LearningMachine

Member-

Posts

1,747 -

Joined

-

Last visited

-

Days Won

6

Content Type

Profiles

Forums

Events

Everything posted by LearningMachine

-

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

LearningMachine replied to thepupil's topic in General Discussion

Similar to royalty trusts, oil companies are still making money hand over fist, and buying back stock at low P/E and trading at high unleveraged FCF yield. Now, imagine, the price of your product was guaranteed by a cartel of governments to keep track of inflation (with some lag). Imagine what happens in the event of a calamity that causes our democratically elected politicians to print even more money. If you believe a bank is not going to get a bank-run with high degree of certainty, some of those banks are making more and more money as interest rates go up. In some specific cases, it can be almost like you owning multifamily buildings, where rental yields are going up, and you have financed the multifamily building with almost zero interest rate, and you have high degree of certainty that you won't have to refinance at rates much higher than zero for at least some portion of your financing for some of the apartments that are on longer term leases and that people giving you money are going to have to leave some of the money there. You ended up renting out some of apartments at longer term leases, while vast majority are at short-term lease. Mr. Market is running around saying those apartments you rented out at longer term low-rental-rate leases should be marked to market so that you lose 30-50% of the value of those apartments. Imagine now you could buy these rights at P/E of 8, i.e. 12.5% earnings yield today, and imagine the entity has been showing history of buying back its stock at low P/Es. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

LearningMachine replied to thepupil's topic in General Discussion

You don't have to wait around. You can be in those companies today, and actually earning FCF yield, money being returned to shareholders, not some hypothetical on the company being able to sell something at a high price in the future. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

LearningMachine replied to thepupil's topic in General Discussion

Let's start with P/E of 7, i.e. earnings yield of 14.3%. In what environment would the earnings yield be 14.3%? Maybe when risk-free interest rate is 7-10%? What types of companies will be making a lot of earnings at interest rates of 10%? Maybe when inflation is also baked in at 7-10%? What types of companies will be making a lot of earnings at inflation of 10%? Maybe when there is a big calamity and there is a lot of fear in the market? What would our democratically elected politicians be doing in that environment? What types of companies will be making a lot of money in that environment? -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

LearningMachine replied to thepupil's topic in General Discussion

What if you could feel joy when your stock's PE goes to 7x? You'd feel that #1. if you had cash ready to deploy into the stock, or #2. if the company you own is making even more money hand over fist in that environment, and either (a) the market has realized it and bid it up, and you can exit it to buy those other stocks at 7x, or (b) the market has not realized it but the company you own is making so much free cash hand over fist that it is buying back that stock at 7x hand-over-fist and adding even more value to you as a shareholder. So, I think you would want to be in one of the above categories. CPT so far doesn't meet 2(b) for me given their history of dilution, and also doesn't meet 2(a) for me because it won't be making money hand-over-fist in that environment. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

LearningMachine replied to thepupil's topic in General Discussion

Got it, thanks @thepupil. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

LearningMachine replied to thepupil's topic in General Discussion

Thanks @thepupil for doing the exercise with 10% interest rates :-). Just so that I understand fully, what did you mean by "1%/yr each headwind"? That weighted average interest rate goes up by 1% each year? Regarding net cash from operating activities, I see it was $744.7M in 2022. For 2023, assuming we believe their midpoint FFO per share, at 106,700,488 shares, FFO would be $747M for all shares in 2023. Taking $215M of interest from 747M would be $532M. At that point, if the market prices CPT at 7-10% leveraged yield (in line with unleveraged risk-free 7-10% treasuries at the time), CPT market cap would be $5.3B to $7.6B. That said, CPT would have an edge over treasuries to be able to increase rents. -

Phenomenal businesses that don't require any capital

LearningMachine replied to LearningMachine's topic in General Discussion

@Spekulatius, we are pretty close. We are both looking at this on a spectrum based on percentages. For percentages, I was suggesting PP&E-to-last-peak-FCF & PP&E-to-net-cash-provided-by-operating-activities. I was suggesting PP&E because it is the cumulative capex on the books that has not been depreciated away, and something that will have to be replaced at inflated prices. I was suggesting net-cash-provided-by-operating-activities because that is the line-item from which capex is spent beyond opex, and stops the cash from coming to the owner's pocket. I was suggesting last-peak-FCF to ignore any special things in a given year. Overall, if we we are going to look at annual capex expenditure itself instead of PP&E, I'd suggest capex-to-net-cash-provided-by-operating-activities, or capex-to-last-peak-FCF-before-capex i.e. what percentage of cash that would have come to the owners' pocket is going to capex. By the above measures, GOOGL and META should be better than other businesses. -

