LearningMachine

Member-

Posts

1,747 -

Joined

-

Last visited

-

Days Won

6

Content Type

Profiles

Forums

Events

Everything posted by LearningMachine

-

Thanks @SharperDingaan, regarding pipelines, beyond Trans Mountain Expansion, did you mean the Coastal Gaslink for LNG or another one for crude oil? My understanding was that the Mainline expansion was completed in 2021, Keystone expansion is still halted, and the Express pipeline expansion that was completed in 2021 was very small. Thanks @Viking, regarding paying down debt, one good thing for shareholders is that it does lower the risk in the low likelihood case there is a long lag again in the future with OPEC+ getting its act together.

-

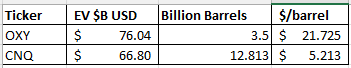

Thanks@SharperDingaan and @LC. The difference is so huge though. For $100, I could either buy 5 barrels with OXY or 20 barrels with CNQ. From my rough math some time back, OXY claims to be breakeven at average weighted cost of $40/barrel USD, and CNQ claims lower average CDN cost per barrel even for oil sands and that cost keeps on going down year over year. They are able to get more for synthetic crude compared to OXY for its barrels. Say, in the future, at some point, both sell at $100 per barrel. With OXY’s 5 barrels, you get back 5*($100 - $40)=$300. With CNQ’s 20 barrels, you get back at least 20* ($100 - $40) = $1200 Huge difference. The factors above can’t really explain such a huge difference, right? Given CNQ’s track record at reducing cost per barrel and not having to look anywhere else for more oil, the difference could end being even bigger. Do you yourself think CNQ barrel should be quarter of the price of OXY barrel?

-

Has anyone looked deeper into why Mr. Market is effectively pricing reserves of oil majors so differently from company to company at $/barrel, even after taking into account operating costs/barrel? For example, OXY is trading at $21.72/barrel and CNQ is trading at $5.21/barrel. If you look at the weighted average operating cost/breakeven price of what they report, including provincial royalties, etc., they are not that different, and arguably CNQ now has lower operating cost per barrel than OXY. @SharperDingaan and @Viking, or anyone else, any thoughts you can provide? Why is the difference so huge? Could it be that Mr. Buffett and Mr. Market are pricing sub-optimally using FCF yield instead of $/barrel that an owner would be using to price an oil well or oil sands, along with operating costs, to purchase? I understand Oxy also has other businesses that you could subtract out to get lower value per barrel but that still doesn't account for the huge difference. some of the reserves are probably understated for both as technology improves and price goes up with inflation.

-

What's the risk of lawsuits against GP by LPs who got sucked into buying assets where GP chose to take on short-term loans/mortgages at lower interest rate to show positive cashflow/income to LPs, and now can't refinance at higher rates, leading to loss of capital for LPs? I'd say non-zero. Any chance the first few public lawsuits can trigger a wave of lawsuits?

-

For those investing in BRK directly, that would be fine, if he gets rid of high-risk deep water, etc. However, for those investing in OXY directly, he would be stealing the Permian from underneath them. Given how much more he has in CVX compared to OXY, if he wanted to buy it outright, he could have done that already. Looks like he doesn't want to do it, but might get pushed into doing it, if he keeps on buying OXY, or if oil price falls and OPEC+'s actions have a lag to take effect, giving him a chance to scoop in. I think if he steals the Permian, he is probably looking at a shareholder lawsuit from OXY shareholders.

-

Setting aside the current market cap and the name of the company, what would be the answer to the following math problem? Say, there is a business that earned $3.6B FCF last quarter. Annualized, it would have been $14.4B, but because the price of its product has dropped since last quarter, let's say annualized, it earns $12B FCF. Now, the business is paying back its debt using the FCF, and after it is done doing that it, it will start giving all of that excess cash flow to you. The price of the product that the business sells is protected against oversupply and inflation by a cartel that has been outside U.S. law's reach, and both political parties have honored not getting into overreaching U.S. law's limits as it could cause adverse effects. Sometimes, the cartel's actions take a little while to show its effects. So, that can cause Mr. Market to think that the price is volatile and hard to predict long-term. The business also provides protection against some other risks: If China ends up invading Taiwan, and Chinese and U.S. economies decouple, and American consumers have to pay for American produced goods, inflation will shoot through the roof. In the event of another covid-like adversity, politicians listen to the pain of the people, and print money in hordes. What would you pay for such a business?

-

Merry Christmas and Happy New Year 2023 everyone! So grateful that we have this board to contribute to each others' learning!

