-

Posts

15,205 -

Joined

-

Last visited

-

Days Won

38

Content Type

Profiles

Forums

Events

Everything posted by Spekulatius

-

Temp staffing for travel nurses? No way the demand for travel nurses stays where it is right now. I think the business is likely to shrink, post pandemic.

-

Adding a bit across the board - LBRDA, PINS, TWTR, TPB, KIND, FROG in small chunks. Started ESTC in one account. I feel some growth or even SAAS plays start to get into interesting valuation ranges.

-

That's not how it works. The land constraint areas have a biggest booms and busts. CA is the primary example. if you have a steady supply of housing coming on the market, it dampens the boom and hence the bust isn't as pronounced either. Example is New England (suburban) and Texas. In NE, the Yankee thriftiness may be a factor too.

-

This is pretty telling too, if you think about it: https://finance.yahoo.com/m/cf1f629c-4909-3e0c-948f-e18f2ef9c3ce/xi-jinping-warns-fed-against.html To put it in simple words, - the economy in China is weak and reale state is becoming unglued, so they won’t to lower interest rates (which are higher than in the US). Now they are afraid of the Fed raising interest rates because they decided to peg their currency to the USD which means that they also peg their monetary policy. Sounds to me like this is his problem not ours.

-

Investments Benefitting from Higher Interest Rates

Spekulatius replied to maplevalue's topic in General Discussion

I think it is the opposite, you want to own long tail insurance with higher rates. While it is true that they will take a hit to book value, their income will rise as fixed income assets roll over. ,if insurance liabilities are long term and we’re sold assuming a certain interest rate or discount rate. They take a hit if they can’t get the returns from their fixed income investments over the time of the contract (which span decades) and get a windfall if their returns exceed the presumed returns at origination. This all assumes higher interest rates for a long time, not just a quick spike that quickly reverses. -

@Gregmal You can get similar houses in "bumblefuck" Maine: https://www.realtor.com/realestateandhomes-detail/266-Rim-Rd_East-Machias_ME_04630_M44034-37661

-

I am from the Mosel valley near Bernkastel-Kues. You find German wines in the liquor stores (Loosen Weingut etc.) , but ice wines are very hard to find. In fact I think it's hard to make them because the temperatures in Germany don't really fall low enough in winter any more. If you do like German style wines, look for wines from the NY Finger lake area. I am a fan of these wines and have a wine club membership from a vineyard there. They make great Rieslings and other whites there, because as I found out, l the slate soil there is very similar to the slate soil in the Mosel or Rhine valley, where the best Riesling grows. You will also find ice wines from the Finger Lake area because it does still get cold enough there. You can PM me if you want leads to vineyards etc.

-

Until the buck stops. Canada is far more vulnerable to a RE crash than the US right now imo, for two reasons; 1) lower cap rates / higher prices 2) Absence of LT fixed mortgage. If interest rates were higher after 5 years, many Canadian that are starting out owning houses now would have no choice but default, because they can't afford the higher payment any more. You can run the math using incomes but many canadians buying houses now need to spent 40-50% of their income on housing. That is why the Canadian government will do anything to keep the interest rates low. This probably means that the CAD will probably crash at some point relative to the USD. Relying on immigration is iffy because at some point, Canada may become unattractive to immigrants because the cost to own are too high. Well, maybe there are always enough rich Chinese that can pay cash, but I am not sure these are the immigrants that Canada wants.

-

Next Thirty Years - Real Estate or Equities?

Spekulatius replied to valueinvestor's topic in General Discussion

Yes, but a levered recap is not cash flow. If you do live in a non-recourse state in the US, you can do the "levered recap hodl". Load up your property under the roof with debt using conforming mortgage and Heloc and keep it 95% levered by continuously refinancing. If property decreases in value substantially, default and live rent free for at least a year until evicted. you may be laughing but that's what some of our acquaintances ended up doing during 2003-2008 although it wasn't the plan to begin with. they even got a few thousand from the bank upon leaving after eviction for the promise not to wreck the house. Sold washer and dryer on ebay when leaving. It's the ultimate heads I win, tails you lose. It's wasn't possible after the GFC for a while but I think you could do it again, albeit probably not to the 95% level, but I think 90% would work. From 2004-2007 you could lever it to ~100% with eager appraisers trying to meet your target and get the job done. They own already another property again so it's not like default prevents you from starting over. -

Movies and TV shows (general recommendation thread)

Spekulatius replied to Liberty's topic in General Discussion

I don't think Shetland is available on Netflix any more - looks like they dropped it a while ago. it looks like you need the Britbox to see it. I agree on Endeavour - it's a great show. -

It's not just quality, it's mind share. Stamps have lost mind share because people stopped using them for the most part basically. old furniture has lost mind share ( at least a couple of years ago, there was a bear market for antique furniture) because people didn't want to have them in their living room or kitchen any more. I do wonder how stiff like NFT will be doing in 10, or 50 years? Maybe it will but I could well see that people completely moved on to something we don't know about yet. Some people collect old bank notes but what if we stop using bank notes entirely and generations growing up will just think they are pieces of paper. It is true that stocks have survivorship bias too but generally speaking, even a company that eventually dies should have thrown off enough cash before it dies to make it a worthwhile investment. i read someone did the math on GM that if you bought it early on, you made a decent return through dividends from it, even though the terminal value was zero because they went bankrupt in 2008. Same applies to houses. Even land can depreciate. My family owned vineyards and they went from being worth 100-200k/hectare in the 70's to being virtually worth no more than grass land next to it (5-10k/ha) 30 years later because cultivation became cost prohibitive and the planted acreage shrank. Well, If you owned land in the Champagne region that would have been different, so it all depends. Same with houses - I have seen houses in Germany where population losses occurred in some areas going to way below replacement value and selling for cheaper than they did in the 1970's 40-50 years later. Those owning RE in Detroit have a similar experience. For those reasons, I like cash flowing assets.

