Cigarbutt

Member-

Posts

3,371 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by Cigarbutt

-

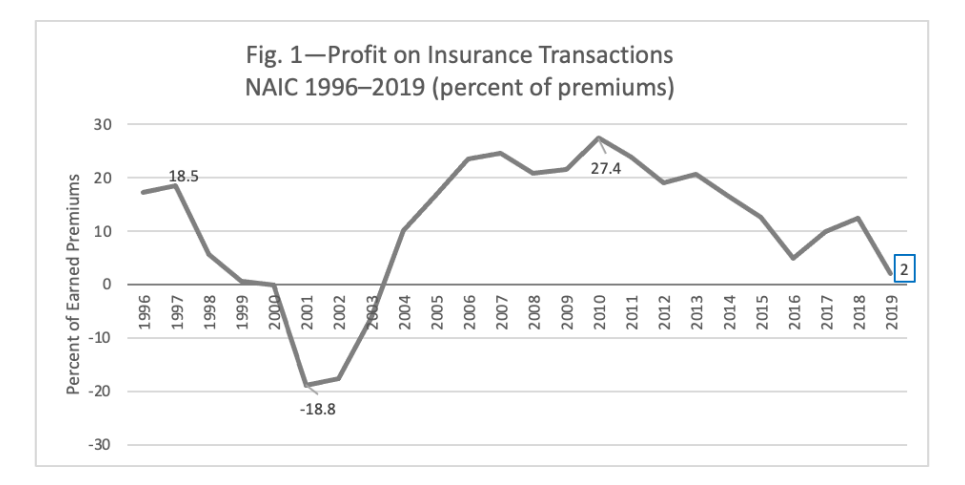

Yes, i think this is correct. It's becoming clear that the 2017-9 years were written with a semi-conscious expectation that premiums were insufficient to meet profit objectives and the shortfall could be compensated by investment income. In the industry, they call this cash flow underwriting and this is based on the same foundation as the need to remain fully invested at all times at the individual level. For the industry, it appears that the eventually realized underwriting losses for those years were compensated by float investment income. See the following graph showing the yield on invested assets. For the industry, add a median 0.5% per year for realized gains: For FFH: It's interesting to note (it's becoming clear now) that, for those years, FFH did better (relatively) than the industry both for the reserves management and the float management. ----- Nuff said about triangles i guess. The relevant uncertain questions about the future are bound to be related to the asset side, i would venture to say, but what do i know?

-

Interesting. Let's build on that using net reserves (ie where reserve development stays with the company instead of being ceded to another party): So using the same line of reasoning, FFH has reserves reported (as of end of 2023) at higher levels than initially reported for the 2018, 2019, 2020 and 2021 years. And up to the 2019 year included, the end-2023 number is 410.5 M higher than the initial estimate. Also, the adverse movement from 2017 to 2018 was 1165.1 M ((254.6)-910.5). Not exactly catastrophic and not remotely as horrific as the late 1990s and early 2000s years (Ranger (ouch!), generic Crum, nauseating TIG etc) but still quite significant. No wonder (now), the late 2010s years were ripe for hardening. So, the same conclusion applies but (opinion) the net reserves trend smooth out significant older and softer adverse development as a result of more recent and harder favorable development. i'd simply add that this appreciation may help to guess the kind of underwriting contribution to the ROE of future years. @jfan, the best thing now would be that someone comes along and tries to establish an opposing view.

