Dinar

-

Posts

1,841 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Events

Posts posted by Dinar

-

-

43 minutes ago, changegonnacome said:

Any tickers in particular?….want to do some more digging myselfI own Spirax Sarco Engineering, Ashtead Plc. Porvair, Diageo, Relx, Experian and Cranswick are all in the on-deck circle. If they either come in 5-15%, or I get cash I will buy them, ceteris paribus.

-

1 hour ago, UK said:

Not about small caps, but seems interesting:

https://www.wsj.com/articles/u-k-markets-are-on-sale-nobody-wants-to-buy-11665996328

“It’s an untouchable market right now,” said Viraj Patel, a London-based global macro strategist at Vanda Research. “You could easily make a case where things get progressively worse from here.”

“Those elements are completely incompatible,” Ms. Ielpo said, noting that while U.K. stocks trade at a large discount, he views few opportunities. “We don’t think valuations are a relevant indication” for U.K. equities.

May be he is not looking hard enough? I have found plenty of opportunities in UK, including world class businesses.

-

54 minutes ago, Xerxes said:

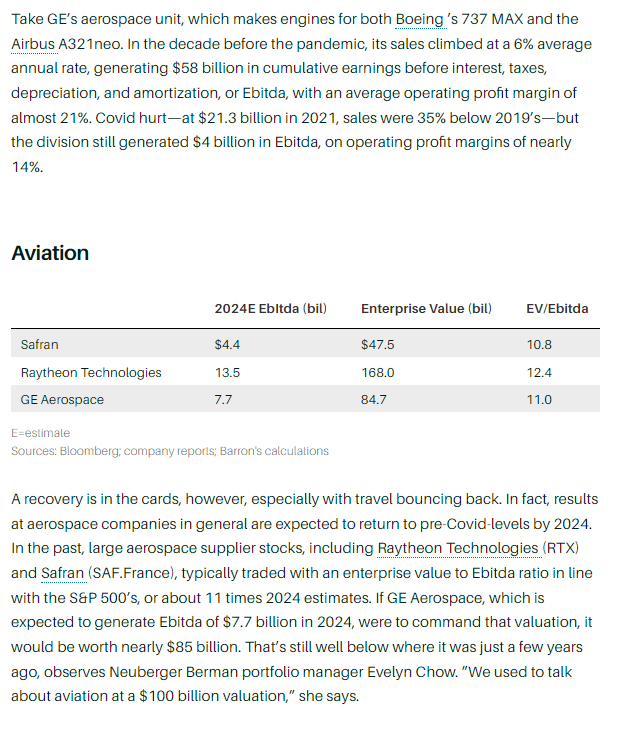

I dont follow Siemens Healthineers. As for SAFRAN, they and General Electric both have a mega business centered around the CFM/Leap engines. But i think we get a lot more optionality with Larry Culp and what he can do with new verticals within the GE Aerospace business than SAFRAN.

Even with the CFM/Leap business, GE has more important IP with its design of the engine core (hot section) vs. SAFRAN ownership of the cold section (the outer section). I just think there is more to have with GE as a long term owner.

Below is from Barron's. SAFRAN is not hugely cheap.

If I am not mistaken Safran is 8x EPS with net cash on 2025 numbers

-

6 minutes ago, Xerxes said:

Barrons had a recent breakdown of the three business that are going to be spun off.

I posted it on the General Electric thread. Re-posted below.

Personally, while i am interested in GE Aerospace (re-named GE Aviation) with Larry Culp at the helm, i dont want to deal with spin-offs in 2023 and 2024.

I dont even believe they have shared yet even the proforma capital structure of three companies, since i last looked. I do know however that the remenants of the Baker Hughes stake and AerCap will be remain part of GE Aerospace until fully unwinded, which would probably mean matching liabilities to it.

I am not expecting a UTC like spin off of Otis and Carrier.

Have you looked at how GE compares to Siemens Healthineers and Safran? I think both are much cheaper.

-

22 minutes ago, UK said:

I see LVMH 2023 EPS estimate 31 EUR?

