Viking

Member-

Posts

5,100 -

Joined

-

Last visited

-

Days Won

49

Content Type

Profiles

Forums

Events

Everything posted by Viking

-

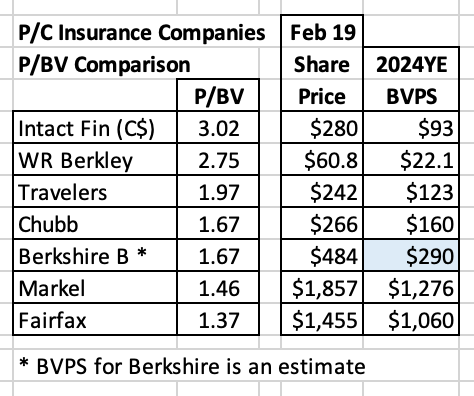

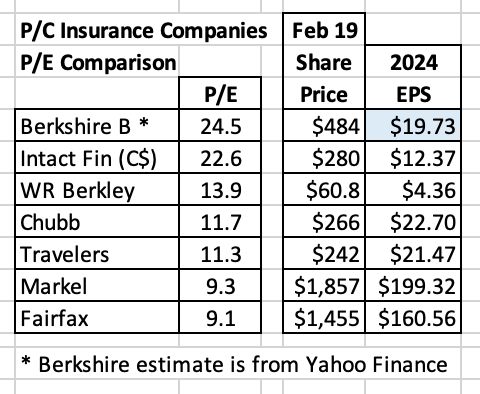

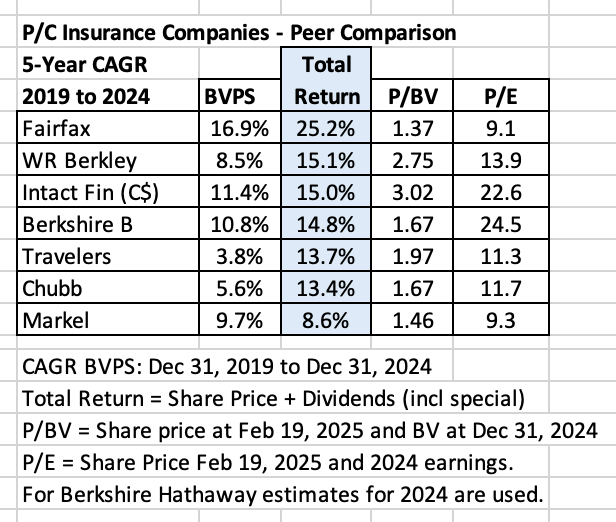

How Does Fairfax’s Valuation Compare to Other P/C Insurance Co’s There are lots of methods an investor can use to value a company and its share price. In this post, we are going to use a method called ‘relative valuation.’ We are going to compare Fairfax to other P/C insurance peers to see what we can learn. How have they performed? How are they being valued today? When compared to some of the best P/C insurance companies in North America. Which companies are we going to include? Below is the list of the seven P/C insurers we will compare (listed in alphabetical order): Berkshire Hathaway: historically, the gold standard; now more of a conglomerate than P/C insurer. We include it for fun. Chubb: Large, traditional insurer; international in scope. Fairfax Financial: An up-and-comer; about 30% of investments are in equities; international in scope. Intact Financial: Largest P/C insurer in Canada; expanding globally. Markel: ‘Baby Berk’; US focus Travelers: Large, traditional insurer; US focus. Part of DJIA. WR Berkley: Traditional insurer; US focus To state the obvious, all P/C insurance companies have unique business models. As a result, we will keep our analysis very high level. Buffett suggests 5 years is a good time frame to use to measure/evaluate the performance of a company - so that is what we will use. Berkshire Hathaway has not released Q4, 2024 results yet. So for them I have used an estimate for 2024YE book value and 2024 EPS. ————— “In other words, the percentage change in book value in any given year is likely to be reasonably close to that year’s change in intrinsic value.” Warren Buffett The most important metric used by investors and analysts to assess the performance of a P/C insurance company is change in book value. Yes, it has its flaws. However, it is a good place to start. 5-Year Change in Book Value We are going to look at the change in book value from December 31, 2019 to December 31, 2024. We have sorted the results in the table below from the best to the worst performers. So, which company has increased BVPS the most? Fairfax Financial. Fairfax has grown book value by 118% over the past 5 years, a CAGR of 16.8%. Wow! The second surprise is the size of Fairfax’s outperformance - it is much higher than #2 Intact Financial and way, way higher (+10% per year) than #6 Chubb and #7 Travelers. I think it is safe to say that Fairfax’s performance has trounced that of its peer group. That is pretty impressive. There are a lot of many quality P/C insurance companies on this list. Were you expecting that? I bet you weren’t expecting that. Looking at accounting results is only the start An added wrinkle The investment portfolio of most P/C insurance companies contain mostly bonds. These are easy to value. As result the value of the investment portfolio captured in book value for most P/C insurance companies is pretty accurate. Fairfax owns lots of equities (about 30% of the total investment portfolio). And over the past 5 years, the ‘excess of fair value over carrying value’ for associate and consolidated companies has increased and sits at $1.48 billion pre-tax ($68/share) at December 31, 2024. This is economic business value that has been created by Fairfax over the past 5 years that has not been captured in its accounting (book) value. When we include this additional value creation, Fairfax’s outperformance versus peers is even better than what we see looking only at the change in BVPS. In recent years Buffett has soured on using book value to measure the performance of Berkshire Hathaway (it is now a conglomerate). His new preferred measure for Berkshire Hathaway? The change in the stock price over time. So let’s now compare the performance of the same group of insurance companies using this measure. Some of our companies pay a dividend. So to be fair, we are going to look at total shareholder return (total increase in share price + dividend paid). 5-Year Total Shareholder Return We are going to look at the total shareholder return for the 5-year period from December 31, 2019 to December 31, 2024. Once again, we have sorted the results in the table below from the best to the worst performers. So, which company has seen the biggest increase in their share price? Fairfax Financial. It has delivered a total return of 208% = CAGR of 25.2% That is an outstanding level of performance - especially over a 5 year time frame. A second surprise is the size of Fairfax’s outperformance compared to peers… it has been much better - more than 10% more per year than the #2 WR Berkley and more than 15% higher than #7 Markel. Wow! Markel has been the clear laggard of the group, with a CAGR of 8.6%. The remaining 5 companies all have a very respectable CAGR in the mid to low teens, which is good. The P/C insurance sector has been a pretty good place to invest over the past 5 years. Let’s move from measures of past performance. Let’s now look at some measures of valuation and how our 7 companies compare. Let’s start by comparing the stock price with the all important measure of book value. Price to Book Value (P/BV) We are going to use the share price for each company today (Feb 19, 2025). And their book value at December 31, 2024. This will give us a trailing P/BV multiple. We have sorted the results in