thepupil

Member-

Posts

4,184 -

Joined

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by thepupil

-

recent anecdote from a family friend seeking $1.8mm home in south florida. A house was put on market at 1.8x 2016 price, no major upgrades (maybe $100K of kitchen/bathrooms) 8 offers within 2 days (friend was trying to buy at $1.9mm w/ few contingencies). seller pulled off market because got worried couldn't secure their upgrade home given the frenzied situation they were experiencing in looking for their new home. +50 bps on the mortgage rate isn't gonna stop that train. need people to become less liquid/rich or a big event.

-

Opinion on Lending out Shares to Schwab at 8.5%?

thepupil replied to wescobrk's topic in General Discussion

To be clear l, I’m not saying “sell the stock because a lot of people are shorting it” I agree shorts can provide rocket fuel (some personal examples: the office REITs we’re all 10-15% short when the vaccine came out and probably overshot fundamentals on covering, short covering (and Lully promotion)helped JOE overshoot IMO. all I’m saying is I’d pay more attention to bear case with something that’s heavily shorted than something that’s GC… -

Opinion on Lending out Shares to Schwab at 8.5%?

thepupil replied to wescobrk's topic in General Discussion

Agree to disagree with both of you. heavy short interest is typically a good indicator for LT underperformance (gross of borrow ). 2021 is obviously a huge exception. And boy were the exceptions glorious! I sthink if something is super high borrow you and it’s spiking, you should you at very least make effort to understand. shorts have been really burned after 2021 and people are gonna have a very high bar for shorting a crowded name -

Opinion on Lending out Shares to Schwab at 8.5%?

thepupil replied to wescobrk's topic in General Discussion

Real question is if Chuck is giving you 8.5% it’s probably lending out at at least double that, so I’d focus on getting comfy with the fact that someone out there is maybe paying 16% or more to bet against you. I think that’s more important than the tail risk of securities lending. it’s an invitation to recheck the thesis if demand for borrow is spiking -

Canada has a 10yr tsy that yields 1.81%. In theory, Canada could organize government/GSE wrapped MBS that would have similar characteristics to US FNMA FRE GNMA securities and could introduce its citizens to the wonders of the 30y fixed. In practice, the US has a multidecadal head start in exporting this security and demand for the canuck version would be unclear since CAD is not the global reserve currency. Agencies are 2nd most liquid FI mkt in the world and a globally important asset class. this is one of the bennies of being the global hegemon..and our blessed fixed income market makers at the large IB's. America!!!

-

Thanks! won’t ask anymore ?’s without modicum of reaearch

-

Good point, yea assume that. more succinctly, do stablecoins circumvent KYC and/or reduce transaction costs for remittances/cross border payments?

-

Dumb question re the more reputable stable coins. if I am a Bangladeshi working in Saudi, can I send a stable coin home to my parents if 1) I have a mobile and/or internet access with internet but parents don’t 2) we both have mobile 3) neither have mobile does one/both sides need a bank? if so, what is the t-cost?

-

Tell me you worked for Capital Group without telling me you worked for Capital Group

-

yep...probably get same gross return buying MAA CPT EQR AVB PLD PSA HLT MAR INVH AMT etc. but then underperform with BREIT on the fees....but you get that sweet sweet volatility suppression.

