thepupil

Member-

Posts

4,361 -

Joined

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by thepupil

-

Fair enough. You are free to take that view. I think you have a real gift in turning someone’s opposing view into a very weird kind of straw man. I often find myself not really wanting to argue with your views so much as your portrayal of my own. But it’s Saturday night…enjoy that sweet sweet additional 50 bps of pre tax carry.

-

being the basic bitch that I am, I will continue to be bewildered at liking corporate credit at these spread levels. And will continue to expect spreads to widen into any meaningful risk event in markets.

-

33% unlevered? For your dream home? money is the slave, not the master. I’m on team “buy it” given the information provided. Only you can decide / have enough information to make this decision.

-

I sold 100% of my ELME, realizing a 36% return since 10/2023, slight underperformance to SPY (+42%). I sold 25% of my FRPH , realizing positive return but significant underperformance to relevant benchmarks (my position doesn't have a single buy/sell date so not really clear of exact return) I also sold some ZROZ which were up 10% in a few weeks while market was down 2%. I put all the proceeds of this into ST tips (IRA) and t-bills (taxable), degrossing to a degree that is almost uncomfortable for me (close to 15% cash). I am taking the DOGE threat to the DC area (and broader) economy seriously. My home equity which is a significant component of my net worth is exposed to this as well. I had about 10% of my portfolio in stocks with this exposure and now have 4% (FRPH), not counting AIV's exposure. I don't expect ELME to get more than $19-$20 in a sale so upside of 15% or so + divvies from here just didn't seem quite enough reward to own mediocre apartments where 10-20% of tenants are feds or contractors.

-

normally I explain ST BRK/B moves w/ XLF, but this runup after earnings is above and beyond XLFs performance. your explanations seem plausible.

-

for example, you can sell the ATM TLT put for for what looks like a slight credit. this would leave you with no capital outlay, a little long of duration short the spreads. you have to do it in huge size to matter and are playhing for a pretty specific thing though

-

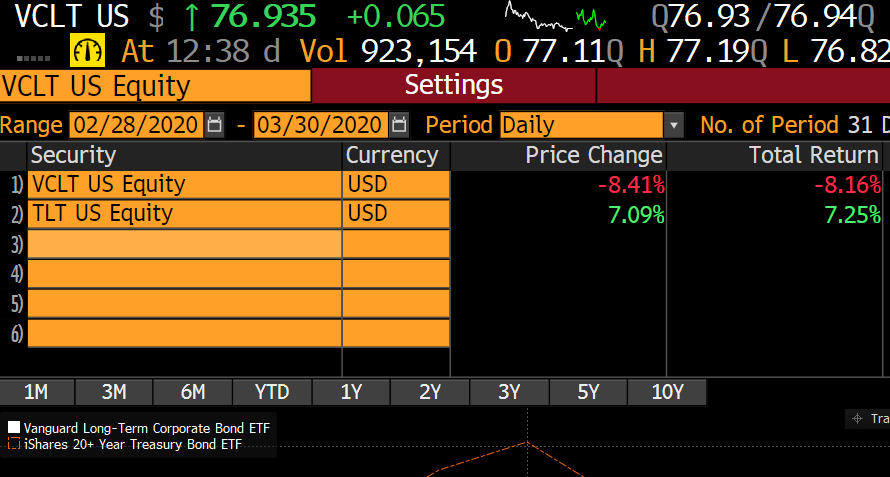

i completely agree. But without a clear catalyst it's a tough bet to make. Ackman's bet worked so well because he got short so much notional and monetized in a month. if he had to keep it for a year, he'd have been out hundreds of millions in premium rather than 10's. for a while there were ETF's to short CDX (WYDE) but it never gained traction...you could build your own by going long a tsy/tsy ETF and short IG ETF of course. VCLT /LQD puts funded with TLT / BND put sales or something

-

@Gregmal feast your eyes!

