Cigarbutt

Member-

Posts

3,371 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by Cigarbutt

-

Then, you may want so send a memo to Omaha to help them realize they are doing some regulated business in California.

-

A few words on the evolving Energy situation. Yes, of course, one has to wonder how the US ('We') will navigate the meanders between deregulation an reregulation in the energy universe (especially relevant now with the democratic drift question, the unusually high level of bipolarization, unusual inability to "get things done" etc versus the actual present challenges: wildfire costs, distributed energy, climate-related issues, huge capital needs etc). Opinion: Mr. Buffett is a great communicator but also a great negotiator. For Geico in the 1970s, he let Jack Byrne be the contractor and carry the stick while he remained the architect and became personally involved (with the carrot part) interacting with Max Wallach, a key DC insurance regulator, in order to reverse what seemed to be an obvious end of going concern destination for Geico. For the Solomon scandal, he also became personally involved with regulators and law makers (especially Nicholas Brady) in order to actually reverse a government decision with ominous implications for the company. Not so long ago (2015, NV Energy vs SolarCity), there was some drama (potential unfairness of return on equity for the utility with net metering over distributed solar energy) and there were negotiations but who actually remembers now the relatively deep questioning about the potential ability to resolve this issue? The issues now are larger (1-how to deal with wildfire costs and 2-is the trend for less-friendly regulated approved reasonable returns a secular one?) and it's not clear who Mr. Buffett needs to talk to but he somehow decided to use the stick and is clearly sending a message (the annual report will obviously be read by relevant regulators all around the country). For the wildfire costs which are very large, the damages to be paid have been and will be determined by juries and the court systems and that's unlikely to change. What needs be figured out is a way to cap those damages (outside of clear negligence and recklessness) and to pass those costs to the electricity consumers. It will happen somehow. Interesting reference: Microsoft Word - 2024_02_14 Utility Companies with Wildfire Liability Exposure Pose Unique Considerations for Investors.docx (clearygottlieb.com) For the regulated ROE question, much has been said about "energy justice" inputs which have had, at least so far, a limited and patchy impact on rates approved. It's about a balance of forces and some of those forces underline the unusually high executive compensation (an idea that Mr. Buffett certainly approves) as an excessive input into the approved rate decision. Also, now that approved rates sometimes go down from something like 10% to 9%, before mounting the barricades, an historical perspective may be helpful keeping in mind that interest rates, apparently, at least in some instances, act like gravity on valuations. Any idea as to why this has suddenly become such an existential issue?

-

Maybe and the aim should be to try to (constructively) destroy the thesis, but in this specific case (expected underwriting results within the next few years, absent extrinsic material surprises)... Every hard market is different: and how a specific company opportunistically takes advantage of a specific hard market is different (just think of the opportunistic capital that comes in the market after very large catastrophe years): Will string of startups truly benefit buyers? | Business Insurance FFH has grown premiums very significantly during this last hard market (net premiums earned 2018: 12066.0M, estimated net premiums earned 2023: about 22100-22300M). Not as impressive as the growth in 2001 to 2004 but quite significant. During a hard market, price of policies increase very likely ahead of underlying policy costs and underwriting standards tighten which very very typically results in reserves linked to "current" accident year policies to become redundant over the duration of the reserves. For all hard markets (not only the last three) (the opposite applies for soft markets but in the other direction), some time after the hardening starts, the accident year combined ratio will tend to (not always) go down (as was the case during the 2001-4 period for FFH) and reserve redundancies will very typically get recognized (as was the case for FFH in the years that followed the 2008-2012 hard market). As far as catastrophe losses, it appears that FFH management is quite mindful of the potential lumpiness of results (in both directions) and they've periodically commented on that aspect, including after the difficult 2011 year and they seem to be focused on making a reasonable return over time and, in the last two years, have been reporting adjustments including reduced exposure at Brit. ----- From now on, i will try to focus on the downside but (opinion) the progress that FFH has shown over the years on the underwriting front has been very impressive and (another opinion hopefully ahead of the cheery consensus) underwriting results are likely to drive various measures of return on capital.

