MMM20

Member-

Posts

1,870 -

Joined

-

Last visited

-

Days Won

10

Content Type

Profiles

Forums

Events

Everything posted by MMM20

-

I think many people miss this point. Think about how much BRK’s % ownership of AAPL has increased as AAPL has bought back stock. That doesn’t appear as a dividend or look through earnings anything on BRK’s financials… just short term stock movements obscuring the economics. Same sort of thing is true for FFH. IMHO it’s best to think through a reasonable total return on investments and what that means for FFH shareholders irrespective of accounting treatment, or even FFH’s cash flows in/out, if enough of their underlying holdings are retaining earnings and making good reinvestment decisions. The value can add up. And what would an ~8-10% total return on FFH’s underlying equity holdings (however they are accounted for) over ~5-10 years mean for shareholders? IV/share could reasonably ~2x over ~5 years, even with “meh” scenarios for underwriting, cash/fixed income, and buybacks.

-

IMHO @Parsad's framing is correct and helpful... but it's also true that sentiment has a ways to go for this to hit fair value, and that the narrative around fewer wholly owned businesses than BRK / MKL could totally flip on its head again if FFH continues performing well on the investment side. A more liquid ("flexible!") portfolio than peers with as good or better recent performance + willingness to sell stuff at the right price (cough cough Coke cough cough Apple) + greater quantum of 0 cost leverage + longer runway for higher returns at their smaller size Story shifts back to *higher expected returns* if with inherently higher risk and volatility... not the low returns and high volatility of a big stretch of the 2010s... => parity or better on valuation Just don't be surprised if it plays out like that.

-

Shareholders hadn't completely thrown in the towel yet. Narrative follows price.

-

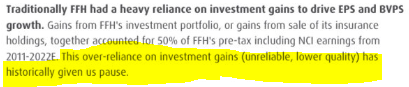

Couldn't agree more. I keep testing the thesis and coming back to roughly your same conclusion. Fairfax's acquisitions and recent organic growth have set them up with huge float vs. the size of their investment portfolio. That didn't matter much when basically anyone could borrow at ~0. Now it's back to being a massive advantage, and Fairfax has relatively more of it than anyone else. Run the numbers and you'll see that with a -1% to 0% cost of financing (99-100% combined ratio) on what amounts to roughly half of their investment portfolio, we should only need market-ish returns on their fixed income and equities to make ~20% long term returns from this valuation - especially when the share count should shrink in a meaningful way over time if the stock keeps trading at such a big discount to IV, which they've telegraphed, and w/ huge leverage on fixed overhead. So I think Fairfax is "worth" US$1500-2000 per share today. From that price, you'd expect to earn a fair ~10% long term return. As a sanity check, that would roughly line up with peers valuations on '23/'24... and FFH really does now have a lot more float than peers relative to its asset base and, yes, has demonstrated the ability to underwrite profitably long term. Of course, this relies on steady execution and no huge macro overlays / swings for the fences, which made the whole thing hard to handicap before but seem to be in the rearview mirror now.

-

Alright, I get that a lot of things can go wrong. Just let me walk through another scenario. I defer to the rates experts here but 3-5% seems conservative to me. Money markets now at 4.5%. Given FFH’s extremely strong long term track record, shouldnt we expect a continuation of very good judgment on duration and spreads? We might very well end up with equity-like 6%+ returns on the fixed income side if they make a few good calls as they've done for decades. And would you be so surprised if the public+private equity portfolio compounds at 10% over the next decade? Research Affilates has nominal 10-year expected returns for a global equity portfolio at about 10%, with EAFE and EM low teens. Ok, let’s assume they just breakeven on the insurance side and no more growth for a decade. Still = 0% borrowing cost on tens of billions. Year 10 = ~$60B cash+fixed income + ~$40B equities, and ~20mm share count (maybe much lower), minus real liabilities and capitalized overhead, w/ no credit for insurance value = NAV ~$3,500 NAV in 10 years. High teens IRR / 5x MOIC. Power of their now huge float and good execution w/o some big bad macro overlay. Prem goes out on top in his 80s. Or goes full Buffett/Munger. I dunno.

