kfh227

Member-

Posts

159 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by kfh227

-

my wife and I want to change our Roth-IRA holdings to be mo0re of a set and forget type system. She doesn't know what she wants but I think she wants a low fee index fund. or to be tied to Bonds. I think what makes the most sense is to invest in well run conglomerates like Farifax and Berskhire. So, I will ask the board. What is the best set and forget strategy for a Roth-IRA? I'm looking at a 20-25 year horizon. I know that I have to keep an eye on anything I invest in. I just want to minimize risk and maximize reward.

-

Blackberry is not much of an issue. I've been following them closer than most since I bought in a few years ago. And I have to tell you, I am not worried at all about the future. They are throwing a lot of mud on the wall and for none of it to stick would be a statistical anomaly. And the thing people seem to ignore is that a lot of that mud is sticking. They are onto their growth phase. We might even start to see commercials again! Don't get gung ho though. The commercials will be on CNBC and if financial districts of bigger cities and doctor trade publications. They are going to go after enterprise users, not consumer. And that is fine. I'm still curious of what the Samsung deal is regarding the next slider that BBRY is coming out with this year. Oh, and the rumored Android device (low end) for emerging markets that is rumored to come out in 1-2 months. And I also own Sandridge. That one actually has me REALLY worried. I hate to say it but wit ha strong US dollar, Sandridge is toast. I didn't understand their business and how it works. The strong US dollar means lower gas prices which means those expensive wells of Sandridge are not profitable.

-

What does this actually mean? The Order of Canada (French: Ordre du Canada) is a Canadian national order, admission into which is the second highest honour for merit in the system of orders, decorations, and medals of Canada. It comes second only to membership in the Order of Merit, which is within the personal gift of Canada's monarch. And I still don't get it. IS this like getting knighted by French speaking people?

-

Not sure how much truth there is to this statement by blackberry: Operating cash flow was $134 million with free cash flow (operating cash flow minus capital expenditures) of $123 million. http://global.blackberry.com/content/dam/bbCompany/Desktop/Global/PDF/Investors/Documents/2016/Q116_Press_Release_-_06192015_FINAL.pdf

-

I would doubt it. He's already got quite a significant amount at stake in the company. His convertible debt helps cover him in the event that this investment doesn't work out, but the more common he buys the less protection it offers. Ya, convertible debt (assuming conversion) already makes Fairfax something like a 33% owner.

-

If you want the lottery ticket, it is better to buy OTM calls like $12-$14. If BBRY's hail mary works, then the stock can be significantly higher given the size of the industry they are playing in. If not, then why lose a lot of premium? Also I would look out further than Jan16. In the short medium term I feel they have to buy some small technology companies to improve their software offering, so cash balance which is source of comfort for many in the downside scenario will have to reduce significantly. I always find it interesting. What industries is Blackberry involved in? There are a lot. They are primarily after large financial companies where security is a big issue. And they are attacking the medical industry by way of IoT. And more .... but those can all be found on Blackbery's web site.

-

How to start a hedge fund in the US? Any advice?

kfh227 replied to muscleman's topic in General Discussion

I thought about doing something like this. The large financial players set up a lot of berries to entry. See all the hoops you need to go through as a little guy? That's not because of the government caring about people. It's because the large players have lobbyists and they want these regulations to keep you out. I gave up. To you, I wish the best of luck! -

JNJ?

-

What happened to this board?

kfh227 replied to watsa_is_a_randian_hero's topic in General Discussion

Strategies and General Discussion should swap order in the list of subforums. Quite frankly, a lot of Strategy stuff is in General Discussion and it shouldn't. On top of this, Strategies should probably be Strategies and Broad Investment Discussion. It might be best to add a General Investment Discussion subforum to break out general crap and actual investment talk. -

Name one product/service that you love and one that you hate

kfh227 replied to LongHaul's topic in General Discussion

Love: Blackberry 10 operating sysem and phones Hate: The love for the overpriced iOS devices when equivalents (Android) can be had for much less. People will groan so. Love: Diet Coke Hate: Cable TV pricing structures (I'm a cord cutter) Love: Jeep Wrangler (this thing in the USA is a monopolistic design) Hate: Budweiser and it's competitor clones (good beer is good) Hate: The US government structure (hint: we are not a democracy) Hate: The Ultra Wealthy that have an self entitlement complex. -

NM

-

Who if anyone is good to listen to regarding currencies? Are there any transparent people about what they think the future will brings? Are there proxys to look at regarding future currency valuations? I was thinking things like Prem Watsa and his fear of deflation in the USA. This is interesting: http://www.zerohedge.com/news/2014-11-13/why-rising-us-dollar-could-destabilize-global-financial-system The attached chart is a 20 year chart.

-

If this works out let me know. I live in Connecticut (Old Saybrook area). I'd love to meet people that can help me change careers. I'm currently a software engineer. I looked into doing money management for the middle class and higher people but once I saw the barriers to entry, time involvement (startup), risk and more .... and the fact that I have two kids. I gave up. I figured out that I'd really need to get a job in the industry or win the lottery to change careers in a low risk manner.

-

I'd do them but I hate market to market accounting crap. I do have some call options on oil stocks but they expire between June and EOY.

