glider3834

Member-

Posts

1,027 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Events

Everything posted by glider3834

-

@SafetyinNumbers I don't have a number in mind as such but just to frame my thought process on - I guess there are two aspects to Ki's profitability 1. returns from Ki's Syndicate 1618 & 2. also from start of 2024, remuneration arrangements with 3P capacity providers/carriers - is it fee/commission based or profitability based or some combination of both? They have to deliver an attractive return profile to these 3P capacity providers, so my impression is they are not in a hurry to add more carriers to their platform because they are focused on profitability in underwriting, cost efficiency & optimising their algo. Whats interesting is if you look at the other smart follow only syndicates they appear to be mostly smart trackers, rather than fully algorithmic risk underwriters, like Ki, & Ki at this stage is also the only digital follow syndicate in Lloyds that is offering capacity from multiple carriers. While Ki operate in a competitive space they have a head start. 'Smart follow underwriting includes algorithmic and augmented underwriting for follow business, but also ‘tracker’ underwriters such as Beazley’s Smart Tracker syndicate or Nephila Syndicate 2358. Smart trackers follow specific leads in particular%20lines of business systematically on a portfolio basis, rather than using a machine learning algorithm to judge individual risks like Ki.' https://www.slipcase.com/view/insurer-in-full-how-smart-follow-and-algorithmic-underwriting-are-changing-the-london-market/3 When you think about it, the more premium that is written on the Ki marketplace, the more overhead cost per $ of premium should fall - so I would think that bringing in more 3P capacity allows them to lower the expense ratio on all business written. 3P capacity allows them to scale the platform, provide more choice/options to brokers using their platform, without having to use their own capital via Ki's own syndicate as well. Also as they scale the platform & the algo ingests more data you would assume or hope the risk selection of the algo improves over time. So I have different questions - what will the fee/commission stream part of Ki digital services with 3P capacity providers look like? what sort of EBITDA margins can they generate? how low can they get their expense ratio/combined - particularly as they start to monetise their R&D/investment spend over next few years? how much 3P capacity premium can they place over their platform?

-

https://www.insuranceinsider.com/article/2eg0na21680fl76l67xmw/behind-the-headlines-mark-allan-on-making-ki-like-a-marketplace-in-its-independent-era the last 6 min were interesting on two points 1. reasons why third party capacity carriers are joining Ki digital follow platform 2. R&D exp component to Ki's combined ratio that is more capex in nature - which potentially means they could have more of a cost advantage over other Lloyds underwriters than it appears now, as they are currently in an investment phase

-

cheers viking we can update John Keells to 24.3% now they have exercised the convertible https://keells.com/resource/reports/investor-presentations/investor-presentation-Q3-2025.pdf

-

from Q4'24 release 'Adjusted operating income (which excludes the benefit of discounting, net of a risk adjustment on claims) of the property and casualty insurance and reinsurance operations increased by 20.9% to a record $4,761.1 million from $3,938.5 million, reflecting the best year in the company's history for both underwriting profit and interest and dividends, and continued strong results from share of profit of associates.'

-

https://www.eurazeo.com/en/newsroom/press-releases/eurazeo-enters-exclusive-discussions-consortium-led-la-financiere-de 'The transaction remains subject to the approval of the relevant authorities and to various requirements, such as documentary conditions, and is expected to be finalised in spring 2025.' https://www.bnnbloomberg.ca/business/company-news/2024/12/11/hermes-family-in-talks-to-invest-in-french-insurer-albingia/

-

yes I think thats likely reason as well subject to official confirmation from FIH - see clause below https://www.fairfaxindia.ca/wp-content/uploads/Corporate-By-laws.pdf - at Dec'23 they had invested $903M cash (or 23.6% of FV of total assets $3822M) for 64% of BIAL - this next $255M should take them over 25% threshold

-

They are also trying to create more separation bw Ki and Brit which is interesting - Ki have hired new CFO, new HR Director, new Gen Counsel https://www.insuranceinsider.com/article/2dp3nldeatj2g1rym7ncw/london-market/ki-moves-to-carve-out-greater-separation-from-brit https://ki-insurance.com/news/https://ki-insurance.com/news/

-

Ki https://ki-insurance.com/news/future-of-ai-in-underwriting Seaspan https://www.seatrade-maritime.com/ship-management/seaspan-and-one-ship-management-jv-a-natural-progression Grivalia https://news.gtp.gr/2024/06/26/op-ed-the-incentive-for-investments-in-greece-has-never-been-stronger-george-chryssikos-grivalia-hospitality/