-

So then what is the right earnings figure? Annual operating profit now = Fixed income ~$1.5B (@ ~3-5% yield) Insurance ~$1B (@ ~97% combined) Equities ~$1-1.5B (@ ~6-8% total return) Minus corporate overhead = ~$3-4B operating profit Minus interest and taxes = $2.3B+ net profit = $100+ earnings per share How is he wrong?

-

Respectfully, this is sort of the point I was trying to make. The history is instructive, of course I agree. But I believe investors then need to look even harder at where that all puts us *looking forward* in a reasonable base case: 1) the insurance operations acquired/improved and structurally profitably in a sustainable way; 2) exiting a decade of interest rate suppression without a giant hole in their B/S; 3) basic blocking and tackling vs major turnarounds on the equities side (and maybe even continuing to ride the wave of statistically cheap stocks catching up from a decade of all time historically terrible returns vs statistically expensive ones); and 4) swearing off shorting and eliminating big macro overlay type bets (we think). IMHO that all makes the business much simpler to underwrite and set up to look much different over the next decade than the last, and I believe investors should analyze it in that context. So if you believe the next 10 years: 1) ~95-98% combined ratio b/c of structural improvements in insurance operations; 2) cash+fixed income ~3-5% with more historically normal rates (such that, yes, as a base case the spread should be better than on average historically including the last decade of interest rate suppression); and 3) overall equity portfolio is easier to handicap and as a base case ~6-8% CAGR, still below 10-year estimates on a global equity beta portfolio (Research Affiliates); and 4) excess cash goes to buying back stock at ~10-15% earnings yield along the way, which they’ve telegraphed well, that all adds up to a ~15-20% compound return for shareholders over the next decade from this current valuation. That’s the gist of why I believe FFH should trade at twice its current valuation right now. So I get your point that the cash/fixed income spread to cost of float looks high, but that seems to be due to structural changes in both their insurance operations over the past 5-7 years and the fixed income markets. Maybe that’s too much of a “this time is different” argument and I get the skepticism! But if the insurance side really is structurally a better business now, and the power of float is much greater looking forward now that borrowing costs are off the lower bound, then that spread *is* structurally higher, with big implications for FFH shareholders that imho the market still doesn’t properly appreciate… maybe specifically b/c we’re exiting a decade-plus of cheap borrowing for everyone, the average analyst at the big funds is about 28 years old, and a Canadian insurance company that your PM probably gave up on in 2017 isn’t exactly the sexiest stock to pitch!

-

I made this a big position at $360 in Jan 2021 after doing a deep dive for the first time b/c of Blackberry becoming a meme stock, of all things. I still have the crazy $BB $100 scenario in my model but realized it was screaming cheap even if BB went to 0. And made it 50%+ of net worth for a week or so in Dec 2021 from US$460 -> $500 into the auction buyback. Hindsight 20/20 but should’ve kept more of it. I got a lot of pushback at the time for suggesting IV then was easily US$800+ if you marked their assets to market and thought hard about intrinsic value. I was called naive but I was convinced a fresh pair of eyes for a deep dive was an advantage and stuck to my guns b/c this was squarely in my circle of competence, having spent many years focused on asset managers / fund investing professionally. I think I am just doing the same now and getting to $1500+ as IV has arguably doubled over the past two years with great capital allocation decisions, mainly short duration fixed income protecting capital and expanding aggressively into the hard market, putting them in a huge position of strength now imho. Amazingly, the valuation on earnings (which don’t seem to be at a cyclical peak, but structurally higher as they’ve protected capital and intelligently taken insurance share by competition weakened by big bond losses) hasn’t really changed as the stock has roughly doubled. I take your point that sentiment has shifted (from depths of hell levels imho) and there is a lot of risk and uncertainty in the business. But as far as I can tell, Fairfax is still such an outlier that I would be surprised if that 50-100% valuation gap persists as more eyes take a fresh look and see the turnaround and great setup. Respectfully, those that have lived and breathed all the ups and downs might still be underestimating how much has changed and what this is worth going forward after some major structural changes. It is looking to me like a potential lollapalooza scenario with earnings growth + multiple expansion from insanely cheap to just fair value at 1.5-2x BV. With setbacks and lumpiness in returns along the way, inevitably. That said, still open to the idea that I’m way too bullish as there was a lot of good luck involved with how rates played out, and no one went broke taking some chips off the table after a stock rerated from 0.6x to 1x BV. I am still inclined to add and held back only by epistemic humility and "sleep well" risk management. Anyway, I am grateful for all the knowledge and wisdom of all the long time FFH followers here.

