-

Posts

2,638 -

Joined

-

Days Won

15

Content Type

Profiles

Forums

Events

Everything posted by UK

-

If I had to bet at the gunpoint, I would bet on: https://www.economist.com/europe/2023/06/20/ukraines-spymaster-has-got-under-the-kremlins-skin "Yet his bravado is not universally welcomed. Leaked documents show that the cia had to intervene to stop General Budanov from ordering an attack on Moscow on the anniversary of the invasion in February. Sabotage and the raids inside Russia since have heightened worries among Ukraine’s allies about provoking a nuclear power."

-

Sometimes energy loss because of these "thesis drift" situations just isn't worth it. It is pity stock doesn't cares or know how you fell though:)

-

https://www.economist.com/europe/2023/09/17/an-interview-with-the-head-of-ukraines-defence-intelligence

-

Together with China's big tech (and some added leverage) I sold more then half of my very over sized (>60 per cent) BRK position last year to buy UMG, META, GOOGL, AMZN and to add substantially to FFH and JOE, and a few smaller things. DIdn't plan for this, but after unexpectedly quick reversal, I am almost out of magnificent and similar stuff, except for still owning some 60 per cent of initial META position. But after exiting margin first, instead of bying back BRK, this year I mostly only added to JOE and even more so to FFH. So for the first time FFH is larger position for me than BRK and substantially, so I hope that the statement about their quality stands:)

-

I know nothing about DG, but generally I think this is very true and important. It is also one of the main mistakes I unfortunately had to learn from myself, especially if that lower quality also involves leverage. Ironically for me it also involved moving somewhat from BRK to make such a mistake a last time. Now I am almost afraid to touch it in order to buy "something better":) I have saved this quote as one of my top checklist item: "The chief losses to investors come from the purchase of low quality securities at times of favorable business conditions"- Benjamin Graham This is maybe also very interesting to consider in terms BRK vs FFH, as currently their valuations is still quite diverge, while quality is seemingly converging. I think and hope that the term "low quality", especially speaking of their insurance operation, is not applicable to FFH anymore. So far I did not yet sold any BRK to buy FFH, as there were better candidates.

-

https://www.bloomberg.com/news/articles/2023-09-17/xi-s-security-obsession-turns-ordinary-citizens-into-spy-hunters?srnd=premium-europe “At the time of economic pressure, there are quite obvious concerns at the top leadership,” said Katja Drinhausen, head of the politics and society program at the Mercator Institute for China Studies in Berlin. “Using collective fear as a way to build political and social cohesion is a very dangerous game to play.”

-

https://www.bloomberg.com/news/articles/2023-09-18/iphone-maker-foxconn-aims-to-double-india-investment-employment?srnd=premium-europe#xj4y7vzkg Apple Inc. partner Foxconn Technology Group plans to double its investment and employment in India, highlighting an accelerating manufacturing shift away from China as Washington-Beijing tensions grow. ... The investment plans of the Taiwanese company, also known for its flagship unit Hon Hai Precision Industry Co., include a 300-acre site close to the airport in Bengaluru, the capital of Karnataka, Bloomberg News previously reported. That plant is likely to assemble iPhones and expected to create about 100,000 jobs.

-

https://www.bloomberg.com/news/articles/2023-09-18/stocks-euphoria-in-india-draws-warning-from-top-performing-fund?srnd=premium-europe “You are in a market where if you think about a stock from an investment point of view, it rises 40% before you even decide to buy it,” Bhan told Bloomberg News in an interview at his Mumbai office. “That is clearly reflective of froth,” said Bhan, who oversees the equivalent of $17.4 billion in equity assets under management.

-

Have You Bought a Hostess Product in the Last Year?

UK replied to Parsad's topic in General Discussion

https://www.wsj.com/business/retail/twinkie-hostess-brands-smucker-deal-4cc72302?mod=hp_lead_pos9 Ten years ago, the unthinkable happened: Twinkies disappeared. Hostess Brands, maker of the golden, cream-filled sponge cake, declared bankruptcy for the second time in a decade. The company closed its factories and began liquidation proceedings, sparking a run on supermarkets as shoppers filled their carts with Twinkies, Ho Hos and other edible specimens of Americana they thought they might never be able to buy again. What happened next was a dramatic comeback that few could have anticipated. Two investment firms rescued the snack cakes, paying $410 million for Hostess’s brands and kicking off a decadelong fix-up job. Then came a dogged quest for efficiency and a determined search for the next Twinkie, all of which culminated this week in a deal to sell Hostess to J.M. Smucker for $4.6 billion. -

Wow, what a passimism from 2025, never saw this, what is the source of this table?

