Cigarbutt

Member-

Posts

3,341 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by Cigarbutt

-

In a world where semantics can be so important, i would submit that the above statement is a factual misrepresentation or at least a partial representation of facts. Since GFC, QE was effectively carried out with non-bank private participants (about 95% of open-market operations). These transactions do end up with a commercial bank balance sheet entry of a new reserve account held at the Fed. But, because of the non-bank participation. there are new balance sheet entries at the commercial bank level, a new asset of the bank ie money as an asset and a new liability ie deposit of the non-bank participant as a liability. This feature explains a lot the rise of the uninsured deposits that occurred especially after Covid. All that to say that 'we' ended up with private participants becoming owners of zero-earning deposits looking to chase yields in related and other investing asset classes, contributing to lowering yields elsewhere and contributing to asset inflation (and also although hard to quantify to main street inflation through the wealth effect). Just something to consider if sustainability becomes an issue or if tightening becomes part of the picture?

-

i think you're right, the 'assessment' at this time of year happens because of a catastrophe-prone quarter, as part of end of year traditional evaluation of trends and also fits within some kind of cycle in itself: https://www.swissre.com/institute/research/sigma-research/Economic-Insights/reserving-higher-uncertainty.html

-

Historically, like most, they tend to look at reserve adequacy typically and especially in Q3 and Q4 and adjust accordingly (by releasing/decreasing reserves set aside if favorable or by increasing reserves if unfavorable). Makes sense?

-

Putting discounting of insurance contract liabilities aside for a second (2023 results will be IFRS17ed). In your quick measure, why do you include the reinsurance part in the numerator but not in the denominator (otherwise the measure becomes about 2.1-2.2)? Retention can vary from year to year and over time. Any way to improve upon that measure? Just take a look at reserve triangles: About 50% milestone of the ultimately paid payments versus adjusted reserves happens in the third year (sometimes in fourth year). A picture about statistics and graphic reserve triangles and interpreted from an undiscounted perspective: Reserve triangles typically look like the above (amounts paid over time) and tend to be somewhat skewed to the right (skewness even more pronounced with longer tail lines). Conceptually (undiscounted), the way duration is meant to mean in the insurance reserves world (opinion), the 50% milestone then underestimates to some degree the duration as recognized in insurers' parlance. ----- Short version, P+C insurers' duration of insurance contract liabilities is reported to be between 2 and 4 years (more towards 4 years with long tail business). So with FFH, you'd expect the duration to be around 4 years because of their very significant exposure to long tail lines. ----- So, i would suggest, as a quick measure, to use your measure, to call it the Spekulatius quick measure, to correct for the harmony between the numerator and denominator and to multiply by 2 and then i think you'd be in the right ballpark.

-

Every time i go to California (larger cities), this 'issue' is always kind of baffling. This is not the area to 'argue' about this 'issue' but, recently, local journalism in my area, looking for models, produced balanced reviews of some kind of a 'model', made in Houston. Kind of interesting. Can we learn from each other? https://www.governing.com/housing/how-houston-cut-its-homeless-population-by-nearly-two-thirds It looks like some communities can achieve improvements but at what cost? -----) Back to: have we hit the top discussions

-

not quite the way that is implied (based on numbers from that period).

-

i know this is not the ideal place for such discussion but if (this is a big IF) uncoupling of debt formation from underlying economic activity comes back to earth (no need to "pay it back"), this is likely to be deflationary and potentially good for bonds in general.. ----- From another thread (related? relevant?): Are new weight-loss drugs the answer to America’s obesity problem? – Harvard Gazette In other words, are these peripheral solutions that don't address fundamentals the way to go? ----- Back to this thread with rewording of title: Are cheap money and debt the answer to America's fiscal/debt problem? Interest Payments on Federal Debt Are About To Skyrocket (reason.com) only if government debt is bought by the Fed and by commercial banks. If the debt is financed through taxes or through draining of private funds, no money is created.

