Vish_ram

Member-

Posts

552 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

Forums

Events

Everything posted by Vish_ram

-

I highly recommend that you click inside the book and read some pages. you are getting $10 worth free as 36 pages cost $200 This is plain awesome

-

With SolarCity IPO, Elon Musk May Get Clean Tech Right

Vish_ram replied to Liberty's topic in General Discussion

interesting read http://grist.org/climate-energy/solar-panels-could-destroy-u-s-utilities-according-to-u-s-utilities/ The utility companies spend considerable resources to maintain the grid. who will subsidize it if everyone goes to solar? Buffett's Mid american energy may suffer too. -

for kindle touch One good option is to save the html or pdf and then send an email (attaching your file) to your kindle with subject "Convert". Amazon does a good job of converting to kindle format. you may incur charges (not for wifi) for whispernet. there is an option called "reading mode" in kindle's web browser. this is really good too There are tools like caliber, mobipocket that convert any files to epub, aws (kindle) ... --- Kindle DX is awesome, you can read a pdf in landscape mode if needed. There is no need to convert.

-

Oddballstocks Where do you get details on OTC stocks? I took KOGL KOPP GLASS INC at random, I couldn't find any info on bloomberg, OTCmarkets.com, SEC or yahoo. Even their website http://www.koppglass.com/ has no info. what site do you use for filtering such stocks?

-

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Vish_ram replied to twacowfca's topic in General Discussion

BB was way early on CNQ and made tons of money; he also got out at the right time. I thought the same thing -- well, both things -- too. Can anyone name a large position that didn't work out well that Berkowitz pounded the table on? I can only think of CNQ -- though he probably made a lot of money there too. He sold others before they worked out -- Pfizer and the health insurers. But, you made good money, I think, if you held. Anything else that someone can name where he made a large investment and it didn't work well? I guess we could argue AIG and SHLD haven't hit yet. I'm not sure of his average price on either. Perhaps it makes sense to wait a few months, or more, given his self-described propensity for "premature accumulation" -- great phrase. But, his ideas are pretty solid from what I've seen. -

Interesting story http://www.thestreet.com/story/11941134/1/kass-the-rabbi-and-the-oracle.html?puc=yahoo&cm_ven=YAHOO Is it just a coincidence that the people who invested their life savings with Buffett during the early years never splurged and led a simple life? Contrast this with lottery winners, a bulk of them declare bankruptcy after few years

-

FNMA and FMCC preferreds. In search of the elusive 10 bagger.

Vish_ram replied to twacowfca's topic in General Discussion

Correct, this is different from AIG/BAC. Treasury changed from getting dividend to getting anything above "A-L-buffer" to prevent the circular flow of funds (ie borrowing from treasury to pay them). Once the loan is paid out in full, what legal/moral argument would they have to continue to get (usurp) all income of a private enterprise? In 10-K, the covenant says Covenants The senior preferred stock purchase agreement, as amended, provides that, until the senior preferred stock is repaid or redeemed in full, we may not, without the prior written consent of Treasury: --- --Terminate the conservatorship - Enter into a corporate reorganization, recapitalization, merger, acquisition or similar event; or Also Termination Provisions The senior preferred stock purchase agreement provides that Treasury’s funding commitment will terminate under any the following circumstances: (1) the completion of our liquidation and fulfillment of Treasury’s obligations under its funding commitment at that time, (2) the payment in full of, or reasonable provision for, all of our liabilities (whether or not contingent, including mortgage guaranty obligations), The treasury's stranglehold may loosen once they are paid in full No, obviously the situation is nothing like AIG or BAC. Fannie and Freddie are in conservatorship and are winding down. The government owns senior preferred shares in Fannie and Freddie, which currently hold 100% of economic value. It's possible that they will decide to recapitalize, and Treasury will give up the senior preferred for cash. But how would that happen? Treasury and FHFA agreed on the current approach which gives all profits to Treasury, and no value left for public shareholders. Do you think Treasury will change their mind and give money away to hedge funds, just because they asked for it? If not, do you think both houses of Congress can agree on that? -

This MUST be a sign we are nearing a market top! ;)

Vish_ram replied to bigbadbakken's topic in General Discussion

I'll tell you when to find the market top. The big name shorts keep predicting the market top and lose tons of $ on their shorts. when they start to give up, then we've a market top. Speculators don't use the words "Taking a moment to study up", "put my Stanford education to work". It is all about buying something because it is going up. -

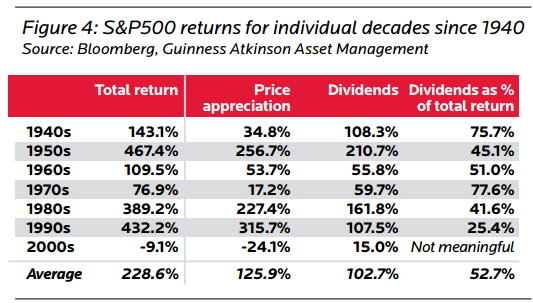

I've heard a lot of anecdotal evidence of common people making decent money using buy and hold (of consumer staples) over a long time. I've never heard of any trader type (naive) folks who have made fabulous money. Another interesting fact is the returns from dividends, it averages more than 50%. These div mostly go to the buy and hold type and not to the traders/market timers. A friend of mine, who is working in at&t (joined as technician at age 18, still is in lower level mgmt) for last 40 years, methodically bought shares, reinvested dividends and now gets 130K/yr in div alone. If he had traded, he would have lost money easily. For a naive person, buy and hold of consumer staples is the best strategy.

