-

Posts

5,142 -

Joined

-

Last visited

-

Days Won

14

Content Type

Profiles

Forums

Events

Everything posted by John Hjorth

-

The Swedish Corporate Real Estate Crisis [2022 to ?]

John Hjorth replied to John Hjorth's topic in General Discussion

@formthirteen, Why do you even qoute a source like The Telegraph and / or the like, when you have the financials [Annual Reports] for all these Swedish RE suckers available as a fact at your finger tips, describing just about everything related to the debt - maturity profile of the long term debt, roll over / refinancing risk, hedging of currency risk, interest rate risk, hedging of that and such? - Please grab the Annual Report 2022 for i.e. SBB, Castellum or Balder and take a look for your self how the financing has been set up and engineered. Rest assured it is to me about three persons with certain personally disorders with regard attitude towards OPM, combined with megalomania, who haven't been stopped in time by incompetent, or dumb ,or both bankers [and greedy? - with regard to banking business volume]. None of those three persons appear to have any clue about the concept of risks related to the debt involved in what they are doing, and it is to me personally likely, that they also don't care. [Bon appetite!]. There is no language barrier here for you, just approach each individual website, upper right corner you can switch to English language, and there will a pdf file available for you in English also of the last Annual Report. -

The Swedish Corporate Real Estate Crisis [2022 to ?]

John Hjorth replied to John Hjorth's topic in General Discussion

Yes & thanks, @Luca, That's the purpose of the topic. I'm also feeling quite confident now, that it is a pure play RE bubble that is about to burst. - - - o 0 o - - - I think yesterday, we passed denial mode on the way downhill, so next will be panick setting in. Sveriges Riksbank [June 1st 2023]: The risks in the financial system have increased. Here is the public response from Rutger Arnhult [who is in severe problems with his M2, Castellum [partly solved by now though] and Corem : SvD [June 1st 2023] : Arnhult defies Thedéen - continues with dividends. In short : Rutger Arnhult does not give a damn! The same day that he has been asked by the head of Sveriges Riksbank to slash dividends, take in more capital and sell properties. I suppose he will not be asked kindly again after that. To me this behavior just demonstrates total lack of situational awareness. It's certainly getting really entertaining now! - - - o 0 o - - - Edit #1: I also yesterday looked at some things related to Balder and the city Göteborg, that indicates that sound reason, business related motives [among them motives to generate profits] aren't the basis for decision making any longer some places in the sector, meaning (towers = tulips). I will share that information later. - - - - o 0 o - - - Edit #2: Bloomberg [June 1st and 2nd 2023] : SBB Attracts Brookfield Interest in Bid to Rescue Landlord. - - - o 0 o - - - Edit #3: Backdrop for Edit #2 : SBB Press Release [November 30th 2022] : SBB sells a 49% stake in its social infrastructure portfolio for public education to Brookfield for SEK 9.2 billion in cash with an additional earn-out of up to SEK 1.2 billion in cash. - - - o 0 o - - - Edit #4: From the press release from Sveriges Riksbank above : I have never in my life seen anything like this in the Nordics. This will include follow-up by the Swedish FSA ["Finansinspektionen"] at the banks. "The party" has just begun. I say poor bond holders and shareholders in those legal entities, that get the verdict "non-viable". All that said, I personally think it's the right thing to do, as acting head of Sveriges Riksbank to stop the folly and to instate systematic damage control based on factbased realism, sound reason and professional assessments. - - - o 0 o - - - Edit #5: SBB Press Release [June 2th 2023] : Leiv Synnes replaces Ilija Batljan as CEO of SBB. [Pretty impressive velocity today here, I would say!] -

The Swedish Corporate Real Estate Crisis [2022 to ?]