the table below from the company with the highest multiple (most expensive) to the lowest (cheapest). Does anything in the chart below jump out? Fairfax’s valuation is the cheapest. And compared to the most expensive companies (Intact Financial and WR Berkley), Fairfax’s valuation is much, much cheaper. Fairfax’s valuation is even cheaper than it looks - when we include ‘excess of FV over CV for associate and consolidated holdings’ (we discussed that earlier in this post so we won’t repeat it here). Let’s look at another valuation measure and see what it tells us. Yes, P/E is frowned upon as an measure to use when analyzing P/C insurance companies. But it can be useful as a tool to compare companies in the same industry. And that is what we are doing here. Price to Earnings Ratio (PE) We are going to use the share price for each company today (Feb 19, 2025). And their reported earnings per share for 2024. This will give us a trailing P/E ratio. We have sorted the results in the table below from the company with the highest ratio (most expensive) to the lowest (cheapest). Does anything in the chart below jump out? Fairfax’s valuation is the cheapest. Again. And compared to the most expensive companies (Berkshire Hathaway and Intact Financial), Fairfax’s valuation is much, much cheaper. Conclusion 5-Year Performance When looking at a large group of high quality P/C insurance companies, Fairfax has delivered the best performance over the past 5 years - both in terms of increase in BVPS and total shareholder return (share price + dividends). The second key take-away is Fairfax’s outperformance of peers - across both measures - has been significant. It has been much, much better. What this demonstrates is the outstanding job that Fairfax has done of building per share value for shareholders over the past 5 years. It has a high quality P/C insurance business. Its investment management business is once again performing at a very high level. And the execution from its senior management team has been best-in-class. Current Valuation When looking at the same large group of high quality P/C insurance companies, Fairfax’s share price today is trading at the cheapest valuation across both P/BV multiple and PE ratio measures. The second key take-away is how much more cheaper Fairfax than many peers - the gap is very large. What does this mean? An investor today is able to buy the top performing P/C insurance company - with among the best future prospects - at the cheapest valuation. Does that make any sense? No, of course not. "The way of the successful investor is normally to do nothing -- not until you see money lying there, somewhere over in the corner, and all that is left for you to do is go over and pick it up." Jim Rogers ————— What is really going on with Fairfax today? Investors have apparently forgotten the incredible power of the P/C insurance (float) model. Buffett leveraged the P/C insurance (float) model to deliver staggeringly high returns for Berkshire Hathaway shareholders. But even more impressive was how long he was able to sustain that performance - it went on for decades. Yes, Fairfax has had 5 very good years. But they are still a small company. It looks to me like they are just getting started. (Hint: There are many ways to use the P/C insurance (float) model to drive incredible returns for shareholders over the long term. Shelby Davis. Henry Singleton/Teledyne. Larry Tisch/Loews. And yes, Warren Buffett/Berkshire Hathaway. The really important point is they all did it in very different ways. Today Fairfax is providing us with the next iteration of how to capitalize on this very powerful model to drive enormous value for shareholders over the long term. Lots of investors just don’t see it yet. And that succinctly explains how the top performer can trade at the cheapest valuation.) Still not sure what to do? If so, you might want to read my last long-form post (it is the sister post to the one above): Is Fairfax ‘the big fish that got away?’ Musings on mistakes that investors keep making. https://thecobf.com/forum/topic/21117-fairfax-2025/page/16/#findComment-601681

-

@glider3834 I appreciate the heads up. Board members, please let me know if you see any other items that can be updated. Your input helps me greatly in keeping the summary accurate/up to date.

-

@Munger_Disciple, as of today, I am comfortable having Fairfax as a core position of about 35% of my total portfolio. I will flex this position up (and then back down) to take advantage of short term price volatility (like I do with all the stocks I own). I think this is what I have been constantly saying for about a year now. Disclaimer: I may change my mind tomorrow. So you are warned! Position size is a complicated topic. It is very situational. And my views on the subject are not fixed - they are continually evolving. Factors for me: - Age / life stage / health situation - Size of total portfolio - Percent of total net worth in financial assets - Estate planning - My spouse (quite risk averse) - Opportunity set - Account types (most of my financial assets are in registered accounts - so it is very easy for me to flex my position) Note, none of the above includes a discussion of the company and its intrinsic value - which is also important

-

We have just had 2 very strong years - equity markets are up +50%. Valuations are probably getting stretched. I like that Fairfax is being very disciplined. But this will change - we will get another bear market. And next time, Fairfax will be flush with cash….

