-

Posts

15,197 -

Joined

-

Last visited

-

Days Won

38

Content Type

Profiles

Forums

Events

Everything posted by Spekulatius

-

@yesman182 awesome analysis and thanks for posting. I think this is how Buffett et all probably look at Berkshire’s valuation as well. The stock does not look screaming cheap but not expensive at all either.

-

Same here. piggybacking on @BG2008 research.

-

These things are not luxury items/brands. FWIW, this kind of thinking gets you in trouble when value investing.

-

Yes, that and probably energy savings (better insulation mandate) and heat pumps for jokes. I think shingles that double up as solar cells could work too. If we do get a real energy crisis and extended high priced things may be possible that do not seem palatable now, including nuclear power.

-

I am sympathetic to the view on nuclear energy here, but this is an investment forum and we should talk about what is likely going to happen, not what we think should happen, because it's "right". FWIW, i see very little support for nuclear from both ends of the political spectrum. I don't think it's matter of political spectrum. This is the reality: https://theintercept.com/2019/02/06/south-caroline-green-new-deal-south-carolina-nuclear-energy/

-

Yes, he possibly has a strong grip on power. Traditionally, China was run by a party committee (post Mao) but that seems to have changed. That said, it is very difficult to access the vulnerability of a regime from the outside and possibly even from the inside.

-

yeah, I think Xi is in big trouble. He has to deal with 1) real estate slow motion crash (likely takes of several percent off from GDP growth) 2) zero COVID policy failing with no end game in sight (also impeding GDP growth and causing civil unrest) 3) failed foreign policy (getting aligned with Putin who seems to be losing a war or at best gets into stalemate) and US hardening stance on Taiwan 4) Fallout from tech crackdown( impeding innovation and causing wealth destruction for the elite) I think there is a bigger risk that Xi get's canned somehow than people think.

-

Where Does the Global Economy Go From Here?

Spekulatius replied to Viking's topic in General Discussion

High energy prices work exactly like a regressive tax on pretty much everyone living on earth. As we know, taking money away from people that spent it is not positive for either economy. Giving free money to not so nice folks like the Saudis and Putin is not great idea either. Thats why high energy prices are not a good thing at all. -

Digital CU has a 3.77% APR apparently. max 60% LTV though. https://www.dcu.org/borrow/mortgage-loans/home-equity-loans.html They are not the greatest to deal with though. Third Federal is another option. I had a HELOC before the financial crisis, which I never drew on before the GFC. They forced me to close it down at some point in 2010. https://www.thirdfederal.com/borrowing/home-equity

-

Price anchoring is one of the worst pitfalls in investing and one of the hardest to avoid - it just plays into human nature too much, especially if you are value investor. As for wish lists, I have a watch list of perhaps 400 stocks in my brokerage account and yahoo finance and a few other sites (docoh.com, tikr.com) it's watch list, not a wish list. It my universe of stocks I know something about and that forever reason i found interesting at some time. The stocks sometimes linger there for years and I forget about them, then something comes up and I look at them again and they seem to be cheap and I do more research. Sometimes I end up buying them, sometimes a competitor. I found these watch lists one of the best tool. if I remember what I took them in the list for and followed them on and off, I have already some basic knowledge that get's me started on further research / or updates.

-

As for the intend of this thread, I found the issues with these wish list is that once those quality stocks fall to your target prices, a lot of other stocks have become so much cheaper relative to your quality list, so you end up not buying them despite lower valuations. In a way, valuations are always relative and there is an opportunity set of stocks out there that one can buy. That makes buying quality stocks always a bit difficult for investors with an inclination to value.

-

Yes, i was wearing shorts too at the University - not a problem. I do recall at one of my first days at work, a new engineer who started with me was wearing shorts in summer and our boss made a comment or gave some advice. He said he truly doesn't care (which i think was the case), but he might some of the other managers might give him a look. That's the last day he wore shorts at work. I sort of wished we had taken the opportunity to collude and all wear shorts the next day.

-

Probably the wrong thread, but I have been waiting decades for this revolution: https://finance.yahoo.com/video/workers-now-wearing-shorts-return-210904603.html

-

I don’t think states like Arizona have much snow cap melt. Nevada has some but the East side of the Sierras is fairly dry too. These states are screwed LT as far as water is concerned. If you ever been in summer to Phoenix, you get an idea what hell on earth feels like.

-

There is defiantly a change in climate. Look for example at the Lake a mead reservoir, which is hlf empty now and the Colorado river system. About 22 million people depend on this water, pretty much Nevada, a good part part Arizona, Colorado and southern California. Many are high growth areas. I am guessing the days that golf courses exist in Phoenix Arizona soon will be over:

-

The last major refinery was build in 1976 by what is now Marathon oil. There were a lot of small Ng fractionators build after 2000 to separate propane and high carbon chain components from the shale NG (methane). It simply does not make sense to build a greenfield refinery, because capacity expansion of existing refineries is much more economical. This has very little to do with government policies, Imo.