-

I think this just gets at the fact that returns will certainly continue to be lumpy… not the structural drivers of returns and what a fair multiple of normalized earnings should be. If combined ratio is 95-98% and equity returns 8% over the next decade - which I think would be below 10-year estimates from Research Affiliates on a global equity index portfolio - then this is a US$1000 stock right now even if cash+fixed income is only 1-2% for the next decade (in large part b/c of the power of the float) b/c from that point shareholders would still make a low teens long term CAGR. So I think the key question is really what normalized earnings are right now at their current size and capabilities. I agree with @Vikingthat US$100/share might be low.

-

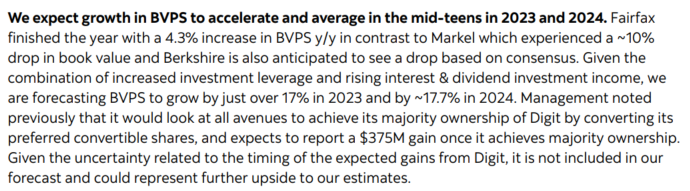

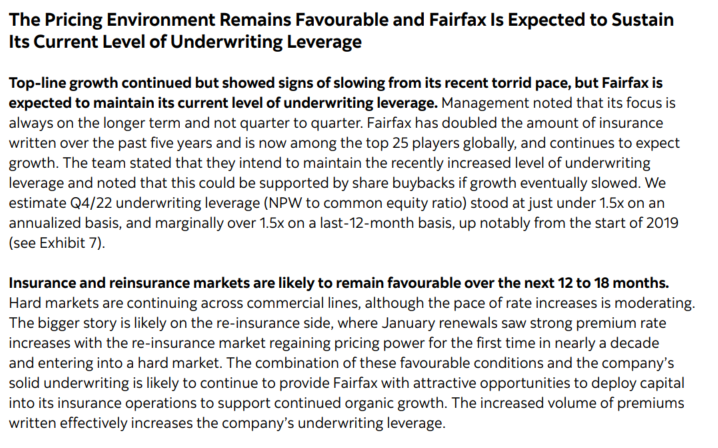

I get the critical importance of their fixed income investing and duration positioning, so not trying to poo poo that conversation, but at risk of sounding like a broken record, even if interest income goes to ~0 by '25/'26, the stock should *still* have a low teens ROE long term driven by profitable underwriting, something like high single digit long term returns on their equity investments, and a shrinking share count w/ FFH telling us they'll look hard at large buybacks (and at ~50% or less of IV unless the stock really pops this year). A lot of this comes down to the sheer size of their float, which again is equivalent to negative interest rate debt, relative to peer levels. If they can create borrowing at negative 2% or maybe even negative 5% interest, then even ~0-1% interest income on cash/fixed income earns us shareholders a decent spread given the sheer size of the insurance operations. I'm copying this chart from Trevor Scott again b/c it perfectly illustrates how much of a crazy outlier FFH still is on a reasonable estimate for the near year or two, despite now being a ~2x over the past couple years. If you think through the size/strength of their insurance ops and public+private equity portfolio, I just don't get how FFH is worth less than 1.5x BV even in in a worst case scenario where interest income is down huge by '25/'26. Closer to 2x BV, still less than a market muliple of earnings, looks more fair now.