-

I’ve avoided commenting but I’ll just say that I think what’s happening and the pace at which it is happening appears counterproductive and chaotic and without regards to any kind of logic. i harbored no antipathy to the civil service and most government workers I know (in my DC burb bubble) are highly educated hard working people who work for the feds because they want to a) serve the country b) not work nights/weekends so they can raise families and c) because they often have family money and can afford to make the low salaries of federal workers. Obviously that’s a type specific to my neighborhood. my other exposure to this is my wife is in the medical field and trained at federal government hospital where they are perpetually understaffed in her field. She works in private practice. 2 of her former colleagues are looking to join her which will gut the VA hospital’s ability to perform care…why work for the feds under this admin? that’s just anecdata. For actual data regarding the cost of the civil service,where the growth and bloat is I would point to this paper from Brookings The federal government employees has been flat for decades while the economy and population grew significantly. Most of the growth in spending is with contractors, 60% of which are defense related. gutting the national park service or (pick your agency) to save dollars seems wholly ineffective. Back to anecdata and biased opinions. as a trump hating conservatively inclined person, I think this will swing the country HARD to the left. https://www.brookings.edu/articles/is-government-too-big-reflections-on-the-size-and-composition-of-todays-federal-government/

-

agreed, duration will likely be the main driver of your position. I’d be inclined to short corporate spreads here / rather than be long them. i can use the same line of argument of “anything can happen” to argue that Meta should trade 1000 over, but that would go against empirical observation and the historical default rate of IG paper which is like <0.1%. The spread on MSFT/META/AAPL bondcan be thought of as a minuscule default credit spread and a less minuscule but still small liquidity spread. I see no reason for either of those to go away. One reason for a liquidity spread is there are simply so many corporate cusips whereas treasure notes and bonds only have a few per year. Buyers sellers are spread across tons of issuers and then tons of bonds of that issuer. another reason for greater liquidity in treasuries is capital treatment by regulated entities. now of course one can conceive how for a day or two some heretofore unbroken relationship can break down, but I still don’t understand any of your logic here beyond “it can happen”. I mean technically I can win the lottery tomorrow. But does that matter. rates will go down because of (insert macro reason for rates going down) but at the same time spreads will “collapse”. Because people are losing faith in the US government credit quality (those same folks bidding up long term obligations of the government) so in the margin they’ll bid up corporates even more furiously? I am just befuddled by the reasoning here. I’ll give you credit for the independent thinking but am reminded of Benny G “You are neither right nor wrong because the crowd disagrees with you. You are right because your data and reasoning are right” Contrarianism for its own sake feels just as if not more fraught than blind following of the consensus. in the end, though, duration will drive the trade and none of this will matter

-

Ha, was working late last night. Early flight this AM…I do love how there’s time zone/schedule diversity on COBF so it’s never “off”. Like Bitcoin trading.

-

Agreed. Spread tightening into a risk event is nonsensical, particularly at the long end. Goes against empirical precedent / lived experience and logic / first principles. Makes no sense to me, but “that’s what makes a market”

-

Of course perpetual real assets can trade at lower going in yields than nominal obligations, but negative corporate spreads is a whole nother ball game the corporates don’t have a printer.

-

In such a scenario where “full faith and credit” becomes questioned (outside of the usual debt. Ceiling hullabaloo) I don’t want to own any USD denominated nominal obligations. If you think the US gov’s willingness to pay creditors is decreasing, I’d say other currencies / gold / BTC / guns / canned food the better trade. Duration is for just your normal recession/slowdown. it seems like a real stretch to think we see corps trade through tsy’s…think we’re just on a different page here

-

Collapses from 50 bps? Corp spreads are historically tight. Is the belief that corporates will be regarded as more reliable payers than the treasury because of the work of our esteemed leader? maybe I’m missing something