-

@jfan Your line of questioning is quite reasonable and, since there's not much action here, i will give it a shot (btw thank you for the crypto links that you had provided after i asked a question or two in that thread). ----- Disclosure: i have no formal training in reserve triangles but it is a fascinating topic and a relevant one for FFH and when an adolescent, i was told that i had what it took to become an actuary, an avenue not considered for various reasons including the deep desire to reach financial independence as soon as possible. ----- -If FFH wants to reach the 15% ROE goal, a key input is the underwriting return over the complete cycle. -Historically, despite many rational attempts to deal with this, there is the underwriting cycle and the associated (and correlated) reserve cycle that happens with a lag. -When looking at triangles such as the ones included above, one has to remember that what happens (recognition of inaccurate reserves) in an older year will work like a domino and change all the reported numbers for the subsequent years. So looking at trends is important. ----- Tentative conclusions -Like the overall P+C (re)insurance market, FFH's numbers (and present trends revealing how wrong previously reported numbers were) reveal that the 2018 and 2019 (+ or - 2020 or even 2021) were written in quite a soft market and eventually recognized reserves have become more than the initially recognized objective for profit. -While it is impossible to be precise, FFH continues to report overall positive net favorable development which means that the adverse development from softer and older years are more than being compensated by favorable from harder and more recent years. -While it is impossible to be precise, FFH appears to have done better than the market in general as a result (combination of skill and luck; likely more skill than luck) of 1-focus on more specialized lines, 2-opportunistic growth ++ during hardening and maybe/likely of 3-better underwriting discipline. -To specifically answer your question (needs to be watched carefully?), FFH has shown for some years the nonspecific strategy to be simply conservative in their reserving overall (choose the conservative side in the range given). Also, the poor years are now quite some time away and more than their typical reserve duration of around 3.8 years. In addition, if history is any guide, the more recent and significant growth in reserves during a hard market should continue to compensate and more for the net favorable development. -Now, it's always possible that the underwriting culture has deteriorated and this may take years to figure out but i would offer a fairly substantiated opinion that this is quite unlikely. If interested for more granular info at subsidiaries, look at the supplemental info: FFH - Annual Financial Supplement (2023 Q4) (fairfax.ca) OdysseyRe continues to be a star performer.

-

Can you elaborate, especially concerning trends including what is referenced to by @jfan, from 2022 to 2023 calendar years?

-

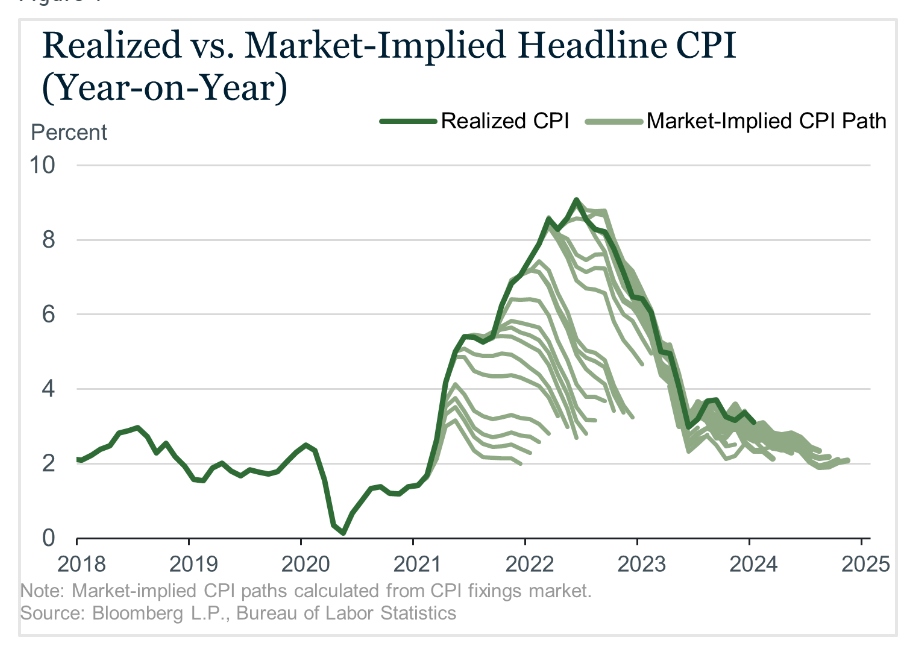

How is the Fed going to cut rates with inflation over 3%?

Cigarbutt replied to ratiman's topic in General Discussion

Thank you for the additional thoughts. ----- On a personal level (private ventures), it's been possible to identify and benefit from (relatively) small pockets of potential margin exploitation (in my case based on complex regulations, areas of bureaucratic inefficiencies etc) but opportunities could not be considered permanent and there's always been the constant threat of real competition. ----- The investment case for EQR (Equity Residential?) (after a 5-10 minutes review..) can be made (various tailwinds, demographic, wealth effect etc combined with an experienced and talented team) but it's not in my zone of comfort (good for you if it works out) and it's hard to discount a comparative advantage based on "tech" in this area if competition is still a thing. Opinion: A lot of the corporate pricing power these days is from lack of competition (and access to cheap and easy money). -

How is the Fed going to cut rates with inflation over 3%?

