changegonnacome

Member-

Posts

2,694 -

Joined

-

Last visited

-

Days Won

7

Content Type

Profiles

Forums

Events

Everything posted by changegonnacome

-

Holy moly….never saw it written down like this……imagine the productivity gains the private sector could have achieved if given control of this amount of capital to invest……instead we got inflation and the private sector is now paying 8%+ on access to its productivity enhancing capital.

-

Yep his next initial coin offering - is the Pearly Gates Coin

-

Yep - I've read the various documents - and whats clear now if you read them- is that CZ has effectively thrown his customers under a bus and thrown B2B partners of Binance like Tether under the bus to save himself. The Binance kimono past and present is being opened up to DOJ, OFAC, CIA to review. Its a treasure trove of nefarious activity. The social contract if you were a nefarious binance customer overseas or using the platform using a VPN in the US to fund Hamas, Al Qaeda, Iran etc. was that they would protect your identity......that they were outlaws too, Binance was your partner in crime.......in that sense they became the rails for lots of global illegal activity (terrorism funding, child porn, extortion, ransomware etc.). You should see the agreement CZ and Binance have made with the US Gov. as effectively a rat throwing a bunch of folks under the bus......IMO state level actors (iran, russia) and terrorist groups (Hamas, Al Queda). I'll make a bold prediction based on this - CZ will be dead within five years. He has double crossed too many scumbags globally with this move. There were lots of sleepless nights last night on foot of this binance news......at best a bunch of folks are worried about the IRS seeing their cap gains on Binance over the last few years that they didnt report......at worst criminal prosecutions will tumble out of the information Binance is handing over.

-

If true deflation has taken hold (to be clear MoM data is not showing actual broad deflation yet, its showing slowing inflation).......it is indeed a positive for price stability.......it is not however if ture a positive sign for the economy in the short run. True deflation the trip from 3 to 2% is one where the economy and labor market do badly....as if you look at the math around nominal spending growth & productivity growth to get back to 2% - it requires requires a contraction in nominal spend from previous levels....one persons spending is another persons income etc....so contractions in nominal spend are the spark that starts a broader based economic slowdown........if we are at the early innings of this we are the early innings of an economic slowdown. Yeah it's an interesting mix on the corporate side - again if true deflation is in place and Im not quite sure it is yet....you clearly cant push price anymore & volumes by definition are a problem.....you've also cut obvious costs (the fat) in 2022/23 but those labor costs that remained you've had to pay them more and you've promised to pay them more into the future (2024)......your ability to deliver on those promises without hurting your margin are impaired.....needless to say its a recipe for things to disimprove on the margin side if that's the case. I dont quite see true progress on underlying monetary inflation yet.....say the sticky ~100-150bps above the 2% baseline....we continue to track to 3.x% inflation rates......so in that respect I dont quite see the weakness occuring in the US economy either. I think it comes, its ETA will be sign posted by this true MoM disinflation or severe flattening of inflation. Lets see its very interesting to see how it plays out.

-

The monitorship of Binance will be interesting to watch.........they've basically agreed to have the US Government sit inside Binance offices watching everything......they may have the $4.2bn to pay the fine...............but were about to find out how many of Binance's customer really liked the UX/UI & CX........and how many REALLY liked the lack of AML, KYC etc........that number will be the number of accounts that are about to go dark on the platform. Strangely this judgement actually increases the likelihood, over time, that a spot bitcoin ETF could be approved......if the Binance platform comes under deep monitorship of US authorities...........you might actually have something with an underlying spot market that has some fidelity to it.....versus the status quo today. Based on CZ's net worth & likely paltry jail sentence - this might be a case of crime actually paying. I'm sure SBF cant believe what CZ has gotten away with.

