-

Posts

15,194 -

Joined

-

Last visited

-

Days Won

38

Content Type

Profiles

Forums

Events

Everything posted by Spekulatius

-

I wouldn’t predict anything as far as China is concerned , but it’s a situation worth keeping and eye on. I think the risk are higher then some here assume. For example BABA jumped when it seemed that they give US auditors a look in their books to stay listed. Noe it seems that this is not the case any more and China’s contingency is to have BABA listed primarily in HK to avoid transparency. This obviously warrants a lower valuation Imo. It worth watching how these things develop over time and see the forest rather than the trees.

-

I don’t think it’s that many people participating in mortgage boycotts yet. However, I think it’s interesting that this became viral and we know how viral things can work. Yes, these were mostly people who put in a deposit or paid for apartments under construction from builders that have defaulted , so these apartments are in a limbo state. It seems however that most Chinese builders and not just Evergrande have ran into financial trouble and so far the central government just lets them just go. I guess we are at the Bear Sterns stage at this point. This means the above could easily repeat many times over. If real estate crashing were the only issue, this probably wouldn’t be so bad. However with Xi being in charge and making things worse and kneecapping the economy (zero COVID-19, tech crackdown) and the ominous neo Maoism becoming a new reality as well as challenging the US on Taiwan (Pelosi is now almost forced to show up in Taiwan on an aircraft carrier doing a Mac Arthur style landing) I really think this could take a turn for the worse. People think that companies can work around these type of issues in a totalitarian state like China - well really?

-

This makes sense.The guy who lost ~$150k was asked to “invest” the money and I was wondering about this , since pretty much everyone should be able to put money in a bank account. So he probably collected money from his relatives/ family and put it in one of those high interest rate account in this private bank and got screwed. Now, I still wonder how the banking system works. Most banks in China are private , since they trade as shareholder corporations. Is banking in China not regulated? No deposit insurance? What happens to depositors money if one of the large banks goes belly up?

-

@Parsad What is strange about this is that despositors lost their money because a criminal gang managed to get control of this bank in Hanan and then plundered it, leaving the depositors out cold. I wonder how this is even possible. Don’t they have deposit insurance or a bank regulator ? From the report it sounds like the central government pushes down the responsibility to handle all this down to the local government , including what to do on the housing end. that sort of makes sense, considering that China is a big place, but now it really depends on the local government how this works out. Systemic issues also are hard to handle on a local level. I am not really doing anything, just watching, but if the confidence in the banking system cracks, we can see some funny stuff happening. So far, these incidents seem small.

-

Pretty good summary on bank frauds and mortgage boycotts. Apparently 70% of the household wealth is stored in real estate but Ci point is that houses are to live in, not for speculation. Chinese do not tend to rent out their investment properties, because they lose value (they become used). I can attest to this as well - was told the same when I was in China years ago.

-

There is another article from the WSJ about the Chinese economy. It seems that the leaders were not too concerned about the property market or decided it’s not worth it risk because of external costs (high housing costs) https://www.wsj.com/articles/chinas-leaders-arent-sweating-growth-slowdown-11659094452 I would say this much, housing is highly levered typically and has a huge multiplier effect on GDP. Someone owns all those mortgages in China, presumably banks. It also requires a lot of material, heavy equipment, energy. Yes a lot of people have been predicting a doomsday in China before, but zi don’t think we ever had a confluence or so many factors and a lousy leadership hampering the economy. Maybe Xi sails into the sunset, but I think this is very wishful thinking. I am not a macro guy generally, so I think the right course is to watch this closely and see which way it goes. I don’t have anything invested in China either so I am more concerned about the externally impacts that the direct ones.

-

Added to CMCSA and KNBE (speculative cybersecurity play).

-

I Need a Laugh. Tell me a Joke. Keep em PC.

Spekulatius replied to doughishere's topic in General Discussion

Let us know how it went. -

Where Does the Global Economy Go From Here?

Spekulatius replied to Viking's topic in General Discussion

Interesting narrative violation - Europe's economy actually outperforms the US in the last quarter: https://www.wsj.com/articles/eurozone-recovery-picks-up-speed-but-ukraine-war-threatens-deep-contractions-11659087222?mod=hp_lead_pos6 Of course the outlook is much more murky, but I think Europe's economy will still exist in 2023. Once they get past the energy issue, which i think will mostly be the case in 2023, the worst will be behind it. -

Yep, I agree. Very prescient observation from Trump.

-

The GFC was a very different situation and China was not in the center of it. They had 9.8% GDP growth in 2008. They could growth out of problems easily back then. They also had good demographics back then and now it’s rapidly turning worse (1 child policy effects lead to labor force shrinking) Its different now, their economy is growth I’m much slower and their real estate sector has been growing in leaps and bounds since then, as it is the preferred way to store wealth for the Chinese, which they may find out to be a boondoggle now. Thats why I think some are refusing to pay their mortgage. Biggest problem is Xi - he is the worst leader since Mao. The zero COVID policy alone is costing them several percent of GDP growth, but I guess that he and other leaders are now so invested in the idea that they can’t let go of it. Same with the common prosperity theme that’s not working out that great either. While it’s difficult to predict China or a meltdown , I think the chances are much much higher now than they were in 2008.

-

I do wonder if China is heading for a meltdown. The real state crisis with boycotts paying mortgages , developers going broke (Evergrande) sort of looks like a meltdown to me. Zero COVID adds to this disaster. The tech crackdown reduces economic growth. Aligning with Putin. “Belt and road” a monumental failure. The list of planned economic policy failures failures goes on and on. Xi as a leader is a disaster. That’s what happens without checks and balances. Maybe not an outright meltdown, but I would not be surprised if China’ economic growth just matches the US going forward or even turns out to be lower.