-

One has to wonder if your time is well spent on some shared minutiae here but your posts triggered some kind of trip to memory lane (and a thick file). Disclosure (variable position sizing for me over time) and opinion: the 'market' has often gotten FFH's valuation approximately right but not always. For example around +/- 2001-2, the market's quotes resulted in an opportunity to buy an uncomfortable asset at quite a steep discount, meaning, as an equivalent, that one could buy an insurer with a price embedding some kind of an additional adverse reserve development cover and potential upside for better underwriting going forward (and some other potential upside to be uncovered over time). Now, from the underwriting point of view (a key ingredient for FFH), it looks like the market presents (has been presenting for some time) another opportunity by being too slow in applying a premium necessary for a much improved and consistent insurance underwriter (the picture has been changing for some time now but, from the legend, apparently Newton only realized some deep insights about gravity when the apple actually fell). ----- The following is a fragment of stuff i've been following. Warning: it may contain errors and some 'in-house' numbers are clearly not up to USGAAP/IFRS standards. Ok, we could talk hours but i aim to visit my mother-in-law today (who shows significant cognitive decline) in order to play Bingo with her so i'll stick to some essentials? Some comments -AY CR adj. is an in-house measure to represent FFH accident year combined ratio adjusted for reserve development (including run-off) and catastrophes % points. -CR as reported is FFH as reported. -comm. CR is a reasonable proxy to compare under, ie US commercial lines Some 'messages' -AY CR is a reasonable way to assess performance over time. For FFH, compare 2007-16 to 2017-23. -When compared to US commercial lines, FFH has done better for reported combined ratios but (opinion based on some minutiae not included here), it would look even better if their reserving process was less conservative (precision: conservative reserving is something to look for and not a comparative disadvantage). Also some years (2011 19.3, 2017 13.7, 2021 7.5), FFH had to absorb higher than usual catastrophe combined ratio points which helps to explain poorer performance vs commercial insurers in general. Also for the period 2017-23, FFH on average reported 7.3 catastrophe points compared to a slightly lower level of catastrophe combined ratio points before which also helps to 'justify' the lower superior more recent performance compared to commercial line insurers. My understanding is that FFH aims to maintain average catastrophe points to 6 combined ratio points or lower (something like that) and it appears that they are taking real actions to achieve this. Anyways, with FFH becoming international, more diversified and with more exposure to reinsurance, the commercial group comparative is becoming less relevant. -The most important message perhaps is the fact that recently reported numbers over the last 2 or 3 years seem to confirm quite clearly a more positive path for further significant underwriting profitability. Starting with a baseline 87.8 and adding 6 points of catastrophe points and adjusting for expected reserve releases, it's very reasonable to expect reported combined ratios between 90 and 95% and likely closer to 90 than 95.

-

Apologies for adding to the information overload as there may be better things to do and what follows, almost for sure, has very little utility for 'top' and 'forecast' discussions... If you want to 'believe' the hot potato effect you may be interested in the following. The hot potato effect is often thought of in relation to the (initially intended) effect of QE on banks' willingness to lend (this has been shown not to be an issue or a real transmission mechanism especially since the Fed has decided to pay interest on excess reserves). However, the hot potato effect may be real on another relevant level. Most QE (90%+) was carried out with non-banks and then, as a separate balance sheet effect, new base money or new deposits are created (yes, as 'they' say, out of thin air) and then this money tries to find its way to other securities that promises to realize a superior to 0% return with a potential for asset inflation disconnected from fundamentals? Of course, the cashier at Macdonald's does not see this but he/she may feel it? MCD's PE ratio since... Have MCD's fundamentals changed in correlation with higher valuation multiples or?

-

The comment was not to make you "change that", it was because several aspects of your post are interesting and, before commenting on this specific aspect, i wanted to make sure we were on the same page. The 2001-4 topic is both interesting and, especially, relevant for today (i think). From 2004: Later in the report: Reserving All in all, I am very happy to report that our reserves held up well. Any development at Northbridge and OdysseyRe was absorbed in their excellent combined ratios. ----- FFH expanded ++ in the late 1990s during an unusually soft market (during the nadir of the cycle in fact) and invested in very very poor underwriters (means bad results now and bad results to come when the tide goes out on reserves). So thanks to very unusual and large covers (Chubb- and SwissRe- like), thanks to the very hard market that followed (2001-4) and (critical for FFH survival) thanks to FFH's unusual ability to raise capital in a quite constrained time for them, FFH was able to absorb the HUGE negative results from the late 1990s that eventually were recognized and was even able to report decent combined ratios with a positive trend from 2001 to 2004. Now in 2024, 'we' have just lived through a moderate hard market for a few years and now, what could happen?