-

The view I’m espousing is one of proportionality…don’t confuse my point with any support of Hamas or lack of support for Israel…...what I’m also pointing out is that raising the question of what makes Israel less safe or move safe over time…..rallying the Arab world around the plight justified or not of Palenstian’s is somewhat playing into the hands of Hamas….the attacks of Oct 7th were designed to bring Egypt, Jordan, Iraq, Iran & Russia into the theatre of the Palenstian & Israel conflict…if one were designing a response that might bring about that result what is occurring in Gaza right now is it. Optimizing the long term survival of Israel is what I’m concerned about….they live in a very nasty neighborhood…..squashing a wasp (Palenstein) in front of tiger (Iran, Iraq, Egypt, Jordan etc etc) may not be that clever. What I guess I’m advocating for is a slower approach to eradicating Hamas…..but let me be clear Israel should destroy every one of those scumbags…..doing so more slowly and surgically over years would be my approach….this shock and awe….risks what I just described. This topic seems to have little nuance…..I’ve never questioned Israel‘a right to defend itself….only that defending itself in the short run and long run would IMO be better served by a different approach. That’s it. That’s all I’ve said. My point is one of what strategy….not of what direction that strategy takes…in that I’m in crushing agreement. Destroy Hamas.

-

I do indeed hold some of @cubsfan views in my head….I can see both sides…. Your right - it seems anything, more or less, can be discussed….but this is one issue where all nuance, minutia and complexity gets lost. Ill take your wise advice @Xerxes

-

Proportionality is a well accepted principle in matters of self-defense…it’s why it’s not acceptable to kill a man for bumping into you on the street even when he meant to do it….on this idea I can assure you we are on firm footing. History has taught us that it’s near impossible to teach peace to the conquered. Short of wiping the Palestinian people from Gaza completely in an act of ethnic cleansing…..you don’t ‘win’ against gorilla warfare…..you have brief pyrrhic victories….until the next wave of nationalistic terrorism, that you seeded with your last supposed victory, reconstitutes itself. Israel has a right to safety but it is not without limits. Hamas in Gaza poses in the short term now almost zero threat to Israeli lives & sovereignty now that Israel’s vast military & intelligence apparatus is focused on the threat. Let’s be clear here….toe to toe….Hamas poses limited threat to the survival of Israel….in fact continue on with this level of proportionality and you risk pulling in unseemly neighbors to the fight such that the question of Israel’s survival as state re-appears when truly resourced state level actors step into the fray. Israel IMO, over the long pull, is making itself less safe not more safe via its current strategy. That is my view as someone deeply interested in the survival of Israel over time. Like I said you don’t beat monsters by becoming a monster. Retribution against an asymmetric threat relative to your strength is a sugar high with a terrible hangover…..the US escapades after 9/11 taught us that. This is not the might of Nazi Germany vs. the Allies…..it’s monsters who had to fly in on god damn powered powergliders for gods sake…. the lufftwaffe this is not. If winning justifies all ends….Israel could win the ‘war’ tonight. And finally it’s not clear to me how these actions with their lack of proportionality are making the state of Israel more safe over time….you destroy an apartment building with one Hamas terriosit and kill 100 civilians…whatever your personal moral view is around who killed those civilians (I’m sympathetic to the view that Hamas really killed those 100 people not Israel)….but what I can assure you is that 1000 people of that family tree that remain….10% of them will blame Israel….well congratulation's you just created 100 Hamas fighters for the next Intifada in 10-15yrs time. This is not how you optimize for the long run safety of the Jewish state for which I am an ardent supporter. I’ve many friends in Israel and this is not a minority view within the State of Israel itself….put simply that the Netanyahu coalition is not acting in the long term interest of Israel.