Cigarbutt replied to ratiman's topic in General Discussion

Thank you for the feedback. However, the companies mentioned are not within my circle of competence. If others can benefit (seeing the present benefit as well as the discounted value of future benefits), that's great. -

Obituary Daniel Kahneman obituary | Psychology | The Guardian He followed a tortuous life path and ended up trying to tone down the noise in order to optimize "adversarial collaboration". Why not?

-

To help with 'clarification', the following was posted earlier in the Fairfax 2024 thread. Fairfax 2024 - Page 28 - Fairfax Financial - Corner of Berkshire and Fairfax - The Value Investor's Haven (thecobf.com) Hope this helps.

-

How is the Fed going to cut rates with inflation over 3%?

Cigarbutt replied to ratiman's topic in General Discussion

Relating to the recent rise in profit margins (since 1999 when Mr. Buffett voiced his 6% 'normal profits' assumption), the material reduction in corporate taxes plays a role but there are other specific material variables, including maybe a common denominator? ----- Relevance for our day-to-day search for alpha? Since 1999, where i've 'looked', most (by far) of the improvement in net margins at relevant investment opportunities have come from lower debt service costs and lower corporate taxes, not from higher margins related to what @Dinar describes ie companies that (apparently) have the intrinsic ability to obtain and maintain superior products versus simply the possibility that monopoly power has gone up because of etc etc Maybe i'm not wired to 'look' where the real money is? -

How is the Fed going to cut rates with inflation over 3%?

Cigarbutt replied to ratiman's topic in General Discussion

The conclusion that market cap growth has decoupled from GDP (and may continue to do so) may be correct but the two underlying assumptions that are mentioned appear to be incorrect. 1-When using GNP instead of GDP in the ratio, the international part which is described above does not materially change the picture. 2-When using NIPA profits (which is an imperfect measure bla bla bla ok but still...) which also includes private companies, the same trend appears. ----- Now, as to why margins have decoupled is anybody's guess but i'd bet public deficits play a role. The following is the same corporate profit line with, superimposed, the budget deficit. Look at what happened since 1999 when Mr. Buffett assumed that margins hovering around 6% would be the norm (absent fiscal largesse? which is sustainable?). -

From the anecdotal to the global and back to China Our oldest offspring is a teacher at the primary level. He (like his peers in in North America) experiences greater trends across the education system in North America. Of course, there are major relative comparative advantages to other jobs especially after achieving a more 'permanent' status including the not so benign side effects of over-regulation, over-management and various 'entitlements'. However, there are also major disadvantages. A rising proportion of recent graduates are leaving after a short time spent on the 'job', despite recent adjustments to various salaries and other other monetary incentives (money does not appear to be enough). Based on what happened this week in his class room (and what has been happening for some time in North America), a major issue is the growing lack of respect linked to the gradual drift to incivility (also 'seen' in various forms of communication..). Here's an 'intelligent' answer from a perplex 'friend': ----- There has been a gradual normalization of this drift and... ----- Back to China The US continues to be a leading pole of light as seen in the large numbers of international students coming to the USA. For China, this has been an important factor in catching up but how to compete now? For the US, it's hard indeed to spoil the secret sauce but its market share of international students has started to decline lately. Why?

-

Note: slippery slope for 'discussion' here but the angle is why BRK (this was likely a CEO decision) declined to 'participate' (for a potential profit) in the surety bond. Above was mentioned that a surety bond of that nature is equivalent to a bond (lending agreement) where capital, capacity, collateral and character assessment play inter-dependent roles (one criteria could compensate for another but one criteria may be enough to decline). Character assessment is one of Mr. Buffett's strength but he's been recently disappointed (alluded to in last annual report) and likely increased the margin of safety required for that part. There are times when the risk-return profile is simply not adequate given the type of risk involved. As far as collateral, liquid assets are normally required for this kind of 'bond' and real estate does not fit the bill. Now, as far as the outcome of the appeal, which is another consideration, a criminal offense of fraud does not require a victim. There is legal context for this and recognized criteria but common sense will tell you that, if you are caught crossing a red light with your car, a defense implying that there was no victim or harm may not be your best legal strategy to invalidate the infraction. There is out there some discussion about the origin of the legal concept of Standing which involves a balance between community and individual autonomy as well as the efficient functioning of courts but the following is a balanced (opinion) view from a reasonable group (moderate-center, objective, high level of fact checking) which assesses the odds of success for appeal: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4690963

-

In their annual 'sustainability' report, FFH describe their "catastrophe exposure tolerance". In 2023, there were 4.0% catastrophe points. ----- So, from a statistical/model point of view, the unlucky scenario you describe should not happen that often.