-

Do you mean from 2001 to 2004?

-

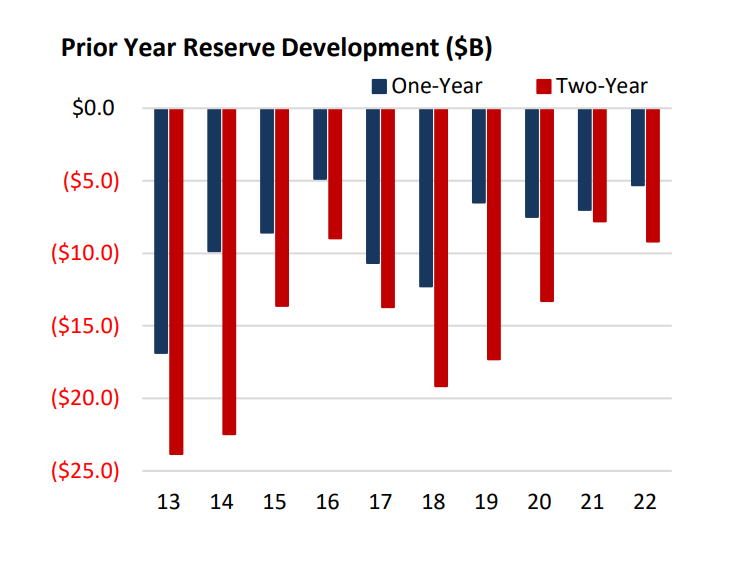

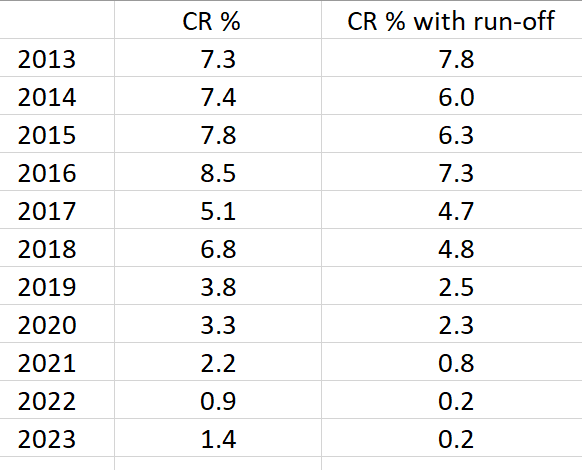

That's a point that needs to be underlined. -Short version FFH's underwriting has improved and this improvement can be seen in reported numbers and more can be inferred to support the conclusion that future underwriting results are likely to surprise, positively, overall, over the next 5 years. -Longer version This has been discussed before (a few years back in these pages and with you at times...). Here are two pictures. The first is the reserve cycle which is tied to the underwriting cycle. This is a longer term graph which includes US P/C (relative proxy for world P/C) and which shows how reported combined ratios eventually benefit from reserve releases a few years after a hard market has started and how the opposite occurs after a soft market. Opinion: for FFH with their insured lines profile, their comparable industry follows more the yellow bars, bars which should be compared to FFH's actual results (see below). Here's another with 2022 results (from NIAC, US P/C): So more of the same and a significant adjustment needs to be made for workers comp which, at the industry level, has seen a very unusual and high rate of reserve redundancy for a few years including more than 6.6B for 2022, thereby indicating otherwise a recent net adverse development pattern. Note: FFH writes WC policies but the proportion is much less than at the overall P/C level. If avid for details, one can go through their IFRS and otherwise appropriate disclosures and dissect the reserve development pattern at Zenith. Spoiler alert: this additional work does not materially change the conclusions from this post. Here's from FFH: The first column is reported directly and represents the CR % points of reserve redundancy at operating subs. The second column requires some basic math and includes the run-off earned premiums and reserve development there also. Several aspects stand out but the main point is that FFH's pattern of reserve releases has been more or less parallel to the industry but better (few % points overall), is likely to improve over the next few years as the market turned around 2018-9 as more recent positive float reserve development will more than compensate older negative float reserve development. The big bonus though (and possibly underestimated and presently unrecognized?) is the fact that FFH grew their premiums very opportunistically, compared to peers. This means that the expected reserve releases over the next few years are likely to surprise to the upside and it's helpful to remember that, for a company writing at a ratio of premiums to equity near one, each one % point of improvement in the reported combined ratio, which includes the accident year combined ratio (which is expected to be reported at slightly to moderately below 100, on a net basis, over the next five years) and the reserve development CR %, corresponds to a pre-tax one % point of improvement in ROE. Technical stuff related to the above Excel table: -the 2023 result in the second column is likely correct or close to correct but this needs to be checked with the release of the annual report -in Q4 2023, 0.7% of CR was released at operating subs, for a total of 1.4% for the year, perhaps putting some weight to the hypothesis that the trend for gradually higher reserve releases may have started to turn to the upside for the quarters to come...