-

Enough people AND the means to produce 80%+ of the war equipment they need….with the remaining 20% supplied by willing and able allies. Ukraine has right on its side….but it lacks people vs. Russia….and is dependent on the kindness of strangers. Russian’s strategy is clearly now just to hunker down and let the Ukrainians burn through young men and burn through the patience and good will of the Western allies…all for a few hundred feet of wasteland . Congress has kindly nodded to the future where the cheques for Ukraine dry up…maybe already have. It should also be noted that for all the Putin war criminal & genocidal maniac talk (which is true)…..Israel in a few short weeks has killed more civilians in Gaza than Putin has in Ukraine in a year and half of war. The difference - Netanyahu is our genocidal maniac…..and the ends justify the means…..when those in ‘other’ countries that aren’t our friends accuse us of self-righteous hypocrisy this is what they mean. To be clear, my opinion is simple, Putin has committed war crimes & so has Netanyahu in the scale and scope of his retaliatory response….he had a right to strike back….but he has failed the proportionality test. You don’t fight monsters by becoming one yourself….cause then in a way they’ve won and you’ve lost. When I say war crimes of course….i say it with a knowing nod to my earlier posts….to say war crimes in the context of great powers or their allies…is to assume some World State that sits above nation states exists….there really is no such justice system….the UN Security Council members + close allies are immune to the mock justice of the international system. Its a dangerous world out there…..but the US is making a huge strategic mistake getting bogged down in Eastern Europe & the Middle East…the real cost isn’t $$$$$…it’s the loss of focus…..and strategic expense of creating new and greatly improved allies for column China….the China sun is rising in the East….and every minute and dollar spent not addressing this is a ‘win’ with a capital W for Xi.

-

Not so sure @Parsad prices aren’t coming down per se….what the WH means is that the acceleration in prices is coming down….from 8% to 3%….its a big difference….nominal prices for lots of things have reset permanently at a higher level vs. 2019…..against nominal wages that never kept up….such that those wages are down now in REAL terms vs. 2019 as per my chart (4.7% down). The headline economic numbers + stock market vs. the general unease in surveys of the general public about the economy tell a different story…..and it’s the real median wages having fallen every year since 2019 issue that the median voter feels and the WH needs to be worried about. The 3m - 10yr inversion is still strongly present (& increased in the latest bond rally) but it serves as a disincentive to create new credit and the higher for longer Fed policy against the underlying progress in inflation is pointing towards ever tighter (in real terms) financial conditions. Not to mention the MTM impairment of tangible capital from banks treasury security bets which the BTFP liquidity fixes for now but that stuff sits there with losses….stalking bank balance sheets and hurting earnings….there is however no CRE-TFP and those losses and future impairment to capital are coming. It’s a recipe to shrink your loan book and build up TBV. If your the CRO at a regional bank looking at your TBV in the context of the 3M-10 inversion AND the loan loss provisions you may have to take in the future on maturing CRE loans….….id certainly be hoarding regulatory capital if the 3m-10yr spread wasn’t enough already to back away from expanding loans. Long yields coming down against lower inflation expectations but with Fed funds at 5% are just increasing the incentive to reduce credit creation. The one plus in all this is where banks/ consumers reduce their credit consumption….Joe & Co. are increasing theirs….I’ve a feeling Joe & Co though might have prematurely stimulated….the effects of which were felt late last year and this year and where deceleration from monetary + RoW factors are gonna overwhelm the fiscal largesse much of which I’m positive is effectively torched in government inefficiency & stupidity….reminds me of China’s GDP games….bridges to nowhere juice GDP in the Qtr or half year but do nothing to enhance the long term productivity growth of your economy while creating tonnes of future debt. Building semiconductor fabs that are uneconomic relative to the price of overseas sourcing is almost the same thing as a bridge to nowhere….building the fab boosts GDP in Qtr or the year it’s built….but once it starts pumping out $50 chips with $50 of gov subsidies built in for a grand total of a real $100 price tag…versus the chip you used to buy from Taiwan for $49 that consumed none of your countries labor or capital….well you haven’t enhanced your productivity at all…you’ve enhanced your security maybe but not your productivity. You aren’t producing/consuming more with less….your consuming the same but now it’s consuming more resources relative to the past…..its not a good productivity trade over the long pull. Lots of the BBB & IRA has this short stimi politically expedient half life….great in Qtr the ‘thing’ is built but negligible or negative longer term….like building electric charging stations for example….this isn’t the productivity enhancing boom that was building the interstate highway system…..it’s the functional equivalent of Eisenhower saying let’s build another I-95 (EV Charging stations) beside the old I95 that still works (gas stations). It’s a subtle point but an important one - the wealth of nations over the long pull is about productivity growth…it’s what matters....put simply lots of this Biden stuff is almost maintenance capex at best as opposed to growth capex. Much of it had to be done for climate change or to address the deficits of the past……there’s a big difference between a new airport and fixing up a battered old one. Both maybe get you re-elected….but only one makes your grandkids genuinely better off.

