-

Posts

1,243 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by Ross812

-

I think this time around we may be in a case of "this time is different". The number of "free" brokerages has exploded and the leverage offered to short term traders with options and futures is insane. Many of these traders are agnostic on the direction of the market; they only want the volatility. The short term "static" has increased; the long term direction is still dictated by fundamentals.

-

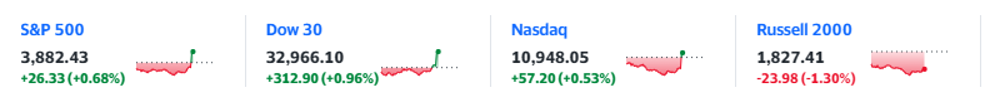

Yep. He messaged me to tell me to trade the lag between the S&P500 and the Russel. Three minutes later: I guess that is one way to make a buck... He said he has made the same trade every FOMC meeting in the direction the other more responsive indices are heading. He loads up on daily IWM calls/puts slightly OTM and sells 5 minutes later.

-

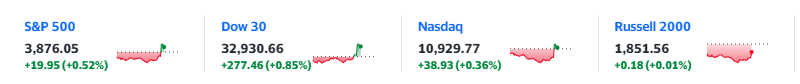

I have a friend who is a trader and uses options/futures contracts around news events like today's FOMC announcement to trade. I as kind of struck by how all the large cap indexes get pulled around by market makers buying/selling to adjust for all the leverage being used. Look at all the big indexes with lots of options liquidity being pulled around versus the Russel 2000. It is kind of ridiculous.

-

iSavings bonds yielding 7.12% currently

Ross812 replied to Spekulatius's topic in General Discussion

I got locked out of my account earlier this summer and spent 6 hours on hold one day. You are going to lean all the hold music and their fund facts! -

Sold ITM covered calls on TMUS, AIV and CASH for the 18th. Traded around some OSTK puts sold last week, closed the $25 puts for a 30c gain when the shares are down $1.50. I know there was a lot of volatility priced in with earnings but damn. Sold more puts down a $1 at $22.50. I am trying to occupy myself and keep some powder dry. I sold out of a 20% TBF position that grew to a 30% position after holding onto it for 12 months. I'm still down 5.5% for the year thanks to my conviction in Meta and Google.

-

Oban 14 and a fire here.

-

Sold puts on OSTK at $25 and $23 and EBAY at $38 expiring next week and two weeks. Added a little to google (to bring me back up to a 10% allocation). Switched from shares to ITM puts on CASH through earnings.

-

Fast Growers - What Are Your Top 5 Picks Today?

Ross812 replied to Viking's topic in General Discussion

I stumbled on Medifast - Med the other day. PE around 8 and likes to return cash to shareholders. I also went fishing in the beaten up boating companies and MarineMax - HZO looks interesting. -

And he isn't even middle class! The latest census numbers indicate what income ranges constitute the middle class (as of 2020). This will depend on family size. For a single individual, a middle-class income ranges from $30,000 - $90,000 per year. For a couple it starts at $42,430 up to $127,300; for a family of three, $60,000 - $180,000; and four $67,100 - $201,270.

-

I think short term rates and the increases we have seen so far in mortgages are trickling down more than you think. Homeowners cashed out $275B worth of home equity last year. That's about the same as the $1200/adult and $500/child covid stimulus checks. That's an indirect stimulus that has completely dried up. Look no further than lumber prices and new home starts to see the impacts of raising interest rates.

-

Your post just made my head hurt.

-

Yeah, I don't have a high opinion of Florida in general. I completely understand living there in the winter, but the summers are awful. The state is essentially rural Alabama/Mississippi 5 miles inland and much of the costal area is no better than living anywhere in the Caribbean as far as shitty areas with swaths of resort type communities. I like the ex-pat lifestyle and people much better. The Florida coast seems full of retires who are either too sick or too small minded to be ex-pats. 1.1M buys you a gorgeous lake front home anywhere in the south. For 8M, you could have a lakefront compound complete with your own security .

-

In this case, they immediately listed the house for rent for 67k per year. Taxes and a 5% note are 50k and insurance/HOA are going to be another 10k. Sounds a bit housing boom 2.0 to me. On a side note, who are these buyers competing for condos and homes in Panama City Florida? I saw a house on the beach listed for 8M up from 1.5M in 2019. The job prospects in the city are nothing like a tier 1 or even tier 2 city. Is this all Boomers competing against each other to move to the sunshine state?

-

Sold my entire ATCO position and put half of it into MKL.

-

Didn't Powell already cave to political pressure when he cut rates in response to Trump's tweets?

-

We have a vacation home at a lake 1.5 hours from our house and spend quite a bit of time there when it isn't rented on AirBnB. Repeats are Costa Rica and south France (wife speaks French). Must see we have been to are really anywhere in Europe - we travel for wine, Bonaire (scuba), and Goa/Jodhpur India. We have tickets booked for Portugal and France this fall/spring. We are also planning on returning to India - Uttar Pradesh and Punjab.

-

States have to balance their budget and can't print. So residents are choosing what to spend money on instead of the state I guess? Almost like when and insurance company gives back a residual.

-

I believe the ticker you are searching for is GMAL.

-

I bought a lot of ATCO yesterday and today as well. I've been in and out of this a few times. Rode it from $7 to $11, then $7 to close to $15. Sold out between $14.70 and $15.00 several months ago. I hope I'm not early here, but the company looks a lot better than it did in 2018 and 2020 and I don't think (hope) it won't go back to $7!

-

Look around bodies of water. 30x70 pole barn with 6 doors is around 35k with concrete and electricity and land is 20-30k and acre for something in a good area with good access. Lock up 65k. Taxes are 650 and electric is 1k and figure another 2k in wear and tear. You can generate $6k/yr from boat storage. Plant hardwoods on the left over 2/3rd of an acre and harvest in 30 years. That is a minimum of 3.6% on a 65k asset which should keep pace with inflation and has a kicker of about 60k worth of hardwood in 2022 dollars when it is done growing.

-

I haven't noticed my home or auto insurance go up. It's interesting because you would think the areas we have seen the most inflation is housing and vehicles. TRV was one of my inflation plays thinking they would raise premiums in excess of inflation (with home and auro prices). My idea doesn't seem to be working out.

-

I've been really surprised by the amount of renovation I've seen at crazy prices. I've been holding off on a deck project since the new year due to wood prices but my neighbors are building decks with $9 2x4s left and right. Ultimately, I think the higher rates are going to further reduce inventory. Cash will be king. Rents will keep rising reflecting the higher mortgage rates, but real-estate prices will hold steady due low inventory. What is insurance doing given the high replacement costs of housing and autos?

-

-

We had friends over and cooked a fancy dinner tonight. Bought and opened my wife's favorite bottle of champagne which is up $10/btl, opened a chateau nuf, and Russian river valley pinot from the cellar. Doing my part to stimulate the economy through frivolous conspicuous consumption.

-

At a 6.3% rate, servicing a mortgage is up 52% from lows of 2.7%. From the last "affordability crisis" Q3 2018 (393k avg. house and 4.9% rates) prices are up to 508k at a 6.3% rate. That is $1670/month (20% down) to $2520/month which is a 50% increase as well.