-

How was your Omicron experience?

Spekulatius replied to backtothebeach's topic in General Discussion

Omicron will be done in February mostly but what is the over and under that a new variant is going to pop up causing similar or more problems? It is clear that the Virus mutates to keep spreading even amongst the vaccinated due to evolutionary pressure. Luckily Omicron was caused my lower hospitalization and death rate than Delta for example, but I don't think there is an evolutionary pressure to make the disease more harmless. So I guess the next variant which is certainly going to pop up within a few month, due to the world being a giant petri dish with a huge number to of ongoing infections to create new mutations. Or could it just be that the virus runs out of space for mutations at some point because it will render itself ineffective? I am curious how other think the end game will be. It's clear the virus will be around somehow forever, but I thought we would be endemic at this point and we clearly aren't. -

The US is unique because Fannie/Freddie are government sponsored/owned and take the interest rate risk. No bank can take the interest rate risk of 30 year mortgages in bulk and that's why they don't exist elsewhere (Europe, Canada etc.).

-

Next Thirty Years - Real Estate or Equities?

Spekulatius replied to valueinvestor's topic in General Discussion

I would always run a DCF model when buying RE. That will tell you a lot about the assumptions to make it work. In the past RE has worked even if the DCF didn't because of multiple expansion (lower cap rates) but I think it's an iffy factor to rely on. -

Yes, the mortgage chart gives alot of perspective. Yet again , once you approach zero, even small changes in the divisor create a very different result. That's something some growth stock investors are learning right now. Then there is the whole reflexivity thing (Who stole my cheese???) on top of this.

-

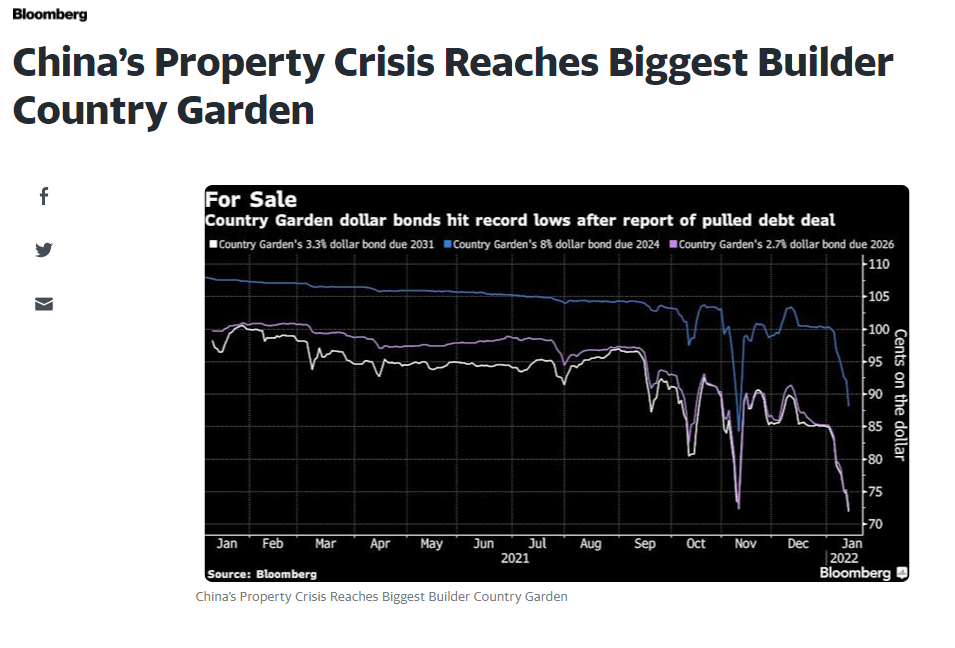

Looks a bit like Lehman. I am sort of surprised the stock only goes down 8% when the bonds crash more. Also who the hell bought the rebound on those bonds after the Nov warning shot from Evergrande? For those that don't remember the financial crisis - Bear Stearns failed in march 2008 and after the initial shock, the SPY almost rebounded and all seemed reasonably well until late summer 2008. Then hell broke lose in September 2008. the old saying about "How do you go bankrupt?" comes to my mind. First slowly - then suddenly.

-

Purdey is the Rolls Royce of shotguns.

-

No I don't think the trend in public vs private ownership has changed much in the US, but it is a factor if you compare different countries.

-

-

There is survivorship bias with collectibles as well though. I think stamps did lousy for example (except the very high end ) and possibly many others. People forget those - the just end up in flea markets.

-

Next Thirty Years - Real Estate or Equities?

Spekulatius replied to valueinvestor's topic in General Discussion

For Canadians, I would stick with stocks or buy real estate in the US. Canada residential real estate is clearly a bubble and sooner or later, there going to be a price to pay. Compared to Canadian RE, the US is downright cheap. -

Movies and TV shows (general recommendation thread)

Spekulatius replied to Liberty's topic in General Discussion

“What we do in the shadows” This mocumentary vampires living in Staaten Island is great is great: https://www.fxnetworks.com/shows/what-we-do-in-the-shadows -

Market cap/ GDP is flawed because this metric depends on how many companies are public versus private. You could have a very expensive stock market with low Market cap/ GDP ratio if most of the companies in this country are private for example. The US tend to have less private companies than most other markets, Why not just use the Shiller or the market PE ratio Instead? It’s a much better indicator. Of course the US is also expensive based on these metrics right now.

-

No, I am a peon on VIC with 90 day delay.

-

Investments Benefitting from Higher Interest Rates

Spekulatius replied to maplevalue's topic in General Discussion

Life insurers have about the most leverage to rising interest rates that I have seen.