-

If history is any guide, two essential ingredients are necessary: 1-when the state uncouples from some kind of fiscal restraint (size of debt versus general economy) with no end in sight 2-when flight from currency possible

-

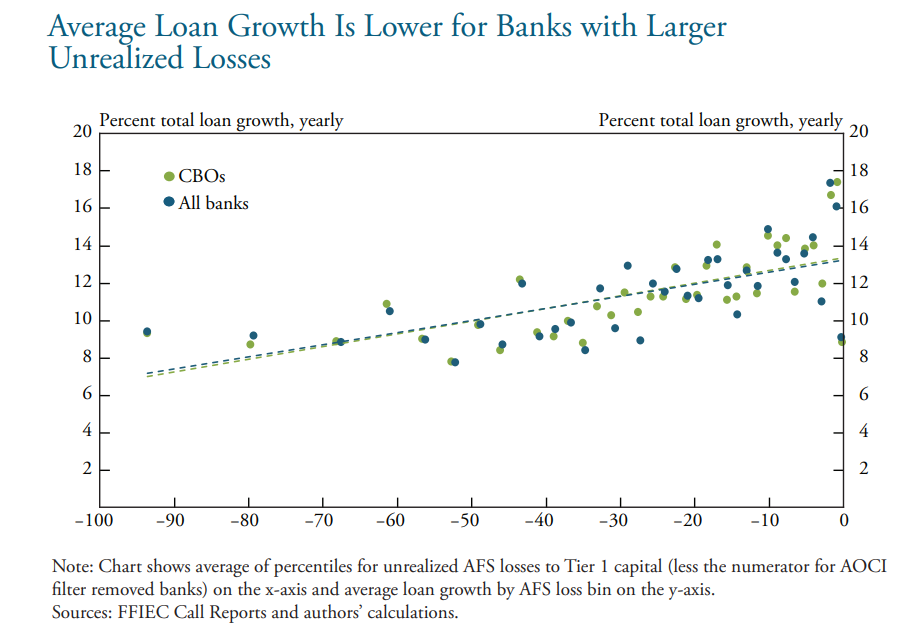

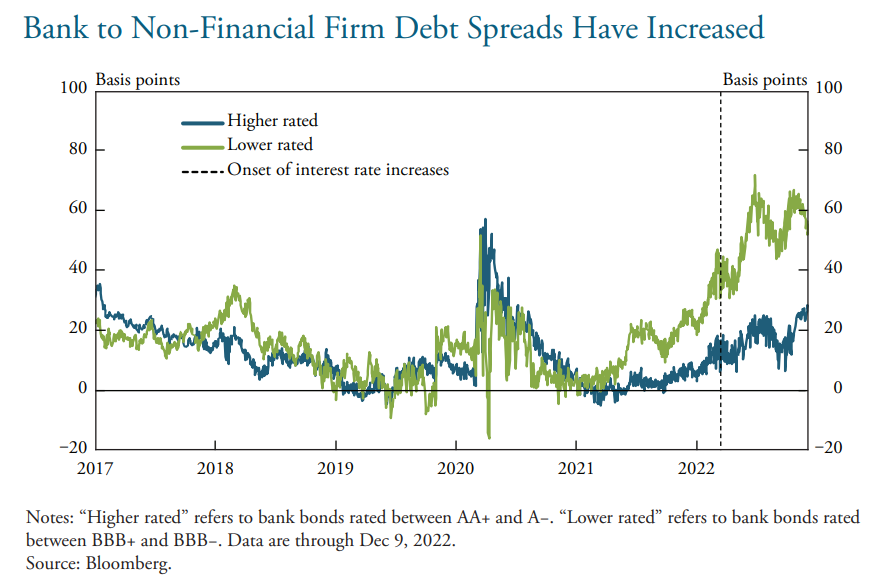

Well the unrealized losses from the interest rate exposure hasn't improved in Q3 (!) and the interesting feature of the BTFP is the sterilization of such losses so. There are still a huge amount of excess uninsured deposits sloshing around. There is no direct link between those unrealized losses and supply appetite for loans and leases but there is a link: There is no point in arguing cause and effect (banks tightening standards, yield curve inversion etc) and there seems to me more than transitory unrealized positions' discomfort in explaining the slow grind of higher funding costs, including when banks turn to the markets for debt:

-

It's been reported that Mr. Buffett met Jack Byrne, then recently appointed CEO in May of that year and immediately after (starting the next day) started to buy large blocks of shares in the open market. Mr. Buffett had also contacted and met a person named Wallach, a key boss (insurance commissioner) at a small but critical regulatory agency (it seems somehow that Mr. Buffett became convinced that Geico was not to be put in receivership). A key concurrent move was to contribute capital before visible improvements in the bottom line and any financial or operational moves that would support Geico.

