SafetyinNumbers

Member-

Posts

1,570 -

Joined

-

Last visited

-

Days Won

5

Content Type

Profiles

Forums

Events

Everything posted by SafetyinNumbers

-

It’s a really good note. Hopefully makes it harder for those funds underweight vs the benchmark to ignore!

-

Canadian exchange traded debt

SafetyinNumbers replied to SafetyinNumbers's topic in General Discussion

The strategic review that ECN announced is what peaked my interest. SKY ended up doing the private placement and apparently wants to buy Triad but wants nothing to do with RV/Marine. Everything ECN has done since is to try and clean itself up for SKY. Ultimately, they still have to execute though. The ACD bonds don’t seem very interesting to me. Like you pointed out, the reward is much higher in the equity. -

He provides the earnings estimates and the moat rating. The quant machine spits out the target price. But he’s especially bad at estimating forward earnings. They don’t make any sense. Ironically, his earnings estimates make other quants want to avoid the stock because they show high variability in earnings estimates and show earnings declining. Things that are not generally associated with quality and what quants prefer.

-

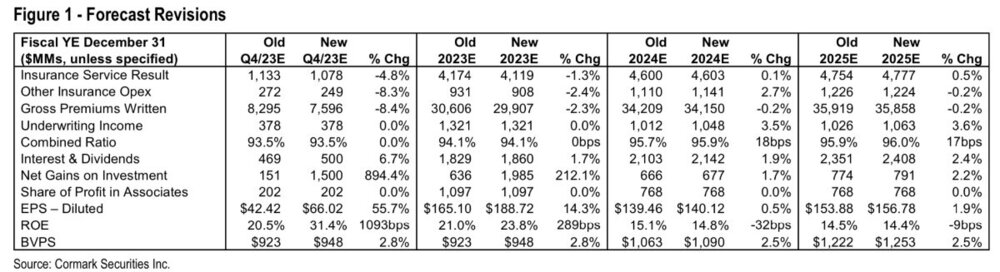

Pretty much the only reason, I think FFH has stayed cheap is because of quants. Volatile earnings streams are by definition not quality. Earnings growth modeled by analysts is also a necessity for most quants to get involved. This rules based approach has worked on a portfolio basis so they won’t make exceptions to over rule the model. Will analysts finally start modeling in earnings growth as the multiple expands, we’ll have to wait and see. Even Cormark with their US$66/sh estimate for Q423, still has them earning only US$140 in 2024. There is no point being a hero when the stock trades at ~ 7x conservative estimates.

-

Canadian exchange traded debt

SafetyinNumbers replied to SafetyinNumbers's topic in General Discussion

Thanks. A big part of the ECN trade is its event driven nature. If they sell the business which is pretty much what they are telling us they are going to do, then ECN.DB.B gets 104.875 + interest until the end of 2024. The sooner a deal is done the better and of course they actually have to do it. I disagree that the goodwill/intangibles aren’t worth anything. Most value/debt investors don’t want to pay for them but origination is valuable because with the right structure it can create significant ROE. I assume that’s why SKY was willing to invest new equity above TBV. On a related note, it will be interesting how much CHW and ACD trade for when they are sold. If you haven’t looked at ACD, it trades at close to half TBV and I think they have every reason to go private given the current conditions. Agreed on the DRT. I like that one of major equity backstops for the rights issue also owns a lot of bonds. I think the rights issue was a clever way of getting a larger stake in the company while ensuring the debentures get paid off but they have to execute too. Equity holders have a lot more faith than the debt holders! Thanks for taking a look. -

I’m guessing the buyer is already short. Coupon probably not too high, relying on the volatility and optionality to pay the majority of the financial cost. I’m not a convert expert but my guess would be a conversion price 30-50% above the recent price and a coupon in line with the reference risk free rate. Maybe 5% dilution and that’s only if the stock goes up a lot which no one seems to believe can happen. It looks optically expensive but it’s a pretty tiny market cap. I’m not sure if there is room for margin improvement and or growth but with a new CEO it might happen and create a lot of Social Value. I don’t own any. If anyone does, please consider sharing your thesis.