-

Not disputing Google doesn't know about it. Also, agree just continuous incremental progress in general AI, sometimes in bigger spurts. Still highlights an existing disruption risk for Google from two angles I shared earlier.

-

It is meant to be only a demo so far. It is not connected to the internet currently. Its power really comes from understanding the meaning of the content similar to how our neural net (brain) does. It can then spit out that understanding in different languages, etc. So, what you see is only a tip of the iceberg. Imagine now if it was connected to the internet, i.e. getting updated by webcrawler regularly like Google's search index is. Overall, one framework to think about it is the effective human age of General AI keeps on going up, sometimes in leaps. It has now reached a stage where you can feed it whatever text you want it to learn. For example, you feed it medical text books, and it can then go ace the MCAT ( I think this milestone was already hit a few years ago). You could feed it LSAT prep books, and it can then go ace the LSAT. Then, you could feed it 10Ks, and so on. Then, you can start feeding it things that humans do today, e.g. think about all the video conferencing content from videoconferencing calls people do for work post-covid, and then it can go learn what those humans' job functions are.

-

Very long term holding periods

LearningMachine replied to Cod Liver Oil's topic in General Discussion

Thanks @thepupil for coming back with real data and accurately summarizing the bad assumption I made by looking at macrotrends only. From my perspective, in this case, I was willing to rule out looking at it deeper, because the PP&E numbers were so so terrible that I realized that even if they were quiet a bit off of what was in macrotrends, it would still be terrible for me to look any deeper. Hold behold, even half the PP&E of what is in macrotrends is still terrible compared to their highest annual FCF-to-date. Yes, we have had the discussion multiple times even prior to any inflation showing up on me considering what would happen to each investment candidate if interest rates/inflation shot up and stayed there. It was a very unorthodox view when I raised it before inflation showing up. Hoping it is not that unorthodox anymore. Don't want to rehash it, but for completeness, this doesn't mean I am saying with certainty that inflation/interest rates will be running high forever, but I'd like to do ok if that were to happen for a long time. The reason I am not looking at UHAL deeper is I won't do ok if inflation were to run high for a long time. If that does happen, and cash starts getting eaten up, market will finally realize hey what is happening to the cash. If it doesn't happen, perhaps, market won't realize that this business is at the mercy of inflation shooting up anytime. -

Very long term holding periods

LearningMachine replied to Cod Liver Oil's topic in General Discussion

I acknowledged above getting numbers straight from macrotrends, and not opening up financial statements because PP&E numbers were so terrible. Given your snapshot above, Rental trucks, rental trailers and other rental equipment, furniture and equipment add up to $6.69 billion. If cost of replacing that doubles to $13.38B, where is the extra cash going to come from? You will answer that they can increase prices. However, if you do the math, by increasing prices per year at rate of inflation, you realize the extra cash from price increase minus extra opex, doesn't add up to you getting all the extra cash needed to replace, while maintaining your FCF to shareholders at rate of inflation. The reason this happens is because cost of replacing PP&E is going up at rate of inflation, while your operating profits could also be going up at rate of inflation. However, PP&E is a much bigger base number compared to operating profits, and so, cost of replacing PP&E ends up being a much bigger number than the increases in operating profits. -

Very long term holding periods

LearningMachine replied to Cod Liver Oil's topic in General Discussion

UHaul PP&E: $10,469 million Uhaul highest annual FCF to date: $631 million $10,469/631 = 16.59 That is extremely high. This means they need many many years of FCF to replace their fleet at inflated prices. In other words, won't be able to give that FCF to shareholders. I realize these numbers are from https://www.macrotrends.net/stocks/charts/UHAL/amerco/free-cash-flow, not from 10K, and so there might be some accuracy issues, but I don't need to look deeper to be more accurate when numbers are this bad. There is a lot of info out there to digest. So, I've to filter out what not to look at deeper quickly. -