I cannot imagine how they are correct. Here is why:

a) H1 2022 EPS = E 15, and H2 is typically the more profitable half, so call it E 31 2022 EPS?

b) Euro is roughly down 10%+ since H1 average 2022 and the company had hedges on top of that, so once hedges roll off, I would expect roughly 15%-20% impact on EPS, so at 1 E = 0.96, 2022 EPS run-rate assuming no hedges would be closer to 35-37.

c) La Samaritaine, Belmond and travel retail have barely contributed. The first two are 3bn+ euro assets that should generate another 0.5-1 E in annual EPS. Travel retail is not back to full strength, so that combined should contribute another 1-1.5 E in EPS.

d) Tiffany's profitability is going up very fast. I remember when Arnault announced the acquisition, he said that he expected the business to increase profitability the same way that Bulgari did post acquisition (5x increase.) That means increase in E 4bn in EBIT and 3bn in after-tax net income or E 6 per share. Now I expect that to take time, but several times since acquisition, executives commented that Tiffany's is doing better than projections. My channel checks also confirmed that profitability can be increased sharply. So call it E 3 from Tiffany's?

e) Impact of buy-backs - company should be able to reduce s/o by 1% = 0.3

f) Chinese demand was impacted heavily by Covid-19 lockdowns - impact?

Total: E 31 + 6 (currency) + 1.25 E (Belmond+Samaritaine+travel retail) + 3 E (Tiffany) + 0.3 from buy-backs = E 41.5. However, this is 2022.

You may have some additional pricing benefit in 2023 vs 2022, + recovery of Chinese demand from Covid-19 shocks so I do not see how 31 Euro EPS is the right estimate for 2023, unless the world economies completely implode.

-

32 minutes ago, UK said:

I do agree, that EU is much more like Japan, than US, however during covid episode, they also printed a lot and fiscal spending was huge, including Hamilton moment and actually these rescue funds from joint borrowing only now are reaching the countries. Spending was mainly done to business, instead of people though. Meanwhile EU has some other big problems and if markets are going crazy about GB, I am not sure how things will go for Italy. If you think that raising rates is crazy or going to fast in US, than it is madness to do the same in Europe, which it seems they will try anyway:). Will be interesting to see how it plays out. And this 10 vs 15 PE, actally if you look moreclosely it mostly because SNP includes better companies/industries. Nestles or LHVMs are not much cheaper than KO or Apple.

How do you figure? KO is at more than 22x EPS, while LVMH is probably closer to 13, KO has debt while LVMH will have zero net debt by 12/31/2022.

-

44 minutes ago, adesigar said:

I don't get the complaints about the drop in the S&P. The only reason the S&P rose to 4800 was because the fed had low interest rates. The fed giveth and the fed taketh away. Market is not even back to pre Covid levels.

Yes and no. While in nominal terms S&P is 10% higher than on Jan 1st 2020, adjusting for inflation it is down around 15% since then.

-

10 minutes ago, Spekulatius said:

Checks to the Ukraine are a great investment. Keeps this particular problem out of our way for decades to come.

Energy is tied to this and needs to take into account the shortfall that is mostly NG not crude. The Russians keep selling crude just like they used to, because they have to.

Why are checks to Ukraine a good idea? The biggest threat to the USA is China, Pakistan - a nuclear state with crazies, not the crumbling Russian Empire that now realizes that it is a paper tiger.

-

5 minutes ago, Spekulatius said:

@lnofeisone and @ValueHippie you could well be right. I do feel that a lot of pessimism is build in valuations for Euorpean manufacturing stocks. As someone who works in the US in manufacturing it is really hard to compete against Europeans now with the USD- Euro exchange rate as it is.

This matters more for France and Germany etc who actually have manufacturing, rather than the UK which has financialized their economy and doesn't really make anything any more and exited the European Union. The UK is in way worse shape than the EU countries in my opinion.

Spek, do the work on Spirax Sarco Engineering, I think that you will be very impressed with the business.

-

I remember 35-40 years ago that most trains in the former USSR were electrified, with the electric cables strung above tracks. So I presume it can be done if it becomes cost effective.