-

Where Does the Global Economy Go From Here?

Spekulatius replied to Viking's topic in General Discussion

Powell made a huge mistake implementing his AIT (average interest rate targeting) at just the wrong time in 2020. AIT lead to a slower response when inflation was rising above 2% in 2021. Now we are paying the piper for this: https://www.federalreserve.gov/monetarypolicy/guide-to-changes-in-statement-on-longer-run-goals-monetary-policy-strategy.htm In the logical sense, this would have to lead to keeping the interest rates higher even if inflation falls below 2%, but I think it was only to work one way and not the other. -

Where Does the Global Economy Go From Here?

Spekulatius replied to Viking's topic in General Discussion

I don't think it's a pivot. It makes sense to raise slower from here, because some things are moving in the right direction already. Maybe he does another 0.5% next time. The economy is going to get used to higher interest rates. Anyways, I think we should ignore what he is saying, and just watch what he is doing. Everything he is saying is calibrated for market impact. -

And here are people claiming that the sanctions are not working based on the Ruble strength. The Ruble strength just means that Russia can't buy anything. Yes energy is booming based on firm pricing, but the rest of Russia's economy is having the equivalent of the great depression, if not worse. @lessthaniv thanks for posting.

-

Sold PYPL on Elliot bump.

-

A strong labor market is bearish for stocks, because it means that the Fed can raise more without causing trouble with employment. The weak consumer sentiment on the other side is very very bullish. In the past, weak consumer sentiment has been correlated with very strong subsequent stock performance. I am guess this is because that weak consumer sentiment is correlated with weak investor sentiment. Got to be greedy when others are fearful.

-

So, here is RIO expected dividend: https://finance.yahoo.com/news/rio-tinto-delivers-underlying-ebitda-062000666.html Price down a few percent, but nothing major. Looks like an opportunity to me.

-

I have been adding GOOGL today and yesterday. It has become one of my larger positions.

-

Where Does the Global Economy Go From Here?

Spekulatius replied to Viking's topic in General Discussion

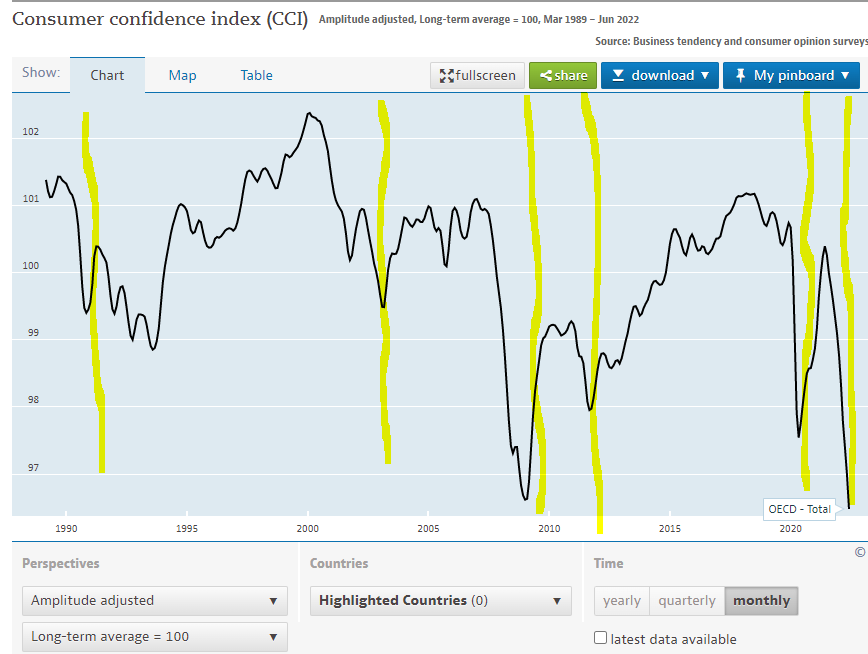

@Viking - low consumer confidence has been an extremely reliable contrarian indicator (my guess is it seeps into investment decisions) and when you bought stocks when consumer confidence was at low levels, it has worked very well every single time. Looks at the lows in 1990 (gulf war) 2002 (9/11, recession) 2008 (GFC), 2010 (Europe). 2020 (epidemic) 2022 (inflation). -

Well there is Redfin and several other discount brokers. The problem is that RE is a relatively complex transaction with of a non-standard assets that has a lot of angles. The search process went already totally online - it was sort of online when I bought my first home in 2002, but you still needed the MLS access via a Realtor for timely access to listing as the listing sites (Realtor.com etc) only got the listings two weeks or so later. This is not the case any more. Then there is the whole thing with the RE lawyers, but that's more an east coast thing - in CA everyone uses standard forms and that pretty much eliminates the need to get a lawyer involved. As for the thread question, I think the gig economy (UPWK, FVRR) may get to a trillion $ in transaction volume eventually, but it's not clear to me how good this business model is, especially for FVRR.

-

I think Hagstrom book (Warren buffet Way) about Buffett contains a lot of his thinking about inflation. Companies with a lot of PPE benefit first but when they have to replace their assets, it's payback time. I think he specifically called out steel companies which actually did fairly poorly in the 70's I think (also due to rising foreign competition, not just issues with inflation). Stuff like TV stations did phenomenally well because the intangibles became more valuable due to ads being a more or less fixed percentage of nominal GDP. Same will be true to GOOGL and FB, I think.

-

That’s not fear, that’s greed.

-

Monkey pox is most likely going to spread in schools and kindergartens, I think. I think it’s time to get prepared for a vaccination campaign and prioritize kids and teachers and folks with high risk. If this become an epidemic, it will be too late to mitigate without preparation.