-

https://fred.stlouisfed.org/series/MEHOINUSA672N I was kind of shocked by this - the fall in real median household income (4.7%) since 2019 belies the strong economy narrative......and when Biden doesn't get reelected the above is what will have done it. 2023 will likely have a modest real gain in incomes perhaps 1% due inflation dipping below wage increases......but the reality will be median folks incomes have been falling for the last three years straight in real terms and it might be the mid-2020's or later before they get back to 2019 levels. Folks aren't dummies - I'm sure the WH looks at the unemployment rate & GDP figures and says we cant catch a break in the polls....but what the voters know at the grocery counter is that they were better off four years ago than they are today....and usually thats what gets a president kicked out of office.

-

One of my favourite strategies.

-

Interesting stuff - appreciate you explaining the deeper context - the supply dynamics appear to be winning the day. Have you given much taught to the mischief making ability of Iran, Russia & even the Saudis may have in 2024 to spear a Biden presidency via spiking energy prices by cutting production. Especially when it seems like the Biden admin has shot their shot with the SPR drawdown. I mean fake bots on Facebook can help swing a few votes to da Donald…..but $120 oil feeding into the gas pumps & spiking inflation, engineering inflation & a weaker economy sure would swing voters to the Donald…whom folks fondly remember presiding over an economy with no inflation etc. I say all this not as a Donald or Biden supporter….but simply in the context of what I think is factual….Donald’s America First philosophy is really, in the foreign policy space, emperors new clothes for a very old thing…American isolationism …..which if your Russia, Iran etc creates certainly more strategic elbow room in your local hood. Would it be worth their while forgoing some many billions in oil sales in 2024 to get a president uninterested in being the world’s policeman vs. Biden? Is there any historical precedent for that in the oil market.

-

Or it could be part of the thesis which says the Fed is successfully achieving what it set out to do! Depends on your perspective I suppose. Like you could see the oil price decline as just another sign that Fed's tightening of financial conditions are starting to bite even in the face of supply cuts by OPEC...........marginal activity where the oil price gets set looks a little soft....an expanding US/European economy needs more oil, a slowing one does not....would be interesting to hear @SharperDingaan take on declining energy prices in the context of supply demand dynamics...............you can argue that oil prices and the market for temp workers (Hirequest) are kind of the same thing> Swing workers and swing energy are starting it seems to have a tougher time of late! The reality remains IMO that 3% to 2% move in inflation will indeed come....but it wont be a bloodless victory as many have hoped for (lets forget the blood of SVB, FRC for a sec)......I've spoken recently with lots of folks in companies, who are, from an incremental capital investment perspective 'downing tools' to 'wait and see'...the math doesnt work for lots and lots of things assuming you can even line up the financing........give Powell his dues.......'wait and see' and deferring consumption is a proxy for central bank success in disinflating & a cooling an overheating economy down via the crude & blunt instrument that is the credit channel....as I've said the Fed is in my opinion more determined of seeing the whites of sustainable 2-ish% inflation than the market has given it credit for.....for what 12 or more months now. I remain also convinced that they will stay higher for longer even when the populous & @Gregmal is screaming at them to cut when quantifiable and statistically significant unemployment spikes occur twinned with MoM inflation prints that perhaps dip below even 2%..which will make the screams even louder ........I think they keep the shoulder to wheel a little longer than most expect. The next identifiable Fed misstep, from Powell's perspective, is cutting too soon.......a successful Fed chair in an inflationary environment is one who gets spit at in the street......and that hasn't quite happened yet. I suspect it kind of will. We'll find out.