-

Thanks for comment. While discussing bonds vs equities I somehow always tend to think in terms of very long term bonds, which could mislead and I do not like them most, especially for buy and hold. I admit, that under certain circumstances, depending on valuations and alternatives, I would go up to 30 per cent (or even more, but perhaps very unlikely) cash or short term bonds (or even longer term) and was in a such position for a quite few times in the past. But also, looking historically, 10 year rates were perhaps like 6 per cent and it was considered normal, while at the same time dotcom craze was going on successfully for quite a while. Just because now they are back to something more or less normal, perhaps does not necessarely mean the end of the world and I am not sure if it automatically merits large allocation, especially if absolute levels are still nothing special (and under required IRR, at least for me) and one can still find equities, providing at least 8-10 expected returns (even BRK still likely clears such a hurdle), if we are talking about longer term horizon.

-

https://www.bloomberg.com/news/articles/2023-09-15/beyond-the-ai-euphoria-is-a-worrying-stock-signal-on-us-growth Look past the exuberance for all things artificial intelligence and you find a stock market backdrop where confidence in American growth is far less robust than it seems. It’s in the dispiriting performance of banks and industrial companies, barely eking out gains in 2023 while the likes of Tesla Inc. and Nvidia Corp. double and triple. Pessimism is visible in versions of major benchmarks that pare down the influence of megacaps, such as the equal-weight S&P 500, up a relatively paltry 4% so far this year. Also alarming is the performance of small-cap stocks, whose charts show worrying signals barely seen over the past two decades. The Russell 2000 has fallen behind an index of the 1000 largest-capitalization stocks for the second month in a row, on track for its second-worst annual underperformance since 1998.

-

To each his own / let's agree to disagree:)

-

Also found this one: https://www.marvalcapital.com/interviews or https://vimeo.com/862872315

-

Btw, it is interesting situation re interest rates and its impact on these magacap companies: https://www.wsj.com/economy/rising-rates-make-big-companies-even-richer-718eafce?mod=hp_lead_pos5 The Federal Reserve jacked up interest rates to slow the red-hot economy. At some of the biggest and most secure companies, the moves had the opposite of the intended effect, boosting their profits and spending power. The winners from higher rates were high-quality borrowers, who locked in low interest rates around the pandemic with bonds maturing further in the future than any time this century. Higher rates have little immediate impact on their borrowing costs—only affecting bonds when they are refinanced—while they earn more on their cash piles straight away. ... Of course, nothing is forever. The disparity between the winners and losers from rate increases provides yet another reason why the biggest stocks—the winners—have been by far the best performers this year. But threats to the dynamic loom: Time and the economy. The longer the Fed keeps rates high, the more bonds of even the best-quality issuers will have to be refinanced at a higher cost. And if the economy finally breaks, cyclical companies—those most sensitive to downturns, such as carmakers—faced with sharply lower cashflows will struggle to pay even low interest rates they locked in long ago. Until then, we live in strange times. Rising rates make a big part of the economy feel richer—not poorer.

-

https://www.bloomberg.com/news/articles/2023-09-14/xi-crackdown-on-china-health-care-aims-root-out-corruption-bribes-for-doctors

-

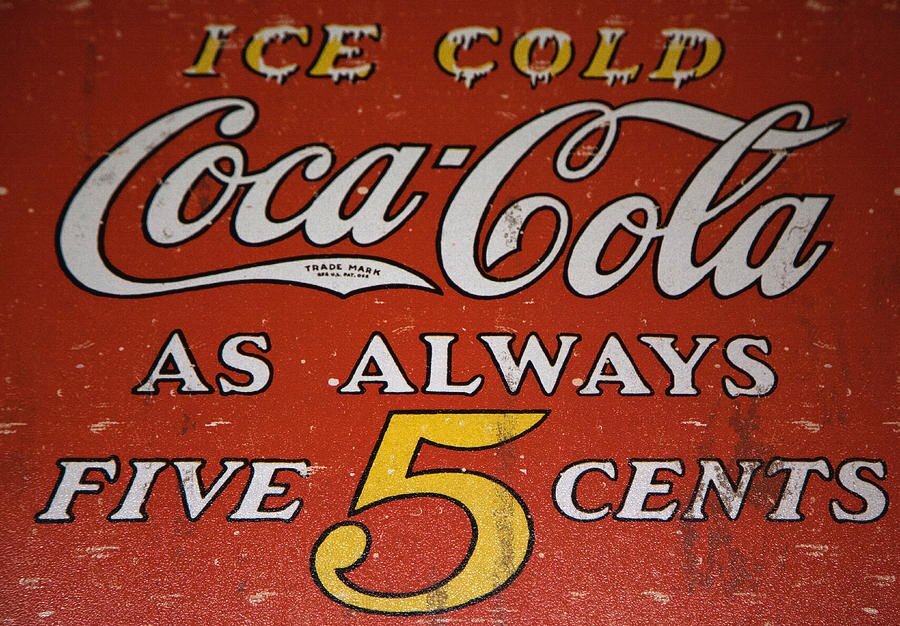

Because if you are not looking at the very short term or hoping to trade them in one or two years, in a longer term (10 years is good enough), if something unexpectedly bad in a major way happens with purchasing power of the currency (don't you share this worry, if you own Bitcoin?), fixed income instruments will be screwed and equities, like other real and/or productive assets, will more or less compensate for this. In some minor way this is just what happened in the last few years with this transitory thing. Maybe we all have our own biases, but I started investing long time ago in equities not because I was seeking some out sized returns, but from fear and in order to preserve what I could save at the time. After seeing with my own eyes before two currencies turning to toilet paper slowly and then quite suddenly:), I just never understood how earning less than 8-10 (which for me in EUR was the case with government bonds all the time, except once, in more then 20 years) was not picking pennies in front of a steamroller. Call it some kind of PTSD from paper money devaluation, but basically only a real estate and equities were the options for me. This poster sums it up:)