-

Thank you @james22 and @TwoCitiesCapital, much to (read, absorb and) think about. i get the network effect, the ease of access etc but continue to wonder if the demand factors will be significantly curtailed by institutions that are now basically in the wait and see mode. Going back to the Cantillon effect which has been playing out since the GFC, my bet is that institutions will reform themselves, somehow. Maybe that assumption is wrong? Below is an adapted picture showing the gradual disconnect since GFC with asset inflation (those with assets benefit more) and a combination of more asset inflation and consumer inflation compensated by temporary main street money creation, at least temporarily, since 2020. Of course more artificial asset inflation and more detrimental consumer inflation would eventually feed into the cryptocurrency demand story.. NB Additional aspect: asset inflation works at two levels with the crypto demand dynamic, first through the negative social aspects tied to the Cantillon effect and second through the systematic relative attraction (hot potato effect) of risky assets, such as the crypto stuff..

-

The questions are not to annoy or to trap into some kind of useless discussion. i don't know how to value cryptocurrencies and want to learn.. IMO it's still not clear, to most, what a cryptocurrency really is and my current understanding is that if the definition evolves towards what money really is, cryptocurrencies are likely to become underwritten by publicly shared institutions based on trust. With the evolving money experiments since GFC and Covid, 'we' have seen various versions of the Cantillon effect (with money preferentially permeating to lower income quintiles since 2020 (!) at least for now which is kind of the opposite of what the referenced links describe) and 'this' is still work in progress*. It's hard to see how money management at large becomes so decentralized without a major regime change overall. *progress in the sense of general improvement over time given science, reason and humanism.

-

Take this as a humble request from a noob (refer to the question directed to you on November 11th 2023 about a topic brought forward by you in relation to cryptocurrencies and the Cantillon effect). Can you please simply explain (instead of providing a quote)? BTW, the quote that you use is often used in virtual/online debates and, in itself, does not mean much. The quote can be used to support the 'truth' but can also be used in pseudo-science circles etc Going quote for quote, here's a relevant counter example: "But the fact that some geniuses were laughed at does not imply that all who are laughed at are geniuses. They laughed at Columbus, they laughed at Fulton, they laughed at the Wright Brothers. But they also laughed at Bozo the Clown." The quote is real and is from Carl Sagan, in Broca's Brain, page 75 (1980). Sagan was someone who supported open discussions, skeptical curiosity with respect and who was against suppression through authority (centralized or decentralized). BTW, the quote that you use is often attributed to Schopenhauer but credible research supporting this is lacking. It appears that somebody at some point decided to attribute this quote to Schopenhauer and many just followed along without questioning the underlying fundamentals. Please elaborate about the Cantillon effect and how this would benefit Bitcoin or cryptocurrencies in general? Please elaborate (with in mind cryptocurrencies as a potential investment) how cryptocurrencies do not end up as creatures of the state? laughed at Fulton, they laughed at the Wright brothers. But they also laughed at Bozo the Clown.