-

I think that's where we're headed in the West. For a few reasons: A curious thing has happened due to the wealth inequality divide in the West.......see you create enough people who are poor or feel poor relative to the top 10%......and it distorts the traditional party structures in a two party state like the UK or USA.....traditionally you had poor people vote democrat or labor in the UK........middle income & upper income voted for fiscally conservative Republicans or the Conservatives in the UK. Now I get the Republic party in the USA has that evangelical wing, the liberatrian wing & single issue voters....all of whom can be 'poor'. To that mix in the Republican party you've now added IMO a nearly prototypical democrat voter. So you see the issue now is you build a large enough constituency of in equality in your society.....of actual poor people or simply those envious enough of the top 10% such that 'feel' poor (but to be clear arent!)........well.........you get what we have now.....a growing 'poor' voter constituency base upsets the balance in a two party system and encourages the fiscally conservative party to shop for those voters such that they can hold on to power....so now IMO there is enough poor people in the tent to fuel an element of keynesianism moving forward in not ONE party, both potentially BOTH parties. The bond market shut down the UK conservative parties move to placate the new working class Red Wall voters it had picked up in the last election. The question is what latitude successive US administrations will have. Donald Trump's great innovation was to pull in what you might think of as traditionally democratic voters (or in his case he found voters who had never really voted at all) and he pulled them into his version of the Republican party. Democrats not to be out flanked promised more and Biden with his 2021/2022 trillion dollar bills delivered more. Its why IMO we arent going back to ZIRP - fiscal largese, deficits and give aways wont allow it..... because both parties now in the USA have a constituency inside them that has gained ground to become the swing vote.....that swing vote, in both parties, deep down wants versions of cheques in the mail ala 2020....and well politicians aim to please. It's just another reason why when running a capitalist liberal democracy you really shouldn't let wealth inequality get too extreme....cause all your doing is expanding a group of voters who feel left behind....... left to their own devices they will elect politicians who do nothing but advocate for sending big cheques in the mail to people & will destabilize the system.

-

Irony of ironies is that the USA decided to only build, back , better and spend some money to fix its crumbling infrastructure & airports not during the period where the 10yr treasury was sitting at 2%...or the 30yr at ~3%......but rather decided to start investing when the 10yr was almost 5%! It'll be viewed as a curious time when economic historians look back and see the Governments of the USA, the UK and much of Europe effectively disinvesting in their own fixed asset bases while the cost of capital to those same governments were at hundred year lows.......I saw the UK numbers somewhere and during the 2010's it was deemed that the UK failed to even spend a level that might be considered maintenance capex on its infrastructure base. I suspect, judging by the airports etc, the same calculation applies to the USA but havent seen it anywhere.