-

Since 2018, Fairfax’s track record with new equity purchases has been very good. The perception is they invest in value traps. That was true pre-2018. That has not been the case since then. Further, they have dealt with almost of all of the former value traps that they owned from pre-2018 (what is remaining is very small it terms of the total equity portfolio). A great example is Stelco. Bought in late 2018. People hated it at the time (including me). At the time it probably checked all the boxes of being a classic value trap. And then it then delivered a CAGR of 25% per year for the next 6 years. Simply outstanding.

-

The equity hedges were taken of at the end of 2016. That was more than 8 years ago. The Blackberry purchase was years before that. My view is Fairfax has learned important lessons from mistakes made in the past. I think it actually makes them a stronger company today. The analogue is when Fairfax messed up on the insurance side of its business in the early 2000's. The lesson's learned then have resulted in the strong insurance business model they have today. They learned from their mistake and it has made them a stronger company. Yes, the view is not what the current narrative is today regarding Fairfax. But that is where my reading of the facts/analysis takes me. I could be wrong. We will see in the coming years.

-

@Txvestor, I love your post... so many juicy topics to discuss/debate. My comments are going to be pretty random... and I am going to go big picture - because I think that is the best place to start when looking at specific topics. Hopefully my comments make sense 1.) FFH-TRS - Fairfax's best investments are make when we have wicked volatility. We haven't had wicked volatility for the past 2 years - so Fairfax has not been able to make 'home run' type investments lately. But that is ok (it is what it is). My guess is they will get their opportunity in another year or two or three. I think lots of Fairfax investors are fearful of volatility and what it will do to Fairfax's results in the short term (not you per se). My view is they have it backwards. 2.) Selling. I am liking this part of Fairfax's capital allocation strategy more and more. There will always be a bubble forming somewhere. Fairfax will get more wonderful opportunities to sell high in the future. We just don't know what or when. For example, if we get a surge in nat gas prices later in 2025/2026 (as all these LNG export facilities come on-line in the US), EXCO looks like it might be an ideal take-out candidate. This is just one example. 3.) Stock buybacks. The key here is what is the actual intrinsic value of Fairfax? My guess is Fairfax has a pretty good idea. They just told us they they still view the FFH-TRS position as being a good investment moving forward. As I have stated before, I hope they keep vacuuming up shares at current prices. Back in late 2021 they paid around 1 x BV. Three years later we learned they got a steal of a deal. My guess is in three years time we will look at stock buybacks at today's prices as being a great deal for long term shareholders. 4.) Interest rates matter. So does the size of the fixed income portfolio and it is growing rapidly in size - due to earnings from a 5% yield and continued top-line growth in the insurance business. What it is invested in also matters - the recently announced Blizzard deal is very interesting in this regard. Bottom line, 'interest and dividend income' is likely to remain robust. 5.) Yes, insurance is slowing. But it is still growing. Only about 20 to 25% of Fairfax income streams come from underwriting profit (a traditional P/C insurance company is closer to 45%). Bottom line, Fairfax is much less exposed to the P/C insurance cycle than a traditional P/C insurance company. In the near term they will continue to take out minority partners. And continue to make more bolt on acquisitions (like Albingia in France). Fairfax also has the ability to shift capital not needed in insurance to other opportunities that will yield a high return. A soft insurance market may also sow the seeds for the next spike in growth (via acquisition). 6.) Greek and Indian economies will ebb and flow. Like I stated above, volatility is good for Fairfax - and it is good for its equity investments. They are well managed and will look to be opportunistic in any downturn. It really is counter-intuitive. Conclusion: It is not possible to know with certainty what Fairfax is going to do in the future. I think looking for certainty might be a mistake. It really comes down to do you trust management. In 2020 I would have probably answered no. But today? I do trust them. I think they have earned it with the execution they have delivered over the past 5 years. Of course my eyes are wide open.

-

I think I am going to print this, frame it and put it on the wall in my den. It is simply brilliant. I couldn't stop smiling when I read it (and I mean that is a good way).

-

@djokovic1, nice analysis. Another thing to keep in mind is book value at a traditional insurance company will capture the value of the investment portfolio pretty accurately. Because most insurance companies are 90% bonds/fixed income and these are pretty easy to value. Fairfax has a big equity portfolio. Over the past 5 years, excess of fair value over carrying value for associate and consolidated companies has increased in value by about $2 billion (from a negative number to a big positive number today). My guess is none of this significant value creation is captured in Fairfax's L5Y ROE of 17.3% that you posted above. And there is even more. The 'fair value' for holdings like BIAL also look materially low. My guess is there are other examples (like what is phantom holding AGT Food Ingredients worth these days?). Bottom line, Fairfax's performance over the past 5 years has been much better than people realize. 'Best in class' is not an exaggeration.