Very long term holding periods

LearningMachine replied to Cod Liver Oil's topic in General Discussion

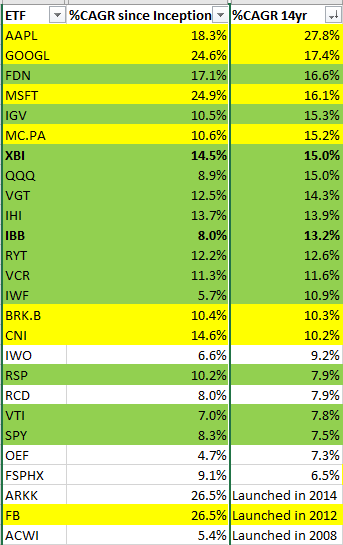

The next question is which ETF would do the best over decades? Why not consider VGT over QQQ so that you are not artificially deciding by which exchange they list in, and both VGT and QQQ are tracking each other. Next questions is why not consider FDN or PNQI, but meticulously walking through that list, you realize, there are so many crappy companies in there who are still taking cash from owners instead of giving cash to owners that you wouldn't buy yourself. We discussed some of this at -

Very long term holding periods

LearningMachine replied to Cod Liver Oil's topic in General Discussion

U-Haul is an example of a business that Munger and Buffett would say is one of the worst in inflation. Reminds me of following quote from Munger: Another one from Buffett: The reason is again their PP&E to FCF ratio would be too high, which means they would need to use cash to replace U-Haul trucks just to stay in business instead of being able to give that cash to shareholders. -

Very long term holding periods

LearningMachine replied to Cod Liver Oil's topic in General Discussion

@LC, having a business be around in 50 years is a great bar. Is that good enough though? If a business is there in 50 years, but had to consume all the FCF it was generating in replacing its PP&E to be able to have high NPS and survive, or refinance debt at a high interest rate, is that ok for you as an owner? At the end of the day, don't you want the business to also give you cash day-in-day-out and increasing amounts of it? -

Very long term holding periods

LearningMachine replied to Cod Liver Oil's topic in General Discussion

Thanks @Cod Liver Oil for sharing. I really like the principles that the article identifies from LSE on what creates a long-lasting marketplace with high return-on-equity, that doesn't require constant re-investment: Principle 1. Need for liquidity: "Customers come because it alone offers them the liquidity, they both require and create, and the resultant network effects buttress the moat." Principle 2. Self-sustaining moat that improves with age: "Importantly, the dynamics that support this, strengthen with time. Liquidity leads to engagement and hence more liquidity. The moat deepens with age and with use and becomes self-reinforcing. This is a core principle, that in our experience, the deepest moats, the most durable over long time spans, are those with self-sustaining qualities that improve with age. Those without form unstable equilibria, are fragile to permutation and ultimately succumb to entropy." What are some marketplaces around us that could satisfy both principles above, especially improving with age? Facebook/AOL/Friendster/MySpace: Not improving with age because a segment of customer base (new generation) that develops over time and that mostly needs to exchange with itself can easily start to develop on another marketplace, e.g. discord, snap, etc. Existing customer base can age off or might want to join the younger generation? Uber/Lyft/Didi: Not a super-strong moat because low barrier to entry to attract some drivers & some customers on another platform that can build over time. Also, exposed to disruption from autonomous cars. iOS/Android app stores: High barrier to get developers of existing apps to invest in getting their apps on another store. Could self-sustain until customers move to another computing platform. Regulatory risks. Airbnb: Liquidity: How important is liquidity to customer base and hosts? Self-sustaining moat: Can some hosts be easily convinced to also list on another platform and attract some customers there? Probably much easier to convince a host to list on another platform than to convince a company to invest in building an app for another mobile platform? How much could Chesky's customer experience focus keep hosts and users on platform instead of also listing on another platform, and for how long? Thoughts? Any other marketplaces that satisfy both principles above? -

Market implied growth rates

LearningMachine replied to learningfromgiants's topic in General Discussion

@learningfromgiants, yes, I do find that market is still pricing in abnormally high growth rates for long long times for many companies. I'm arriving at that differently though. Very simply, a lot of companies are still giving back less than 3% per year to shareholders in terms of dividends plus sustainable buybacks (upto FCF without putting enterprise at mercy of refinancing at high interest rate debt) minus stock-based-compensation. If you want 15% per year, the rest has to come from growth for long long time. How many companies really have the longevity and will indeed be able to grow their returns to shareholders at more than 12% per year for long long time at a high certainty? Not too many. In case of large caps, you will also end up running into sheer size issues. Curious how you are calculating implied growth rate? -

Buffett/Berkshire - general news

LearningMachine replied to fareastwarriors's topic in Berkshire Hathaway

Thank you @Ulti for sharing. Awesome principles: "Founder led businesses outperform because the founders are the fiduciary, and they have a longer time horizon." Focus on "sticky customers and how that affects valuation." "Figure out CAC and LTV...When you slice the data, there are really big pockets where the LTV is negative, and that is where the potential is to improve margins.” So consistent with Buffett's feedback to American Express CEO in the middle of the pandemic that their affluent customer base was their best asset! They must have also calculated LTV of Apple's customers was much higher as you could make more money from customers in the top x% of income distribution vs. those in the bottom x%. "Focus your attention on the unit economics." "The worst business grows and needs infinite capital with declining returns. The best business grows exponentially with no capital. " Is anyone else surprised to hear Todd say they are right on maybe 1/10 predictions? Maybe he meant something else and it didn't get transcribed correctly in the article? -

Fast Growers - What Are Your Top 5 Picks Today?