-

What you describe is the whole (main) point as to why insurers may be worth more than book value. For FFH, some adjustments (less discounting of the reserves) need to be made to the potential delta effect that you mention. Also, to avoid double counting, i think you need to recognize that some of the intangible asset aspect has already been recognized when subs were acquired:

-

Your post is helpful. But there's room between a p/b of 1.0 and 1.5 or more. The likelihood of seeing intrinsic value (can use book value as proxy) is somewhat elevated over the next few years but it's less clear if this will be recognized in the marketplace with a higher p/b? There are reversible factors for this but there are also irreversible factors, such as their unusual ability to perform atypical transactions such as the monetization of the runoff sub mentioned before. This approach (is great in a way but) leaves them vulnerable to less enthusiasm from the market, to reasonable criticism and, unfortunately, to junk/mud attacks. The sale of Riverstone-Barbados was a great way to monetize an asset in times of need but included aspects which had costs from a risk management and quality of earnings point of view. The CVR tied to the deal effectively was equivalent to an adverse reserve development cover (liability side of the transaction) sold by FFH as part of the deal and the guarantee on the asset side was effectively an off-balance sheet arrangement reported through a derivative-type of disclosure which corresponded to, effectively, FFH buying a total return swap on the underlying common stocks held in exchange for some kind of cash flow streams, while FFH continued to "guarantee" the value of the underlying securities to the buyer. Now this aspect of the transaction has become much smaller and manageable but it was quite large at the time of the sale.. Anyways, Fairfax is Fairfax and will continue to be, i guess, to a large degree and potentially in a lumpy way..

-

Then, why such a big discount to the 1.5x BV numbers these days? The graph needs some recent update.. The reason i'm asking is because, evidently, the float liability needs to be discounted and, presently, given the potential for profitable growth in float, maybe the required discount on the float liabilities suggest a higher P/B than 1.0. i'm asking also because an example of the junk presentation by recently attacking shorts concerns the Riverstone-Barbados entity, a transaction involving two sophisticated parties exchanging an entity in run-off (where the insurance liabilities will clearly need to be paid out and maybe more than written in the books) for a P/B of about 1.0. Isn't FFH now worth more than Riverstone-Barbados then, from a P/B value point of view?

-

On November 1st of 2023, there was a discussion in these pages (FFH Q3 results) with some others and 'we' (in a collegial way?) had defined the Spekulatius quick measure (SQM) of reserve duration for insurers (basically using 'insurance contract liabilities' net of reinsurance divided by net premiums earned) and it looks like this basic measure (ratio of 2.1 for FFH) needed to be multiplied by 1.8 to arrive at 3.8 years (let's call this the adjusted Spek's measure (aSQM)) if i listened well during the last call ("due to the reserves have a longer duration of 3.8 years compared to Fairfax’s very short duration on the fixed income portfolio of 1.6 years", courtesy of J. Allen). For BRK, using similar numbers (careful IFRS vs US GAAP), the SQM comes to 2.2, suggesting an overall reserve duration of 3.9-4.0 years. In the case of BRK, they have some kind of bimodal distribution of both very short and very very long tails. At any rate, concerning the quality of float, longer tail lines are both a blessing and a curse as the time value of money can magnify both the favorable and unfavorable reserve development. For FFH, if the past is indicative of the future:

-

They could also simply explain? For example, when referring to the CVC-Riverstone Barbados transaction, they (management, on the call tomorrow) could (opinion) simply infirm the insinuation by explaining that the total consideration paid of 1329 millions for 100% of the joint venture as reported by Gatland in 2021, implied, for Fairfax 60% interest, 695.7 millions (as reported) + the discounted value of the CVR of 235.7. So, 695.7 (1329-169.5) * 60% + 463.8 (Omers 40% part, (1329-169.5) * 40% + discounted 235.7 ie 169.5 = 1329 That is because the fair value of the CVR is generally be determined by discounting the probability-weighted future payments at an appropriate risk-adjusted rate, or by using derivative valuation methods such as the Black-Scholes option pricing model and because the fair value of the CVR is considered part of the consideration paid in the transaction, under the purchase accounting method for business combinations. The 1329 number is from a 2021 annual report. The eventual realized value of the CVR is very likely linked to potential adverse development of reserves over a few years. In the event of unfavorable development, the CVR value for FFH would decrease but that does not have an effect on the 1329 reported for the 2021 year.

-

As usual, the full story is more complex and opaque than often suggested, Here's a letter to the SEC which is short with an emphasis on one side of the story but may be enough for the purpose of what you are looking for. s73108-39.pdf (sec.gov) If looking for some retrospective insights into the 'story', the following has a section on Fairfax then: SEC Enforcement Actions and Issuer Litigation in the Context of a "Short Attack" | Scholars Portal Journals For short, here's the conclusion: For short, this is another trading opportunity, just a more straightforward one and a shorter-duration one.