-

Can i submit an alternative view of facts here? Opinion about relevance: The investing climate has been changing and there's an unusual amount of noise, no? Thomas Edison was unusual and made a lot enemies along the way. However, at a time when we was really busy (six-sigma kind of busy), he took the time to write an elaborate piece on the rational necessity of efficient government regulation. There was a specific personal interest involved but he took the time and mental energy necessary to produce a constructive series of arguments against the Sherman Act, including an alternative plan. ... “Edison was a Republican,” Israel said. “Republicans in that era tended to be much more in favor of government regulation and government involvement in the economy than Democrats. He supported Teddy Roosevelt, the great trust-buster.” Times have changed. Opinion: Polarization is nothing new; it just seems that the polarization then was more about policy and less about stupidity. Signed: someone hoping for a more constructive atmosphere for debate -----) Back to the trip to mars and the starship search for extra-terrestrial intelligence Edison apparently offered an opinion that a trip to the moon was not within reason (1911). Although he (opinion) likely meant that it was within reason during his lifetime. A pseudo-fact supporting that opinion is that he also got involved in scientific fiction writing which involved such travel and more.

-

^About the share-based compensation aspect, FFH's program is quite unique and includes several shareholder-friendly features: share-based not option-based, pre-funded in substance, long vesting period but the program has been growing significantly; one has to determine if this manager-friendly posture is (and will be) shareholder-friendly. Opinion: a qualified yes. To be 'fair' (@Thrifty3000), if one uses the diluted share count, one should add back the amortization of share-based payment awards to the operating income (found in the operating section of cash flows). Note: this line item is included in corporate expense. The long term trend (in M USD): 2010 3.2 2011: 11.3 2012: 16.6 ... 2020: 84.3 2021: 104.1 2022: 146.1 2023: 147.0

-

Why did so many smart investors miss making a killing on BRK stock?

Cigarbutt replied to Viking's topic in Berkshire Hathaway

Interesting. Just in case this is useful, here's a short discussion with a picture. ----- i recently used that concept with one of my daughters who's more into math and statistics and not into investing. She wonders if, going forward, she should invest her excess earning power into an index (which is great in a lot of ways) and she wonders (the downside part in her) how long her initial investment could be under water after the initial period. i used the graph below which is a typical potential catastrophe loss graph (exceedance probability graph) showing the likelihood of loss and the 'modelled' loss per return period with, in this specific picture, how present undiscounted factors could be integrated to shift the graph line, in this case, for example, how the use of specific mitigation measures could bring down the potential loss and the potential likelihood of loss, such as improved building codes and wildland management versus wildfire costs. Anyways, the graph was used in a way to show the likelihood of marked-to-market loss sufficient to remain underwater on the y-axis against time on the x-axis (1yr, 5yrs, 10yrs, 20 yrs? etc). One can then figure out the time it would take to "recover" from a sentimental and fundamental point of view given a relatively low likelihood of loss following the initial phase. With her, several factors were discussed including present valuation levels which could influence the loss curve especially for the lower duration period ie 10 years or less. Anyways, if you can weather the loss, it's not really an issue. Or is it? ----- Anyways, for the topic at hand (use of leverage to buy BRK), a similar concept can be applied with the likelihood of margin calls on the y-axis and time duration on the x-axis. The loss curve can be approximated from history (previous BRK drawdowns, frequency of such drawdowns and other factors etc). Many underlying assumptions do not follow the stationarity principle and could be used to 'adjust' the curve for different potential foresight scenarios. Of those assumptions, one has to consider the trend that BRK's market returns have been becoming more and more correlated with the S&P index (no longer such an uncorrelated pillar of strength in time of uncertainty). Another factor to consider is the growing proportional revenue and net income/cash flow streams coming from energy, a sector not appreciated for these qualities presently in an environment that is causing various degrees of transitory 'regulatory (un-)friendliness'. Bottom line, your approach to avoid becoming nervous appears reasonable and does not require fancy models and all but i've spent some time recently on the potential for catastrophe results to impact targeted investments and this post required 5 minutes to share so.. -