-

Dividends work for me because I have 2/3 of my assets in tax free accounts. I do agree that buybacks are more tax efficient in theory, but buybacks also tend to be pro cyclical and companies tend to buy back stock when valuation are elevated. This even applies to Berkshire - Buffet didn’t buy back stock when the B shares were at $200 (and below) but then went massive in when b shares were above $250. Now I understand why he did it, but it’s an inefficiency nevertheless and there are many much worse cases than Berkshire in terms of timing buybacks. Then again, WEB and the shareholders are crystal clear about their preferences. If you like dividends, there are plenty of decent choices to put your money in.

-

Where Does the Global Economy Go From Here?

Spekulatius replied to Viking's topic in General Discussion

Found this on Reddit. Seems like this report is implying a 3-4% GDP growth headwind from real estate alone. If so, China will show barely any GDP growth this year. https://www.yielddive.com/post/what-s-going-on-in-the-chinese-realestate-market -

Windfall taxes on energy production make no sense. I agree Biden should encourage more production, especially much needed NG. It is odd that the only government that has instituted a Windfall tax, is the conservative UK government under Boris Johnson. https://www.cnbc.com/2022/05/26/cost-of-living-crisis-uk-slaps-windfall-tax-on-oil-and-gas-giants.html

-

-

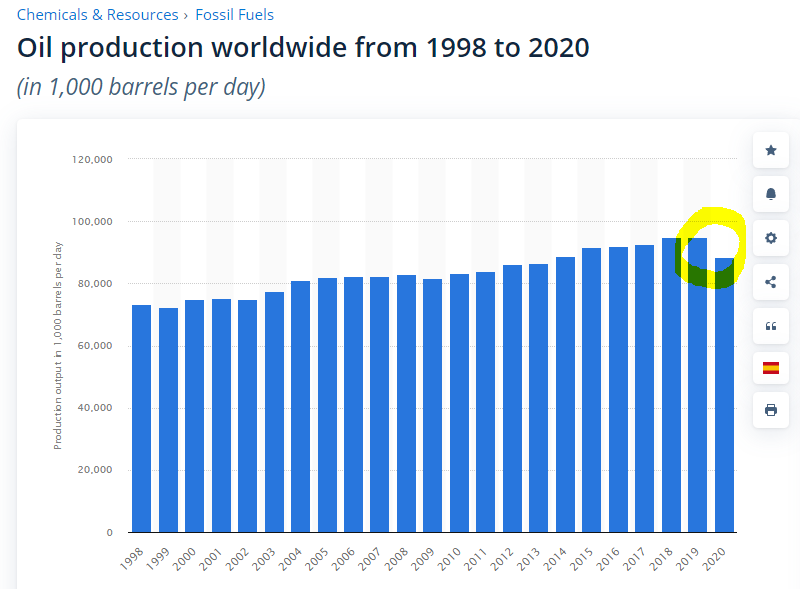

@CorpRaider All the factors you mention could matter at the margin, but I don't think they are the red X, as we used to say when trying to do root cause analysis. I think the red X is that we have seen extraordinary supply reduction in 2020 (production down 7%) and now finding it hard to get the production back. In the meantime, demand keeps rising after falling off the cliff in 2020 and then swiftly coming back. A production cut of 7% has never happened before and now we are dealing with the consequences. the OPEC has raised quotas but they can't meet them (in the past they have often produced more than official quotas). Russia is partly of the map (they funnel their crude through India and China at a discount, but their production is falling due to sanctions). I think the gap will eventually close, but it could take years - in the mean time we just will have rationing via higher prices, which I expect to affect emerging market economies the most.

-

Yes that's possible, but most other countries don't have the same ESG constraints that the US or Europe has. US is only ~10% of the total supply which matters, but it isn't really determining the outcome here. The oil majors also become more tilted towards ESG, so that could matter as well, but then there is always green washing. I think the bigger impact may be that interest rates rise overall. Edit - I looked up the cost of debt for Shell, which is a very typical Major and they only pay 4.4%, if this website is correct. This is very low - i don't see a problem here: https://valueinvesting.io/RDSA.AS/valuation/wacc

-

Well, in the long run, your return will match the return on equity, which I don't think will every be that great with Jungfraubahn. This is a stay rich stock, not a get rich stock.

-

Just because there are fewer projects in the US does not mean spot price goes higher in a world wide market. Also, aren’t all the operators swimming in cash now? Why do they need lending?