-

Posts

2,638 -

Joined

-

Days Won

15

Content Type

Profiles

Forums

Events

Everything posted by UK

-

Funny, but yet another wrong step. Fact or propaganda:)?

-

https://www.wsj.com/articles/canada-tests-the-limits-of-its-liberal-immigration-strategy-bc61e0de?mod=lead_feature_below_a_pos1 The country of 40 million people last year welcomed more than one million permanent and temporary immigrants, Statistics Canada said. That influx generated a population growth of 2.7%; the increase of 1.05 million people was nearly equivalent to last year’s increase in the U.S., a country with more than eight times Canada’s population. In the next two years, Canadian officials say they will boost the number of permanent newcomers by almost a third, with most being skilled migrants such as carpenters, computer scientists and healthcare workers who qualify under a merit-based points system.

-

https://www.wsj.com/articles/global-economy-economic-losers-fba30b53 The world’s biggest economies are offering huge subsidies in a cutthroat race to win the industries of the future. The losers: all the countries that can’t pay up. New tax credits for manufacturing batteries, solar-power equipment and other green technology are drawing a flood of capital to the U.S. The European Union is trying to respond with its own green-energy support package. Japan has announced plans for $150 billion of borrowing to finance a wave of investment in green technology. All of them are working to become less dependent on China, which has a big lead in areas including batteries and the minerals to make them.

-

https://www.wsj.com/articles/wildfires-and-thunderstorms-are-throwing-insurance-market-into-turbulence-2c62ab7b?mod=hp_minor_pos19 Not only have reinsurers in some cases raised the cost of coverage, but they have also moved up the starting point for when they will begin to absorb losses. Thus, the amount of losses that primary insurers have to take before reinsurance kicks in is in many cases getting larger. Reinsurers are now typically seeking to start at the level of catastrophe losses that occur around once every 10 years, rather than the more typical starting point of one-in-three-year or -five-year events, Gallagher Re said in its January report. Clearly, the insurance industry as a whole needs to keep adjusting to worse events, more often. That won’t happen without cost.

-

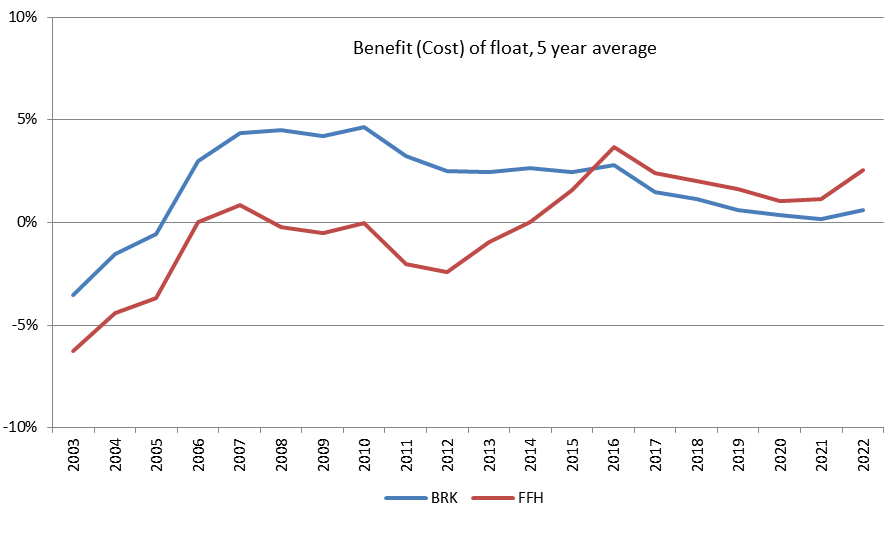

Not sure if I did it without mistakes, but it is quite interesting if you compare this data of FFH with BRK! ffh brk float.pdf ffh brk float.xlsx

-

Thanks! https://www.barrons.com/articles/jnj-kenvue-stock-price-odd-lot-rule-96aa9b74 Also: One potential positive is that arbitragers have been buying J&J and selling short Kenvue to take advantage of the 7.5% spread. This has depressed Kenvue by about 3% since the deal was announced in July while J&J is up about 2%. This could mean that Kenvue may appreciate once the deal is done and that trade is unwound. When General Electric did an exchange offer for Synchrony Financial in 2015, GE stock outperformed before the deal and Synchrony outperformed GE immediately thereafter. And: https://finance.yahoo.com/news/kenvue-set-join-p-500-224200805.html