-

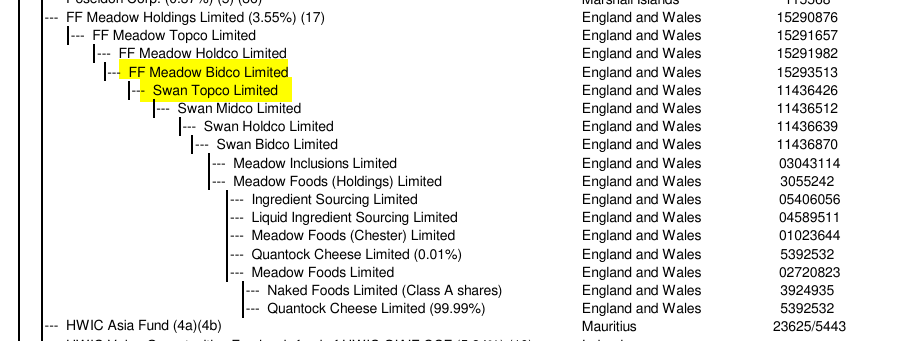

as I understand Meadow is a consolidated sub - Fairfax (via FF Meadow Bidco) bought controlling interest in Swan Topco from Exponent and Swan Topco is the controlling shareholder of underlying Meadow Foods business

-

viking assuming no changes since Dec-23, I suspect Fairfax may be carrying their AGT equity interest at nil - see Odyssey AR 2023 below

-

-

I believe Preferred divs are not deductible while interest on notes should be, so after tax cost likely cheaper with notes.

-

I think this is Seaspan ULC rather than Seaspan Corp

-

https://www.artemis.bm/news/hurricane-milton-losses-likely-below-a-5-cat-bond-market-impact-icosa-investments/ https://www.artemis.bm/news/hurricane-milton-cat-3-landfall-in-sarasota-worst-case-tampa-loss-scenarios-avoided/

-

viking yes I would expect so - a gain on consolidation - similar to Gulf Insurance transaction in the sense we are moving from equity associate to controlled sub, but we will need to wait for official confirmation from Fairfax to determine the amount of any potential consolidation gain here with Peak deal.

-

looks like Moodys insured loss estimate still to come 'In terms of insured losses, Moody’s says it remains too early to put a precise cost on the storm, but the Moody’s RMS Event Response team will be releasing an estimate in the coming weeks.' It looks like Gallagher re have upped their estimate for insured loss range to mid to high single digit billions https://www.artemis.bm/news/hurricane-helene-private-insurance-loss-seen-mid-to-high-single-digit-billions-bowen-gallagher-re/ & made these comments 'The overall economic loss is going to be well beyond $10 billion. Very limited flood insurance take-up in far inland areas is going to mean a large portion of damage will be uninsured. NFIP coverage limits (Residential: $250k structure / $100k contents + Commercial: $500k structure / $500k contents) will in many cases mean properties will not be fully insured against incurred damage. The gap between the overall direct economic cost and the portion covered by private / public insurance for Helene will be sizeable; similar to other historical flood-driven hurricane events.'

-

not sure if any salient commentary in here on Seaspan - it has a paywall https://www.tradewindsnews.com/containers/inside-seaspan-understanding-major-newbuilding-investments-and-what-comes-next/2-1-1708114

-

Hellenic share price now up to 3.84 euros which is closer to TBV - not sure what Eurobank is going to do from here with remaining minority shareholders - Eurobank stake in Hellenic has more than doubled from their cost base - mkt value ~0.89B euro (~US$1B)

-

TS Francine - new one to watch https://www.statesman.com/story/weather/hurricane/2024/09/08/nhc-hurricane-tracker-path-texas-spaghetti-models-hurricane-season-2024-tropical-storm-francine/75132485007/

-

just on reserving topic - I thought what Brit have said below from 1H24 report was interesting - they build in a net risk adjustment amount that sits above their best estimate. Ultimately they have to decide what percentile they want to set their reserves at ie what margin of safety they want to build in to their reserving.

-

-

future results may deviate the past but Northbridge had lower cat losses in combined ratio (CR) % points than Intact & Definity in 2022 & 2023. Having said that, we will have to wait for Fairfax's Q3 results to know how Northbridge has been impacted. Intact Canada P&C C$ 14.9 (cat loss 2023 7.5 CR pts; 2022 4.1 CR pts) Definity C $ 4.0 (cat loss 2023 6.2 CR pts; 2022 3.7 CR pts) Northbridge C$ 3.2 (cat loss 2023 1 CR pts; 2022 2 CR pts) * Fairfax rounded out the CR pts in the ARs

-

thanks petec

-

I don't know much about this one but I think @petec mentioned this one previously - it looks like it has come to life a bit this year but a small holding