-

Thank you for the exchange. Obviously, the two of 'us' can't figure this out. However, 'we' don't need to and can sleep well, assuming 'they' will eventually figure it out. The idea behind going into energy decades ago included that assumption. So much to discuss and so little time... ----- Finally, 'we' have some snow in my area. Time to get opportunistically moving.

-

There is a school of thought (moderate evidence (including in the western usa area) with medium confidence...) that suggests that relatively heavy suppressive efforts (fire fighting etc) around wildfires from the last decades may have prevented nature's work and may have caused a build-up of 'fuel', potentially explaining (at least some) higher acreages burned more recently etc. This is why some groups are advocating for prescribed burns done under control (happening in Oregon). ----- sidenote: This notion of human interference with nature is, at least when applied in a positive way on a net basis, one the foundations behind human progress. If interested, this is the idea of entropy vs human progress described by Pinker in Enlightenment. This is also why it's been felt that it's possible for humans to interfere with the 'natural' laws of the economy and introduce some kind of Great Moderation... But progress is not always linear or (at least temporarily) in the right direction? ----- This part of the post is derived mostly from work done some time ago based on the 'reorganization' of PG&E, a California-based investor-owned electric utility. (In one the PCG threads from the time, i had suggested that PG&E could have been acquired at an opportunistic time by BRK as wildfire costs had been priced in and more; that was before Oregon fires got into the picture with real and non-vicarious income statement effect at the parent). Underground lines are costly, especially under certain geographical circumstances. For example, in the case of PG&E after their fire-related financial pressures, it's being proposed that some specific increase in rates be linked to underground lines. This will be a slow process (now much less than 10% of their transmission lines) and they seem to focus in high risk areas. It's been estimated that only involving the cost of underground lines across the board, the typical California client would see its electric utility bill double. An option to look into but IMHO not a cheap panacea.

-

Thanks for the healthy response! ----) away from BHE for a minute The IPCC is an interesting organization and a very reasonable source of input for rational discussions. i would submit however that your above statement is a slight misrepresentation of their conclusions. Overall, they conclude with "medium confidence" about certain aspects and we can argue about what medium confidence means but (opinion) it doesn't mean what you mean. Here's their latest summary for North America: With these multi-variable dynamic situations mixed with potential tribal feelings, it's sometimes hard to 'connect': I learned about the above quote not because of the movie but because of the Guns N' Roses song Civil War which i often play during my typical winter training 'rides' in the basement but it's actually raining outside this AM (this is slowly becoming the norm around my latitude so maybe soon i can train outside all year long so climate ch**ge may not be all that bad?). -----) Back to BHE Although irritating and maybe enough, as an analogy, to consider leaving some states for insurers when regulators refuse to allow 'deserved' rate changes, there are 'things' that BHE can do (for example): Global Strategies for Utility Wildfire Mitigation (ca.gov)

-

When dealing with the rainy snow in my drive way yesterday during another atypical day in my (northern) environment, my neighbor said (or something like that): "Everything should be made as simple as possible, but not simpler". There may be more than two factors (relevant and significant) involved here? ----- The following is derived from a cigar butt situation experienced a few years ago with Pacific Gas and Electric (PCG) when it reached the vicinity of bankruptcy (i'm no 'expert' here but there was a fair amount of time spent on the 'research' so further technical discussion and/or reference to specific data/analysis possible if warranted in this (to be ongoing?) online 'public' discussion). ----- People being "pushed" (because of unaffordable housing) to the wildland-urban interface is an issue but (opinion) more importantly people being 'pulled' into those areas is more significant because of: 1-the relative quality of life searched, 2-the financial shield experienced (from poor policies, misalignment of incentives and moral hazard) from the true cost of exposure from losses versus the cost of property taxes and property insurance premiums. Losses are basically mutualized at the federal level. It's basic math. For a number of years the number of acres burned has been on the rise as well as the aggregate home values at risk at the wildland-urban interface. As far as the 'causes' of the gradual rise in acres burned, excessive fire suppression has likely contributed but climate variables (the use of "climate change" terminology is avoided in order to suppress the potential contamination of critical thinking) have likely contributed significantly and have the potential to contribute more. At a basic level, wildfires (and associated societal damages) have to be linked to temperature changes (no?) and the level of temperature, well The Times They Are a-Changin'. ----- All that to say that, if the legal strategy for PacifiCorp implies to suggest that "climate change" does not exist, in this day and age, it may mean higher 'punitive' damages. Contrary to property insurers who can adapt and slowly adjust premiums over time to reflect rising costs, electric utilities with transmission capacity are exposed to stochastic-like losses (transmission infrastructure is one the the three main causes of wildfires, with human actions and lightning being the other two significant triggers) and should become leaders in helping to define ways to prevent such losses (involving their own infrastructure and perhaps also by collaborating with rulers/regulators). Of course present contemporary legal costs are painful but should eventually become integrated in the the general costs of doing business. Longer term thinking required? Confidence in institutions required? ----- All i know, as a simple individual these days, is that my (and my household) alpine ski season is getting more bizarre every year (not in a downhill straight line but down and for a while now).