-

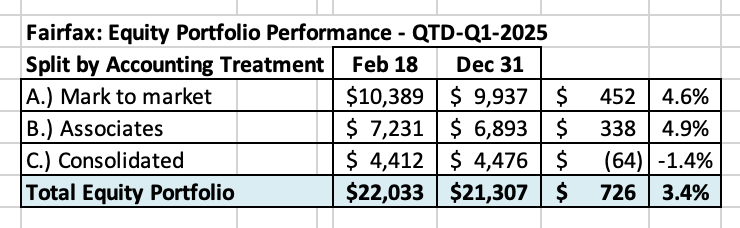

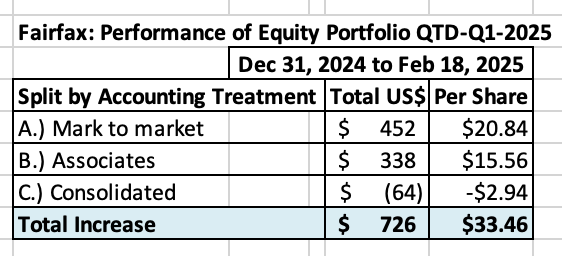

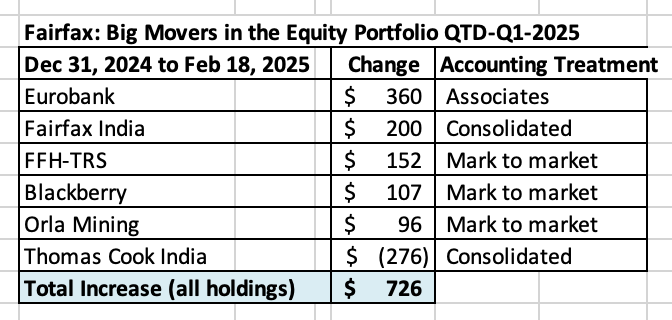

Fairfax’s equity portfolio (that I track) increased in market value from December 31, 2024 to February 18, 2025, by about $726 million (pre-tax). The equity portfolio had a total value of about $22.0 billion at February 18, 2025. Included in our estimates is information from Fairfax’s Q4-2024-13F and its year-end earnings news release on February 13, 2025. When Fairfax releases their annual report (March 7th) we will get updates to lots of important information, especially the YE 2024 carrying values of many of the large associate and consolidated equity holdings. Notes: The FFH-TRS position is included in the mark to market bucket and at its notional value. The warrants and debentures captured are also included in the mark to market bucket. The ‘tracker portfolio’ is not an exact match to Fairfax’s actual holdings. It is useful only as a tool to understand the rough change in Fairfax’s equity portfolio (and not the precise change). The ‘tracker portfolio’ does not include the following: Any change in value of Digit, Fairfax's publicly traded P/C insurance company in India. Split of holdings by accounting treatment About 47% of Fairfax’s equity holdings are mark to market - and will fluctuate each quarter with changes in equity markets. The other 53% are Associates and Consolidated holdings. The Sleep Country and Peak Achievement (Bauer) acquisitions closed in Q4. We have included a guess of the carrying value for these two holdings – it will be updated when Fairfax releases its annual report. Over the past couple of years, the share of the mark to market holdings has been shrinking. This means Fairfax's quarterly reported results will be less impacted by volatility in equity markets. Split of total gains by accounting treatment The total change is an increase of about $726 million = $33/share (pre-tax) The mark to market change is an increase of about $452 million = $21/share. What were the big movers in the equity portfolio Q1-YTD? The usual suspects continue to perform very well - Eurobank and FFH-TRS. Fairfax India's stock price has spiked higher to start the new year. Not sure what is up with Blackberry's big move higher. Orla Mining (a gold stock) continued to run higher which is not surprising given the big move in the price of gold. At the same time, after a strong 2-year run higher, stocks in India have been selling off in recent months. Excess of fair value over carrying value (not captured in book value) For Associate and Consolidated holdings (in my tracker), the excess of fair value to carrying value is about $1.48 billion pre-tax ($68/share). The 'excess of FV to CV’ has been materially increasing in recent years. This is economic value that has been created by Fairfax that is not captured in book value – it is a good example of how book value is understated at Fairfax. Excess of FV over CV: Associates: $838 million Consolidated: $644 million Equity Tracker Spreadsheet explained: We have separated holdings by accounting treatment: Mark to market Associates – equity accounted Consolidated Other Holdings – total return swaps and warrants/debentures The value of each holding is calculated by multiplying the share price by the number of shares. All holdings are tracked in US$, so non-US holdings have their values adjusted for currency. This spreadsheet contains errors. It is updated as new and better information becomes available. PS: I have attached the updated version of my Excel workbook at the bottom of this post. Fairfax Feb 18 2025.xlsx

-

I think one of the keys when looking at PE is earnings quality. If earnings quality is low (like cyclical companies) then using PE is not useful. But PE is useful for high quality earnings streams. Fairfax’s biggest income stream today (by far) is interest and dividend income - very high quality. Especially with an average duration on the fixed income portfolio of 3.3 years. Underwriting is high quality. As is share of profit of associates. With the additions of Sleep Country and Peak Achievements, the non-insurance consolidated companies income stream will be increasing materially in size and in consistency/quality. Given the transformation that Fairfax has seen in its business/income streams over the past 4 years (to much higher quality sources), its PE today provides more information when looking at valuation than is generally appreciated (IMHO). ————— Not that long ago (pre 2021), around 45% of earnings at Fairfax were driven by investment gains, which was very volatile. That is no longer the case. I think investment gains is now closer to 20% of the total. Investment gains is still a big number. It’s the other 4 income streams that have ballooned in size.