-

I think the guy from Leucadia should be fired for always asking Prem to raise the dividend. In what world is a higher dividend preferable to buying back stock at <7x earnings and arguably 30-50% of intrinsic value? Dividend is worse in every way including tax efficiency. I hope Prem will set him straight on one of these calls and tell him to sell a little bit of stock to create his own dividend if he wants a tax bill so badly. At least we don't have that crazy guy with the thick brooklyn russian accent yelling at Prem for being out of touch anymore, which in retrospect basically bottom ticked the stock. The professional analysts still seem out of touch with what actually matters at Fairfax.

-

@TwoCitiesCapital even if we are headed back to 0, that would logically coincide with credit distress and spreads widening out, right? Just seems extremely unlikely that they end up “stuck” at 0% interest income. Taking what the markets are giving us with the inverted curve seems like the right call unless you are trying to show “locked in” interest income for Mr market to capitalize at a higher multiple at the expense of what seems to be the right long term risk reward move for shareholders imho.

-

I believe FFH would have been the best performing stock in the S&P 500 last year if eligible. And still trading at ~6.5-7x what seem to be sustainable earnings growing low single digits per share long term from here. If yields return to ~0 and so by ‘25 they lose most of that interest income w/o extending duration, really a draconian scenario for that piece, well, ok, you now sustainably have a ~US$20B+ equity portfolio earning ~US$1.5-2B+/year and an insurance engine earning ~US$1B+ looking forward. I have a hard time seeing how this isn’t worth at least 10x ~US$3-4B operating income with their solid capital allocation and shareholder orientation. That would just put them in line with peers on Trevor’s chart. Still think this is easily a US$1000 stock right now and probably closer to US$1500.

-

I was glad to see him lay out this math in a straightforward way. And mentioning that the stock still trades at 6.5x P/E as a sustainable base and so they will strongly consider large ongoing buybacks if we don’t see a reacceleration in insurance pricing. ^from Trevor Scott on Twitter. I will be surprised if this persists.

-

That report should be more than enough for the quants and more backward looking and quality growth types to push this back up to ~1.5x BV over the next few months, but still not holding my breath.

-

TORONTO, Feb. 10, 2023 (GLOBE NEWSWIRE) -- Fairfax Financial Holdings Limited (TSX: FFH and FFH.U) will hold a conference call at 8:30 a.m. Eastern Time on Friday, February 17, 2023 to discuss its 2022 year-end results, which will be announced after the close of markets on Thursday, February 16, 2023 and will be available at that time on its website at www.fairfax.ca.