-

I don't disagree with the idea, but do disagree with the implementation. Investing in a corporate bond for this trade has a few issues. I will use the MSFT 3.04% of 2062 as an example, currently at $65.8 / 5.1% YTM / 50 bps more than the 2054 30 yr treasury 1) if you pay state income tax, then most of your spread will go to that. You'll pay 5-10%+ of the current yield (4.6%), 20-46 bps in state taxes about 40-90% of your miniscule credit spread. Treasuries are not taxable by states/localities. 2). If SHTF, spreads will blow out and (partially) offset your rate pnl. In 2020, 30 year AA bonds went from 88 over to 250 over at the wides. In 2022, spreads went from 90 to 150. On our Microsoft bond, a 100 bp widening is gonna drop that pup from $65 to $55, knocking a full 15% off. To bear this risk in exchange for 50 bps more per year (which you'll pay to the state tax man if you don't live in FL, which you do, but not everyone does), is piggish. forego those 50 bps. 3) Margin treatment: treasuries and treasury futures are better. 4) Liquidity: treasuries and treasury futures are better 5) Duration: Fuck the yield. The yield decreases your duration. This bond only has duration of 16. That's pussy shit. Buy options on zero's or tsy futures options. you want more punch than you're gonna get from a coupon bond. I owns an unhealthy amount of zero coupon bonds in my IRAs. It’s a shame that zero’s tax treatment sucks but that’s why god gave us 1256 contracts and futures/options right?

-

In 2019 (when I was 31), I bought a 20 year term policy for $2mm for $900 / year. I doubt this is replicable today, but LT rates are higher so it may not be too much more expensive. That would pay off my mortgage ($700K) and give an immediate $1.3mm of walking around money and along with current other assets provide a decent lifestyle. As for management of assets, we have a few family friends that are traditional financial advisors who put you in index like things and charge 50-90 bps. they won't steal your money. they'll just put you i 70/30 diversified stuff and take their parasitic fee. I'd be fine with that. It's a low probability event. if in that low probability event, my family has to pay fees to my wife's best friend's husband at northwestern mutual to put her in index funds but doesn't have to worry, I'm fine with that. no need to get too complicated with it in my view.

-

I think this depends on the intrinsic value range of the company. Like in the last 10 years or so, I made a lot of money trading EQC on 2%-10% moves. At various times, these were huge swings in the implied value of remaining assets or just a big swing in the multiple of cash + RE. the apartment REITs are a less extreme version. There can be pretty big differences in implied unit values / cap rates and risk reward on a 20-40% move. Like let's say you buy a 5% position in a MF REIT that realistically has like 20% downside and 40% upside (basically MF REITs in late 2022) and it goes up 40%over 12 months. Let's say your view of value went up by 10%, so you now have 10% upside and 38% downside and a bigger position (7% if the portfolio was flat). You started out risking 100 bps in downside scenario to make 200 bps. now you are risking 266 bps to make 70*. Surely the risk / reward has deteriorated. Now maybe you say "i don't want to pay taxes and I'll just dilute the position down by adding to other stuff; I'm fine just earning the LT hold IRR of these assets", but at some point, one may need to take more aggressive action to improve r/r of portfolio, right? I think this is pretty straightforward when dealing with assets with a potentially more narrow range of outcomes and when one can replace the appreciated asset with relatively fungible (but better priced) risk; RE companies lend themselves to such trades, which is probably why I've made a far higher return than the LT returns of many of my holdings. Obviously this is much more complex if you're talking about less fungible companies and things with potentially wider range of outcomes. of course, levered stuff it's the opposite. a 50-100% move in stock price can be almost meaningless in terms of risk / reward. *of course there is also a "constant multiple" LT return just from holding the asset, but I mean the short to intermediate return from re-rating / multiple change

-

I think you're thinking of Bob, right? https://awealthofcommonsense.com/2014/02/worlds-worst-market-timer/ I've never checked the numbers/always taken it at face value. I think Bob is a great lesson for those who don't need money for 30, 40,50 years and a terrible one for those who need (or may need) it in 1,3,5,10.

