-

Posts

305 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by WayWardCloud

-

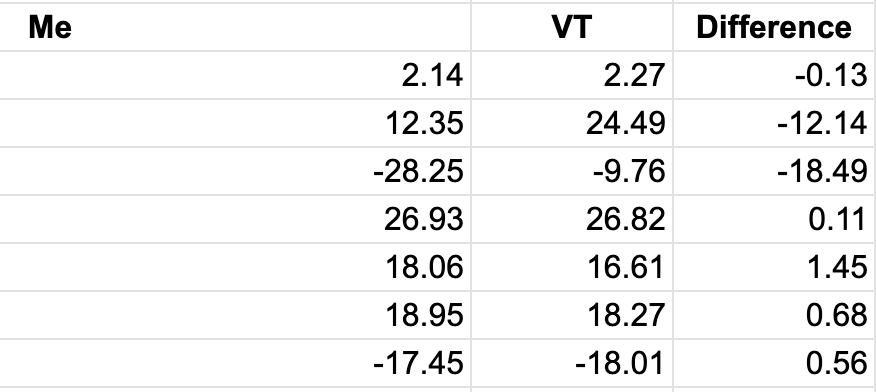

-17.45% Most of the losses came from entering the year with ~10+% positions in Alphabet and Charter and holding steady through the pain. Additional losses on Chinese tech (Tencent, JD, Alibaba) somewhat mitigated by successful trading around. I was genuinely surprised to learn I didn't underperform my index reference, VT -18.01%, after such a poor performance. I guess most other things got hammered about as bad as my picks. Very impressed with everyone's returns here, thanks for sharing your thoughts throughout the year! I feel like I have to change something. I'm about 70% passive and 30% active and considering going 90-95% passive and just 5-10% active via long term (2 years) options when/if I have a strong contrarian opinion on maybe one or two names. Right now those two would be Charter (because I'm a Malone masochist apparently) and General Motors (because I'm a self-driving nerd). Happy New Year! the first line is for the last two months of 2016 only, that's when I started investing in case you're wondering why just 2%. the first six lines are on a much smaller portfolio basis (starting with 15k up to a bit over a 140k thanks to savings from work). This year's returns however have applied to my first really meaningful portfolio thanks to an inheritance (now mid 6 figures) and I'm feeling the difference.

-

Emerging indices are largely comprised of China + Taiwan + South Korea + India. Russia was actually very small in there even before the war so it makes sense that the performance didn't suffer much from them getting banned out of our markets.

-

OK I'll play No recession in the US Stagnation in Europe Something nasty in China

-

Malone has this awkward sentence at 38:47 of the CNBC interview: "Despite my Irish heritage, I'm an American" even though he was born in Connecticut. Ireland is known as a tax heaven and he owns land, a castle, a hotel and a golf course there. Malone is famous for hating taxes and being a libertarian. He has two children and he publicly praised Murdoch for his smart estate moves with Fox. Although I do not believe Malone's children are interested in running any of his companies like the Murdoch brothers were I'm fairly convinced Malone's primary focus these days isn't to grow shareholder value but to prep his empire for a tax efficient transition to his heirs, potentially by renouncing US citizenship. I'm not sure how this affects or doesn't affect common shareholders but he's shown willing to screw everyone else for his own interest as recently as the CWC/LILA deal and the LBTYA/LGF deal so I worry the next time he will throw us under the bus will be for estate planning purposes.

-

Makes sense. Congrats on the trade!

-

I feel the same way, thanks for sharing. What catalyst are you referring to?

-

Lightened up on some Interactive Brokers (IBKR) after a nice run up. Sold out the remaining half of the Bank of America (BAC) shares I bought during COVID. It was a simple swing play and I waited way too long to do so. Both seem fairly/neutrally valued in a market that offers many attractive opportunities.

-

Do people generally focus on long term fundamentals at market bottoms? I'm agnostic whether we are near one or not by the way. Just not understanding your logic.

-

That is true if you assume rationality... The problem is autocrats tend to surround themselves with people who are so terrified to speak up they only tell them what they want to hear. Let's say whatever general overseeing the Taiwan area studies the military option for months and concludes it's a terrible idea. He gets fired for contradicting Xi's holy word and replaced by someone who will have a plan for success, even if that plan is widely unrealistic. That's exactly what happened with Putin and Ukraine. I don't think either Putin or Xi are "insane" taken individually. They have just surrounded themselves by an echo chamber of people through their paranoia and purges. The apparatchiks most willing to bend reality for career advancement get selected year after year until eventually a terrible decisions is made based on the false intel. In general, I don't think arguments appealing to rationality against wars starting hold water because war is almost always the worst choice for everyone involved, yet they happen. I would like to add that I hear a lot of hubris recently coming from us the cobf community about both economic competition with China (eg semi-conductors) and a potential war over Taiwan. Could be a recency bias due to the Russian army and logistical abilities being so much worse than initially assumed. China isn't Russia. Not saying that US/Europe/Japan/Australia wouldn't eventually prevail in a long conflict but that the efforts required and the cost in lives and wasted capital would be unlike anything we've seen since WWII. I think humanity's best bet remains by a far margin to focus on avoiding the Thucydides trap by maintaining an honest diplomatic dialogue, by helping to organize those - both inside the country and outside within the gigantic Chinese diaspora around the world - who want democracy and by providing small inconsequential face-saving concessions to the leader once in a while to bide our time until a regime change. Of course we should stand our ground strongly on tech protection and military preparation just in case, but if we truly believe free markets are the superior model for developed economies (I do) and that demography is destiny, then this whole regime should eventually face plant on its own anyway. Look at them shooting their own two feet already with zero-covid policy plus the biggest real estate bubble in history. For once with China, time is on our side. I've started feeling like my point of view is losing ground as I read more and more articles and comments casually mentioning war, including from people who used to be much more moderate. I worry we are dramatically underestimating what that path would require from us.