-

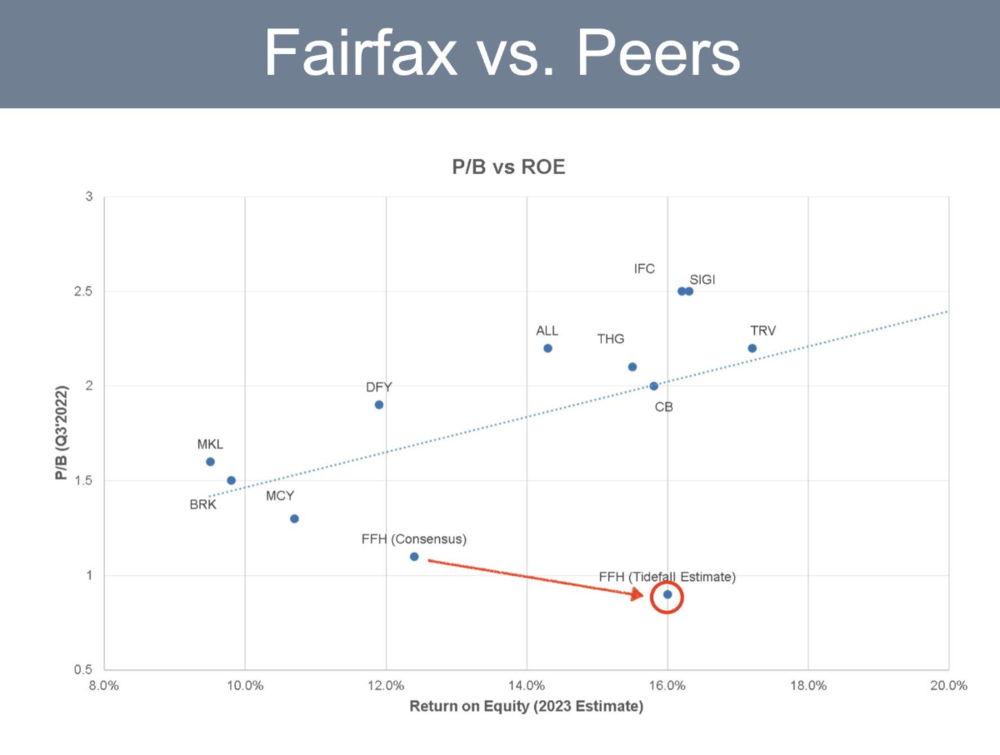

Just incredible that you can cover this company professionally and literally lead off your upgrade report getting the whole point totally backwards. Lumpy does not equate "unreliable" and "lower quality" earnings. Lumpiness in intelligent value investing is the price you pay for a shot at long term outperformance. Give me the lumpy returns from Fairfax's private and illiquid public investments all day. Would you rather have "smooth" returns from keeping the cash in the bank or buying long duration treasuries all the way up to 1-2% yields like most insurance companies did over through the past few years? Looks super smooth quarter to quarter, doesn't it? So you get a premium valuation for that even if you're definitionally locking in lower returns for investors? If Fairfax can underwrite to 95-98% combined ratio and invest in cash/fixed income at ~3-4% and equities at ~6-8% CAGR over the next decade, that'll be an absolute home run for shareholders from this valuation, even if it's "lower quality" and puts a cap on multiple expansion b/c of bad logic like BMO's. If you insist on smooth 15% returns, well, that's how you end up invested in Madoff.

-

@StubbleJumper Makes sense, thanks for your thoughts. I hear you and incorporating all that I still think the stock is way undervalued at this point. If we use a 100% combined ratio, ~3% cash+fixed income yield, and ~6% public+private equity cagr - yes, i agree that no one year over the next decade will look anything like that! - that's still ~$2B in pretax income. I think you could pay $25B for that today b/c with something like ~20% of normalized net income paid out as a dividend, the ~80% retained and reinvested at any reasonable incremental return (and they have a lot of good options) = a fair low teens long term total return for shareholders from that valuation. Even that would be a ~$1000 stock and again that's assuming 0 profitability in insurance underwriting and imho too-conservative e(r)s for the investment portfolio. I heavily discount the early-mid 2010s performance for a bunch of reasons that @Viking and others have laid out so well, and I hope prem is still going strong in 5-10 years... but anyway.

-

@StubbleJumper I guess what I'm getting at is, which specific piece of the earnings algorithm now is overearning? Are you saying a ~98-99%+ combined ratio not 95% is an appropriate number on the insurance side for the next decade? ~2% yield on the fixed income portfolio instead of what looks conservatively to be ~4%+ going forward? Total public+private equity returns of ~5% instead of ~8%? Should we assume the share count increases with some big misguided acquisition funded with stock instead of shrinking with buybacks? I get that insurance prices and interest rates have been up recently, but I'm still trying to understand specifically how that translates to FFH overearning, b/c it looks like the investment portfolio alone is now set up to earn $2.5B+ in normalized pretax income per year, using something like ~4% for the ~$35B+ cash+fixed income side and ~8% for the ~$15B+ private+public equities. So then assuming decent sustainable profitability in insurance at their current size (and after subtracting interest/dividends on the debt+prefs) gets us to $3B or maybe even $4B in normalized pretax earnings, even if insurance pricing and float growth is flattish over the next few years. What is that actually worth to a shareholder with an imho fair low teens cost of equity for FFH? Maybe I'm off base but as a generalist looking at all kinds of stuff all over the place I think it's something like a ~10x multiple of pretax earnings - which translates to a ~$30-40B fair market cap right now, today. Yes, that is roughly a "market multiple" (a bit less still) and a big premium to current BV and to most other insurance companies. Appreciate the conversation and just trying to understand where this logic/math is wrong. Thanks.

