's, driven by a high earnings yield and buybacks. And BTW the stock still trades at less than half of today's IV. IMHO.

-

@Luca not sure I follow your example but yeah, I think we must look at look-through earnings on their equity holdings (and not just dividends and quarterly price movements) when we are thinking about the underlying earnings power of the business. The marked-to-market vs associates vs fully consolidated accounting treatment of their equity investments does no one any favors… it’s basically arbitrary from an long term investor POV. I wish Chris Bloomstran would give FFH the same 100 page valuation update treatment as he does BRK… to lay this out better than I ever could.