-

That's interesting and the topic (household equity allocation) has been discussed before here (some years ago..). Here's a graph you included above: So there was this person from Philosophical Economics who produced this correlation graph (with some potential forward looking value) up to 2013: Since the GFC, the correlation seems to have broken down? Why? It's hard to suggest that the democratization of investing is responsible since it's hard to see why there would have been such a delay between the onset of this demographic feature and the advent of a permanent plateau in multiples? Maybe it's one of those unknown unknowns that is different when this time is different? Let's try a tentative explanation for the (temporary or transitory?) disconnect. First, a conceptual issue. When people mention that 'money' flowed from bonds to equities, in general, it does not correspond to the reality of money movements. When people sell bonds, others are buying bonds and the 'money' stays with the previous bond holders. When the household allocation % to equities rises, it's not from money moving from bonds to equities, it's (it has been essentially at least before the GFC) from revaluation (higher multiple) of the underlying equity earning power. As such, when markets go down, money is not leaving equities, it's just that new owners come to equity and pay less for the same underlying assets. Anyways. i wonder if this 'money' aspect is not related to the breakdown of the above mentioned correlation because, since the GFC, money creation has been no longer tied to the growth of loans and leases at commercial banks (which held quite constant versus underlying economic activity) but has been mostly driven by quantitative easing and commercial banks' expansion of their balance sheets with government debt (their asset a government debt security matched with a private deposit liability) effectively financing directly the federal government and in reality creating money (for investments and the related effect on multiples and valuation and for consumption and the related effect on inflation). Anyways. From a basic down-to-earth perspective, it always struck me that household equity allocation was one of the ultimate counter-cyclical indicators and well done surveys have showed that household investors at cyclical peaks have (before) always felt that equities were to continue to deliver higher returns (with lower volatility?) but with the government so 'involved' in counter-cycle resistance is this time different for real?

-

In a way, that's what Mr. Graham was saying in 1955. Dollar cost averaging makes some sense from a math point of view (not always) but it's primary a psychological tool and who knows what happens when it matters most? dollar cost averaging benjamin graham - Google Search

-

Here's a summarized version with slightly modified text from Mr. Buffett's partnership letter released towards the end of 1969. ----- For the first time in my investment lifetime. I now believe there is little choice for the average investor between professionally managed money in stocks and passive investment in bonds. If correct. this view has important implications. Let me briefly (and in somewhat oversimplified form) set out the situation as I see it...vs taxation vs expectations... Purely passive investment in tax-free bonds will now bring about 6-1/2%. This yield can be achieved with excellent quality and locked up for just about any period for which the investor wishes to contract... The ten year expectation for corporate stocks as a group is probably not better than 9% overall. say 3% dividends and 6% gain in value. I would doubt that Gross National Product grows more than 6% per annum - I don't believe corporate profits are likely to grow significantly as a percentage of GNP - and if earnings multipliers don't change (and with these assumptions and present interest rates they shouldn't) the aggregate valuation of American corporate enterprise should not grow at a long-term compounded rate above 6% per annum. This typical experience in stocks might produce (for the taxpayer described earlier) 1-3/4% after tax from dividends and 4-3/4% after tax from capital gain, for a total after-tax return of about 6-1/2%. The pre-tax mix between dividends and capital gains might be more like 4% and 5%, giving a slightly lower aftertax result. This is not far from historical experience and overall, I believe future tax rules on capital gains are likely to be stiffer than in the past. Finally, probably half the money invested in stocks over the next decade will be professionally managed. Thus, by definition virtually, the total investor experience with professionally managed money will be average results (or 6-1/2% after tax if my assumptions above are correct). My judgment would be that less than 10% of professionally managed money (which might imply an average of $40 billion just for this superior segment) handled consistently for the decade would average 2 points per annum over group expectancy. So-called "aggressively run" money is unlikely to do significantly better than the general run of professionally managed money... The rather startling conclusion is that under today's historically unusual conditions, passive investment in tax-free bonds is likely to be fully the equivalent of expectations from professionally managed money in stocks, and only modestly inferior to extremely well-managed equity money. A word about inflation - it has very little to do with the above calculation except that it enters into the 6% assumed growth rate in GNP and contributes to the causes producing 6-1/2% on tax-free bonds. If stocks should produce 8% after tax and bonds 4%, stocks are better to own than bonds, regardless of whether prices go up, down or sidewise. The converse is true if bonds produce 6-1/2% after tax. and stocks 6%. The simple truth, of course, is that the best expectable after-tax rate of return makes the most sense - given a rising, declining or stable dollar. All of the above should be viewed with all the suspicion properly accorded to assessments of the future. It does seem to me to be the most realistic evaluation of what is always an uncertain future - I present it with no great feeling regarding its approximate accuracy, but only so you will know what I think at this time. ----- Here's a photo of the BRK insurance subs' balance sheet (1971) showing the investment allocation: ----- Of course, in the decade following 1969, the future revealed itself in a relatively unexpected way and Mr. Buffett adjusted the allocation accordingly, at a time when bonds became an institutional favorite. ----- As of now, the Aaa Corporate Bond Yield is at 4.95% and Treasury yields look like this: As for expected general stock index return for the next 10 years or so, who knows but it's reasonable to suggest that a reasonable investor may be facing some alternatives and then is there still room for the prudent investor ("prudent" in the sense of the prudent investor rule)? As for the aggressive investor, the markets need to reflect a wide variety of perspectives including optimistic ones and that's great again. Given a certain perspective about prospective returns, it's possible that the future will be different than the past but an optimistic stance requires, to some degree, to think like Pangloss: "It is demonstrable that things cannot be otherwise than as they are; for all being created for an end, all is necessarily for the best end."