Phenomenal businesses that don't require any capital

LearningMachine replied to LearningMachine's topic in General Discussion

That is a little high, but still all funded as a percent of net cash provided by operating activities without having to raise any capital, and PP&E-to-last-peak-FCF & PP&E-to-net-cash-provided-by-operating-activities are still quiet low compared to other businesses. -

Phenomenal businesses that don't require any capital

LearningMachine replied to LearningMachine's topic in General Discussion

Land, defined as the right to exclude others from a boundary marked on earth, indeed doesn't require any capital. It could become a phenomenal business if the right to the marked boundary could be rented out to generate FCF year after year, e.g. farmland or the Permian basin, instead of eying to get some value for the marked boundary in the distant future that has to be discounted to current value. That phenomenal business could become a phenomenal investment if it could be bought at 10% unleveraged FCF, but this right is too well known & interest rates have been too low so far for this right to trade directly at that level. -

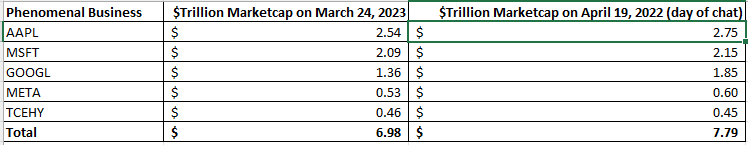

I think he meant businesses like AAPL, MSFT, GOOGL, META, and TCEHY, where R&D is already accounted for in operating expenses, don't have to make additional capital investments out of retained earnings, resulting in a lot of FCF. Not only do they not have to invest additional capital from earnings, R&D that is already part of operating expenses, ends up helping grow the FCF.

-

Phenomenal businesses that don't require any capital

LearningMachine replied to LearningMachine's topic in General Discussion

I didn't include Amazon because it requires a lot of capital, i.e. $186.7 Billion of property & Equipment on Balance sheet, many multiples of its last peak positive FCF. In 2022, AMZN spent $58B on purchases of property and equipment, and $7.9B on principal repayments of finance leases. -

Todd Combs: "So, we have $10 trillion in market cap amongst 5 phenomenal businesses that really don't require any capital whatsoever." Todd said the above in Fireside chat with Charlie at https://youtu.be/aciej48jbFk . Which 5 businesses do folks think Todd meant? AAPL, GOOGL, MSFT, META, and TCEHY? That added up to only $7.79 T on the day of the chat. Thoughts?

-

Interesting to see Charlie also alluding to the cartel as one of the core reasons for investing in oil companies in his Fireside chat with Todd Combs at https://www.youtube.com/watch?v=aciej48jbFk&t=1s: #1. "It's the nature of things that a bunch of democratically-elected politicians will eventually print too much money." #2. "Nobody thinks it's illegal for a bunch of sovereign nations to have a cartel in producing their own oil, and every reason it can't happen is that, 'Oh, they're a bunch of dumb this and dumb that.' But it could happen, and you could argue if solar would be a good business." #3. "The other thing that's similar is that there are only, what three or four players making the fertilizer. And that's an interesting thing to watch, and I don't know how it's going to play out." #4. "Obviously, nobody knows, but there are going to be some sort of cartel-like things done by governments, and nobody will do anything about those. Somebody will make money by predicting that stuff." #5. Todd: "The weak link is always the cartel breakdown." Charlie: "Yes, of course." What do folks think he meant by "But it could happen"? Does he mean it could happen that OPEC+ cartel becomes illegal? Is he questioning if solar would be a good business in that case, i.e. solar would become a bad business if oil cartel became illegal?

-

Thanks @ValueMaven for posting. Really liked the following quotes. #1 is an axiom that can eliminate a lot of unnecessary thought patterns that people sometimes end up pursuing. #1. "It's the nature of things that a bunch of democratically-elected politicians will eventually print too much money." #2. "Nobody thinks it's illegal for a bunch of sovereign nations to have a cartel in producing their own oil, and every reason it can't happen is that, 'Oh, they're a bunch of dumb this and dumb that.' But it could happen, and you could argue if solar would be a good business." #3. "The other thing that's similar is that there are only, what three or four players making the fertilizer. And that's an interesting thing to watch, and I don't know how it's going to play out." #4. "Obviously, nobody knows, but there are going to be some sort of cartel-like things done by governments, and nobody will do anything about those. Somebody will make money by predicting that stuff." #5. Todd: "The weak link is always the cartel breakdown." Charlie: "Yes, of course." #6. Todd: "So, we have $10 trillion in market cap amongst 5 phenomenal businesses that really don't require any capital whatsoever." #7. "What are the changes of a really major calamity? I don't know about you, but certainly it's at least 10%." I'm curious what he meant by "it could happen" in #2-4 above. Will start the discussion in one of the Energy threads.