-

I set up a poll. Please vote!

-

Market expectations vs CoBF expectations

SafetyinNumbers replied to SafetyinNumbers's topic in Fairfax Financial

That’s interesting. I think quality tends to trade in or above its intrinsic value range if the underlying is very liquid and has predictable earnings streams. I think picking idiosyncratic ideas from everything left over has a good chance of success. -

This poll was inspired by this terrific interview w/ Bill Nygren. I posted the same poll on Twitter and thought it might be interesting to see how the responses differ if at all. https://www.fool.com/investing/2024/01/17/next-great-value-stock-bill-nygren-explains/

-

it would be interesting if they found a single buyer for it like a pension plan or endowment fund. That could be structured very creatively too.

-

I don’t think it’s necessary to get multiple expansion to justify keeping the TRS on given BV growth + dividend is well north of the cost of keeping the position on but the optionality is pretty great.

-

I think you’re correct. The multiple is open ended so if FFH can keep up a strong ROE, the flows could take multiples above fair value (north of 3x) but I doubt most of us will have the patience to hold on that long. I think it’s important to think about the outcomes probabilistically to avoid selling too soon and letting in the institutions that are underweight in too cheaply.

-

All great points. I think most investors are focused on the downside risk and not the optionality which is open ended on forward ROE and multiple expansion. With the stock trading ~1x BV, the market is assuming a forward ROE of 10%. Based on Viking’s analysis, it’s pretty clear that the odds of only a 10% ROE for the foreseeable future are pretty low. I would argue the odds of 20% ROE over the next 3-5 years are higher. If forward ROE does surprise i.e. exceeds 10% for a few years, the multiple might expand to where IFC trades or where FFH has traded historically I.e. 2.5-3x+ P/B. I think with Fairfax’s near term outlook, the stock is unlikely to trade below 1x so the multiple expansion optionality also seems to the upside. Multiple expansion so far has been relatively slow. Lifting 0.1x P/B in past 6 months. That could change dramatically once those benchmarked to the S&P/TSX Composite/60 figure out that FFH is likely next in line to go in the 60. That equates ~1m shares of buying in a short time frame which has a greater impact than buying spread out over long periods of time. Further, all of those benchmarked to the index may feel compelled to get to market weight so as not to underperform. It makes sense to do that before the add and not after but plenty of both is possible. Inevitably a spot in the 60 will open up and it could happen at any time either on active deletion or M&A.

-

Thanks for sharing. The EUROB position is ~US$100/share so a significant chunk of the share price. Coincidentally, Fairfax’s share of EUROB’s expected dividend for 2024 is about US$5/share or the same amount as FFH’s dividend increase. European bank valuations are low so lots of room to rerate but hard to bet on. It might mean that earnings estimates are too low though as high returns are available for excess capital like the Hellenic Bank acquisition.

-

I think FFH and ELF would be diversified enough and provide decent returns. FFH has exposure to fixed income and inefficient markets. ELF is a good substitute for index funds as on a look through basis it owns VOO and diversified global GARP stocks. Both offer cheap leverage for structurally higher returns.

-

We’ll find out if FFH added to their position when they report earnings. Recall, they adjusted their agreement to be able to add late last year. The stock hasn’t really done much in two months, why do you think it looks particularly bad now?

-

Thanks for sharing. I assume the Committee also has to consider the relative size of FFH vs whatever it’s replacing in the 60. Perhaps that mitigates the historic 20bp rule of thumb. It would be interesting to know the ratio of weights of every add to every deletion historically. That might give us a clue as to when they might act voluntarily or when Fairfax might become an outlier. My guess that this likely happens in 2024, is somewhat predicated on strong book value growth and multiple expansion leading to a much higher weight than 96bps by the end of 2024. Lots of things have to go right but I still like the odds.