-

https://www.bloomberg.com/news/articles/2023-08-09/sweden-needs-to-treble-nuclear-power-as-electricity-demand-soars#xj4y7vzkg Sweden said it needs to treble nuclear power capacity over the next couple of decades to meet a surge in electricity demand. At least 10 new conventional reactors need to be built by 2045, Romina Pourmokhtari, the nation’s climate and energy minister, said in a statement on Wednesday. The biggest Nordic nation has six reactors in operation today. Sweden needs all the new power capacity it can get as demand is poised to double in the next few decades amid the electrification of industries and transportation. New nuclear plants are at the heart of the government’s strategy to expand power output.

-

https://www.reuters.com/world/china/china-require-all-apps-share-business-details-new-oversight-push-2023-08-09/ A lot of "regulations are over" promises recently, yet almost every week there is some kind of new announcement.

-

Thanks very much! I guess, on the other hand, all this again is also a very good remainder (at least for me) that with an insurance business you really have to trust managment a lot. I remember I first tried to look at some insurance companies (other than BRK) in 2010 or 2011, after BRK invested in Munich RE and also when AIG was starting its second life:). This is when I also discovered this board and FFH for the first time:). Maybe WB letters and warnings on insurance had a big influence, but at that time I came to a very simple (stupid?) conclusion: no other insurance company other than BRK is investable for me at that time (good sleep), at least for big/high conviction position. I bought some FFH in 2012, but generally just went with BRK for large allocation, which was also quite cheap in 2011-2012 period. Even today, together with other leveraged financials (also after some very different expierence of investing in banks: worked generally really good with US, not so with EU:)) I do not like these companies: no traditional pricing power, high leverage and all the dangers of "creating profits" with pen, dancing till the music stops etc. More so when they are not owner operated etc. On the other hand BRK (and some other companies) has proved, that a well run insurance operation, especially combined with well run investment side of the business, could do wonders for investors. So the crux with FFH, at least for me, is do I trust them with that? I think (or hope), that the answer after the last decade is finally yes with FFH? So I would be very worried if something bad came out of their insurance operations or if they would made another very big insurance acquisition. But it seems so far so good on this side?

-

Viking, thanks for update! I am not sure I understand this IFRS 17 effect correctly (or at all:)), but wouldnt constant rates imply, that this line more likely would be a zero in the future, as only further rising rates would translate into some positive number (and vice versa)? 'On the mechanics of IFRS 17':

-

I think it is very healthy when we still have such opinions from analysts, especially when they are obviously wrong:). If you read only COBF, these days consensus on FFH almost worryingly too cheery. But when I speak about FFH with some other investors, I am still getting a lot of push back and/or very low interest. These views are usually because of expierence of the decade from 2010 and they just do not want to dig deeper, or to change the old opinion, or to dig at all, but also maybe because FFH is quite complex and in the insurance business. Anyway, if or when this Morningstar analyst will upgrade FFH to some 'medium moat' and a price with the multiple of 1.3 or 1.5 BV in the next 3 years, he probably will be another 50 or 100 per cent to late and at that time expected returns will be much lower:)

-

https://fortune.com/2023/08/05/black-swan-hedge-fund-mark-spitznagel-interview-taleb-credit-bubble/ I hoped that Spitznagel would help me find a simple yet practical solution to protect your portfolio from worst-case scenarios (or tail risks)—after all, that is his “bread and butter.” But his answer wasn’t what I anticipated. When you ask the man who has written multiple books on risk mitigation—his latest is called Safe Haven: Investing for Financial Storms—how retail investors can protect their capital, you expect to hear a few of the typical options: gold, Treasurys, or maybe the Swiss Franc. Instead of all that, Spitznagel warned that when it comes to safe-haven investing, “the cure is often worse than the disease.” If risk mitigation isn’t cost effective and supportive of higher overall returns in the long term, then it’s not worth it. In his view, most of the classic safe-haven strategies used by retail investors fall into this category. There is some good news, however. A recession or market downturn may come—and Spitznagel says he’s worried about what he calls the “greatest credit bubble in human history” and a “tinderbox” economy—but perhaps paradoxically, he doesn’t expect even that to be the end of the world for retail investors focused on building wealth for the future. It may take time, he said, but markets always recover, even from unexpected, economy-crushing black swan events. In spite of the potential for economic disaster, Spitznagel believes that retail investors should probably just listen to the timeless advice of Berkshire Hathaway chairman Warren Buffett: Focus on the long haul and don’t bet against America.