-

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

LearningMachine replied to thepupil's topic in General Discussion

There is a big gulf between sub 1% probability and almost 100% certainty that would be needed for some to go play with options. For that big gulf in between, especially if someone thinks it is a possibility much higher than 1% even if not 100%, to protect yourself, it makes sense to do the exercise on how a REIT would perform in a 7-10% interest rate environment. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

LearningMachine replied to thepupil's topic in General Discussion

10% inflation takes more than 7 years to double rent. 10% interest rates start more than doubling interest cost at the the next refinancing. Once market starts learning the impact of not being able to get refinancing with some REITS at even 7%, market might start to price in that 10% interest rate cost much faster than 7 years. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

LearningMachine replied to thepupil's topic in General Discussion

So, if our limit is interest rates can go up 4% per year, you can easily see the possibility of getting to 7-10% over a few years. Getting to 7-10% in some years might be deadly given relatively low average maturity of loans at some of these REITS. So, I don't see the probability of 7% 10 year as EXTREMELY low. Not only do I see 7% as a significant enough possibility to do the exercise to make sure you don't lose a lot in that scenario, I also see 10% as a possibility enough to do the exercise to make sure you don't killed if that happens over years. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

LearningMachine replied to thepupil's topic in General Discussion

You just want to make sure you will be fine either way, i.e. (1) they have to refinance at high rates, or (2) they can refinance at low rates. To do the exercise to protect yourself, you don't need to know whether #1 will happen with 100% probability. -

High Quality Multi-family REITs - EQR, CPT, ESS, AVB

LearningMachine replied to thepupil's topic in General Discussion

Might want to check how much money they would make assuming they have to refinance at 7-10% instead of 3-5%, and if debt service coverage ratio is not acceptable, which assets they give back to the bank. -

@Xerxes, did you mean to say Gundlach thinks Fed/treasury giving banks par-value for their treasuries is inflationary not disinflationary?

-

FDIC currently charges assessments based on "total liabilities, not just insured deposits." See https://www.fdic.gov/resources/deposit-insurance/deposit-insurance-fund/dif-assessments.html . You're probably right they might make more adjustments to it. $128B balance that FDIC currently has might not be enough to plug more bank failures. See https://www.fdic.gov/analysis/quarterly-banking-profile/fdic-quarterly/index.html . Increased assessments are not going to come in right away. So, FDIC is going to need to get the money from treasury printing it using some mechanism somehow for now, and maybe some of it gets paid back through assessments in the future to assure the taxpayers that they are not funding it. Maybe Treasury/Fed could lend to FDIC at no interest to give FDIC & banks some benefit that doesn't trigger political issues for democrats.

-

Point is Buffett was more likely to be alive in those subsequent years after 2007 than as of today. From 2007 to 2009, BRK was almost cut in half price. You don't want to be in a situation where BRK faces a similar drop and Buffett is no more to help, when you could have been outside BRK to take 2009-like opportunities.

-

Thanks @KJP for pointing out the assumptions causing “leakage” in logic. Exactly what I was looking for. I agree the percentage of deposits moving to treasuries might not be as high as 25%. Some depositors might continue to just move deposits from small and mid-size banks to BAC and JPM. Also, agree we probably won’t have mass failure of banks, and government would act with bigger and bigger measures before that happens to at least guarantee depositors. I think one thing is likely for certain. The extra $5 trillion in deposits created during Covid is here to stay as guaranteed. Fed/treasury/FDIC is not going to choose using bank failures as a way to reduce some of this increase. To the contrary, they will likely be willing to print more money if needed to backstop any bank failures that FDIC is not able to cover.

-

You could have purchased BRK with the same logic on Dec 7, 2007. But then, he was 77, and now he is 92. This time, BRK is also sitting on 44.1% of the portfolio in a single stock that has not yet adjusted for treasuries yielding higher than (FCF-SBC or buyback) yield on that stock and has not yet adjusted for many risks over risk-free treasuries.