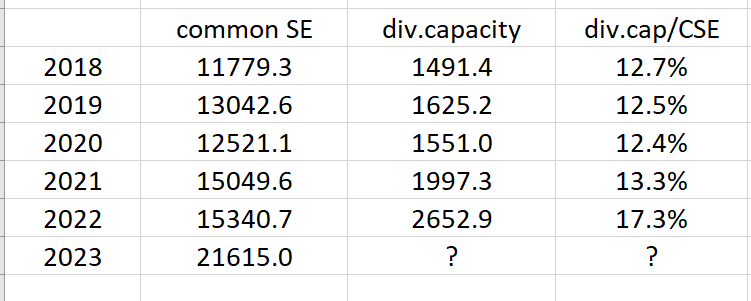

Many moving variables. The most significant being -higher adjusted operating profits/overall profits ahead of net premiums growth at relevant subs in 2023, -reported (and expected for the full year) relatively low capital sent to relevant subs in 2023.

-

Impressive amount of info indeed but recovering from a hip replacement is not what it used to be. There were some comments about profit margins (overall market and some specific companies). Mr. Bloomstran suggests that we've seen a peak in margins but this is a dangerous area to forecast it seems. Below is a graph suggesting that the NPM/GDP ratio has entered a new era with a positive slope instead of the cyclicality within a "band of normalcy" from decades before? Below is what Mr. Buffett included in his 'market valuation and rational expectations' 1999 article. It's hard to forecast even if the underlying reasoning is sound. ----- In the letter, there is a section showing that many BRK's subs have benefitted from rising profit margins in the last 20 years. Not Geico however, which showed a variable margin (combined ratio) over time; its value was more into growth and resilience (although many predicted an ominous demise not so long ago, especially compared to Progressive). Unaudited numbers for 2023, Geico 90.7%, Progressive 94.9%.

-

First apologies. These 'money' questions are incredibly interesting but is it worthwhile to discuss? For entertainment value only then The ivory tower experts define excess money growth as excess broad money measures growth over GDP growth. Similar to:

-

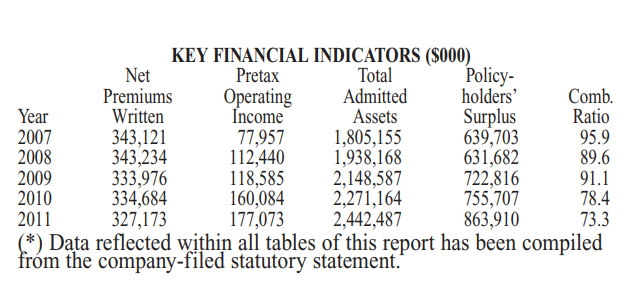

A word about Timothy Kenesey, who may have some work to do in his main line of business. And a word about MedPro, the gem bought by BRK in 2005 for 825M. A gem like so many others hidden in plain sight within consolidated numbers. The MedPro topic is expanded upon here slightly as there may be a correlated message to another contemporary topic here related to unrecognized value when an insurer has recently entered a hard market. When BRK bought MedPro, their market was in a mess but an unrecognized recovery was already under way (i guess it felt like then what is felt like now in relation to BHE's prospects?). Retrospective look to the period before the 2005 acquisition: The above is the total return curve for the industry's lines where MedPro has been evolving. The poor numbers reported in the 2001-3 period were affected by poor investment results but especially by bad underwriting results (both accident and calendar year reporting). So BRK bought in 2005 for 1.5x surplus value. And then: The above are MedPro's results in the years following the acquisition. Ok this may be simply boring historical stuff but the MedPro gem is very likely about to (next few years) report very strong results. Of note: the 'premium' paid in 2005, in retrospect, suggests that what GE accepted as a 'price' was not exactly efficient.

-

To the question "Is capitalism working?" who knows. i'd say it'll be fine. (may have some bumps along the way?) Similar picture: The 'market' had it right? Too early can be seen as wrong though? ----- As far as the forces outside of capitalism, forces trying to modulate it (for better or for worse), there has got to be a link with recent excess money creation at large, accepting the possibility of lag events, confusing what transitory means?

