-

Posts

3,264 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by Dalal.Holdings

-

Are people in Europe even aware of the big problems facing their continent ?

-

WTI in the 60s and folks going offshore…LMAO

-

https://www.reuters.com/technology/space/airbus-ceo-says-spacex-would-not-pass-anti-trust-test-europe-2024-11-14/ The hardcore globalists of the World Economic Forum have left their mark on Europe. It’s not pretty

-

I think it all depends on China. I have no clue as to how China goes

-

So when does this sector hit bottom ?

-

-

This is what happens when you let environmental radicals in the driver's seat

-

The European mind cannot comprehend the American election

-

May another Trump presidency be the accelerant that stirs Europe awake

-

Denmark is but one country in the EU. It alone is not really relevant to the issues the continent faces. Also, Denmark wisely chose not to adopt the Euro and has its own currency. Perhaps more EU members should consider similar path…

-

Drahi: You need Euro bonds for this to become a reality. The problem is that some states view this as a bailout of others which goes to show you that the “Union” in European Union is very weak.

-

Europe has been living in La La land because they had their defense covered by the U.S. and cheap energy from Russia — both of which supported a cushy lifestyle and little ambition and little worries. On top of all that, you’ve had people who believe GDP growth is bad successfully lobbying policy in some places and the European Commission strangling the continent with insane regulatory framework…then add all the separate interests from the different countries (Nordics don’t trust France when it comes to militarizing because they think it is a ploy to benefit French companies, etc.)… All of these things are structurally very bad for the Continent and it needs to wake up. There needs to be bold reform: decide if the European Commission is truly the way to go (and so the states give up their own sovereignty) or whether you go back to individual sovereign states working toward common interests but also doing things their own way… The European Commission’s regs like AI Act and GDPR need to be either drastically gutted or eliminated entirely. The European Commission’s regulators who suffer with “Man with Hammer syndrome” need to be fired. There needs to be drastic reform

-

If EU is in Degrowth mode, it will diverge more and more from the USA and China where eventually it will be seen as pretty much irrelevant. Consequences the degrowth people don’t want to talk about and why we’ve heard from Drahi and Macron on the topic lately.

-

-

If you look at someone popular in Europe like Greta Thunberg, she basically believes in this: https://medium.com/age-of-awareness/gretas-plan-to-displace-capitalism-embrace-utopia-ba27259e38a4 I am not sure this is as fringe in Europe as it is in U.S... The environmentalists who believe this in Europe have affected policy (ie shutting down nuclear power). They seem to have far more traction in Europe than in the USA https://foreignpolicy.com/2023/12/17/degrowth-economics-europe-climate-policy/

-

https://www.economist.com/europe/2024/10/24/angela-who-merkels-legacy-looks-increasingly-terrible Great moments in history. I'm sure this pic will make the history books. Trump was right about Europe, Merkel wrong. Of course it got deleted from the VW thread, so I guess it belongs here.

-

It appears the “degrowth” folks are winning in Europe

-

Yawn...

-

Quote from Mr. Rifkin: And yet the front page of business newspapers today: VW Seeks Unprecedented Plant Closings as Auto Crisis Deepens Yeah, Germany is doing really great pal. Good luck w that.

-

https://www.economist.com/europe/2024/10/24/angela-who-merkels-legacy-looks-increasingly-terrible Angela who? Merkel’s legacy looks increasingly terrible

-

Never go full libtard

-

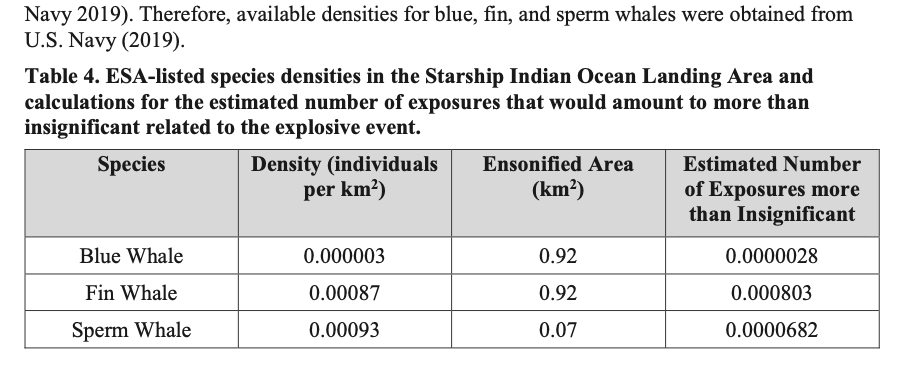

If you agree that bureaucrats asked SpaceX to assess sonic boom impacts on seals, probability of rockets hitting whales/sharks in the Indian Ocean is comedic and very hard to believe, then we are on the same page. Unfortunately, it's true.

-

Here's another EU-level regulatooor trying to sue SpaceX: So many Rocket Scientists among asylum-seekers. Very important issue for the Biden-Harris admin to look into. I'm sure European regulators are taking notes

-

I'm sorry that you find the notion that government officials asking a rocket company to test if seals got hearing damage from sonic booms is "too political". This from the same government that routinely tests supersonic jets, bombs, etc without any consideration of such. Sounds like Elon Musk triggers you

-

Yep we have these types of people in American bureaucracy as well and it just goes to show you how ridiculous these overeducated types are and how they detract from the progress of human civilization