-

Posts

305 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by WayWardCloud

-

Beginning of the End of Car Ownership as We Know It

WayWardCloud replied to Parsad's topic in General Discussion

I'm glad we're having this discussion thanks for starting the topic! Fear is an understandable reaction to change but I have to say as a foreigner, respectfully, I'm always baffled to see just how much Americans associate car ownership with their personality/way of life/sense of freedom/political leaning... instead of simply a tool to go from point A to point B. Autonomous companies will have to face a pretty steep wall of passionate resistance because cars are being amalgamated with so much more in the national psyche and they seem to trigger really wild reactions such as road rage even in people who aren't otherwise particularly prone to anger. Like we would for any other product, I suggest focusing our attention on use cases instead of listing everything that it isn't. AVs don't have to be the tool for EVERYTHING and don't have to bring forth "the end of car ownership as we know it" to still be a major new exciting TAM opening up. Focusing on that one theoretical time when there is a snow blizzard and you must haul a grand piano on a dirt road within the next 5 minutes or your family dies is really just masquerading an agenda that's more ideological than rational in my opinion, sorry. People used to argue against seat belts and airbags using stories just like that. See also climate change denial. Yes, we will still need emergency vehicles for emergencies, big trucks to haul big things, gasoline-powered vehicles for long distance trips and off the grid usage, etc But here is what Waymo and Cruise seem about to do: - replacing Uber/Lyft/cabs : cheaper, safer, more reliable, use case is already proven. - Offering autonomy to people who cannot enjoy it today: handicapped people especially blind, older folks, under 16yo. That is a HUGE cohort. For example Voyage was focusing exclusively on retirement communities before being acquired by Cruise. - Delivering your Amazon Fresh or Uber eats order to your curb for pickup. Then as the technology matures and scales, price per mile drops and we get - replacing one or two of a suburban family's commuter cars and giving all that time back to people to do something else (napping, working) on their way to and back from work. If you have to deal with bumper to bumper traffic every day I promise you being chauffeured around so you can focus on something else is WAY nicer (Hi Los Angeles!). - replacing car ownership completely for some people who live in downtown high rises where a parking spot is super expensive and who would rather borrow or rent a car once in a while when they do need it (Hi NYC!). These alone represent over a trillion in TAM. No need to forcefully take away all cars from the cold dead hands of car enthusiasts or whatever the big anxiety seems to be. -

That's a great point. Thanks for sharing I understand better what you meant now.

-

Since we already have very popular "What are you buying today?" and "What are you selling today?" threads I thought I'd start this one because I'm curious to hear how everyone is incorporating puts and shorts into their strategy if at all. The market has been on a tear lately and I don't feel like any of the stuff I own is particularly overvalued but it would be nice to have a little bit of a cushion on the downside when the inevitable future rough times hit us someday. I'll start! 2.4% of my portfolio is currently on TSLA Sept20'24 $220 Puts Thesis: - valuation of a tech company but it's a car maker - In China and Europe they're already just one of the many makers because they started late (Europe) and the competition is better (China). This fact hasn't sipped through US investors yet because Tesla has enjoyed pretty much a monopoly here in NA forever. I believe homegrown competition is finally coming in '24 and '25 and that Tesla's share of EV sold in NA should go from 90%+ a few years ago to 70% today to ~50% in the next two years. More importantly, their margins will have to drop as well. We're already seeing them slashing prices left and right so they can keep up with their aggressive revenue growth plans. They have never been demand constrained and whenever they'll hit that wall things will get ugly. - Musk has managed to antagonize both the left and the right. - He's been selling his shares while creating value outside of Tesla for a few years now. - Very limited line up, two cars, and a very minimalist interior style that's not necessarily everyone's preference. People want choice. - They just gave up their one competitive advantage by opening their charging network to competitors. - I'm a self driving tech nerd and FSD is an amazing drivers assist but I guarantee it will never be able to change existing cars into autonomous taxis. Tactic: I'm planning on selling my puts at a gain if Tesla's price lowers enough (or grows into its valuation) to trade at a still rich EV/EBITDA of 20 to 23. Currently we're at 41 and the trough of last December was at 14. Another reason to sell would be Fear&Greed index <40 (Currently 81) no matter the price. I figured if during fearful times people still don't let this one drop like a stone they never will and I should give up. If neither of those happen before expiration I will lose my money but it should mean that the rest of my portfolio has done very well. I think of puts more as a fire insurance on my house than as something that will make me rich. The holy grail being of course to win on both fronts but I'm very aware the tide tends to lift/lowers all boats. This one boat just looks particularly stupidly bloated compared to its little comrades so I'm hoping to capture some of the difference. I should add that I used to own some NVDA Dec'23 $250 puts This was based on their EV/EBITDA ratio of 70 at the time + AI hype. It represented about 1.5% of the portfolio and I sold them all at a loss of ~65% after the monster earnings last quarter pushed the stock to $400 while still lowering the valuation a lot. Big failure on my part. Could be a good bet now, I don't know, I'm pretty dumb so I try at least not to get burned twice by the same flame and moved on. Looking forward to reading your comments!