-

Yes, you are right, I just thought about treasuries, since Luca mentioned them in his original post. And yes, TwoCitiesCapital also refered to better alternatives. Still, maybe because of the wrong biases, I just do not find anything below 8-10 per cent expected returs atractive, especialy if these returns are nominal, as with fixed income. Kinda: https://fortune.com/2012/02/09/warren-buffett-why-stocks-beat-gold-and-bonds/

-

https://www.wsj.com/world/europe/ukraine-says-it-eliminated-advanced-russian-air-defense-system-in-crimea-a7c97151 Ukrainian forces destroyed one of Russia’s most advanced air-defense systems in Crimea, a Ukrainian security official said, striking a fresh blow to Russia’s military on the occupied peninsula that serves as a critical logistical base for Moscow’s war in Ukraine. The strike in the early hours of Thursday morning used drones and Ukrainian-made cruise missiles to target the S-400 missile system near Yevpatoriya in western Crimea, the official said. Videos shared online showed a fireball and a plume of smoke near the city. ... The operation marks the first officially confirmed use of the Ukrainian-produced Neptune missile to attack a target on the ground. Neptune is a ground-launched antiship missile, designed and produced in Ukraine based on a Soviet-era weapon. It shot to prominence in April 2022 when it was used to sink the Moskva, the flagship of Russia’s Black Sea Fleet. The missile, which has a range of about 200 miles, was later adapted to strike ground targets. Ukraine has received cruise missiles from the U.K. and France, but stocks are limited and the U.S. and Germany are still deliberating whether to approve Kyiv’s requests for further long-range weapons. Ukrainian President Volodymyr Zelensky last month said Ukraine was upgrading production facilities and could produce “colossal numbers” of missiles, including Neptunes.

-

It is funny, because, perhaps not without different biases involved, I actually thought exact opposite after seeing this (btw really nice analysis/tables), meaning who on earth would buy 10 year bonds at 4.3, if even SNP could still deliver 6 per cent (I think it is quite reasonable or even on the optimistic side) over the next 10 years? Maybe if you good at trading them, but for the buy and hold and with much better options than SNP?

-

I follow this, but more for the interest. However atractive it may sound (and it sounds atractivelly), I would lose my sleep making a big bet on such thing. For big bet I like JOE much better:). Does anyone here think differently? There was also an article about uranium in WSJ yesterday: https://www.wsj.com/finance/commodities-futures/nukes-are-back-but-uranium-is-in-short-supply-44c4ccbf

-

https://www.bloomberg.com/opinion/articles/2023-09-13/the-world-is-still-better-off-with-us-hegemony The Pax Americana was never perfect, just preferable to no pax at all. Here’s hoping that it stays with us a bit longer. ... Is US power actually waning, or does it just seem that way? Does the US, going into a presidential election next year, even want to remain hegemon? Or are Americans fed up with defending that battered regime so awkwardly named the “rules-based international order”? Not least, should the world root for American decline or continued US preeminence? That last one depends largely on where in the world you happen to find yourself. If you’re in Beijing, US hegemony can’t end fast enough, because you think China should reclaim its rightful place as a sort of Middle Kingdom in world affairs. If you’re in Tallinn, Estonia, you want the US to stay strong and engaged, because you realize that an American presence in Europe is probably the only thing standing between you and renewed subjugation by the Kremlin at some point. .. But ask yourself two questions. The first is whether the world would be better off substituting in a different hegemon. Given the prerequisites in economic, technological, military and nuclear power, that could only be China in the foreseeable future. I doubt many people beyond its borders would choose the Chinese Communist Party as ward of the international system and its rules. The second question is whether the world would really improve if it had no hegemon at all — that’s the alternative implied by the catchphrase of multipolarity. If you accept, as I do, that the international system’s default state is anarchy, the answer is No. And even if you believe in the balance of power as the secret sauce, keep in mind that in that realist tradition war is a feature rather than a bug in the system — it’s what recalibrates the scales every so often.

-

Thanks! Very interesting! Do I understand correctly, that letters of Marval Capital are available only for its clients?

-

Even if AAPL was cut in half, it would be only some 10 per cent loss to BRK value, but than you end up with them owning somewhat undervalued position:) Re catastrophes, I expect, that it is more of a opportunity, than a threat for them (and other well run insurers). More risks, more oportunities.