-

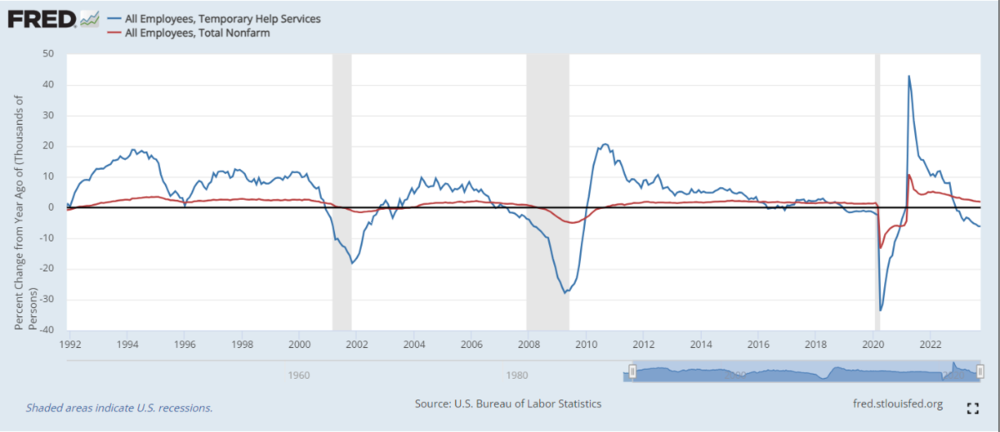

This played out as I expected...kind of closing the book on it now. as we head into year end...CPI report yesterday was indeed positive although I remain slightly skeptical of MoM perceived progress as employees head into another wage increase season......uptick in inflation early in 2024 in response seems like..... bu against that you've got leading economic indicators (temp staffing - HQI for example) showing some weakness.......didn't get as much torque as I would have liked into the idea but worked out well. Safe to say there won't be any cuts in 2023 as I had said....but I'm starting to think we could see some in 2024.

-

Well we've got to an interesting point.....for the longest time we worried about what would happen in a recession if the Fed was already at lower bound (0% + QE). The pushing on a string problem....or out of bullets one. Whats actually occured is that the Fed has reloaded the monetary bullets (5% Fed Fund) which feels like things should be ok at the next downturn.....they'll pull out the 1981-2021 Fed playback.....cut Fed funds....shift the whole curve downwards but with a nice steepener......which encourages fiscal borrowing and the banks to increase credit & feeds a general rebound. Standard stuff. However what's occured is the fiscal authorities have got themselves in a very curious position...they are running an annual fiscal deficits as if there was a recession right NOW....they have a debt to GDP ratio that as if we just had WW3......so ironically its the fiscal authorities that lack bullets.......if/when a recession occurs the budget deficit is in danger of blowing out to almost double digits.....there will be no IRA's, BBB's bills being enacted in congress this time around to send peeps/business cheques. The fiscal bullets were fired (misfired) in 2020/2021/2022. Ok so what could potentially happen. Sure the Fed will cut rates........as they always do....but what wont happen this time potentially, unlike every other time....is the Fed will pin the short end down........but the mid & long end won't cooperate in a traditional manner...cause it will have one eye on the fiscal deterioration.....treasury holders will also remember the three years of losses doled out to them too in the face of steepening supply of issuance.......so IMO its possible the curve will not be one that is conducive to an economic recovery......too flat & high in the the first third perhaps (the 2's-10's)...or the long end blows out. This is only going to exacerbate the problem in some of the banks with too much duration (CRE coming due + treasury exposure) all at a time when folks would ordinarily be relying on expanding credit from the banks as the first step in an economic recovery. Put it all together - the fiscal authorities dont have bullets......the Fed has bullets but because of the poor fiscal situation it might f-up up the treasury curve you'd/they'd ordinarily like to see in a recession. The banks b/s's are kind of zirp'd up. You've got a sh!t show potentially in the next downturn. One where the answer can only reach for yield curve control & likely straight up monetization of debt coming out of the treasury by the Fed. Which is the point where the dollar drops and inflation comes back. Very long way of saying that a standard recession playbook for stocks that worked from 1981 to 2021 might not be the right answer for prospective equity returns at the next downturn.