-

Thank you @RichardGibbons for your contributions in this thread. The topic is concerning but i'm slowly getting around to a very optimistic outlook based on (still unseen in what appears to be very static) significant productivity gains to be achieved over time.

-

Well, the "current" regime (whatever it has been and evolving into for the last 25 years) has been easy for the average person with some assets. Then what do i tell three members of my growing clan (who have burgeoning earning power and growing intent of buying assets, housing, securities and otherwise) when they wonder about prices of assets versus general levels of earning power? Then, in a stoic way, what do i tell them when it's being shown that the post-Covid tightening phase induced by the Fed has been (at least temporarily) tempered by the ultimate fiscal stimulus? i recently watched: Watch MADOFF: The Monster of Wall Street | Netflix Official Site The short series leaves a lot to desire in terms of art in the making but still is quite fascinating in some respect. For example, the semi-documentary shows that the principal character always had, deep inside his psyche, the Ponzi potential. And it took a while to figure out even in retrospect. A key revelation (opinion) is that the biography of the man shows what can happen when insufficient restraints are in place. ----- Any relevance to investing? In the distant past, Fairfax used to have this macro mean-reversion risk-aversion mentality and, more recently, this has cost them a fair bit. But they no longer carry this unreported asset and this has prevented me to go all-in, wise decision? -----) Back to regional banks, any relevance? Like JPM complains these days, it (eventual mean reversion) may mean requirements to hold more capital and to operate with more constraints, eventually? when?

-

The Fed's programs have gotten to be very large and (not unlike the Florida insurance market (!) as discussed elsewhere) they now have to deal with many priorities (liquidity, solvency, stability) including affordability (moral hazard risk) which may involve contradictory stances (some of the stuff they do (simultaneously) eases and some others tighten). For a while, the Fed has embarked on a scheme of doing more and more. It's interesting to note that since mid-2022, the Fed has started to unwind its balance sheet but has only reduced their assets by less than 10% at this point, a process which, on its own, would have had about a zero effect on interest rates so in order to artificially raise rates, the Fed has had to pay interest on excess reserves. That didn't matter when rates were near the zero bound but now the Fed's largesse has become a high contributor to commercial banks' return on assets. i appreciate your opinion about the 'stimulation' part but it appears (opinion) that, on a net basis, the Fed has been tightening overall. An aspect that supports that is the correlated trend in commercial banks' tightening of credit in general: Anyways, that's what USB had to say on the matter: Federal Reserve Focuses Monetary Policy on Fighting Inflation | U.S. Bank (usbank.com)

