-

Posts

3,234 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by Dalal.Holdings

-

You're right. Real innovation comes from large groups of individuals (committees). Governance via committees forms the foundation of the EU and explains why they are the bastion of the world's innovation. I believe Steve Jobs also ran Apple with committees in charge and would routinely subvert his own vision in the face of them. In fact, I think even Warren Buffett makes his investment decisions after consulting a committee full of individuals with extensive business and accounting degrees. Here is a committee of highly specialized (and educated) "experts" delivering their moonshot that will bear the fruits of innovation for generations to come:

-

Weird how GM, Ford, Lockheed, Boeing can’t accomplish even a fraction of what Elon has with access to MORE gov’t aid. GM was rescued in whole by the taxpayer and promised us EVs and gave us the Bolt and Volt. Boeing’s SLS has received vastly more funds than SpaceX equivalent and left two astronauts stranded in space and had no reusability. But yeah, thanks for sharing the contrarian take. Always helps me to invert.

-

Indeed. It seems that for the first time in about 50 years we have a clear path back to the moon and then after that beyond...

-

In light of SpaceX's accomplishment, it's worthwhile to consider how Europe approached rocketry as of late: https://www.politico.eu/article/how-europe-screwed-up-its-rocket-program/ Thierry and his fellow regulators hard at work on the 300 page regulation Word doc Meanwhile, his nemesis Elon has been busy...

-

As usual, Elon Musk's SpaceX puts on an incredible show and has advanced humanity...much further ahead than any other space entity, including government space agencies...

-

I'm sure he will keep foreign investors' interests in mind

-

What is astonishing is that despite these eye-popping statistics, there is no one in Brussels/EU establishment talking about ways of fixing this. Instead, they are talking about regulating tech even more. "To a man with a hammer, every problem looks like a nail". To a regulator, every problem looks like a need to create more regulations.

-

Related: https://www.bloomberg.com/news/articles/2024-10-05/ireland-s-anti-migrant-rage-lands-on-a-hedge-fund-trader-s-doorstep I'm sure they'll discuss this in World Economic Forum as well. What this crowd wants--whether Brussels or Davos or overseas based hedge fund managers--is to subvert the will of the people by telling them that their grievances are simply "wrong". The Davos and Brussels crowd are, in effect, subverting democracy.

-

-

2 Trillion Yuan is $300B. Comes out to about $200 per citizen. It's going to take a lot more to boost consumption and get China out of its funk. CCP and Xi are still in charge. It's like betting on a management team that got you into a big mess to get you out of it. Fortunately I am finding pretty cheap stocks outside of the United States that are not in China. China is not the only option

-

Right now a lot of their actions seem geared toward helping the property sector including even buying unsold units... The problem is that there are just way too many property units in China and the people of China view real estate as their main investment vehicle over their own local stock market…China’s population cannot support so many real estate units and they are not a country with significant immigration. The losses in real estate will not be easy to reverse. Boosting the stock market and corporate sector is certainly not what the CCP has prioritized lately and allowing their tech/corporate sector to flourish would be a 180 from since they purged Jack Ma. Then there are other questions. Are they going to put their desire for Taiwan and all the other aggressive actions in the South China Sea on the back-burner to save their economy? Tepper did well in the wake of the GFC, but China is not the U.S.A. The Chinese stock market has not historically served as the primary investment vehicle of its people and because the people lack a vested interest in it, it has been allowed to flounder. There has also been very limited progress in turning the economy into one driven by consumption.

-

https://finance.yahoo.com/news/fedex-stock-plummets-after-earnings-miss-lower-outlook-flashes-warning-on-economy-150444995.html Everything is fine

-

https://hoodline.com/2024/09/faa-delays-spacex-starship-launches-from-south-texas-citing-environmental-and-safety-reviews/ We have to save the turtles in this corner of Texas... Has anyone "investigated" the environmental impact of all the rocket companies that throw away their rockets after a single use? Someone tell me why the Federal "Aviation" Administration has any say in "environmental" concerns like this one

-

If these nutjob liberals get their way, the U.S. will get EU style regulation of the space industry

-

Yep. "Windfall taxes" are basically just theft of private property. I am hesitant to invest in such places. And I echo that they have no idea how positive tail events work and what to do to create an environment to foster them. Rather, Brussels seems intent on strangling positive tail events before they are born. One clear example is the positive tail innovation of shale drilling. There is no way such an innovation could occur in a place like the EU thanks to their narrow & dogmatic views on fossil fuels. This innovation has literally liberated U.S. into energy independence. And look at how Europe is doing with its own energy needs...they're also shutting down their nuclear plants on top of it all.