John Hjorth replied to John Hjorth's topic in General Discussion

An understandable stance of yours , which I certainly respect, @Spekulatius, The development pipelines in each of these Swedish suckers will be postponed, stalled, mothballed or cancelled, because of lack of access to financing, thereby hitting the Swedish construction sector hard [in a *classic* way in a downturn], and spread into the general Swedish economy from there. The SEK is very low ATM compared to EUR [and DKK, pegged to EUR], which will help exporting Swedish industrials short term. I do not follow Swedish macro, though, and thus not able to comment further. The banks are in a priviged position as creditor, because they have the real estate as collateral for now. While the holders of the bonds that are getting downgraded to non-investment grade are unsecured, causing refinancing getting difficult or directly impossible. These bond holders want their money back and out of this mess asap. So all these companies are on their knees in the banks for financing to substitute the bond debt coming due. So the banks have a firm grip in the long end of the tow, with thumbs up/down de facto decision power in every single refinancing case for maturing bond debt. No part of this mountain of debt, be it to banks or to bondholders, is on non-recourse terms. We just need one bank or one bondholder per company of these companies in distress losing patience and temper, and the whole thing starts coming down in a huge *kapow!* like a demolished collapsing tower. If the banks have done their homework in each case individually while lending in the first place, they will likely be relatively fine, I think, and the bond holders ending as the bagholders, together with some shareholders. I have no idea of who are holding all these bonds, and thereby who will be hit. I consider the market cycle downturn as unavoidable by now, I feel confident a fire sale will take place, alone SBB is a big mouthful even for the Swedish market, but lets see. The more violent it may become, the bigger will the opportunities be, the faster it will over and the more violent the swing-back of the pendulum to the better will be. Edit : I really feel that the Swedish FSA [called "Finansinspektionen"] has failed here since this has come so far. It would never happen by now on this side of Øresund [, meaning here in Denmark]. Here, credit hasen't been low hanging fruit since the GFC. The Danish FSA [called "Finanstilsynet"] has been really brutal from to time - if you weren't the one getting beaten up, you were an observer, making sure to get in line, by looking at examples made of others. -

The Swedish Corporate Real Estate Crisis [2022 to ?]

John Hjorth replied to John Hjorth's topic in General Discussion

So far, It just pop corn & wacthing from the sidelines. It very educational. But I would like to own more RE in the Nordics. I consider SBB, Castellum & Balder all uninvestable at the moment. I consider the financial design of these companies flawed. My guess is that SBB will be forced to file for backruptcy [financial recontruction] monday morning. SBB hasen't any properties, that to me to have future economic potential. Both Castellum and Balder own properties that I would like to partcipate in for the long term. But both need to get their fundamentals right. Wihlborgs and Fabege I consider interesting, too. I consider it a game of monopoly for now, where the players able to play from a position of strength are Paulsson / Backahill AB and Fredrik Lundberg / Lundbergföretagen AB. I think all the larger banks in Nordics : Danske Bank, Nordea, Swedbank, SEB, Svenska Handelsbanken and DNB are involved in the risks in this mess. An interesting catch / angle on this is that Fredrik Lundberg is among the Swedish RE tycoons and at the same time a material degree of control over Svenska Handelsbanken [Vice Chairman of the bank], a large personal shareholder in the bank [for years now he has been buying SHB shares for his received didends from L.E. Lundbergföretagen AB - typically in lots of 500,000 shares per day], L.E. Lundbergföretagen is itself a material SHB shareholder, too, and L. E. Lundbergföretagen is the controlling shareholder of Industrivärden AB, which is also a large SHB shareholder. I think the Lundberg sphere could easily ramp up an acquisition capacity of SEK 20 - 30 B in total in Hufvudstaden, which is a 100+ years old geriatric with low leverage and a lot of deferred taxes and in Lundbergs Fastigheter, which is almost free of external debt, for both of them, combined. Personally I'm already involved here by holding of LUND_B.STO & SHB_A.STO for now almost a decade. Backahill AB is one of the most impressive privately held family owned holding companies in the nordics, that I have ever looked at, cenetered about swedish real estate in many dimensions with an actual equity [adjusted for hidden reserves] in the area of SEK 20 B as per YE 2021. I've been basically extremely inactive for a long period now, doing basically nothing, just nibbling SCHO.CPH now and then for dividends recieved. So I'll have to let something go, to engage here, if I decide to. We are not at panick, nor capitulation, in this complex situation here yet, I think. Let's see how things evolves. -

It's OK - at least for my part, personally, @Xerxes, The NATO dilusion [in the meaning of cost sharing][not to be confused *delusion*! ] of NATO defence spending is a great thing. I personally think a contract on the head of the *unmentional* would be cheaper [, at least short term]. In Denmark, decisions have now been made, so we now ramp up immediately to the required 2% of BNP on military budgets, according to NATO membership requirements. No sweat, here, we're doing fairly well.