-

I don't think this contradicts the study. You have to remember survivorship bias. The overwhelming majority of early car makers went bankrupt but the very few that made it out of the haystack and survived such as Ford and GM posted positive returns for many many years since then. So both stats can be true at the same time. Dead companies have no stocks but they sure destroyed all your wealth. There are a million other parameters at play here so you can't really deduce or disprove much using a comparison between market cap weight and equal weight indices. Probably less of a momentum tilt yes but also more of a value tilt, mid-small tilt, different sector weights... Whatever, it's just a different portfolio and the outperfromance or underperformance will come from many factors so maybe some other tilt "makes up" for not having as much of the big winners some of the years and some of the years it doesn't and equal weight underperforms. Also who said the big winners were necessarily the top holdings in weight? I'm not married to this study at all by the way so thanks for bringing it to my attention I just would need some proof/convincing because it looks legit to me. Do you have a source?

-

I think you're nailing it. People with a short bias like saying "The market is up but if you remove the biggest winners it isn't really". That's what markets do. A few winners. Here is the Bessembinder study on that topic for the US. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3537838 - most stocks LOSE value over time - 0.3% of stocks have contributed to 50% of the total wealth creation Agreed as well on Tesla being the exception. I don't know who decided this co should trade like a 2x NASDAQ bull ETF instead of a freaking car maker but dammit I'm coming for their lunch.

-

Added to Liberty Broadband. My one conviction that hasn't gone up in this rally so relatively speaking it's even cheaper now. I just don't see what the market sees... Below is management telling you they're planning to 2x-3x your money in 3-5 years

-

6% dividend, nice! Would love to hear your thesis.

-

I'd buy VTI and be done with it. Basically a completely agnostic toll booth on the entire world. If you can't bring yourself to holding just one ETF then Betterment is a good hands-off wealth management tool. It rebalances between asset classes et harvests tax losses automatically for you according to the risk profile you have initially chosen. Hope you're doing well. Take care,

-

Thanks for explaining! I admire your ability to change your mind, thesis creep is one of my main weaknesses. Eagerly awaiting the split between Liberty Sirius and Liberty Live in June to see if the discount is still significant enough to justify rolling my Live Nation position into Liberty Live. They're planning to use the tracker not only to hold the LYV but also to buy and develop venues of their own in collaboration. Could be fun.

-

What changed? Sold out of MSGE completely today. What a successful trade! I bought at $47 a few months ago, it went up to $61 by the time of the spin so +30%. Then I was able to frontrun people in selling the Sphere and buying the Garden early the day of the spin thanks to Interactive Brokers being on top of their game and made a quick +13% on those shares in a matter of 2-3 weeks. I believe there is more upside to the stock and the Garden is one of those absolute top tier quality assets you could hold on for life and do very well but unfortunately in my opinion Dolan is a narcissistic crook and a nepo baby so I'm not comfortable being in business with him long term. A giant THANK YOU to @Gregmal for the idea and to everyone who contributed to the thread with both positive and negative opinions. Sold out of TIGO (Millicom) today at a loss of about 25% over four years. I started buying in 2019 at $50 and averaged down significantly to a $24 average share price. It went down all the way to $11 then back up to $20 recently thanks to Apollo and Atlas fighting over it. There was a lot to like but oh my goodness did the thesis go wrong! Learned a lot. Q1 was very disappointing and I finally had too much. It's not even about the business anymore it's about guessing secret transactions between big players : towers spin, tigo money spin, the corrupt muni of Medellin, Claure/Apollo vs Niels/Atlas ... and deciding on all of these for us is a management that has just proven it's ready to throw the minority shareholders under the bus for their own benefit... There is tremendous value to be realized but I felt like a sardine waiting to see which shark is going to eat it for dinner.