-

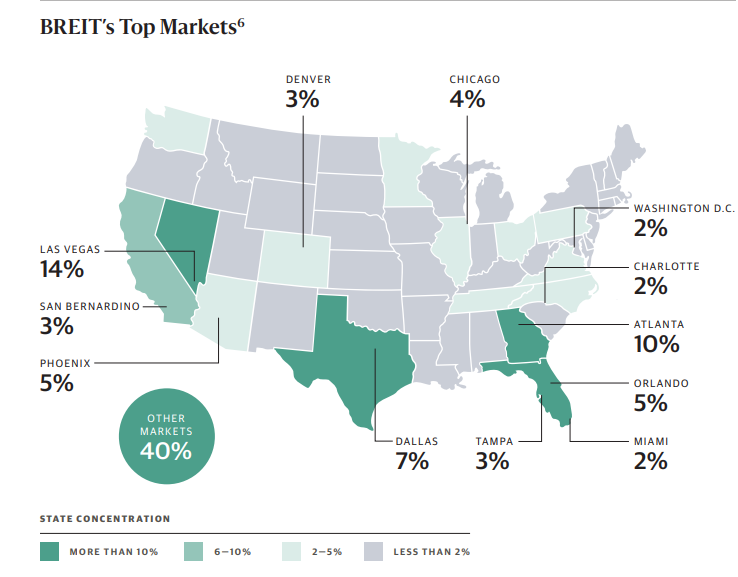

complex topic re housing policy, history, etc.... but I think $BX buying sunbelt apartments is more simple. $BX is simply raising a massive amount of long duration capital* and has loads of money to put to work. They have created a fundraising retail machine and are setting the price for desireable assts ever higher. Mass affluent have decided they'd rather invest in a $BX managed private REIT for their core RE than REITs because they don't like the volatility or whatever. https://www.breit.com/wp-content/uploads/sites/4/2020/10/BREIT_Fact_Card.pdf?v=1640618455 BREIT has $78 billion AUM and 2300 properties, including 137,000 units of multifamily. Atlanta is their #2 market. I don't know if this is correct and i can't find historical financials on BREIT's website, but I heard that BREIT is raising like $2-4 billion per month. Let's just say that's $1 billion. At 40% leverage that translates to $1.6 billion of apartment purchases per month going to a vehicle that has quasi-permanent capital (if they're only buying apartments) or $800 million if they're doing 1/2 apartments. Recall there are some months they may be raising more than $1 billion. At $300K/unit and $800 million, that's 2,600 units per month that $BX is buying. 31,000 per year. That's a Mid America (the largest multifamily REIT in the US at 100K units) every 3 years. Who knows how long it will last, but that giant sucking sound you hear is $BX hoovering up all the desirable real estate to put in its long duration low returning core private REIT sold to mass affluent / retail *what's odd is that it's not really permanent capital, technically 5% / quarter (20%/yr can redeem) so it's looong duration capital, but not permanent. it would be interesting to see what happens if the fundraising stops and you get net redmeptions > sustainable rate.

-

pretty much same here. -now 4-5% net cash/ SPACs in the investment portfolio -completely undrawn HELOC despite planning on using it to buy i bonds (just actually paid for them instead), -not cash out refi-zing despite HPA de levering me to 55% LTV, -cars paid for - sold my two most complex and levered businesses (Brookfield and Softbank) - have even considered stopping my buy $x k of index / month in the 401k - top of portfolio emphasizes the most excessively capitalized feels a little market time-y to me but I have lower conviction in the risk reward right of overall portfolio right now…trying to resist urge to go 10% or even 20% cash. I’ll never understand the “I think the market should trade for 10x earnings and am 100% cash” crowd, but I’m a little bit more of a pansy now than I have been In most Recent past

-

someone was arguing with him about a stock's fundamentals and Adam decided that the proper response was to doxx that person (via a link to the person's LinkedIn) and make fun of the college that person attended.

-

Smart people tell me I should care about crypto…and I just really struggle to do so. this along with my hatred of Tesla is mainly because I’m a “small dicked fit wit”.... I think it in part stems from the fact that every time i've invested in silver and gold, i end up buying to sell other stuff that i like more and it's not a worthwhile activity for me because i never end up owning enough for diversification bennies and don't have the discpline to HODL something in whcih i have no conviction.

-

I pay my nanny $60K / year ($23 / hr plus $400/month healthcare premiums) with 2 weeks paid vacation 5 sick days and paid snow days. This is the rate for well referenced/experienced nanny’s in suburban DC. would be closer to $50K if paying under the table though there are modest tax benefits for going above board. Great time for “low skilled” labor (though I wouldn’t describe a nanny as “low skilled” but you get my point