-

This thread is fed just in case banks start to look 'interesting', when? FDIC just released their recent bank profitability/stability report: FDIC: PR-72-2023 9/7/2023 In a nutshell, what happened in early 2023 (apart from 'abnormal' banks) was mostly noise. Still, there seem to be many misconceptions about some aspects: deposit growth, funding costs, healthy private balance sheets etc 1-Deposit growth Despite the widespread notion about deposit flights to safety, deposits' levels are now mostly determined by central tools (QE/QT and commercial banks expansion or de-expansion of government debt held as security (asset)) and deposits' levels remain above pre-pandemic trend by a lot. Of note: real growth in main street all loans and leases has become anemic/negative lately. 2-Deposit cost Despite the notion of exploding deposit cost and the flight of capital to MMFs, real data does not show this rise in cost. 3-Weird notion of bank hoarding 'money' as mentioned in: US banks hoard $3.3 trillion in cash amid fears of an economic slump (msn.com) Of course, the 'money' is there: But it's not a result of 'hoarding' as banks are forced-fed 'money' as interest-bearing reserves: To suggest that private decisions about savings/deposits haven't been influenced by command-and-control factors or that obvious supply-side issues were the main factor at play is, at the very least, quite intriguing.

-

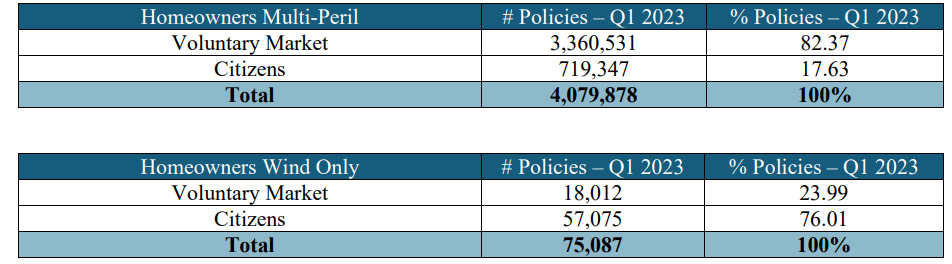

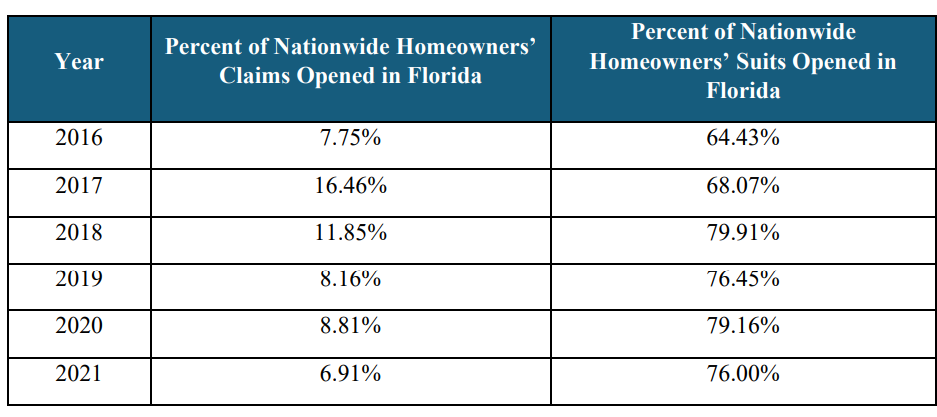

^i guess 'we' could spend all day 'discussing' the 'political' aspects and i wonder if switching theme to "public governance issues" would make us all relatively more intelligent (or the same level of brightness with less contamination?). One could venture to say that Florida is a great State (i do, for many reasons) but that the governance has been extremely poor for the socialization of risk in the homeowners' segment. Can the tribe live with that statement? The retention of wind risk by the public 'residual' (not so residual anymore) entities means that there is a high likelihood of unusual 'redistribution' patterns going forward. That's all. ----- Now, maybe a more interesting question is why has BRK recently entered into a giant agreement to backstop this mess? https://www.reinsurancene.ws/berkshire-gets-giant-1bn-share-of-florida-citizens-reinsurance-renewal/ The following is an attempt at an answer. First, reinsurance prices have gone up +++. Second, BRK has carefully chosen the layers of participation staying away from 'coastal' accounts. Third, in a contrarian way (profitability in the property segment has been dismal lately), BRK has invested to potentially benefit from the political attempts recently enacted to improve the legal context (part of the social inflation theme) which has been dismal in Florida.