-

@giulio , a agree that Fairfax’s shares were very undervalued in 2020. But I think 2 other factors have also contributed a great deal - perhaps they are equally important to the spike in the share price. 1.) Managements decisions. The decisions the management team at Fairfax have made since 2020 have been exceptional. They have delivered billions in incremental shareholder value. This was not visible to shareholders in 2020. Putting on the FFH-TRS position Selling pet insurance / selling Resolute Forest Products at the peak of the lumber cycle / Stelco sale in 2024. Aggressively buying back stock over past 4 years (sale of 10% of Odyssey was brilliant). Buying more of much of what they already owned (too many transactions over the past 4 years to list) 2.) External events. External factors (finally) aligned with how Fairfax was positioned. This also delivered billions in incremental shareholder value. This was also not visible in 2020. Spiking in inflation and interest rates when the fixed income portfolio was sitting at 1.2 years average duration. Hard market in insurance since late 2019. Renaissance of Greek economy - catapulting the investment in Eurobank. Modi’s continued transformation of economy in India - pro capitalist - spiking Indian equities. So over the last 4 years we had three things happen at the same time: Wicked low share price. Best in class execution from management. External environment lining up with how Fairfax was positioned. The key in my mind was staying up to date on what was happening at the company / monitoring the story. Understanding what was going on with the fundamentals (continually/materially improving year after year) helped an investor not get anchored to the stock price.

-

I think you have to remember that Buffett in his younger years was able to compound at 20% per year in his sleep. So it made little sense for him to buy back stock - regardless of where it was trading. Fairfax is good, but they are not as good as Buffett in his prime (no one is). As a result, stock buybacks will make much more sense (as a capital allocation option) for Fairfax than they did for a younger/smaller Berkshire Hathaway. Over the years, Berkshire has morphed into a huge conglomerate, with a side P/C insurance business. In recent years, Fairfax has doubled down on P/C insurance business (quadrupled its size the past 10 years if memory serves me correctly). So today, some comparisons between Berkshire and Fairfax make sense. Others do not (IMHO) - like applying Buffett's 1.2 x BV 'rule of thumb' for buybacks to Fairfax.

-

@Buffett_Groupie , one of the interesting things with Fairfax in 2020 was an investor did not have to buy stock during the viscous Covid sell off that hit all stocks in March. Everything was on sale then. The general stock market did not stay down for long... it was back to new highs by August 2020. But Fairfax? Fairfax never recovered. In October the S&P500 was hitting new all time highs and Fairfax was still trading 40% below its pre-Covid price. Fairfax's stock portfolio was recovering (a big reason for the initial sell off)... so the stock price in October 2020 made no rational sense. Fortunately, a few posters on this board were pounding the table (I remember Sanjeev's posts.. but there were others). It was only in October that I got back on the Fairfax train. And I aggressively sized my position up in November when the vaccine news came out. With hindsight, I was extremely lucky (that Fairfax remained so cheap for so long). Fairfax is a great example of just how much time investors sometimes have to get comfortable with an investment and to get their positioned sized right. In Fairfax's case, an investor had 8 months. And that was if you wanted to bottom tick the opportunity. As we now know, 2021, 2022, 2023 and 2024 were also wonderful times to buy shares in Fairfax. Yes, that is a little nuts.

-

I could have written this post to 1990's version of myself... I messed up with Berkshire Hathaway then. Big time. I owned the stock many times. And always sold it for a nice gain. But I missed out on making the big money (getting my position size right and then sitting on my hands). I am trying to not make the same mistake with Fairfax today. Fairfax looks to me like it has a similar set-up to a much younger Berkshire Hathaway. I don't expect Fairfax to compound at +20%. But I think 15% over the next few years is doable (I am talking about intrinsic business value). Fairfax also will get there in very different way than BRK did back in the 1990's. I am ok with that. Congrats on your long-standing investment in Berkshire. Well done.