-

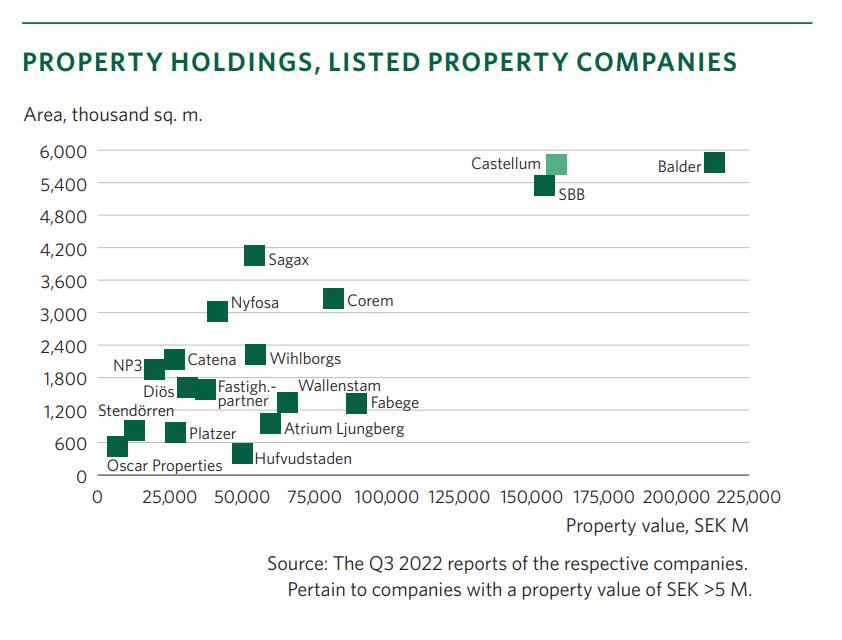

International Monetary Fund - Svetlana Vtyurina and Rhiannon Sowerbutts - Selected Issues Paper [March 23 2023] : Sweden’s Corporate Vulnerabilities: A Focus on Commercial Real Estate: SWEDEN. We have - since interest rates have started to crawling up, and inflation has arrived, both, many places on the world - had discussions of the implications and ramifications for investing in general and for banking and real estate in the General Discussion Forum. Those discussions have mainly focused on North America conditions, I think. There are issues in other parts of the world, too. Here, I try to focus on Corporate Real Estate in Sweden, while I assess for now Danish Corporate Real Estate cooling a lot, it it's not in distress, I think, while things are turning really bad nowadays in Sweden. Danish banks are in general in good shape, I think, while I have nu clue what the near future will bring for banks involved in financing of Swedish Corporate Real Estate. I think it appears bad - really bad. For staters, here is a chart from the 2022 Annual Report for Castellum AB [CAST.STO] : Please combine the information in that chart with the information in the following chart from the above mentioned report by IMF : Please note the last chart is from 2021, and thus not totally up to date. But more importantly, note the errors about listed/non-listed for Fabege, Wihlborgs, Diös, Catena & Hufvudstaden all been listed [, also in 2021]. To me, it's almost as a yarn wrench of all kinds af cross holdings. Key persons on the weak side are Ilija Batljan [SBB], Rutger Arnhult [Castellum] & Erik Selin [Balder]. Mentioned here in the order I personally think they will loose their shirt in this mess, because their individual personal and private holding companies / entities are also levered to the sky. How much capital [understood as equity] is there in this "total system* when RE prices are their way down, also considering nneded write-downs on cross holdings? All have basically been applying same financing strategy, cheap bond financing [unsecured] based on rating, combined with bank financing where the properties are collateral for the banks, now the companies are getting downgraded to junk on their bond issues, making bond refinancing on maturing oustanding bonds impossible, so there are like likely only a few options left, getting on their knee in the banks the most immediate option. This game unfolding now involves hundreds of billions of capitalization in SEK, and I think it has the potential go really bad, worse than the GFC. I think we have just left denial sentiment on the way headed into to entering panick mode.