-

I have a hunch that we might be taking one element for granted when we draw analogies between Russia/Ukraine and China/Taiwan. Not every society has the fighting spirit of the Ukrainians (or the Vietnamese to give another example) and if the Taiwanese don't fight back tooth and nail no amount of US help will be enough to keep China away. Taiwan is a country that has been under constant threat for decades, has just watched Hong-Kong be taken over and yet keeps spending much too little on defense as a percent of its GDP. It's an island and they have the capital and the engineers to quickly turn it into a porcupine if they made it a true national priority. Something just doesn't add up. Look at how Japan is re-arming for example and the difference is stark - but those people have a long history of being warriors (and of having beefs with China). Not to throw shade at anyone by the way, I think being a pacifist people is a very honorable thing, just some thoughts. I really like the concept of Howard Marks to try to find the one thing "everyone knows" that just isn't. Everyone seems to assume Taiwan doesn't cave in quickly and instead would rather walk their youth straight into a giant meat grinder to safeguard their cherished independence. I mean can you imagine what this Island will go through if a proxy war between two superpowers rages on it? Look at what's left of Ukraine. If they are not successful at pushing back the first wave of Chinese landings there is a good argument to be made to avoid escalation and negotiate some half-ass special status within China just a few days after the start of hostilities.

-

I like it. Original enough to vastly differ from average market returns and give you FU money if you are right and or lucky, anchored enough to live to fight another day if you are not. How much of your net worth is this portfolio? Did the CSU concentration happen from the position growing naturally or was it a deliberate choice to buy that much? Thanks for sharing!

-

Sold all my SPHR at open and rolled some of the proceeds into MSGE.

-

I enjoy this twitter account intensely https://twitter.com/TikTokInvestors

-

How about this bad boy? https://www.ishares.com/us/products/239659/ishares-msci-india-etf

-

No significant other but you nailed it regarding the cats, John! I have long accepted that my real job on Earth is tuna can opener, everything else is just silly hobbies I have on the side. Back on topic. Thanks everyone for sharing, it's fascinating! I worry a bit when I see similar names coming up in everyone's portfolio (including mine!). The bubble effect is real... As well as the Gregmal halo!

-

-

I think the market's logic is as follow : Regional banks stress will force the Fed to stop or even reverse rate hikes. Lower rates make growth assets more valuable.

-

Basket of Large Cap US Financials - No Brainer Buy Today?

WayWardCloud replied to Viking's topic in General Discussion

Maybe I'm being too greedy but I just don't think large banks as a whole have fallen all that much to justify getting excited. In my mind it's a good time to enter if you wanted to add them anyway but if that little dip is all there is to the crisis I won't mind passing on it and waiting for something else to swing. If you have a strong conviction on a specific name that's down much more then obviously that's a different story but I'm not knowledgeable enough to stock pick here. We had similar prices last October and last June without any of the fuss. -

Bet a bit against Tesla to protect my downside after very strong January gains. June16'23 $190 Puts

-

Anyone calling it "the" Ukraine a year into the conflict disqualifies themselves to have an opinion in my book. Literally can't even name correctly the place they think they understand so much better than everyone else, please

-

Sold Live Nation (LYV) for a nice profit. My whole thesis is that it's a monopoly and it seems like politicians might be waking up to the fact. Yet still trading right at their average valuation (excluding covid and post-covid bubble) of about 1 times sales. I'm planning on staying away for a bit and hop back in if they get out unscathed of that self-inflicted mess. https://www.nytimes.com/live/2023/01/24/arts/ticketmaster-taylor-swift

-

Thanks so much. Wondering how the calls on Newco can be traded if they don't add up to lots of 100s

-

What happens to calls during a spinoff? I've never held derivatives during one.

-

What do you think of Analyst Estimates and how useful are they?

WayWardCloud replied to Luca's topic in General Discussion

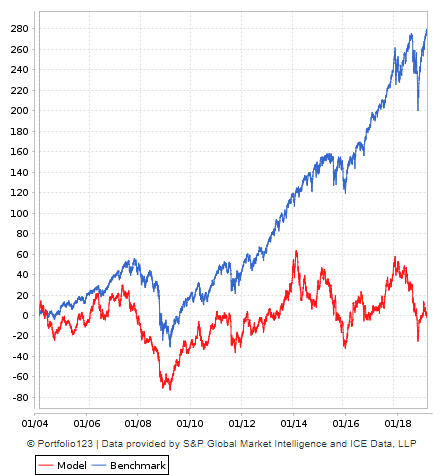

Great question! Someone backtested it: https://www.gurufocus.com/news/874000/a-backtest-approach-do-wall-street-analysts-add-value The blue line is the whole US market (VTI) The red line is analysts recs Killing it