-

I think the answer to this is "probably". Valuations very much probably have an impact on long term returns based on history. But the long term is truly a long time. 10-20+ years. and until very recently equities offered very substantial premiums to risk free alternatives. In a tax free account, I think TIPs are starting to get a little more competitive but still not there. the long term case for stocks remains, but feels less strong given valuations. I don't know what anyone should really do with that though. young people should buy risk assets, mostly, and old people should acknowledge SORR / mark to market / volatility and maybe not be 100% US equities unless they ahve a like 2-3% WR....beyond those truisms, doesn't feel like anyone should do anything differently w/ high valuations versus low versus medium. I for one thought do find it harder to index w/ US index at these levels...but I own enough US stocks/risk assets to be fine with or without the 401k portion of my NW (where I must pick some kind of index) in US stocks. it's in EM / bonds right now. my wife's is in a target fund which owns the whole world / mostly equities. small sample size. this only uses 1985 - 2024 but would suggest a strong relationship. this uses 1926 - 2017 and finds that valuations potentially do matter and have a degree of predictive power, but there is wide variance and predictions should not be single-point, but rather directional. https://www.kitces.com/blog/us-equity-valuations-investment-cape-10-diversification-stocks-sp-500/

-

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

Doing some basic napkin math $700mm debt 88mm shares $140mm MF NOI gonna cap slap 6.5% =0.065 $16.50/share as a bear case, going to say 5.25% / $22 as a very bulled up case. watergate is $12mm NOI /300k sf. gonna say $60mm ($200 / 20% ) as bear case, $120mm ($400 / 10%) as bull case 0.7-1.4 from watergate so napkin math = $17.25-$23.40. I’d probably say $19/$20 is realistic. At about $17 in the aftermarket, 0-37% upside with a 4.2% divvy. probably not a terrible amount of risk, but also not too too much reward either. this basically says 5.8% for larger 1980s built DC metro apartments as of 7/2024. https://berkadia.com/wp-content/uploads/2024/07/Berkadia-Mid-Year-2024-Multifamily-Report-Washington-D.C.pdf bump it to 6% for trump/doge/rates, gets you $18.50 + $1.00 for Watergate = $19.50 = $19 just to use a round number, would be a rough base case. maybe people get a little more timid because DOGE/fear of trump, but maybe not. Nov 2024: JP Morgan Note (Stock at $16.70): "We calculate ELME to trade at an implied cap rate of 6.5% whcih seems about 75 bps wide of where we anecdotally hear about transactions for similar assets" <-- perhaps they are just repeating the same stuff, but that's another high 5's guesstimate. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

thepupil replied to thepupil's topic in General Discussion

$ELME pretty much saying it's for sale. I feel good about my basis of $13.25 but don't think the results going to be too exciting. but that was kind of the deal, when bought in 2023. approaching 7.5 cap, 5% divvy, hard to lose money, maybe a better target since streamlined, but nothing too exciting. here's to a good 2025 for this most mediocre of REITs! -

we taking 100% positions now?

-

I'm doing roth conversions at close to max bracket. it doesn't make sense from a net worth/current cash flow maximization standpoint but starting in 2028 my housing costs will be sustainably covered. I probably won't actually take money out then, but building the ladder now.

-

I have a good amount relative to my age..though am not as young as I once was and honestly it's hard to tell what numbers mean anymore because everyone else is getting more nominally rich too. One of my problems is only 20% of my total pre-tax liability, pre transaction costs net worth is accessible/liquid/spendable. So I feel a lot poorer than my personal capital calculator would suggest. home equity, IRA/HSA/401k/etc, a private RE investment, a small trust comprise the other 80%, all of which are illiquid/restricted/come with tax penalties. I've become more focused on increasing the accessibility/liquidity of these than maximizing the actual number...which isn't where I want it to be either.