-

Posts

3,234 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by Dalal.Holdings

-

The forum topic is whether the EU is uninvestable, so my annoyances to EU policy as an American is of minimal concern. The main concern is whether the EU is harming itself by allowing Brussels to smother the continent in regulation. It seems to be the case. Apple has forked iOS for the EU now. Everyone in EU gets a different (I will say inferior) version of iOS from rest of the world. https://www.apple.com/newsroom/2024/01/apple-announces-changes-to-ios-safari-and-the-app-store-in-the-european-union/ Apple Intelligence (their AI version) is not available in EU https://www.axios.com/2024/06/21/apple-ai-features-europe https://www.forbes.com/sites/ewanspence/2024/09/16/apple-iphone-16-pro-apple-intelligence-european-union-dma-new-iphone/ This caught regulators by surprise, but by being so possessive over user data, it makes implementing AI for users impossible to execute for Apple. I'm afraid that EU regulator Ms. Vestager has no idea how AI or competition in technology works. She is clueless just like Thierry was. If EU thinks that all these rules have helped competitiveness in Europe, I look forward to seeing a bunch of vibrant startups sprouting up on the continent (any day now...) Have fun with your precious data, Europe. So is Europe Uninvestable? I would argue that within 21st century industries, it would take a large burden of proof to convince me to invest in Europe.

-

https://stratechery.com/2024/the-e-u-goes-too-far/

-

That’s why GDPR was created. So you can customize your cookies on every website you visit. The problem is that no one actually does it and now it’s just an annoyance that gets in the way of experiencing the internet. Like I said—these things sounds great in theory (and they may have good intentions), but don’t work well in practice and you end up with layers of useless regulation.

-

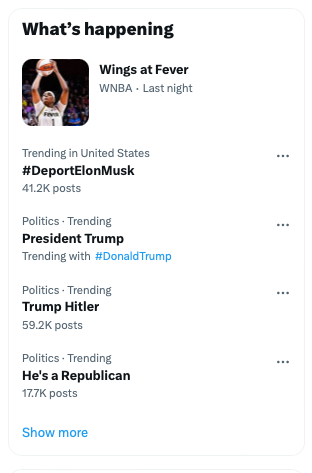

That’s why I said here’s what’s trending “for me”… The fact is that there were tens of thousands of posts yesterday on X calling for the owner of X to be deported and this was the top trending item for at least some users. So that to me is a piece of evidence that counters your assertion that Elon is a free speech hypocrite. I have yet to see evidence that Elon systematically censors content he does not like ideologically on X.

-

What exactly is the solution? We create a committee of certified fact checkers who can roam the internet for misinformation to stomp out? That's how people who work in Brussels think and that's my point. With free speech, you have to accept the noise and the crazies. It has been a hallmark of open societies.

-

The point is that the platform is owned by the guy with top trending item calling for his deportation. That looks like a platform that has free speech to me.

-

Yes this is perfect and goes into most of my points. I enjoyed it in video form:

-

To those who argue that Elon Musk is a free speech hypocrite, here are the top trending items on X right now for me:

-

I'm sure there were large teams of professionals wearing ties that spent long hours formulating all these regulations and reports spanning hundreds of pages. Now please explain to me whether someone in the EU is better off than someone elsewhere who uses AI/technology thanks to all this regulatory apparatus. It all sounds great in theory, but it fails in practice and merely hinders innovation (unborn companies). But I get it, these guys in Brussels are on the payroll and need something to do to fill their time.

-

It's amazing how these EU regulatoooors use word salad to confuse and distract from what they are doing. He claimed the "DSA does not regulate content" but then of course we must have "mitigation measures" against "disinformation". It's all smoke and mirrors that allows these unelected bureaucrats to exercise their power. The EU is much worse off for it.

-

Who gave them the power to regulate these corporations? Does democracy mean anything? I didn't vote for these clowns and I still have to click that I accept cookies on every website

-

I didn't realize GDPR was saving the world and human rights. Maybe I need to read this 80 page report to understand better the benefits of more regulation: https://www.europarl.europa.eu/RegData/etudes/STUD/2020/641530/EPRS_STU(2020)641530_EN.pdf

-

https://www.ft.com/content/09cf4713-7199-4e47-a373-ed5de61c2afa Amazing how these unelected folks let their power get to their heads... He broke from the bureaucratic chain of command in an attempt to one-up Elon Musk (like I said, these guys hate him and will never understand him/entrepreneurs). It was a pretty egregious and ridiculous affront to the principle of free speech and even the EU could not defend it Thierry KO'd in trying to take on Musk...

-

Maybe a European can explain to me how GDPR and asking you to accept cookies on every website has improved their lives/protected them online? Unfortunately it's one of those "EU innovations" that even those of us in the USA are forced to suffer through... I have a feeling these annoying regulatory regimes are the result of bureaucrats sitting in their offices in Brussels being compelled to "do something".