-

Capital is there, Berkshire is there but, under present circumstances (various 'incentives'...), progress will be slow. Somehow, progress will become more rapid eventually and this is related to the WW2 reconfiguration question mentioned above thread. In any case, BRK will likely be ready. Buffett on clean energy push: This country should be ahead of where it is (cnbc.com)

-

Hawaï is very interesting (for many reasons in excess of insurance moral hazard issues) but isn't the topic of this thread the state of the insurance market in a state where a government-owned not-for-profit entity (charging less than private rates) representing Citizens holds the largest market share (18%) of the home insurance coverage and where a government-sponsored and only partially funded catastrophe fund is responsible for 87.4% of the reinsurance coverage?

-

Biased and potentially misleading addition on my part here. Off-topic but quite interesting and relevant? to BRK? others? On a personal level, one of the most interesting aspects of the period is how war efforts were financed (the war was publicly financed) but this is a 'story' for another day. ----- Freedom's Forge is an interesting reference but is quite uni-dimensional and focuses mostly on some aspects of corporate contribution. For a more balanced review: For a more diverse view with a focus on individuals (the book is based on the underlying assumption that the 'secret sauce' (some kind of semi-collaborative context balancing key participants) was in place): Another useful reference (most likely to meet your limited-time-availability expectations) is: Mobilizing U.S. Industry in World War II: Myth and Reality (ethz.ch) The book describes how the US process to get involved in the war was 'messy' but demonstrates that the US was able to eventually get ahead while balancing military and civilian needs. The book describes the 'team' effort. It goes through the various institutions (War Production Board, Office of War Mobilization etc) that were (semi-strategically) put in place and the people who led the team efforts (Sidney Weinberg was a player in the team; it was a time when public office was held in high esteem..). And now here 'we' are and this too shall pass.

-

Which activities in life brings you the most fun?

Cigarbutt replied to Charlie's topic in General Discussion

What a disturbing movie which shows extremes of pleasure as well as extremes of hardship (maybe not a totally balanced view with even some tendency to glorify drug use?). The toilet scene/metaphor is...interesting, even enough to have an olfactory hallucination with nausea just from watching... Anyways, it's not clear what you mean by history repeating itself (heroin overdoses as an essential cause of death has come down lately with deaths for 'synthetic' opioids, especially fentanyl showing a rising trend with no signs of slowing down). US data: ----- Anyways, lately, it's been possible to come up with synthetic alternatives that are highly potent (both ups and downs) and that seem to connect very strongly with pleasure/fun brain centers which derive from a long evolutionary process (to survive, reproduce etc) which did not 'forecast' such an option in nature. i guess 'we' will eventually adapt. ----- Anyways most people posting in this thread seem to go for more measured forms of fun. -

Which activities in life brings you the most fun?

Cigarbutt replied to Charlie's topic in General Discussion

i sense that you want to conclude this sub-discussion in a decent way but your last comment underlines that fun activities are a form of compromise. You may find interesting that there is data that help to quantify the "price" paid for fun. There is that recent Veteran study that suggests (along the line of basic lifestyle changes that you mentioned earlier) that combining 8 lifestyle changes at age 40 could result (likely overestimated to some degree because of study methods) in a close to 25-year increase in lifespan (also healthspan to a large degree). So this kind of data can be used to estimate the 'price' of periodic hangovers. For example, using the following graph, the third line from the bottom (in purple) corresponds to the potential incremental gain in years (lifespan) if periodic binge drinking does not occur. Of course, hangovers can occur with 'reasonable' drinking (quantity and frequency) so that the number of years lost from periodic moderate hangovers after 40 is about 1-3 and, after 60 about 1-2 and maybe the pleasure of occasional alcohol relative over-consumption is worth it? -

Which activities in life brings you the most fun?

Cigarbutt replied to Charlie's topic in General Discussion

You are correct. Even if a peripheral issue, i apologize for the potentially misleading part of the graph (for the topic discussed) as i did not appropriately look at all aspects before putting the graph as a reference. There was no conscious intent and, as explained, there are potential reasons for the part of the graph that can be found distracting and less intuitive. Many people studying this issue ((dis)ability component of health) have an interest in sports physiology and training. Typically when looking at performance, you get something like this (here is long jump but you get a similar phenomenon in all athletic sports, especially those with a large aerobic component ie long distance running): As you can see, the shape of the curve is similar to the one i had included in the initial response. This additional info does not negate the fact that you pointed out correctly that there was an inadequate part in the info i provided. PS One of the things in life that brings me the most fun is to be proven wrong, thank you.