-

Yep! And if you look under the hood of VWO you'll see that even though the name hasn't changed we're talking about two completely different allocations. Capital has flown from Latin America (particularly Brazil and Mexico) and into Asia (particularly China, India, S. Korea and Taiwan). So the story is really about Latin America failing to live up to investors (very lofty) expectations, their hopes moving East... just in time to get destroyed by Xi. I wonder sometimes if because those ETFs package together such different areas of the world under the "emerging" umbrella (which by the way makes no sense : S. Korea and Taiwan are developed economies and have been for a while) the slow re-balancing between them make you always about 5-10 years late to the party. For example let's say tensions keep rising in Asia and as a result Latin America receives a lot of US investments to relocate factories and gets a great decade, we'll miss the pendulum completely once again since VWO only has a 10% allocation left in the region.

-

Fast Growers - What Are Your Top 5 Picks Today?

WayWardCloud replied to Viking's topic in General Discussion

You could look towards South East Asia where tech growth has been decimated : Grab (9B market cap) GoTo (15B market cap) Sea (23B market cap) -

Charter via Liberty Broadband. The market is pricing in the beginning of yet another classic "Malone incinerates a fortune buying back a melting ice cube to the death" and I just don't see it

-

Thanks for starting a great new topic! First of all let's not lie to ourselves, this is an attempt at market timing (I do it too), and you know it/seem to acknowledge it. Nothing wrong with that but let's look at it in the eyes. Some of us are doing it using idle cash ("dry powder"), some of us use margin so we can tell ourselves we're 100% invested at all times and not letting all that cash do nothing (depreciate really because of inflation) because we've read our Bogle and our Fama/French and we've seen the backtests. But that's bullshit because 100% invested is just as arbitrary as 90% or 110%. So let's say you're comfortable with 20% margin and you plan on going up there whenever sentiment hits a certain bottom based on the VIX or the Fear and Greed meter or whatever metric, my guess is you'd do better holding 120% long the entire time without waiting for a pullback. It's really all about our comfort level with volatility, our ability to withstand a margin call and the time frame of our investment. Here is what I've learned from experience works, at least for me. Sentiment is ridiculously easy to get right. I follow this forum and another one from my home country and they provide a pool of investors who together paint a good picture of the average sentiment of people who follow the stock market. Newspaper titles (not financial newspapers) will give you markers for the bigger swings. Finally in more rare times of extreme sentiment one way or another the people around who know absolutely nothing about investing will tell you everything you need to know. For example my grandma wanted to liquidate everything in 2011. On the other hand my best friend became all of a sudden enthused with "investing" and was parading his gains on meme stocks and coins all throughout 2021 but refused to read anything of substance I would send his way when he asked me questions about investing. So here you have it. Three levels of information gathering and you can see that the more subtle ones happen very often (we spend our time freaking out about every little thing here because we're looking for things to worry about) and the huge ones are maybe once a decade when sentiment osmosis goes aaaaall the way to reaching the minds of the know-nothing and usually-doesn't-care-one-bit people. Now the trick is to completely separate that information from whatever macroeconomic view you might hold. Do not consider the "why" at all. There will always be a million great reasons to be bearish at the very bottom and a million great reasons to be bullish at the very top. I see that often on the forum : someone will pound the table saying "things are cheap, let's invest" and someone else will reply 'Yes they are but I don't see how it gets better short term because blablabla, so not yet." This is a mistake. What moves stocks isn't the world doing better it's the average sentiment of people believing the world is about to be doing better or worse, and good luck timing crowd movements. Way too many variables and chaos since what we call "the market" is really just billions of overnight successful apes strapped together with fiber optics exchanging make-believe tokens at a frantic pace. After a few ups and downs you know yourself and you learn to watch your own "gut feeling". Not necessarily run with it, not necessarily be contrarian with it either, just watch your own emotions with curiosity. What types of companies catch your eye these days and ask why? How do you feel before pressing the "buy" or "sell" button? Do you second guess yourself a lot or do you feel like you've got this? Then try to remember when did you feel like this in the past? What kind of stuff was it a good time to buy then? What mistakes have you made, successes have you had when listening to what part of your brain in what type of situation?