-

The lack of innovation is not just restricted to EU. Even the northeastern part of the United States is looking like the EU in many ways. Old money liberal philosophy and old firms like IBM, GE, etc which have lost their luster. The new stuff is pretty much confined to Silicon Valley. Liberals think that innovation comes from PhDs working in a lab like the movies. In actuality, it's risk taking cowboys in Silicon Valley, many of whom fail and go bust (we only see the winners due to survivorship bias). Liberals tend to enact regulations that hamper the true innovators. You can look at AI Act, Thierry Breton, Lina Khan, Elizabeth Warren, Davos Crowd, etc. These personalities think they are making the world better, but they are eliminating the positive tail risk takers who drive innovation forward. "Fail fast, fail often" culturally mainly exists in a few pockets of the United States which churn out vast amounts of innovation.

-

If you can’t name a major company started this century on your continent, then your continent is way behind America when it comes to innovating. It’s not hard to understand. That is all. Good luck with that AI Act though!

-

If all you have point to are Airbus, SAP, ASML, etc as examples, then you've proved my point. These are exemplars of 20th century industries, not 21st. Elon's companies are great examples because they would never exist in EU. SpaceX, Paypal are two examples where you didn't need frothy capital markets and SpaceX leaves European Space Agency in the dust. What Elon does is tolerate failure and iterate and improve upon failure. The EU mindset is that failure is intolerable and so everything has to be preplanned with lots of committees and regulatory guardrails. That's not at all how startup culture works. And that's just one entrepreneur in America. You have a whole ecosystem of 21st century stalwarts born in America and just about zilch in EU. I guess you can give them Spotify but that's about it...

-

Are you referencing X the platform or Elon's posts on X? The latter do not have to be unbiased as they reflect his own personal views. I still see lots of Elon hate and liberal posts on X, so unless I missed something, I don't think he has censored opposing viewpoints. Old Twitter management did restrict conservative viewpoints (covid origins, Hunter Bided laptop), often under pressure from the government which is highly worrying. Free speech is an issue when governments try to restrict free speech with laws and crackdowns -- as the UK, EU, and Brazil are demonstrating. Also, under old Twitter, the U.S. government tried to restrict speech on Twitter by pressuring the company to censor what they deemed "problematic". That is a lot more troubling than a platform being biased. Fox News and MSNBC can be biased, but that does not mean they are anti-free speech. It is when governments restrict free speech that it is a problem and that's what Elon is up against in UK, EU, and Brazil. It's true he himself avoids insulting CCP, however anti-CCP speech is NOT restricted on X. In fact, X/Twitter is and long has been blocked in China. So again, aside from Elon the person which is irrelevant, I'm not sure that you have proved anything here about free speech on X the platform.

-

For starters, the AI Act is a joke--regulating something BEFORE it has even sprouted as a technology (and of course no company in the EU is even competitive in AI which makes it all the more laughable). Then there's GDPR where we are all inundated on the internet to "accept cookies". DO you think these regulations make sense @Luke ? The golden eggs are on the U.S. West coast now. Incubators that allow a plethora of startups, some of which become unicorns. Companies like Tesla, SpaceX, Uber, Airbnb, etc. How are the EU carmakers doing on EVs? How is the EU/ESA doing in terms of space launches? X is a free speech platform. Thierry clearly does not understand that and a lot of Europeans don't either. I see problems in the UK (where people are being arrested for posting "hate"), France, etc. Free speech, defiance of authority, independent thought, etc are ingrained into American culture and allow those golden egg startups to be incubated here. In Europe, they are suffocated in the womb. I thought these were Enlightenment principles that originated in Europe, but now they seem to have been pushed aside. Now read this letter from Thierry and help it make sense for me:

-

Those European regulators, like many liberals in the USA, dismiss Elon's accomplishments and think that if they just threw money at the same problems via government agencies run by academics, they'd achieve the same results as Elon. They think risk taking entrepreneurs like Elon are nothing special and a lifetime academic physics professor much more respectable and representative of "science". EU regulators do not respect the invisible hand, startups, random successes etc. This is great for Europe's multigenerational rich families who have ruled the continent for centuries...they won't get disrupted by new money. This has nothing to do with X. However, the relevant part with X is EU is now trying to stifle free speech on the X platform (they've also gone after Telegram).

-

You have an army of so-called “professionals” such as in the below image who have been indoctrinated and educated through many useless fields to contend with if you want to tackle the regulatory beast of the EU. These people are driven by dogma, believing they are truly making the world a better place when in fact they are slowly chipping away at the goose that lays golden eggs. Is it a stretch to surmise that 100% of the people in the below image probably hate Elon Musk? Culture is not easy to change.

-

*Chef’s kiss*

-

And why exactly are Europeans cool being ruled by an unelected layer of government?

-

America innovates. China replicates. And... Europe regulates. I can't get over the level of smugness in this photo.

-

This one guy gets it. The rest of the EU bureaucrats celebrate not when they build something, but when they create new regulations: Reminds me of people at mission control celebrating the Apollo landings or SpaceX employees celebrating their own milestones. In the case of the EU, however, the milestone is creating more regulations.