-

Thank you gentlemen

-

2 hours ago, SharperDingaan said:

Agreed, but right after WWII that wasn't the case; the black market thrived, and bribing to obtain all kinds of industrial 'favors' was a very common practice. People had to live, there was little infrastructure left, and they did what they had to do.

Per the Corruption Perceptions Index (CPI) Germany (80) is less corrupt than Canada (74), and less corrupt than the Ukraine (32). While corruption is indeed the regional norm around the Ukraine, it is not the case in Estonia (74) where blockchain is in wide use.

Most would expect that the financing to rebuild Ukraine would be primarily 'western', distributed using blockchain, and that corruption would average out at around 53 [(74+32)/2]; or about as corrupt as a Cypress (53) or a Saudi Arabia (53). Not great, but at least tolerable. https://www.transparency.org/en/cpi/2021

Cypress has long been a Russian money-laundering hub, and Saudi Arabia has long been the source of a good chunk of western oil and gas. Corrupt, but not corrupt enough to avoid doing business with.

SD

SD - Estonia is essentially German, or was. Latvia, Estonia and Lithuania were always a breed apart in the USSR. These were German provinces that became part of Russian empire for 170-190 years, and then independent again in 1917. Finland is the same story (except it avoided the Soviet yoke from 1938-1990). If I were to invest in Ukraine, I would consider it charity and assume that the money would be gone. It is the same approach when I lend to people - I assume that I will never see the money again. (I lent money twice in my life, in both case I did not expect to be repaid when I was asked for a loan, and both times was pleasantly surprised.)

-

25 minutes ago, SharperDingaan said:

Most would expect that the Russia/Ukraine special operation is going to end up a draw. Ukraine part of NATO, all annexed Ukrainian lands back in Ukrainian control, a new iron curtain on the border, and an agreement on both sides to withdraw short-term nukes from the frontier. No incursions into Russia, and no prosecution for war crimes. https://www.bbc.com/news/world-europe-63189627

The flip side is that on cessation of hostilities, large parts of Ukraine will very much resemble large parts of Germany after the bombing of WWII. Should reinvestment and rebuilding with state-of-the-art infrastructure, do much the same as it did for Germany; Ukraine becomes a future dominant regional economic power in the east. Level of corruption not much different to what it was in Germany at the time.

The mystery is the path to peace, and the path to regime change in Russia itself.

Lots of volatility, but the end point would seem to be pretty baked in.

SD

With all due respect, I disagree in one very important aspect. Germany was and is a fundamentally honest society that abhorred corruption. Ukraine (and the rest of the former USSR and Russian empire before) has had a culture of corruption for centuries.

-

I own CP & CN. CN had the best network in NA before CP bought KSU. I am very bullish for the reasons Viking mentioned & I found the interview with Mandelblatt to be very interesting. I think Mexico and US manufacturing will be major beneficiaries of re-shoring, and CP & CNI will benefit. I also think that CP lowballed the synergies associated with KSU acquisitions and I think that technology and automous trains will help drastically cut costs.

-

8 hours ago, Gregmal said:

It was a number of thing IMO, all converging at once. Sending $300 a month, per kid, to lower and middle income families definitely had a ripple. I mentioned last year part of the “buy anything housing” bonanza was because if a family of 3 now had $900 a month for rent, those bs one or two bedroom units that used to go for $1400 a month anywhere decent in America now needed to be priced at probably $1800 minimum. This definitely reverberated. Same with groceries and entertainment. But at the end of the day, the Fed can’t drill oil, build homes or plow wheat. Their solutions only make those problems worse.

Which I guess is why I’m still balls to the wall long shelter, food/resources, and energy. Despite thinking the current inflation is passing and all.

Greg, if you do not mind, could you please share how you are long food/resources. I have not been able to find good agricultural plays for instance. Thank you.