-

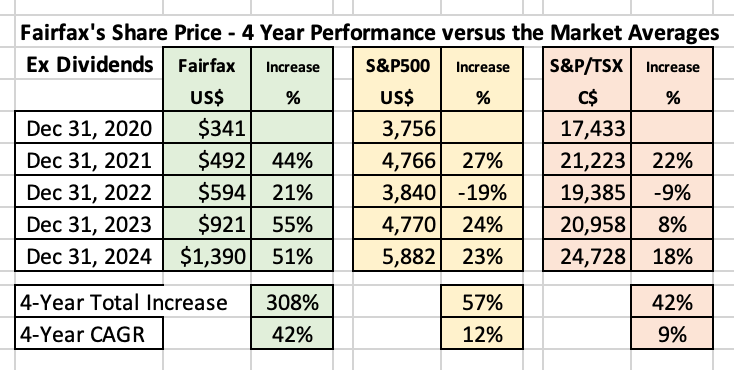

Is Fairfax the big fish that got away? Musings on mistakes that investors keep making. Introduction Investors have lots of regrets. Missed opportunities. Not buying a stock that afterwards turns into a big winner. Or selling a winning position way too early. ‘The big fish that got away’ kind of story. These stories resonate so much because big fish are very hard to catch. When you have one nibbling at the end of your fishing line you need to make sure you hook it and reel it in. It might be a long time before another one comes along. In 2021, Fairfax’s shares delivered a return of 44%. After such a big run in the share price over such a short period of time (one year), an investor looking at Fairfax in early 2022 (who did not own shares) might have reasonably concluded ‘Dang, missed that one!’ and not invested. ‘I’ll just wait for a sell off in the shares and buy them then.’ At the time, this logic and approach probably made perfect sense! It was Fairfax after all… a perennial underachiever. Of course the shares would sell off at some point (like they always had over the previous decade). In 2022, Fairfax’s shares delivered a return of 21%. Most stocks got crushed in the bear market of 2022, so Fairfax’s performance compared to the market averages was exceptional (+40% compared to the S&P500). That same investor, looking at Fairfax in early 2023, might have come to the same conclusion: ‘Dang, missed that one! For the second year in a row!’ and again decided to not invest in Fairfax. The fish story just got a little bigger. In 2023, Fairfax’s shares delivered a return of 55%. What? A third year in a row of significant outperformance compared to the market averages? Surely that meant that Fairfax’s shares were now way overvalued - that’s the only thing that explains Fairfax’s improbable run over the previous 3 years. So, should a rational investor buy shares in Fairfax in early 2024? Are you kidding? No. Obviously the easy money has been made with this investment. Only a sucker would buy shares after the run they have had the past three years. Our fish story is turning in to a whopper of a tale. What happened in 2024? After three great years, Fairfax must (finally) have had a terrible year in 2024… right? Nope. In 2024, Fairfax’s shares delivered a gain of 51%. Over the past 4 years, Fairfax’s shares have returned 308% (plus another $45/share in dividends), making it a ‘3 bagger’ in Peter Lynch parlance. Investors who did not buy shares (or those who sold their position way too early) are now left asking themselves what happened? How did they miss out on one of the great investments of the past four years? How did they let such a big fish keep slipping through their fingers - year after year? After all, it was right there - staring them right in the face! Our fish story just keeps getting bigger and bigger. So here we are at the beginning of 2025… and investors who don’t own the stock (or those who sold their position way too early) are once again asking themselves ‘What do I do now?’ Fairfax, the ‘big fish,’ continues to taunt investors. ————— What is one of the keys to being a successful investor? In other posts we focus on what investors need to do to be successful. In this post we are going to flip the script and focus on mistakes investors have been making with Fairfax over the past 4 years. Avoiding common mistakes is a great way to improve returns. Charlie Munger passed away a little over a year ago. In this post we honour Charlie, who was the master of inverting. Avoid doing stupid things “It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.” Charlie Munger Truth be told, many of the people who did well with Fairfax as an investment over the past 4 years likely didn’t do well because they were smarter than most other investors. Rather, many did well simply because they avoided making big mistakes. Some of which are reviewed below. In the remainder of this post, we are going to review 5 mistakes that some (many?) investors have made when analyzing Fairfax over the past 4 years: Using a faulty investment framework. Getting badly burned by a stock. ‘Past performance is the best predictor of future performance’ Missing out on a big winner (that you knew about). Watching a stock you sold spike higher in price. ————— Brains/intellect mistake The first mistake we are going to review is one of logic. 1.) Using a faulty investment framework. Price (by itself) is a terrible investment framework to use to value a stock. Of course, what matters to value a stock is your estimate of the intrinsic value of the company and how it compares to its current share price. Building a good investing framework One of my all-time favourite books on investing is ‘One up on Wall Street’ by Peter Lynch. It was published way back in 1989. And it is full of investing wisdom - it has many useful mental models to help investors build out their investing framework. And because mental models don’t have a shelf life - they are still very useful for investors today. ‘Ive Got It, I’ve Got It. What Is It?’ - One Up on Wall Street by Peter Lynch As outlined in Chapter 7 of his book, before trying to value a stock, Lynch would first drop it in to one of 6 categories: Slow growers - ‘Large and aging companies that are expected to grow slightly faster than the GNP.’ P100 Stalwarts -‘ These multibillion-dollar hulks are not exactly agile climbers, but they’re faster than the slow growers.’ P104 Fast growers - ‘These are among my favourite investments: small, aggressive new enterprises that grow 20 to 25 percent a year. If you chose wisely, this is the land of the 10- to 40- baggers.’ P108 Cyclicals - ‘A cyclical is a company whose sales and profits rise and fall in regular if not completely predictable fashion.’ P109 Turnarounds - ’Turnaround candidates have been battered, depressed, and often can barely drag themselves into chapter 11.’ P113 Asset plays - ‘An asset play is any company that’s sitting on something valuable that you know about, but that the Wall Street crowd has overlooked.’ P115 Why did Lynch categorize stock opportunities? Classifying stocks properly at the beginning of the process is critical. Because the classification determines the proper method to use to analyze and then to value the stock. ‘Putting stocks in categories is the first step in developing the story. Now at least you know what kind of story it’s supposed to be. The next step is filling in the details that will help you guess how the story is going to turn out.’ P120 Categorize => Develop the story => Analysis/forecasts and valuation => Buy (or not) decision An important point is your goal as an investor is not to try and clone other great investors, like Lynch. That is impossible. The key is to copy the parts that resonate and fit with your intellect/psychological wiring. I like the idea of categorizing stocks - but I don’t try and shoehorn all stock opportunities into one of Lynch’s 6 categories listed above. I am a flexible. There is a second important insight Over time, some companies move from one category to another. ‘Companies don’t stay in the same category forever. Over my years of watching stocks I’ve seen hundreds of them start out fitting one description and end up fitting another.’ P118 This highlights the importance of monitoring what is happening at a company (management, fundamentals, business results, prospects). It its critically important to be open minded, flexible and to be rational with what you learn. Because this will help ensure you continue to categorize the company properly. Especially those companies that have lots of things going on. You need to be able to recognize when a change in classification is appropriate. What does this have to do with Fairfax? Over the past decade, it looks to me like Fairfax has changed ‘categories’ 3 times. This is very unusual - most companies don’t change categories once. This is likely an important reason why many investors have missed the opportunity - they had the stock categorized improperly. Below is a highly simplified summary of how I have categorized Fairfax over the past decade: 1.) Pre-2019: ‘old Fairfax’ Ok P/C insurance business. Below average investment management business. 