Xerxes

Member-

Posts

4,626 -

Joined

-

Last visited

-

Days Won

6

Content Type

Profiles

Forums

Events

Everything posted by Xerxes

-

You got to be f&&&ing kidding me. I talked about Russia, Ukraine, genocides in Rwanda, Burma, former Yoguslavia etc. I talked about fucking Gorbachov, I talked about Franco-German wars, the mongoles, Golden horde in Crimea, U.S. foreign policy, I talked about how Trump's greatest achievement was to create peace between the Arabs and Israel, ... but the moment someone makes a comment about Israel and its lands, you get all the retards in the world, rolling over themselves up to draw red lines around Israel and profess their support. No comments about children being thrown in the fires in Burma ,,, that is all good. But we fuc*ing cannot talk about Israel. Let's get this clear and see if we can through your head => Israel won its lands through wars of conquest. PERIOD. There is nothing wrong with that. PERIOD. And it doesnt matter who started the war, Nasser or "name the Arab tyrant" of the day. PERIOD. They have it now and as far as I am concerned they can keep it, since they are better steward than the alternative. PERIOD. But doesnt change the fact that they are responsible for popluation there yet they seem to have no problem treating Palestinean like shit and throwing them out of their home for fun. PERIOD. Are Palestineans any better, nope, since they refuse to accept the inveitable for decades. PERIOD. Now, that doesnt change the fact that everytime someone says "israel", retards line up to support and profess their love for Israel. PERIOD. That is what it means controlling the NARRATIVE. Who knows maybe 50 years from now, in an unlikely scenario that Russia somehow keeps swaths of Ukraine and de-populates some of the cities and replace the locals with Russians and throws them out of their home, we would be so tired & numb of seeing footages Ukrainian throwing stones to Russian troops that we wont care either. Now, now, now before you get too excited to point out the difference between Russian naked aggression in Ukraine and Israeli wars to defend itself in 1967 and 1973, no one is making that comparision. But the END RESULTS is the same, a population controlling (subjugating) another and making rules. Hence wars of conquest. If this cannot get through your biased, brainwashed head, nothing else can. PERIOD. I am done with this thread.

-

Cubsfan, Grow up & stop whining just because someone uttered the word Israel. Good thing I stated they had won their land fair and square. Victors had always written their own narrative from the dawn of mankind, whether wars were just or not. If nothing else, get that through your head.

-

There is no such thing as unfair or fair in war. In a war, you set out to win & completely obliterate your oponenent and then hire bunch of latte-sipping analysts re-write history. Like how Israel done it. They got the Arab lands (fair and square through wars of conquest, IMO), and they can write their own narrative. Several decades later, only the bravest Westerner is allowed to critize Israel, before being called an anti-semitic and shamed into going back on what they said. And even when they critisize Israel, they have to bow and dance and explain themselves. For every geoplitical action there is an equal or greater geopolitical reaction (a bit different then Newtonian mechanics). So only a fool would dismiss the long term liabilities of a certain action that we are taking now with Russia. It is a gamble. If it works and somehow Russia get rid of Putin in a not too distant future that is great. But it can also backfire and backfire badly. I would remind everyone, that it was not long ago (last August) when U.S. made a complete mess in Afghanistan, and now it is Russia who is the one making a mess, and sleepy Joe is beaming in pride. Situation changed in a matter of six months. Things that may look very clear now, may look very different 5 months from now. Putin rolled the dice, gambeled and in my opinion lost big time (even if he reduces Ukraine to ashes). Credit goes to Zelensky (who IMO signed his own death warrant with his heroism). Right now we are the one rolling the dice and keep getting double-sixes.

-

Cycles of violence. Worth looking at the history Franco-German conflicts. Same year might be off. - 1806: Napoleonic invasion and subjugation of Prussia - 1815: Battle of Waterloo: everyone knows about Duke of Wellington, little people know that there would be no Waterloo without Blucher and his Prussian seeking revenge. - 1870-72: Creation of German Empire and the elevation of King of Prussia to Kaiser. This was done in the famed Hall of Mirrors in the Versailles Palace in France, after Otto von Bismarck had Napoleon III on the run. Loss of Alsac-Lorraine territories - 1914-18: French re-took the Alsac-Lorraine territories. In 1918, Maraschal Foch and his German counterpart sign the armistice in his train carriage (which i believe was his warcarriage). Treaty of Versailles few years later (1921?) and subjugation of Germany. The treaty was signed in the very same hall of mirrors where German Empire was proclaimed. - 1939-40: German conquest of France. French surrended signed in the very same train carriage that Foch took German's cease-fire. After that Hitler had the train carriage destroyed and in his mind the shame was forever removed. In Sept 1984, severn decades after the start of the First World War, German Chancellor Kohl and French President Mitterrand held hands. That is 178 years from the Napoleonic invasions. Think of everychild now in Ukraine and one of them is thinking ....