-

Some more thoughts about the evolving hard market. The following is about the US property-casualty market: The recent hard market is similar in extent (area under the curve) to the 2000-4 hard market and FFH, once again, was able to grow much more than peers but, this time around, at least at this point, they don't have to absorb losses that materialized before (late 90s) and which are yet to be reported. The best scenario would be for the hard market to continue and the ideal scenario would be that new momentum be given to more hardening as a result of pain from the asset side of the balance sheets at large with FFH potentially remaining more flexible during a relative downturn. However, it seems like the hard market may be abating. If that's the case, it will be interesting to see how FFH (at the holding company) use the dividend capacity at the subs. Summary table form the last few years: The dividend capacity at end of 2023 is (estimation/guess) likely between 3.6 to 4.5B. So, dividend capacity has been growing at a higher rate than equity during rising premiums requiring more capital. Interesting (forward-looking), no?

-

Maybe it's a way to play the regulatory competition game across states of the union or just a way to cap damages and obtain a pass-through mechanism to clients. Yes, don't hold your breath because, if BHE plans to leave Oregon (or hyper-regulated California or whatever), they certainly don't act that way presently. Just following a significant rate increase obtained last January in Oregon, Pacific Power filed 10 days ago for a plan aiming at a 16.9% rate "adjustment" including innovative insurance-related solutions and an inspired by PC&G recent travails but improved catastrophic fire fund with significant contributions from parties other than the utility itself (which keeps skin in the game obviously). Oregon rate proposal (pacificpower.net) 06_Joelle_R_Steward_Direct_Testimony.pdf (pacificpower.net) They also just produced an extensive 420-page document (date Feb 22, 2024, 2 days after the annual report release, what a coincidence..) which would provide a framework to sort of ring-fence this issue across the following relevant states (perceived as less friendly? and relevant to BHE liabilities, known and to be reported), Oregon, Washington, California and Utah. The report's main theme is Lessons Learned, which may be the carrot that Greg Abel will be seen to carry. Charlie Munger on Greg Abel: The Warren Buffett of Tomorrow? | Collection: Charlie Munger #304 (yapss.com) Opinion: What Mr. Buffett is doing appears to be an assist (with the meaning associated to ice hockey). Adapted meaning of an assist: In ice hockey, an assist is attributed to the player of the scoring team who shot, passed or deflected the puck towards the scoring teammate. Apologies for the hockey example but i played outside hockey today and the girl taking care of the ice rink (who happened to play very well) told me this was likely the last day of the year (very very unusual for this time of year at this latitude, from memory first time ever in February) so one has to adapt to changing circumstances (players, climatic conditions) i guess.

-

From my understanding, Mr. Buffett suggests that 'we' have to figure out what 'we' want (for energy delivery to clients) and i guess that should be the result of rational and constructive discussions (with COBF as a microcosm of these discussions). ----- In the previous post, you suggest that as a result of "CA over-regulates everything not just utilities", "I expect this to eventually lead to a slim down of BHE perhaps even a complete exit." (my bold) The logical extension of this statement would be for BRK to exit all regulated businesses in CA. So why will they continue to write a massive amount of insurance contracts in the "over-regulated" state of CA? ----- Maybe Mr. Buffett's long term assumption that people in charge will do "the right thing", as recently as in 2008, no longer holds?

-

The link you mention also discusses the potential advantages of specialty lines. One of the keys for the transformation (survival) of Crum & Forster about 25 years ago was the rapid move out of commodity lines to more specialized lines with very obvious positive underwriting results. The specialty market has been growing faster than the general market and FFH has followed. When using a similar proportional table as the one you've included above (using the last 8 to 12 years), specialty lines (as defined by FFH) have grown a lot but not significantly versus total premiums at large. For some years now, S&P Global has produced a ranking with the last one being: "The U.S. Property and Casualty Insurance Performance Rankings are based on statutory financial results collected and compiled by S&P Global Market Intelligence. They are determined using 13 financial metrics from 2022 statutory filings grouped into six buckets: rates of return, underwriting profitability, balance sheet expansion, investment performance, prior-accident-year reserve development and premium growth." S&P Global describes how the above rankings show that some relatively small players have been able to grow profitably a lot from a small base and expanding into specialty markets. They also describe that FFH was able to grow profitably both their niche specialty segments and also their much larger portfolio of commodity-like products. i would venture to say that there is some 'moat' in there, especially when considering the now longer-term track record.