2.) 2019-2021: Turnaround Fixing the investment management business (hedges/shorts/investment framework). 3.) 2022-2023: ‘new Fairfax’ - an improved version of ‘old Fairfax’ Ok P/C insurance business. Ok investment management business. 4.) 2024 to today: new Fairfax - a high quality company Above average P/C insurance business. Above average investment management business. Best in class management team. Information advantage In 2020, no one - investors or analysts - were following Fairfax. It was a hated company. So the few investors who were following the company also had a big information advantage. They were able to recognize the many positive changes that were happening under the hood at Fairfax - a year or so before they actually showed up in the financials. It was like having a crystal ball. All an investor had to do was buy the stock, get their position size right and then be patient. As we begin 2025, the information advantage has shrunk. But my guess is lots of investors/analysts today are categorizing Fairfax the wrong way - they are stuck in ‘Ok P/C insurance business. Ok investment management business.’ And this will likely cause them to use the wrong method to analyze and value the stock. My guess is Fairfax’s P/C insurance business, investment management business and senior management team are all better than most think. As a result, like the past 4 years, I expect Fairfax to continue to outperform the expectations of investors/analysts (in terms of growth in intrinsic business value). This usually is a pretty good set up for a stock (it usually means it is being undervalued). ————— Psychological traps The remaining mistakes we will review are the result of using faulty mental models. They get into the behavioural part of investing, that Munger so often talked about. 2.) Getting badly burned by a stock Hand on the stove problem: Getting badly burned by a stock is usually a really hard thing to overcome. The mental and financial scars are real. Once that happens, it is really hard to look at the company and be objective. This is probably a much bigger problem for institutional investors (because of the hit to their reputation from putting clients in a chronically poorly performing stock) than individual investors. Fairfax’s stock delivered a lost decade for shareholders (2010 to 2020). It was not a fun time to be a shareholder. Facts are facts. What is the solution? Time. It can take years to work up the courage to go back into the water. 3.) Past performance is the best predictor of future performance Investors use lots of rules of thumb when they analyze stocks (called heuristics). This is one of them. How an investment has performed in the past (accounting results, management and share price) is important to understand. But they are not all an investor needs to look at. For example, accounting results tell you what has happened in the past. They don’t tell you what is going to happen in the future. And they certainly don’t tell you what a company is worth or how it should be valued. This is especially true for a turnaround play - like Fairfax was back from 2019 to 2021. For a turnaround that has successfully turned around, focussing on past performance will usually not help much. Actually it is worse than that. Focussing on past results/management decisions will likely lead an investor to materially underestimate the fundamentals of the company and its future earnings. This will lead them to materially undervalue the stock. And this will often cause them to not invest - or to sell a winning position way too early. Exactly what we saw play out with Fairfax year after year. What is the solution? Be inquisitive. And be open minded with what you learn. 4.) Missing out on a big winner (that you knew about). It is really hard to buy a stock that is rising in price. Especially if you researched it early on and didn’t pull the trigger (buy any shares). This is also a big problem for many value investors - because buying a stock that is rising in price just doesn’t rhyme with ‘buy low’. And watching the stock just keep powering higher (that you didn’t buy) is about as much fun as repeatedly getting punched in the nose - it just doesn’t feel very good. So what do investors do? For starters they probably take the stock off their watch list - out of sight / out of mind. That makes them feel better. And they say things like ‘I’m not going to chase it’ - because it sounds smart to them at the time. Bottom line, they avoid the stock. Of course, if the stock is a big winner (like Fairfax has been), well this strategy is really dumb. Ignoring the big winners is a really hard way to outperform the market averages, let alone make the big money. Especially if you understand the company/industry (i.e it is in your circle of competence to begin with). What is the solution? Be rational - your brain (investment framework) needs to over-rule your gut (emotions). 5.) Watching a stock you sold spike higher in price. How many times have you sold a winning stock way, way too early? Only to regret it year after year after year… as it keeps powering higher. And you think of what could have been… (This was Berkshire Hathaway for me back in the 1990’s and 2000’s.) It is really hard for most investors to buy back a stock that they sold when it is now trading at a much higher price. This mistake is the sister of the one we just discussed. But what do you do when you realize this has happened? Do you buy it back? No, of course not. Because… well, we just reviewed all the reasons in 3.) so we won’t review them again. What to do? Get better with your sell strategy. Most people spend most of their time thinking about what/when to buy a stock. They spend very little time on why/when to sell. So their sell strategy is not very sophisticated - and this leads them open to making behavioural mistakes, like selling a winning position way too early - for not good reasons. Conclusion ‘Investing is simple (not easy).’ Charlie Munger What makes investing so difficult? The biggest mistakes made by investors are often driven by behavioural mistakes. Emotions are an unseen driver of our investment decisions. They can distort/warp a well thought out investment framework. In turn, this can result in poor decisions and sub-optimal returns. It is critical to recognize that emotions (behavioural factors) are a part of the investment process - because we are humans (not robots). But emotional responses can’t be allowed to knock your ship off its intended course. As a result, you must be constantly on your guard. It is important to self-reflect - and to be honest with yourself with what you learn. Make adjustments as needed. It’s important to ensure your emotions aren’t what is sitting in the captain’s chair. Given its incredible run over the past 4 years, is Fairfax’s stock still a buy today? The answer is simple. It will depend on your estimate of what the intrinsic value of the company is today. And how it compares to the price of the stock. And as Munger reminds us, that is also the hard part. (And make sure you don’t fixate on the price move of the stock over the past 4 years - or that fish story is likely to turn into even more of a whopper of a tale.) ————— Narrative Narratives for companies take years to get established. And once established, they are very slow to change (taking years). This works for most companies - where things change slowly. For the past 5 years, it looks to me like the narrative for Fairfax has been continuously running about 12 to 24 months months behind what is actually going on ‘under the hood’ at the company (management, fundamentals/business results, prospects). Interestingly, it looks like the stock price is a leading indicator of the change in narrative. (The narrative only changes after the stock price has gone up.) Change in fundamentals => change in share price => change in narrative PS: This process is really apparent when you read most analyst reports for Fairfax from over the past 4 years. ————— To learn more about ‘why we behave as we do’, from the Farnam Street blog: The Psychology of Human Misjudgment, by Charlie Munger https://fs.blog/great-talks/psychology-human-misjudgment/