-

Tom Brady sacked (suspended) for four games

kfh227 replied to boilermaker75's topic in General Discussion

+1, every year the NFL gets worse. This is precisely what NASCAR did years ago to lose so many fans. They started fining drivers for cussing, fighting, "rough" driving that was completely standard, etc. But that's a big part of the sport and the personalities in the sport. Take away that fun and excitement and a lot of the fans go too. Ya, that's what *LEFT* turned all *LEFT* the fans *LEFT* away. Nascar has the same life expectancy that I would expect out of poker, darts or billiards. Popular for a while but it is just too boring to last. Interesting to some for a while but only die hards will care long term. -

OPEC Sees Oil Price Below $100 a Barrel in the Next Decade

kfh227 replied to tede02's topic in General Discussion

http://www.cornerofberkshireandfairfax.ca/forum/general-discussion/oil-and-the-us-dollar/msg215931/#msg215931 Unless the US dollar falls or all other currencies improve, we will have cheap oil for a while. -

Tom Brady sacked (suspended) for four games

kfh227 replied to boilermaker75's topic in General Discussion

Someopne at work posted a sign by his desk that says: #FreeBrady We are going to replace it with: #killBrady #honesty #FreeAir Any other ideas? -

Great goodness?!?!?!? Did not expect to see that.

-

I cut it and our landline phone (also via Comcast) and save about $100/month. I have a Bluetooth phone base at home that supports two phones, so we still have the same home phone setup but we save money by not having a landline. Saving about $100-$110 per month. I didn't miss it from day one because I already realized how bad TV has gotten. I kind of miss sports but not that much. I might get cable again for sports but not for $80 or whatever the hell it is a month. It's pity, but we also got rid of Netflix. We have it till the last day this month. The thing is, you can watch all the good stuff in bursts. So all I have left are documentaries that I kinda car about but not really. Once that is gone, we are going to do RedBox. That way, we have to watch TV wit ha purpose. No instant gratification. It's more about that. I am fed up with the instant gratification that the internet provides. Why is it wrong to have a scheduled time slot for things anymore? Even with sports, I have friends that say to just record it and watch it later. Why?

-

My son is in 4th grade. He is an odd boy. He has the entrepreneurial sprit. Likes the idea of sports but actually seems to want to spend time learning about business and getting rich more than do sports. I don't understand it fully. So, I'd like this thread to be about how to teach kids financial literacy at a younger age. And for kids like mine, how to teach them about business. Anyway .... I worry that he wants to get rich the wrong way though. I keep telling him that if you run a business one day, you make sure that your employees have work to do at all times so they can feed their families. You do this for people and the financial rewards will come to you. The focus shouldn't be on getting rich. It should be on keeping people employed. I reiterate this all the time and hope it sticks. Anyway, I spent a lot of time trying to find a first book for him and I think I found it. He just started it. Poor Charlies Almanac! It's almost perfect because it is full of pictures. Most of the text is larger font so each page goes quickly. And it has some powerful anecdotal stories and information in the book. So if some of that is sticky in his brain, I will be ecstatic. As for future books, I was actually thinking about short autobiographies of important people in business history. If anyone can think of shorter books that he could read, I'd appreciate it. At his age though, it can not be math heavy. Qualitative, not quantitative. There is a serious shortage of books on finance for kids. I get it though. It's smaller than a small market. Still, it makes me sad. EDIT 1: A thread that may help: What are the best books on history (financial or otherwise?) http://www.cornerofberkshireandfairfax.ca/forum/general-discussion/what-are-the-best-books-on-history-(financial-or-otherwise)/ Not really about books for kids but still worth while.

-

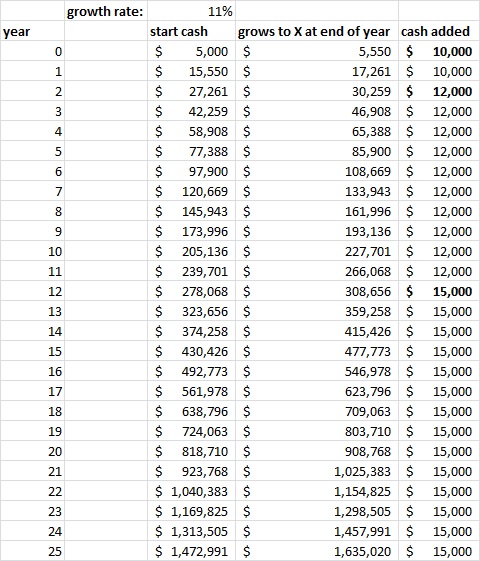

I think I calced that at a 15% CAGR, it would be around $500B. I added an image to my post showing what compounding at 11% will do in 25 years (ignoring inflation). I guess that would be something like 14% compounded including inflation.

-

Since FFH was mentioned, I'd like to make a statement. I am 38 right now. 25 years till retirement. My wife and I have a Roth-IRA (and other retirement accounts through our employers). In our Roth-IRAs I decided to start buying companies like Berkshire, FFH, etc and stop trying to do better than the likes of Prem Watsa (in retirement accounts ;)). So, 2-3 months ago my wife's account had a bunch of FFH placed in it. I dollar cost averaged into mine. And next year, I am thinking that FFH will be placed into both. 25 years from now, I don't see why FFH would not be a $100B+ company. That's modest though. It's $15B today. I figure it should be in the $200B+ area by then.

-

In skydiving, it's usually the experienced skydivers you read about killing themselves. Usually doing something stupid (aka: technically difficult).

-

I tested high in highschool. Something like 180. But I think IQ tests are biased on a per test basis. Some may test memory while others math and others X,Y,Z. I was good in math but sucked at reading comprehension.

-

[glow=red,2,300]Solved #1 in about 5 minutes. Not that hard.[/glow] EDIT: This is Mensa? This has nothing to do with intelligence and everything to do with riddles being a hobby. Getting my engineering degree had harder problems than this. Anyway, this stuff all falls into the knowable but not important category. I quit.