-

Saluki, If you chose to visit Oslo, the capitol of Norway, I would suggest you to visit the HQ of Norges Bank Investment Management [http://www.nbim.no][The Norwegian Gorvernment Pension Fund Global] [the worlds largest investment fund]. The location is fairly close the Oslo Opera and the Oslo Stock Exchange. The adress is : Bankplassen 2, NO-0107 Oslo, Norway. The underwhelming experience of such visit will likely overwhelm you and your spouse dearly. It's really a "wtf?" experience.

-

Talks between americans all along, getting along. New data for today just revealed Germany is in mild / garden version of recession. I couldn't care less.

-

I would certainly not take the other side on such a bet with you. Which reminds me : "Why not put a contract out in the open on the head of such a person? - One page contract, simple terms, Buffett style? A drop in the sea compared to the US military budget.

-

Thanks for explanation of the backdrop, @Spekulatius, When I typed what I did, I looked at it, thinking "Something is wrong here, does not look right, and it does not seem to have that punch, resourcefulness and impact I recalled from your line ..." - Now fixed in my post above!

-

Welcome, @TulipCap! I think your choice of username is a perfect fit, regarding your nationality, as a reminder!

-

It appears in media here in Europe that the city of Bakmuth has fallen for Ukraine and is now under control by Russian forces by yesterday. I have been thinking about : "What does that mean?" The city in fact does not exist any more - it is about it's roughly totally destructed by now. [Mike [ @cubsfan ] has been posting about this fact for a long time now in this topic.] What does is matter? I don't know. Does any of it makes some kind of sense? I'm not sure, but I personally have a hard time to see some purpose/meaning in much related to this armed conflict by now. Add to that, it's just plain butt ugly. What's next? I have no idea, but if someone asked I would suggest "It's teatime", like when Asterix was fighting the British. Talks about creating a list containing damages done Russia to Ukraine, for the purpose of Russia to pay damages at a later moment. "The destruction of the city of Bakmuth" added to list - Check!" - Price? It's just so lame to me. When this is over later, Russia will not be able to pay anything to the Ukraine rebuild for a long time, because it has its own internal challenges. The bill will by necessity have to be picked up by Ukraine allies, meaning migher taxes for them.

-

Thank you, @cubsfan & @Charlie, To me, just pretty amazing to be presented by the lines of decision making in the Berkshire Insurance sphere like this, involving economic risks of friggin' [estimated] USD 15 B. [Berkshire will be hit by a dent, and will eventually get over it, if the bet goes wrong.] Thinking about that whole process from proposal to accept is just mind boggling. Where the hell do you place the balls of these gents, when they are no longer among the people alive on Earth? Tjernobyl [J/K]?

-

What are my fellow CoBF board members' opinion / stance on Mr. Buffett giving a "go" to Mr. Jain for taking further USD 15 B in CAT risk related to Florida, as mentioned at the AGM, in what is perceived an El Niño year? -Thank you in advance for your response.

-

... And all while the talk in this topic with the topic title "Is the bottom almost here" goes on and on and now includes talk about both recessions, inflation, interest rates and markets in FOMO mode, [please take no offense @backtothebeach ], and all such, I found my self at a new ATH just exactly sniffing to the next million DKK i total portfolio value, while : 1. Being almost fully invested, with no margin, 2. Doing basically nothing, but : 2a. Nagging here on CoBF about Brookfield, Brookfields reporting in various shades, Brookfields complexity & Brookfields opacity, & 2b. Studying the Swedish real estate carnage going on, evolving and unfolding in these days [from the sideline] & at the same time nagging about that too on Twitter to anybody in Sweden on Twitter who seem to be involved and care about it, & 2c. Nagging internally about the stock price of SCHO.CPH and why it does not go up, while buying on/off for dividends received, while I should just be buying, & 3. Being absolutely without any idea of what markets will do tomorrow, the day after tomorrow, and so on, with no clue at all, be it 1 - 5 years or so. 4. Remembering the signature line in @Spekulatiuss profile on CoBF under former software platform : "To be an realist optimist, one has to believe in miracles".