-

Significantly Outperforming a Bear Market

WayWardCloud replied to spartansaver's topic in General Discussion

Great topic, I'm curious to hear you guys' stories! Entered COVID at around 0.9x leverage and kept adding all the way down. I got to around around 1.35x leverage at the bottom and rode the whole thing back up. Didn't see the crisis coming at all, didn't time the bottom at all, didn't predict the quick recovery either... I just kept adding to my usual holdings as things got cheaper using an amount of leverage I was comfortable with. -

Since you're planning to invest the proceeds you should consider the RE price drop RELATIVE to the stock market price drop during the same time period. Yes you are selling your house for a bit less but also buying stocks for cheaper with the proceeds. You might actually come out ahead. No one can predict the future anyway and a RE rebound to new ATH is not certain so move on with your life plans and be happy. Just providing the above logic to soften the psychological blow of not selling at the very top which almost never happens anyway

-

The 2021 investor day is available in full right here if you can put up with the the channel's host live commentary, I tried and personally could not

-

More Tencent. It has become a major position of mine. Amazing core business spitting out free cash which is being reallocated to a gigantic international VC portfolio. If you back out their investments this trades at a PE in the low teens. I wish the CCP would leave them alone but then again it's the only reason you could ever buy this for so cheap so I'm ready to take the political risk and see where we're at in 10 years. Politicians and their scrutiny come and go, hopefully.

-

I don't think anyone here has said they were actively betting against Malone (shorting LSXMA). We're simply unsure about the long term value of the one-way satellite technology that's the infrastructure behind SiriusXM, see a lot of competition with deep pockets attacking the content side, and have witnessed Malone and Maffei incinerate money buying back Qurate shares over the years. Ps: almost 40% of my portfolio is invested in companies related to John Malone so don't get me wrong I'm a big fan as well

-

When do you guys think they will hit the 80%? I owned the stock briefly for that very reason about 3 years ago and sold when they bought Pandora because it brought their percentage ownership down right when they were about the cross the threshold. I'm conflicted because I love the special situation aspect but I have no faith whatsoever in the underlying op co, so I'm trying to be in and out of this quickly around the time of the event.

-

Investing Lessons/"Mistakes" from 2020?

WayWardCloud replied to valueinvestor's topic in General Discussion

Selling entirely my huge 15% position in JD.com at $38 in April after holding it for two years from around $35. It trades at $100 now. Why? The stock was flat since January while some of my other holdings like BAC and WFC were down 35% so I concluded the later had become relatively better investments and that it made sense to move capital towards the bigger bargains. I was expecting China to be faring much worse than the US given that it was the original birthplace of the pandemic. I was also convinced their weird looking number of cases/death charts were a fraud and the government was hiding a massive number of cases that was going to be revealed any day (I'm still fairly convinced the numbers were fake but they did end up controlling the epidemic very well moving away quickly from their first "cover up and deny everything" response, while on the other hand the US government... Well, let's not go there.) Mistake The logic was flawed because I failed to recognize the crisis had not hurt all companies in the same way. Maybe one company deserves a -35% and another one 0% due to a specific set of new circumstances. Can't get stuck on old price targets when the world has clearly changed. I knew JD as an online retailer was founded during the Asian SARS crisis and I should have realized they would be very well equipped for this. -

Liberty Broadband Millicom General Motors Tessenderlo Alphabet Bank of America Wells Fargo Live Nation Liberty Latin America Liberty Global Financiere de l'Odet Alibaba Interactive Brokers Formula One Idorsia Amazon Peyto Ordered by size with the biggest stake being Liberty Broadband at 14% and the smallest one Peyto at 1.3%. About 33% of the whole is invested in John Malone related cable assets so they better perform :P

-

I honestly don't care if my order flow is being sold but 1.I don't trust Robinhood to be nearly as solid as a major broker in case of extraordinary events so no way I'm parking any substantial amount of money with them. 2.Interactive Brokers' Portfolio margin is unmatched. 3.Ethically, I don't like to be associated with people whose entire business plan is to take advantage of idiots gambling away their life savings.

-

Thanks for clarifying! I'll take it all with a grain of salt since there's no source but super interesting. Your last comment is what I keep thinking every single time the CCP does anything. Long term they seem to be creating an army of resentful powerful people all around them : former CCP politicians getting thrown under the bus, Founders of huge companies (Alibaba) being canned, billionaires having to flee to Taiwan, the US, Australia, Canada, before they get "disappeared", top University professors and researchers and in general Tibetans, Uyghurs, Hmongs, Taiwanese, Hong-Kongers, Indians, Japanese, Koreans, Vietnamese people... They're creating their own opposition constantly both all around and inside themselves. Maybe that's just another day at work for autocracies though.

-

I'm definitely one of "those". Could you please explain? I couldn't find anything googling "Bei-Dai-River meeting". By the way, thanks for starting this thread Undervalued! I wouldn't be surprised if it ends up being dozens of pages long as I think the US/China relationship (not just tech) will be one of the major questions to untangle if we want to be successful investors during the next decade.

-

Added a little bit to Live Nation (LYV) and Liberty Global (LBTYK)