-

18 minutes ago, Viking said:

How do you negotiate with someone who doesn’t want to negotiate? Just imagine if Churchill had decided the best course of action was to negotiate with Hitler (and sue for peace)? Yes, the war would have been over much earlier. And the world would look very different today, especially in Europe. Looking with hindsight, i think Churchill made the right decision.How do you know? Seriously, you compare Hitler and Putin? How many people Putin killed? Tens of thousands? Hitler - 100 million. Do I like President Putin? Hell no, and I had the same opinion nearly 25 years ago when he gained power, I thought that no normal/honourable person joins KGB voluntarily. But to compare him to Hitler? Again, I do not know what Putin truly wants and I do not know whether the Putin or the West tried to negotiate. But to claim that Putin refuses to negotiate is absurd, have you talked to him and did he tell you that himself?

-

7 minutes ago, changegonnacome said:

Exactly........what does it look like to 'win' against Putin..........I mean the narrative in the press is to win, to beat Putin on his doorstep no less, humiliate him.........is it a good idea to corner a rat who has nuclear bombs? Guess we'll find out...........I mean what would it look like to win the battle in Ukraine, but loose the planet via nuclear conflict.......where are the god damn off ramps here people!!......ones that respect the reality that the country your trying to beat, holds the worlds destruction at its fingertips.......as folks cheer on Ukraine's advancement to Russian borders with NATO weapons in hand I'm not so sure we should be feeling so joyous.

An existential threat to a nuclear superpower is the final chapter in the bad version all our life stories.

I agree, the top priority for the West should be to find a way for Putin to save face and end this war as soon as possible.

-

For whatever it is worth, I spoke with a friend today. His wife owns a small property portfolio in Hoboken & Jersey city, around 100 apartments (she buys brownstones with his money, restores them and rents them out.) He said that they are fully rented (granted his wife is really good - went through Covid with essentially no vacancies and rent reductions), any apartment that they put on the market gets rented in days, not weeks, and rents are up 20-25% vs pre-pandemic levels. So may be some people are fleeing NYC but ending up in Jersey city.

-

30 minutes ago, Gregmal said:

Yea you’d think they own toxic mold or something. But trading action not totally unexpected given the optics. 25 bps up on the 10 year is the new 200 more COVID cases for REITs.

The company needs an activist. I do not understand why corporate overhead is $40MM per annum, take a look at their website - a bunch of people who in my opinion should not be there. Also, they need to start buying back stock hand over fist, no way you can buy these assets at 5.5% cap rate in the private market, at 5.5% cap rate this is a $24 stock

-

Bought more VRE - 8% cap rate here unless I screwed up my math.

-

I agree with you that we need a well thought out immigration policy, but unlikely to get it. I forgot to mention Columbia doubling income taxes on top earners - more demand for Miami/Manhattan real estate.

-

What we need to keep in mind is that millions of people are and have poured over the Southern border, hundreds of thousands if not a million or two have and will come from Ukraine/Russia, and hundreds of thousands will come from China and India as immigration resumes and quite a few people in China are not happy with Covid-19 policies. Where will these 3-5 million people (say 500K-1.5MM households) live? This will put upward pressure on rental and ownership markets at all levers - both low income and high income.

-

25 minutes ago, Mephistopheles said:

It's funny how Israel remains neutral in the Ukraine-Russia war. And the West bends over backwards to show its love for Israel by punishing Iran. It seems like a one sided love affair if you ask me.

Re: terrorism - I guess we can forget that 9/11 hijackers were mostly Saudi. And the destabilization of Yemen. And the murder of Jamal Khashoggi. lol

I'm not saying make friends in the literal sense. Just saying strategically it's good to not suppress a major oil producer. I'd say its a win to do business with both Saudi and Iran.

You have forgotten numerous terrorist acts committed by Iranians, as well as its support for Al-Queda, and Hezbollah's attacks on US interests.

-

Very hard to do, and yes, my biggest mistakes were undersizing massive winners

Is The Bottom Almost Here?

in General Discussion

Posted

Japan in 1990 was very different from the US today in a number of respects. One very important one - the market for corporate control and lack of discipline of the takeover market. You have a number of companies - SK Kaken a good example where the returns have been terrible for a decade or two because the company has just sat on cash and stockpiled it rather than return it to shareholders.