-

Denzel Washington : Penn's 2011 Commencement Address [video on Youtube]. If you want to save some time, you can get to Mr. Washingtons points directly starting the video at the 7:00 mark. It's about failure, failing, falling forwards, falling backwards and trying. It's a lot about attitude and motivation. Personally, I think it's great, and I enjoyed it a lot.

-

@Gregmal, I personally follow and agree with your thinking and stance about shortsellers taking advantage of others misfortunes by malpractice involving i.e. Main Stream Media and / or Social Media. Jamie Dimon has been all over the place lately, here as an example : Business Insider - Markets [May 12th 2023] : JPMorgan CEO Jamie Dimon wants US regulators to consider a ban on the short selling of bank stocks. Then I also listen to this : CNBC [May 11th 2023] : Jamie Dimon says short-sellers on social media are to blame for banking crisis. So it's complicated. The total number of US banks has been going down since approx. 1970 or so, so US banking has more or less been in consolidation mode for about 5 decades. Based on my knowledge about European banking, I think it's actually a similar evolution / trend here in Europe, too. Perhaps - and alone therefore - regional US banks under a certain size thereby simply don't have a future long term as separate and independent legal entities. I can't see any way to give all banks same conditions as the GSIBs for deposits, because they - the regional banks - can't handle the regulatory burden that rests on the shoulders of the GSIBs. The GSIBs would protest fiercely, if that - same regulatory burdens for all - was not part of such package. It's the problem of finding a balance with regard to giving equal terms and conditions of existence to high and low in an regulated industry, that favours none of both in the industry. Perhaps that problem does not have a solution. Also : FDIC - Banks - Data

-

It's a fascinating phenomen : dumpster diving / container archeology taken to the extremes, all about position sizing for each subject is 0% or 100%, unless one has some partners in crime to share risk and capital outlay with.

-

@dealraker, Thank you for sharing a great photo!

-

@dealraker, To me personally, on the photo, you appear to me to be a fairly fit man, perhaps and likely in the early fifties. Motion, fresh air and all such good habits means a lot.

-

@dealraker, Your apperance from that particular photo is like you are approaching seniority, not the age have informed CoBF is actually yours. You look like a sea eagle in refreshing headwind.

-

To me personally, that would be morbid. Danish privately held Danfoss has such a thing on top floor at HQ highrise at Nordborg, Als, Denmark, memorating the original founder. No public access though. To me, totally waste of office usage. One bears memories of the ones who passed away in memory, not by creating museums inside a listed company.

-

Vladimir Putin will eventually meet his fate and it won't be pretty, but I feel quite sure it will be violent. He hasn't even been able to take an European non-NATO member country by brute force, what should be next?

-

John Maxfield : Maxfield on Banks Periodization [on Youtube]

John Hjorth replied to John Hjorth's topic in General Discussion

Thank you, @Saluki, From what I have understood, John Maxfield will later release a part two, and when I see it, I'll share it here. - - - o 0 o - - - These days, I can't help project this stuff to Swedish banking and the carnage evolving over time in Sweden, with regard to Swedish real estate, with SBB.STO [SBB AB] and CAST.STO [Castellum AB] situated center stage. I'm thinking about who will eventually be the bag holders on that mess, which mess to me is pretty wild, while at the same time fascinating to study and experience play out in real time. I'm pretty sure it is about bad banking and wrong/missing use of the word : "No". -

Everybody with an opinion on the Royal British family to me should dive in to the following websites for educational purposes : Wikipedia : The Crown, & Official website : The Crown Estate . Awesome business! releasing yearly financials and I don't know what!, held by the incumbent British ruler, but he can't in any way do with it at his own personal discretion! As just a holder, why would that qualify for God to put him in Hell? Should he abdicate to get in heaven, by that also by logic thereby putting one of his sons in the line for Hell?