-

https://seekingalpha.com/article/4624021-fairfax-financial-holdings-limited-frfhf-q2-2023-earnings-call-transcript And Tom, one other point on the buying back. In our annual report we said that our book value per share grew at 18.8% from inception compounded at 18.8%. Our stock price sometimes compounds above and sometimes below. Well at the end of 2022 we said what stock price Canadian dollars would make the book value compound and the stock price compound the same? And that number we put in our annual report was CAD 1375 1-3-7-5. That just makes it same. Book value is our first indication. Our book value we think is very understated and our book value -- our intrinsic value which I'll leave you guys to estimate is worth a lot more than the book value. But that's how we look at it. So at the end of the year CAD 1375, if we can buy our shares we think we're doing all shareholders that we're doing well by all shareholders by buying back the stock. Fran, next question?

-

WSJ: This has been an inflated year for natural disasters in the U.S. The number of U.S. potential billion-dollar weather and climate disasters in 2023 through June has exceeded every year tracked by that point besides 2017, with 12 such events so far, according to the National Oceanic and Atmospheric Administration’s National Centers for Environmental Information. The average from 1980 to 2022, adjusting costs for inflation, was around eight annually. FFH: The consolidated combined ratio of the property and casualty insurance and reinsurance operations was 93.9%, producing an underwriting profit of $337.5 million, compared to a combined ratio of 94.1% and an underwriting profit of $301.7 million in 2022, driven by continued growth in business volumes (net insurance revenue increased by 6.2%), prudent expense management and decreased catastrophe losses of $134.8 million or 2.4 combined ratio points in the quarter.

-

Thanks Viking! The underwriting results, which was my biggest worry (as usual:)), are just awesome, especially while considering context!

-

https://www.wsj.com/articles/insurers-are-facing-more-than-one-kind-of-inflation-bb925670?mod=hp_minor_pos19 This has been an inflated year for natural disasters in the U.S. The number of U.S. potential billion-dollar weather and climate disasters in 2023 through June has exceeded every year tracked by that point besides 2017, with 12 such events so far, according to the National Oceanic and Atmospheric Administration’s National Centers for Environmental Information. The average from 1980 to 2022, adjusting costs for inflation, was around eight annually. https://www.wsj.com/articles/home-insurers-are-charging-more-and-insuring-less-9e948113 “We’re still seeing the industry having an underwriting loss this year continuing out to 2025,” said Dale Porfilio, chief insurance officer at industry body the Insurance Information Institute. The institute expects that “the cycle of continuing to take rates upward is going to continue for the next two years,” Porfilio said. ... The escalating cost of catastrophes is reflected in a steep increase in premiums for the reinsurance coverage that home-insurance companies buy to pass on some of their risk. Depending on the state regulator, those higher premiums can feed directly through to the price charged to homeowners, Fox said. His firm’s data shows reinsurance premiums were up on average 33% for June 1 renewals, which includes many Florida carriers, and 50% for renewals at the start of this year. The question of whether reinsurance prices will keep rising, piling more pressure on home-insurance premiums, depends a lot on what happens in the second half of this year, according to Fox. “There’s a fork in the road ahead,” he said. “If we have another major hurricane or some medium-size hurricanes or a spate of wildfires…that [reinsurance] price will go up again.”

-

My best guess (and hope) it is because of the very good price performance of share price of FFH recently and in a last few years, but it is really hard to understand why it is still trading today at only 1 PBV and not at some 1.2 or 1.3 already. However you look, on absolute or on relative, it does not make sense.

-

https://www.wsj.com/articles/while-everyone-else-fights-inflation-chinas-deflation-fears-deepen-4045cabf

-

The value of this forum is unbelievable. To illustrate, based on recent history:), basically all one had to do is to read everything carefully and than at least to follow Parsad into META, Viking into FFH and Greg into JOE...not to mention many other great ideas and posters!

-

I think one could worry somewhat about this or maybe should in the future if market continues to do what it did in 1H: But in my humble opinion it is still to early and more importantly not at a such an extreme point yet to make any big market calls. Maybe it is the case with some AI related or other hot things (avoid), maybe already even somewhat with big tech (avoid or be less greedy/more selective), but even in case of general market (not to hot, not to cold, no opinion), but especially the universe of not so magnificent another 493 companies or companies not even in SNP500, I think you can still find/own things to be quite excited about.