-

“Keep your eye on one thing and one thing only, how much government is spending. Because that’s the true tax. Every budget is balanced. There is no such thing as an unbalanced federal budget. You’re paying for it. If you’re not paying for it in the form of explicit taxes, you’re paying for it indirectly in the form of inflation or in the form of borrowing. The thing you should keep your eye on is what government spends. And the real problem is to hold down government spending as a fraction of our income. And if you do that, you can stop worrying about the debt.” - Milton Friedman Stolen from top of Wedgewood letter - https://imonkey-files.s3-us-west-1.amazonaws.com/WP_3Q202_-Client_LetterFedUp.pdf I think its about right - at this point......the last mile in terms of inflation and the final landing we have all been waiting for wont occur until fiscal spending by hook or by crook is reigned in. Fiscal is fighting the Fed..and fiscal has won until now levitating the economy...the last mile of inflation 3% to 2% is difficult to close using interest rates with 7-8% budget deficits.......the price the fiscal authorities are going to pay for this largesse is the incremental debt itself, sure....but the real cost is buried and is in the amount of debt that is going to roll over into this higher for longer period that didnt need to happen........higher for longer BECAUSE the authorities wont stop fiscally stimulating an economy at full capacity......forcing the Fed to raise the short end....while scaring the holders of the long end. This period of government borrowing relative to the set of cards for the US economy that drove that borrowing (full employment/debt to GDP ratio+ inflationary backdrop) is by far away the most reckless its ever undertaken.

-

The nature of tightening cycles is that the Central Bank is too late to the party and then stays too long. The current inflation numbers unfortunately don't provide a green light for rate cuts & the federal government's deficit spending is contributing to continued nominal spending growth exceeding productivity growth in a way that is ultimately counterproductive and doesnt allow the Fed to cut. Ironically the federal government, not the Fed, will be responsible this time for not delivering a soft landing. It's a pity I suspect if 8% deficit spending wasn't occurring we might have drifted down to 2-ish% inflation with minimal labor market turbulence just based on the progress to date............which is there but not quite there in terms of getting us back to 2%.....nearly never won the race.......and thats kind of where we've landed I think....close to something approximating a soft landing (see Target CEO above on consumers moderating)....but not quite enough because the federal government is running recessionary like deficits with full employment....usually at this point in the cycle (the end!) you'd expect fiscal surpluses or at least balanced budgets......instead we have 8% deficits....which should be reserved for the beginning of the business cycle not now. It's inverse and perverse keynesianism. We are a year out from the November 2024 elections......nothing meaningful is happening with fiscal spending in the months to come.......a mess of tough & some forced decisions await the new federal administration in 2025. Grandpa Joe must praying that he's shoved enough fiscal adrenaline into the economy to keep it limping on for another few months.

-

Got it thanks for the broad update - yep both sides seem to be spinning their wheels while they destroy huge amounts of resources....which is to say nothing off the human death and casualities.... The Ukrainians from what I can see continue to outperform expectations.....especially expectations around casualty exchange ratios for an offensive party versus a defensive one....as well the same metric for equipment. It seems the Russian army is /was in a poorer state than anybody could have imagined.......all the more reason to double efforts now to support Ukraine.......the Russian army is a shambles......but the reality of any standing army is that battle experience (assuming the resources to continue to support them) improves over time....Congress needs to stop dilly dallying on support.....there will be dimishing returns to aid provided in 2024/2025 as the Red Army gets its act together. https://www.csis.org/analysis/seizing-initiative-ukraine-waging-war-defense-dominant-world

-

Havent been following the situation in Ukraine closely for the last couple of months. As we head for winter in Europe - what is the general take on the Ukrainian counter-offensive.....broadly it seems clear there has been very very little territorial advancement around recapturing lands that Russia has annexed. Article below however talks about a more subtle take which is underlying strategic victoires that bode well for the future: https://foreignpolicy.com/2023/10/20/ukraine-crimea-black-sea-counteroffensive-russia-fleet-navy-drones-war/ My only quibble with the above article which makes me think things arent going quite so well is when the author leans on the victories against the black sea fleet as signs of Ukraine's progress.......this is not a naval war.....its very much a land war.....Ukraine can do what it wishes to the black sea fleet it will have little to no bearing on taking back the Donbas for example.

-

-

https://www.thefp.com/p/israel-and-america-have-no-choice-but-to-act Interesting read - its really a time for American diplomacy and coalition building to be at the top of its game.....the world has become a much more complicated place