LearningMachine replied to Viking's topic in General Discussion

I've combed through FDN & PNQI, and found only a handful that are giving money to owners instead of taking money from owners each year (i.e. dilution), while still having growth prospects. However, they are too big to be 10-100 baggers. Now, starting to comb through VUG, which considers past & future EPS growth rate, return on assets, etc. However, it also has a lot of things that you wouldn't want to own otherwise. Even though these ETFs have a lot of stocks you won't want, one potential benefit in a taxable account could be if you buy something at a low enough price, it could double over next few years, and then grow at a decent rate, including the capital that you would have otherwise given to the government. Not feeling good about a lot of bad stocks in them though. That said, VIX is no where close to 60 yet, and FCF yield on a lot of stocks is still very low. So, looks like we might have to wait some more time, but good to do all the homework during this time. -

100 plus year chart inflation/earnings and stock worries

LearningMachine replied to dealraker's topic in General Discussion

Thanks @dealraker for sharing your experience here. Really appreciate it. In hindsight, and to go along with the rest of your theme, because of the taxes, would it have been better to buy things for forever that you would never have to sell, e.g. S&P 500 ETF, or companies with durable longevity of FCFs and opportunities to grow without much capital investment for decades? -

@Munger_Disciple, the question someone asked in the video was slightly different, i.e. if BRK held S&P 500. Buffett mentions in the video that BRK's dividend tax rate is between 10.5 and 13 percent, and capital gains tax rate is now 21% plus state taxes. What really surprises me in Buffet's and Munger's answers is that they didn't bring up anything regarding benefit of leverage through float by holding S&P 500 inside BRK. Any thoughts on that from you or anyone else? I thought Munger had said in the past that people directly buying same stocks as BRK won't get benefit of BRK's leverage through float. Wondering if they didn't bring up benefit of leverage through float now because benefit of leverage from float will get eaten up by taxes?

-

That is exactly the crux I am trying to get to here. If you listen to the video, I think Munger might have meant one of these two things: Interpretation 1: Even if we just match the S&P 500, we'd be way ahead of the S&P 500 after taxes. Interpretation 2: Even if we just match the S&P 500, we'd be way ahead of your current position after taxes. If you continue listening to Munger later in the video, and try to be consistent with what Buffett said earlier in the video, Munger seems to be saying #2, not #1. In other words, to be consistent with what Buffett says earlier in the video, if BRK holds S&P 500, BRK would be worse off then holding S&P 500 directly because of taxes, and because leverage through float apparently doesn't help enough to fill the hole created by taxes? Do folks agree?

-

In 2019, Buffett answered that BRK intrinsic value will underperform S&P 500 if BRK just held S&P 500. Looks like he missed accounting for leverage through float, or did he take that into account, and saying taxes will nullify any benefit from float and eat some more? Charlie answers, "even if we just match the S&P 500, we would be way ahead after taxes... we shouldn't be too disappointed". Buffett continues, "We could have structured differently ... present form ... corporate capital gains tax up to 39%, certainly 35%, and on top of that state income tax..." So, if BRK's investments are going to generate only as good as S&P 500, is it better to just hold S&P 500? The impact from taxes eats away at any poisitive impact from leverage through float? Then, why take the risk of holding a single entity that also has insurance risk, instead of holding S&P 500, post Buffett and Munger, unless successors show that they can earn way more then S&P500 to pay for taxes also? Thoughts?

-

Given OPEC+ controls 74% of oil exports, what do folks think are risks to OPEC+'s ability to control supply/demand dynamics and oil prices? Canada currently exports 7.3% of world oil exports. If Canadian production goes up by 300 basis points, could OPEC+ easily absorb cutting its supply if needed? Any risk of U.S. producing much more? If another country starts producing much more, could OPEC+ still absorb the cut? Any risk of an OPEC+ member wanting lower oil price than $90 like Saudis did earlier this decade? Any other risks?