-

I disagree with that statement. Sounds like we are saying that, "we are doing all the hard work of choking you to death, but you got to do some legwork and remove the guy we dont like". Sanctions are stupid and work only to create an entire generation people that know nothing but misery, The moment sanctions goes up, at that very moment, almost instantiously, black markets comes into business. And whoever controls the border and ministries and flow of goods, controls the black market. We are making headlines about going after Oligarch yachts and mansions, but at this very moment, we are creating a new class of oligarch in Russia. We do not know the names of this new class of enterprising Russians that will circumnavigate the sanctions, because they are being created at this very moment. But you will know them and hear their stories 15 years from now.

-

LOL ... Yes, i do indeed like my lattes in fact, i love coffee, that first sip in the morning kills me ! Damn, i hope that does not mean that I am projecting myself and actually that it is me who up just woke and realized the world is one big ugly place. Seriously though, some of those scenes that you see, where black people (students or otherwise) trying to leave Ukraine, and they are being held back by Polish or Ukrainian police at the border really pisses me off. I dont see much coverage of that. Granted I dont have full context but I assume this is not the time to let or not let people to escape to safety based on the color of their skin. This crisis has really shown the best and the worse of us.

-

Ackman is yet another Westerner who just woke up and realized that the world is one big bad place. Forget about wars .. how many genocides we had in the past 30 years ? I can think of former Yugoslavia, Rwanda, Burma etc they were throwing babies in fire in Burma https://nationalpost.com/opinion/theyre-throwing-babies-onto-fires-in-myanmar-we-need-to-recognize-genocide-is-occurring/wcm/37e88f89-0e4c-495d-aa09-99ff8c307032/amp/ now the latte-sipping crowd is getting concerned.

-

Folks. I submit to you that it is time for NATO members not to increase their defence budget but rather to decrease. clearly Russian capability to project power is not there, beyond bludgeoning through sheer dumb scale. I just hope NATO are not planning to bleed the Russian to the last Ukrainian.

-

stupid Q: These dealings with OMERS, does anyone know if it is based on personal relationship. i.e. if that someone leaves OMERS, that Fairfax does not have the same level of relationship that it had before. I would imagine OMERS being a large institution with large risk management team whereby everything is vetted. I realize OMERS is getting a good yield, but still it begs the question what happens when the OMERS contact moves forward to better opperunities in his/her career. If it is purely institutional relationship than i guess it does not matter.

-

Agreed. To be fair everyone here know we are just bouncing around ideas. Who could have known the biggest 2022 risk would be this in 2021. I don't think China (Xi) made a mistake. I think they will eventually own Russia in several decades down the road. And in this crisis, they will be instrumental to connect Western allies and Kremlin, I think. I think of Russia (with Putin) as I think of Softbank, where the CEO has a 300 year vision but he wants to fast-track that in his life time. China's vision, which equals CCP's vision, goes well beyound the lifespan of one man. Xi is the beaurcrat of the moment, appointed 10 years ago, with a mandate of incremental assertivness. Will see if he is renewed for another 10 years as the Party' boss in the month of Oct, 2022. George Soros does not believe that he will be ! For whatever reason Westerners are obseesed in seeing Xi as a Chinese-like Putin, all because Xi extended presidential term. Westerners always see this from a Western point of view. The role of President does NOT mean anything in China. All that matters is the chairmanship of the party and who has it. In fact, (however unlikely) Xi can remain as the president of China and someone else can chosen as Secretary General of the CCP, and that new person will be the defacto ruler.

-

If neither or either Russian (state & people) cannot use Bitcoin to its fullest potential for their respective aim, that would be failing the acid test for BTC. Russian oligarch or others should be able to use Bitcoin to "lock away" asset for seizue both in Russia and abraod. I know Ukrainian have been using to capture donations at a blink of an eye.

-

So Leon's Furniture was not a #neversell. That is cool !

-

i am actually expecting a nuclear test of a sort (with an actual mushroom cloud), as the angered bear lets out a roar. But in reality, nuclear deterance will hold (unless someone misunderstands someone else' posture). Shipping Western money and h/w to the Ukrainian is all fair game. That said, Russia needs to gain ground in the war to have better chips when talks inveitably re-starts. What is possible, and probably scary, is a their low-yield tactical nukes, which is part of their conventional military doctrine.

-

In the other thread in the political section I alluded to Nixon’s Mad Man theory. For the threat of mutually assured destruction to be credible, one must appear credibly out of hinge and irrational. Or we can hope.

-

If Captain Jean Luc Picard was reading this, he would say, “we cannot violate the Prime directive” lots of emotional inertia, like there was with 2011 Arab spring. 10 years later back to what it was. I see a dark future. I see barb lines, and DMZ cutting through Ukraine. I see de-population. I see garrisons. I see a cesspool of hate & nationalism & blame that will take 40 years to heal. putin had said: “there is no reason for the world to exist if there is no Russia” At some point Zelensky has in turn to decide if “there is no reason for the world to exist if there is no Ukraine”. Very sad.