-

I've written in the past about how this logic doesn't really apply to insurance the same way it does to commodity businesses. The reason a shale operator with a $50/barrel breakeven cost isn't worth 20x earnings when oil is at $100/barrel is that the sustainable clearing price for oil is closer to $60. High cost production capacity gets added when prices are high, which inevitably pushes prices back to equilibrium where the $50 operator barely makes a profit. This is not the case in insurance, correct? We shouldn't see insurance prices down huge just b/c capacity is added, right? Maybe just see flattish or slightly down prices from here in a bad scenario, and a good disciplined operator like Fairfax should still do well, so $100 EPS (and not $30 so ~20-22x normalized p/e or even $50 or ~12-13x normalized p/e) really should be a sustainable “base” looking forward. Can the insurance expert OGs here please set me straight if I'm misunderstanding? Have there been times in the past where pricing just gets absolutely crushed after a hard market?

-

I am a terrible trader but it seems more likely to me that Fairfax hits $1200 for the first time at ~1-1.2x BV in ~3-5 years and so the decision to hold is made easier by the market's fixation on valuing it as a multiple of book, which imho systematically undervalues the underlying cash flowing power of the business (and frankly management's willingness and ability to "do a teledyne") on a forward looking basis. I think it just depends how things look if/when we get there, right? But the dream of 15% compounding is certainly alive if they can continue to underwrite at 95% combined ratio which, as I think many others here understand intuitively, is functionally equivalent to borrowing about half the value of their ~$50B investment portfolio at a negative 5% interest rate - which is even more valuable now that rates are back to "normal"-ish! This is the power of float and a relatively large and truly well managed insurance operation. I personally think that largely for this reason it's actually cheaper now than it was in 2020, or at least not dissimilar given the range of outcomes from their current position of massive strength. But, again, I might still be the biggest bull here, and I am wrong all the time. Wish I could go to the meeting for the first time but i'll have a newborn! Next year i hope! Love Toronto!

-

I've learned to focus more on sustainable earnings / cashflowing power than accounting book value, which has masked the underlying transformation at FFH for at least the past few years and frankly tells us little to nothing for most public companies nowadays. The pet insurance sale epitomizes that dynamic in FFH's case, doesn't it? But I get your point and understand that FFH investors tend to be old school book value / low accounting multiple value guys and so that's the way the market tends to price it, which might continue to put a cap on multiple expansion. I guess what that means to me is that FFH might just continue to trade too cheap vs the actual earnings power, which just means it ends up a long term hold compounder that might never hit fair value again. So maybe it trades at ~$2000 at ~8x '30 earnings in 6-7 years, at which point ~$4000 would be a lot fairer!? I hope so... but maybe you're right b/c I definitely do get way too bulled up sometimes.

-

Couldn't agree more. Maybe FFH rerates to a market multiple once investors are smacked in the face by the fact that ~$100 '23 EPS actually should be a sustainable floor which should grow at a 10-15%+ CAGR from here with basic blocking and tackling... as you've laid out so well in your posts. A market multiple is a ~$2000 stock a year or two out. Even a low teens P/E which would just put them in line with most other insurance cos is better than a double from here. Still here for the ride.

-

+1. Simple framework = ~$50B of assets roughly half of which are financed by float based borrowing at a negative 5% interest rate (using ~95% normalized combined ratio). That is huge. Buffett understood this 60+ years ago but many investors even BRK fans still don't really get it. It is much more of an advantage to borrow at -5% interest when regular old debt costs 6-8% and not ~1-3% or whatever it was at roughly 5,000 year lows!