-

One more: https://www.bloomberg.com/news/articles/2023-07-29/stocks-crush-year-of-bond-in-biggest-market-sentiment-shift-since-99?srnd=premium “What’s happened, particularly in the US stock market, has taken a lot of people by surprise,” he said. SentimenTrader suggests the shift may endure. Unlike in the past, corporate insiders are big buyers, while technicals like subdued volatility and bullish options are keeping equity sentiment elevated. The only other two instances when stocks versus bond sentiment were so wide apart were in 2003 and 2009 “both coming out of protracted bear markets and indicating a dramatic shift in investor expectations,” said Jason Goepfert, director of research at Sundial Capital Research and SentimenTrader, which analyzes futures positioning, surveys, options activity and fund flows. “Both preceded new bull markets.”

-

Not necessarily about such scenarios, but sure I am worried about what is going on. But then again: 'If a problem is fixable, then there is no need to worry. If it is not fixable, then there is no help in worrying'.

-

https://www.economist.com/international/2023/07/27/the-ukrainian-army-commits-new-forces-in-a-big-southward-push These factors explain why General Valery Zaluzhny, Ukraine’s top general, decided to throw in fresh legs on July 26th. He has been forced to adapt his original plan. Brigades from Ukraine’s 9th Corps had been expected to fight their way to Russia’s main line of defence. Then the 10th Corps, in essence a second echelon, including three Western-equipped brigades, were to be deployed to fight their way through the strongest defences. Finally, light, fast-moving air-assault units were supposed to exploit any breakthrough, pouring through the hard-won breach. In the event, 9th Corps struggled. Advances that were supposed to be completed in days ended up taking weeks. Ukraine was unable to deploy whole brigades, instead breaking them down into smaller units. Some experts worry that 10th Corps has now been thrown in prematurely. The main Russian line is still kilometres away and 10th Corps’s units might be worn down before they get there, leaving them too exhausted to punch through. Western officials play down these concerns. “I think they timed it well,” says one. Ukraine is in a “very strong operational position”, says another, pointing to the turmoil in Russia’s senior ranks, including the decision in early July to sack General Ivan Popov, who commanded a big portion of Russian forces in southern Ukraine. Russian military bloggers have described heavy losses of Russian artillery pieces in recent weeks. However, a fluid war of manoeuvre is likely to remain a stretch for a force cobbled together in a few months. The Russian verb peremalyvat (to grind through) is invoked on both sides. But Ukraine’s junior commanders, having seen their units gutted over the past 18 months, refuse to send their new citizen army into a meat-grinder in the way that Russia did in Bakhmut. As Ukraine has become more European, Ben Wallace, Britain’s defence minister, recently suggested, it has acquired “a Western European caution”. Some American and European military officials argue that Ukrainian commanders have in fact been too slow to strike with their new brigades, a mistake that they think Ukraine committed last year in Kherson, when tens of thousands of Russian troops withdrew east over the Dnieper river with their equipment. Ukrainian commanders chafe at the idea that they should gamble their army in circumstances that nato generals have never faced. The 10th Corps’s assault is a break with that hesitation. And the upside of the aversion to casualties thus far is that many Ukrainian units are in better shape than planners had assumed. Brigades that assaulted Russian positions were expected to be left with only a third of their original strength. Thanks in part to well-armoured Western vehicles, they have taken a lighter knock. Even so, the commitment of 10th Corps is a fateful moment for General Zaluzhny, a cautious commander with the weight of Ukrainian and allied expectations on his shoulders. “This is the last big decision for Zaluzhny to make this summer,” says the Western official. “The die is cast.”

-

https://www.economist.com/united-states/2023/07/28/joe-biden-donates-weapons-to-taiwan-as-he-does-to-ukraine On July 28th it took that reasoning a leap forward by announcing it would for the first time start to arm Taiwan from America’s own military stocks, as it has done repeatedly for Ukraine. The main difference is that it has not invoked an “emergency” to justify the move. Instead, it believes the arms supplies will help forestall a war across the Taiwan Strait. The military move may instead provoke a new crisis. China will not accept American claims that it is nothing out of the ordinary, and represents “no change” in America’s Taiwan policy. After all, America is shifting from selling weapons to Taiwan to subsidising its armed forces.