-

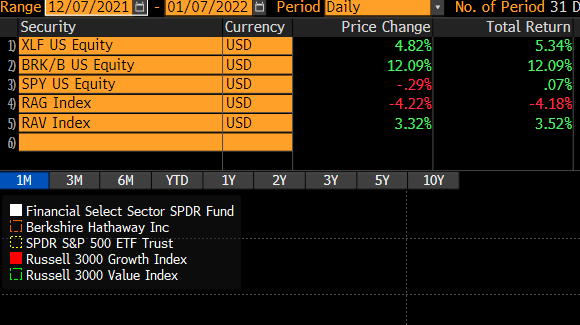

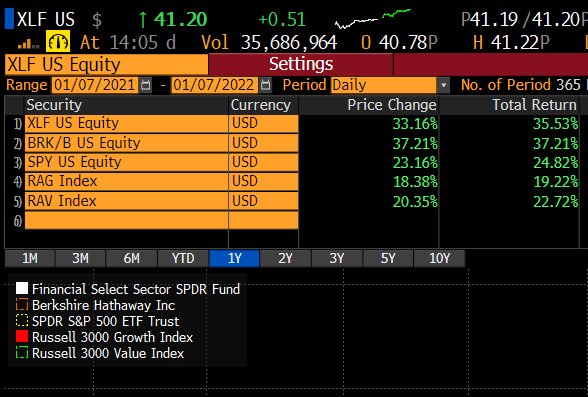

sorry, thought this was about Berkshire and not general value rotation. The answer is yes, there's a broad based value vs growth rotation occurring. I personally hate making money this way lol. It feels so unsustainable and arbitrary. I prefer takeouts and blow-out earnings/reports from my holdings, but I'll take it. Whatever.

-

For recent time periods: Berkshire>Financials>Value>Growth Over 5-10 yr time frame: Growth>Financials>Berkshire>Value

-

Amazing! Congrats

-

2021: I made about 55% on a consolidated basis. Have precise data for interactive brokers (+68%) and Fidelity looks like (+22%). NW increased by about 60% marking house to market, but I arbitrarily wrote down the residence to cost to stay hungry, so only went up 30%. Lots went right. Little went wrong. I started the thread to obnoxiously tout my own returns. Now others may do so and one-up me (particularly on a long term basis) My LT results are very market like with more vol and higher tax drag

-

iSavings bonds yielding 7.12% currently

thepupil replied to Spekulatius's topic in General Discussion

Just couldn’t resist, bought $10k for my kid today, bringing total December purchases to $30k, will do $30k more in late January. At the risk of making a macro prediction, it wouldn’t surprise me if CPI > short term rates for a long time and this remains a nice “arbitrage” for a while -

This was 2011-2013…definitely recall some 40 yr 221d4 (construction to perm), but maybe I’m misremembering??? It was long ago. but ya those are the folks, walker dunlop, greystone, Wells Fargo, PNC, Red Capital, Berkadia, Arbor Capital, I’m sure many others and I’m sure some of the lesser well known ones I listed don’t do it anymore. my impression was regular for profit owners of buildings could take these out and the info here says so (for profit and non profit borrowers, no income m/affordability requirements for units) and again my info is way stale on this, but we were doing 7+ $1B + securitizations/ year and we’re just one player so while it’s not huge, a fair number of people take these out. https://www.hud.gov/program_offices/housing/mfh/progdesc/purchrefi223f here’s some more stuff, note that it takes a really long time to get one, so you obviously couldn’t use in a bidding processes https://blog.stacksource.com/beginners-guide-to-hud-multi-family-loans-d07531e0e6f3

-

You’ll have to get a quote from a mtg banker. I suspect smaller loans would be 4ish% and big ones below 4%

-

Ginnie Mae we’ll do a 40 yr amortization construction loan that converts to permanent, tough to get, but I used to fund them (as well as 80-90%LTV 30-35 yr permanent loans on big buildings… like $50mm loans)…also do senior housing and nursing homes homes look up 223f and 223a7 221d4 loans ginnie Mae hud https://www.mandtrealtycapital.com/FHA/HUD_Multifamily/fha_multifamily.html

-

iSavings bonds yielding 7.12% currently

thepupil replied to Spekulatius's topic in General Discussion

I have $150K unused HELOC capacity. I'm using $40K of that to buy i-bonds this month/next month (i thought about doing $60K, but decided not to give $20K to my kid, for now, even if i could just never tell him about it and get it later). I don't really love the prospect of 0% real return (- federal tax), but am getting em now while borrowing rates are very low and they pay a risk free nominal 7%. I can always re-evaluate. my HELOC cost ~3% the biggest risk is there's some huge opportunity for that $40k w/i the next 12 months, but i have much more than that in spare IBKR margin and will still have a lot of HELOC unused. I don't want to tie up my equity in i-bonds but i'm happy to tie up my unmonetized home equity. But honestly, I thought about just buying some starter positions in midstream MLP's EPD/MMP instead...will probably make the divvy 8-9% w/o huge depreciation and would be better use, but I'm kind of reloading the gun (only 103% long and unused HELOC)...have even thought of...gasp...holding a little cash it's odd that I can borrow from a bank with a 2nd mortgage and lend to the US government and make a nice NIM