-

@nwoodman, I love these summaries of yours. They are a great read and very informative. A couple of things that really jump out at me with the FFH-TRS position: 1.) How opportunistic Fairfax was to put these on in late 2020/early 2021. 2.) The massive size of the position - how concentrated the investment was. 3.) The large amount of leverage involved - the cash outlay from Fairfax was very small given the size of the exposure. Late 2020/early 2021 must have been very dark days at Fairfax’s head office (in terms of where investor sentiment and the stock price was). It says something about their character/investment process that they had the wherewithal to put this position on. 4.) Unwinding the position is an elegant way for them to buy back stock in large blocks without overpaying - if what they did in Q4 is indicative of what they plan on doing with the remaining 1.7 million shares. And it also looks like they also had an exit strategy in mind that they are now implementing… With earnings so high, Fairfax should be able to continue to buy back large chunks of the TRS moving forward - and still do lots of other things from a capital allocation perspective. In other words, they can have their cake and eat it too. As an investor, I would love it if Fairfax is able to reduce effective shares outstanding by another 1.7 million shares over the next couple of years

-

Prem's salary has been a massive long term win for Fairfax shareholders. C$600,000 per year is nuts. I think Gaynor's total pay at Markel is something like $8 million per year. Money aside, look at what they are respectively delivering in terms of performance. The value creation for Fairfax shareholders over the decades of Prem's rock bottom salary has been meaningful (looking at the power of compounding in a slightly different way).

-

@73 Reds , Morningstar's 'analysis' of Fairfax is a head scratcher for me. It is looking more and more like a Saturday Night Live skit. But I don't think that is what they are intending. It is a great example of how frameworks can mess up investors/analysts. Brett's framework when it comes to Fairfax needs to be updated (it looks about 10 years out of date). But he is clearly not able to do it - facts be damned! The question, I guess, is he just being lazy or is he really this... (I'll let you fill in the blank)? It reminds me of Charlie Munger's line 'To The Man With A Hammer, Every Problem Tends To Look Like A Nail.' Brett is hammering away again - he is determined to make what is going on at Fairfax today fit into his model. It is starting to get weird. The unfortunate thing is this type of 'analysis' really does reflect poorly on Morningstar. If Brett Horn's 'analysis' of Fairfax is an example of the quality of work they are producing today... well who in their right mind would want to pay real money to use Morningstar as a service?

-

Great comments on an important topic. This also looks like a good example of where Fairfax is thinking long term when they are making decisions.

-

@SafetyinNumbers, very well said. Too much information can be a big problem - especially when it is inconsequential. Because it can sometimes lead to actions that are not in your long term best interests (psychological failings). There is sometimes a lot of chatter on Fairfax’s 13F holdings on Twitter… and the stocks being discussed are tiny in size. I think it is very helpful to keep looking at the size ranking of Fairfax’s largest equity holdings - to keep grounded in what really matters. Interesting that both Eurobank and FFH-TRS got a little smaller in recent months (still dominant positions).

-

@gfp , Yes, after I posted my table I realized it likely was not actually answering anything. you raise an important question. We are all trying to understand what the end game is for the FFH-TRS position - and what the impacts are for Fairfax.

-

In terms of underwriting results, it appears Fairfax is moving up the quality rankings for P/C insurance companies. In a high catastrophe year, as a company it delivered a combined Q4 CR of 89.5% and another record underwriting profit of $1.8 billion. That is outstanding. And its two largest operating companies, Allied and Odyssey delivered Q4 CR's of 83.4% and 85.3%. Bottom line, the quality of Fairfax P/C insurance businesses are way under-rated. Importantly, looking to the future, they look very well positioned. Andy Barnard (and team) should get a gold star on their report card from Prem.

-

@gfp, does this table help answer your question? I have not updated it to include the information from Q4. The table is in my excel workbook (shares tab, near the bottom) that I have been sharing.

-

The ‘non-insurance consolidated companies’ income stream looks like it might be breaking out for Fairfax. It delivered $150.1 million in Q4. This does not include a full quarter of results from Peak Achievements. If the annual run rate for this income stream is now $600 million… well that would be amazing. That is not in analysts estimates right now. Hopefully it is discussed on the conference call tomorrow. A stock is worth the future cash flows it generates discounted back to today… Do we care that a new material income stream has materialized right before our eyes (kind of like what Share of Profit of Associates did 3 years ago…)? Who is included in ‘non-insurance consolidated companies’ bucket? Sleep Country, Peak Achievements, Recipe, Grivalia Hospitality, Meadow Foods, Sporting Life, And more… Of Fairfax’s 5 income streams, this one is the smallest. But it looks like it is about to get much bigger: Underwriting income Interest and dividend income Share of profit of associates investment gains Non-insurance consolidated companies