-

Wrong forum. I recommend going to the “political” forum.

-

Anyone been looking at Farmer' Edge. 85%+ down. Well that IPO was a good decision. Was that thing just sucking up resources at corporate... then IPO, you are on your own, sink or swim, ,,, and it sank. Don't feel bad though, samething happened with Vimeo and IAC. So it does happen with the best of us. Everyone has been talking about the "pivot' at FFH and wether it is the market, managerial, better investment, etc. No one is talking about the fact that things got better since the previous President stepped down. Coincidence ?

-

very true, BUT the inverse does not apply ----- If someone told me in late 2019 that we would have a) No major world wide epidemic b) No military conflict in Europea with Russia c) the SP500 would be down 50% in 2022 i would have said, yeah, that is very possible

-

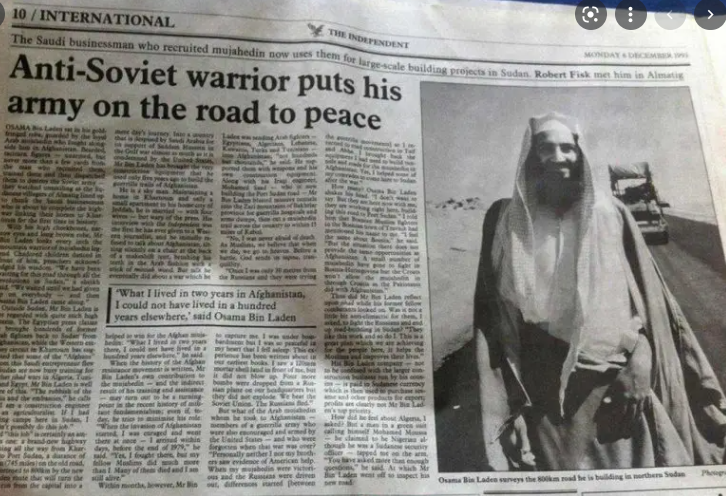

@Viking Remember this Saudi enterpreunur & businessman from the 1990s. This is from 1993, few years after John Rambo and him fought side by side in Afghanistan as Rebel Alliance against the might of the Soviet Union. We do not need more of these future 'crazies' with/or/without beard being created. And we need new Rambo movies even less. The last was one was total garbage.

-

Viking, the point of my posting that video, the portion that matters is about the fog of war. I actually did not listen when he talks about Zelensky. Whether it is under the guise of the Golden Horde, Grand Duchy of Moscow, House of Romanov, USSR and now 'modern' era, the Slavic desire of for an empire is always there as they cast their wary eyes on the West. If not Putin, it would have been someone else. In my view, Ukrain leaning toward West is reaction to Russia domineering the relationship, if there was no Russia, it would be Ukraine the very nexus of that empire. West simplifies this into+ > Putin didnt like how the cold war ended, rememner his comment about it being the greatest tragedy, he wants to undo the end of the war. Nothing is wrong with NATO expanding to East, but like everything else in life there are consequence, and at the end of the day it is the normal everyday people like you, me and Ukrainian or Russian that pay the price. I live in Iran during the 8-year war as a kid, so have a different perspective than the usual view of West-is-right-everybody-else-is-wrong (not saying that you are saying that)

-

^^^ i wouldnt put too much stock in his statements about the U.S. that is why I didnt meantion U.S. by name. The key point in mind is that it is a different situation given that it is intended to be a sort of partial annexation and/or a friendly regime. WIthout too many facts, the "current view" from the West is that Russian has been driven away by the Rebel Alliance. We just do not have any much information to go with. Fog of war is thick. And it is Day 4. On a different note, I was listening to Fareed and Robert Gates. I agree with them that this miscalculation says something about Putin' state of mind. It may not have been a military miscalculation (Ukraine can be ripped apart conventionally if Moscow wish it to be) but it was a political miscalculation. As far as U.S. is concerned, putting aside their idiotic politicians aside (and I include everyone here: left or right), their military and their level of professionalism deserves the outmost respect. That goes without saying. When I am bashing the U.S. i am talking the White House and the civilian retards that wrap themselves in the flag ... never their military or the men and women that signed up to serve their country (for good or bad). (well except Flynn maybe)

-

Not sure who this is. An American stuck in Kiev ? regardless of its legitimacy, it bears keeping in mind, annexation or semi-annexation means keeping the infrastructure intact among other things. A bit different than another country ripping another apart in a far flung corner of the world…

-

James Perhaps not for Germany, because they cannot do an immediate 180 degree, but i would say nuclear (uranuim) is the one that will get a bid. A true base-load source of energy.

-

Unf***beivable They destroyed An-225 !!! RIP

-

Putin has made NATO great again !! i put this miscalculation on his part on having a middle-age crisis as a autocrat. (i.e. wanting to accomplish something, mortals buy Tesla cars to combat their middle-age crisis, for autocrats it is different, it is about legacy) Ukrain has been re-born again in the fires of the last couple of days ! kudos to them.