-

EU regulation means the tech sector is pretty much uninvestable in EU unless you get such a very cheap price or some special situation. According to EU regulators, the EU should be a thriving place of tech competition and startups thanks to their regulation, but instead the opposite is true. The regulation of that industry has made it uninvestable (or raises barrier on investing in) similar to a country that nationalizes (e.g. natural resources) or regulates into oblivion (e.g. tobacco) certain industries.

-

If you asked me whether China or Russia were investable, their government and regulatory apparatus would absolutely be relevant. So why is the EU any different?

-

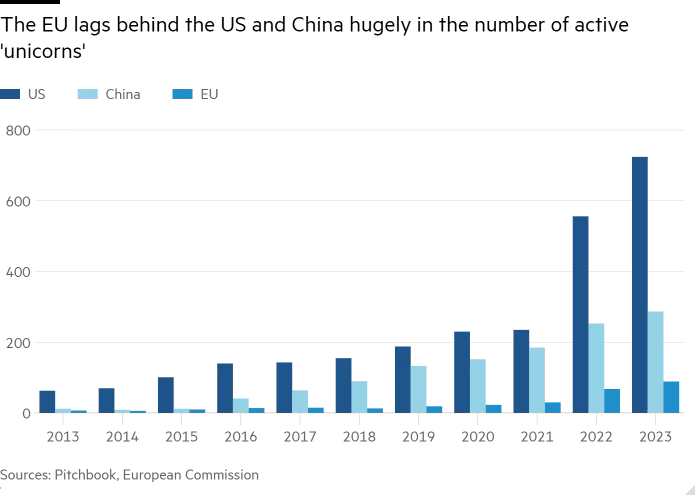

EU regulators do not believe in the invisible hand. Only their hand. The results of EU innovation (their presence in the tech sector, number of unicorns, etc) speaks for itself. If their regulations actually INCREASED competition like they claim, you would see the opposite result and EU would be a bastion of innovation. The fact that it is not tells you all you need to know.

-

The idea may be good but the implementation is awful. For example, removing google maps results from search—how does this just not ruin the user experience? Same with asking about cookies on every website

-

The walled garden has its benefits that are often discounted. If people want a choice they have Android

-

https://finance.yahoo.com/news/apple-faces-eu-warning-open-090111580.html “Today is the first time we use specification proceedings under the DMA to guide Apple towards effective compliance with its interoperability obligations,” EU competition chief Margrethe Vestager said in a statement. “Effective interoperability, for example with smartphones and their operating systems, plays an important role in this.” You gotta love these EU regulatooors throwing around their acronyms like it gives them power (no one gives a sh*t about DMA, DSA, GDPR, whatever other nonsense you make up). These people are not members of a legislature that were elected by the people they supposedly represent. They are unelected bureaucrats who exercise an inordinate amount of power. And in many cases what they are trying to force companies do amount to nationalization or simple theft of IP.

-

https://finance.yahoo.com/news/america-car-mart-inc-announces-201200827.html Man wasn’t the Boston Omaha guy buying this stock? I wonder if Warren building up $300B in T-Bills has something to do with live data he’s getting from Berkshire subsidiaries. Nah, I’m sure everything will be fine.

-

Your unicorns today will give you GDP tomorrow. It’s as simple as that.

-

Gotta love the comments to that FT piece

-

You know things are coming to a head if Mario Draghi and the FT are getting all over this issue: https://www.ft.com/content/47d28f39-6f9d-4c46-9e36-c45a9f398a62