-

Terrific post as usual Viking! It made me think about what could be on the 2024 list. We already had the 50% dividend increase. I think there is a decent chance Fairfax gets added into the S&P/TSX 60 in 2024. It's already 29th biggest in the S&P//TSX composite so when the next spot opens up, it has to be near the top or on the top of the list. That would generate ~750k-1m of buying in a very short period of time. I would expect a lot of managers benchmarked to both of those indices will have to take another look at Fairfax and increases the chances they decide to go to market weight from no position. Chances also are PMs will have to revisit being overweight IFC, if FFH becomes a bigger weight. IFC is currently 22nd biggest in the Composite at ~121bp and FFH is 96bp. The anticipated Eurobank dividend might have a very big impact on valuation as Viking pointed out. IPOs of Digit and BIAL would be huge. It was easy to come up with 5 potential Top 10 items for 2024. What else would you throw on the list or is there anything on my list have less than a 50% chance of happening? Top 10 (mostly predictions) List 2024 (in no particular order) 1. Dividend increase 2. Addition to S&P/TSX 60 3. Eurobank dividend 4. Digit IPO 5. BIAL IPO 6. ?

-

I think most investors including analysts are focused on the downside so they attribute little or no returns to the equity portfolio. Since the stock is so cheap there is no reason to include realistic estimates. It will be interesting if we see that change as they continue to beat estimates and if the stock begins to rerate. The same might hold true for some of the equity holdings. No earnings growth is expected from Eurobank despite really strong momentum. They like Fairfax will have a lot of excess capital to reinvest after dividends. At 5x earnings analysts don't have a reason to be optimistic here either. My theory is that both stocks will rerate faster once earnings estimates start going up because that's what quants focus on and most active capital is tied to quant screens in one way or another. For Fairfax, that can't' happen unless analysts start building in higher returns from the equity portfolio. Most won't bother until the market forces them to. Maybe that's starting to happen.

-

Canadian exchange traded debt

SafetyinNumbers replied to SafetyinNumbers's topic in General Discussion

Where are you trading AMC debt? I haven’t delved into US paper. Was seriously considering some GNW floaters a few years ago but just owned the common instead. If you look at ECN.DB.B or DRT.DB.A, please let me know what you think. -

There are two more interviews here worth listening to as well: https://www.marvalcapital.com/interviews Francis Chou also brought Ben by the Ben Graham Dinner last year and gave us a chance to ask questions. I liked his answers.

-

Canadian exchange traded debt

SafetyinNumbers replied to SafetyinNumbers's topic in General Discussion

This is definitely not a cash replacement strategy. The decline in interest rates is helpful in that it makes it easier to do a refinancing or sell businesses. It's much more akin to an event-driven expected value. Generally super illiquid and decently high risk of bankruptcy which usually doesn't mean a zero but very well could. I made 5x on bankruptcy of Twin Butte bankruptcy and took a zero recently on AH bonds so the range of outcomes is wide. A good strategy for probabilistic investors, terrible for deterministic investors. It's a pond that almost no one is swimming which can mean easily mispriced securities. Too high and too low so I tend to keep positions small but occasionally there is a fat pitch. Value traps can be frustrating but at least with these there is a maturity date. Unfortunately, corporates often try to screw over the debenture holders and because they are small issues without many institutions involved, they often get away with it. That's why it's nice to find aligned incentives and maybe get big enough one day to fight back. -

Do you know Ben and thus have an informed opinion? I don’t know him personally but he seems like a very competent, thoughtful investor and he literally grew up in the culture. I’m not sure there is anyone more qualified to be Chairman after Prem.

-

Impossible for me to say but it's not something I worry about.

-

Canadian exchange traded debt

SafetyinNumbers replied to SafetyinNumbers's topic in General Discussion

I guess there isn’t much interest. Two special sits I find interesting are ECN.DB.B and DRT.DB.A. Both haven’t rallied despite big equity injections relative to the EV. With ECN, it seems like they want to sell the business given the strategic process last year. The conference call was pretty clear they will sell or spin the RV/Marine business in short order. That should allow them to sell the remaining Triad business which should trigger a change of control which has very favourable terms for ECN.DB.B holders. $DRT.DB.A just closed a rights issue today. One of the parties backstopping the rights issue also owns a lot of debentures so it seems like this transaction improves the odds of repayment significantly. I like the less risky 38.5% YTM post the rights issue.