-

So just trying to be unreasonable for a second in this post. "The reasonable man adapts himself to the world: the unreasonable one persists in trying to adapt the world to himself. Therefore all progress depends on the unreasonable man." George Bernard Shaw There seems to be some kind of relative misconception about this money flow concept (in and out of equity and in and out of cash). To support the unreasonable conclusion, many discussion paths can be taken (balance sheet approach, semantic approach) but let's use a simple example related to MMFs. Euphoricbutt buys a Treasury security from james22. It's an asset swap and no money or 'cash' is created. For various reasons, let's say 'we' decide to use an intermediate. ValueArb accepts a deposit from Euphoricbutt in exchange for an IOU with interest and ValueArb buys the Treasury from james22 and performs another asset swap. Again, no money or 'cash is created. ValueArb figures out it's good business and leaves his job as a stock picker and becomes a Treasury-money changer, thereby expanding his business balance sheet, potentially faster than GDP. Again no money or 'cash' created, even on a larger scale. The point is that when money enters the MMF, like Elvis Presley at the end of his shows, money leaves the building. Money is not sitting there as dry powder waiting to be deployed or whatever sideline terminology. However, like most things in life, you may be onto something with this money-waiting-to-be-dumped-in-the-market 'narrative'. Despite all the tightening talk, 'we' are still living in a cheap (and excessive?) money era and the MMFs' growth in assets may be more a symptom than an actual disease in itself. 'We' now live in an era where the growth of money and credit aggregates has outpaced (and in fact decoupled) from underlying economic activity and, with a larger picture in mind than just MMFs, this 'growth' has fed into inflation (mostly asset inflation but with enough creativity also into consumer inflation (not that well tolerated by the populace)). Is this sustainable and does that provide any insight for future returns?

-

In this one-liner, you likely refer to headlines made in reference to growing holdings in money-market funds. Can you please describe what is meant by cash and where [the cash] is from and where [the cash] would go in the event of leaving the "sidelines"? With all those top headlines, and the moving from sidelines, Irving Fisher and the permanent purchasing power of cash, What happens when the cash goes away, some kind of a...? Apologies, ran out of inspiration in the end.

-

What Is the Best Investment That You've Ever Made?

Cigarbutt replied to Blake Hampton's topic in General Discussion

Interesting. From my end, very different circumstances but some similarities in outcome (relevant to this thread?). i bought the book used in 2006...the second edition that came out in 2005...with an updated version including a second chapter on the real estate bu**le in the US (circled in blue below). Graph included for fun and Mr. Shiller looked at this from the real price angle. -

-About newspapers/journalism, the ability to get balanced views and the transition 'we' are going through: "Now about 95% of [newspapers are] going to disappear and go away forever. And what do we get in substitute? We get a bunch of people who attract an audience because they’re crazy …. I have my favorite crazies, and you have your favorite crazies, and we get together and all become crazier as we hire people to tell us what we want to hear. This is no substitute for Walter Cronkite and all those great newspapers of yesteryear. We have suffered a huge loss here. It’s nobody’s fault. It’s the creative destruction of capitalism, but it’s a terrible thing that’s happened to our country.” — 2022 Daily Journal Annual Meeting