-

Buffett, With His Magic Touch, May Be Irreplaceable

Vish_ram replied to Buffett_Groupie's topic in Berkshire Hathaway

This article is phenomenally wrong on several counts Even after Buffett, Berkshire will have enormous capital to invest. The management/board of companies love to get an investor who doesn't agitate for board/ceo changes, change strategy and interfere in CEO's actions. This fact will persist for a long time and give enormous structural advantage to Berkshire. Can you ever think of Loeb or Icahn investing 5% into a company and sitting on the sidelines? Buffett/Berkshire's hands off approach is well known and will pay off dividends for decades. -

Thanks Sanjeev. The ads are gone. For the first time I donated $25. If Price is what you pay and value is what you get, then this site has been an absolute bargain ;D

-

I Worry About "The Shot Heard Around The World"

Vish_ram replied to Parsad's topic in General Discussion

I can say for sure that Fed actions are having the intended effect. There are folks I watch, who lost money in 2000 and 2008. They were so burnt out and have now started investing (should I say speculating) again. One such fella is in DDD. Greed is setting in now. We are setting the stage for another pull back. The volume of junk bond issuance and junk bond yields are a sure sign that fear is all but gone. The major beneficiary of this market has been the PE crowd. Their ability to borrow at ultra low rates and buyout companies has been nothing but spectacular. All levering up ends in tears. this is where the seeds of next bust are sown. I think we are in 7th innings. -

How did you get this market cap? I see 10-Q showing that they've 1,227,928 outstanding. That comes to 466MM (yahoo shows the same). But Morningstar shows 543MM. If it is 466, then BH valuations are certainly interesting.

-

To know Bill Miller, read his comments about Citigroup in 2008. Morningstar gives him one star With Mila Kunis entering stocks, Bill Miller appearing on CNBC touting stocks, are we already entering another phase of bull market?

-

Corner of Berkshire & Fairfax Message Board - 11th Anniversary!

Vish_ram replied to Parsad's topic in General Discussion

Congratulations to Parsad. The intrinsic value of the board has only gone up in last 11 years. I'm richer both literally and figuratively by reading many of the messages. -

Loeb vs Ackman - This ought to be fun to watch

Vish_ram replied to longlake95's topic in General Discussion

Ackman already had a bad 2011 & 2012. If we have a porsche style covering, it'll be fireworks The folks in Amway/Herbalife have so much lobby power. I wonder if Ackman can influence them to bring up new legislation. MLM is only slightly better than a lottery in terms of who gets the money whom -

Sokol Says He Should Have Left Berkshire Earlier

Vish_ram replied to Parsad's topic in Berkshire Hathaway

What surprises me is, why is Berkshire Hathaway not having a pre-clearance for all employees trading activity? they need to have a formal process that employees just follow. Sometimes I think that berkshire is run like erstwhile AIG. -

Thanks for the book recommendation. It was absolutely fantastic. On a different note, who are the current CEO's who can fill in the next great CEO's book? Let me nominate Ebix Raina.

-

The problem is that the genie is out of the bottle. No new measures will control the guns out there. This country is totally screwed. What I don't understand is ,why are those social conservatives in Republican side support NRA? where is the family value when you see people getting killed day in and out? Guns don't kill people, yes TNT doesnt kill people, nuclear bombs don't kill people. I used to work near Newtown (danbury). I've two elementary school going kids in GA. It is scary. What is scarier is the apathy of American people towards gun violence. Hope NRA rot in hell

-

I bought HP laser jet P1102w. this is a wifi printer. you can print it from ipad wirelessly. It prints super fast. you can buy cartridge from amazon. so far so good

-

Parsad During registration, why don't you ask the user to enter the S&P's closing value the day before? This value changes often. You can have a javascript to check if user entered value is different from S&P 500 index (from google finance API). If different you can ignore the registration. you can also open up registration only during certain time periods of the day (and keep changing it every month randomly).

-

I bought some GLD shares in late 2005 only to sell it after couple of months after reading Buffett's thoughts on gold. If only BRK performed 1/4th as good as GLD. I recently watched "End of road" documentary. A scary one. http://documentarychannel.com/movie.php?currID=10536&t=End%20of%20the%20Road:%20How%20Money%20Became%20Worthless;%20The For decades, a bubble in housing was unthinkable. In early 2000 there was a talk about it. The recklessness of people dealing with every aspect of housing industry made the bubble a reality and finally it burst. Many decades of conventional wisdom was proved wrong. The same thing can happen to dollar. if it happens, it'll take several decades for US to recover. The way the Auction rate security market collapsed, we might very well see treasury auction attract no bidders. This can start the panic. What if US govt bans possession of Gold & confiscates everything? Any fiat currency is just a confidence game.

-

This is from a personal experience. The last time I got excited about msft was when I first saw win 3 and then win 95. It has been downhilll ever since. The win xp has been a major pain, even with all security updates. I have owned ipad 1 since it came out and got ipad 3 last week. I am in awe. It is sheer joy to use ipad 3. I never considered buying apple products before due to its premium pricing. I now understand that it is better to pay 30-50% more and save yourself of daily hassles with security issues, constant updates, crashing etc. in future, even if appl is priced more, I'll go for it. the ipad 1's performance hasn't changed one bit in last few years. The vanity fair article is spot on; I expect to see APPL take more market share in laptops too; Their momentum may last another 10 years. I wouldn't underestimate the hatred people have for MSFT.

-

What Berkshire is worth and what it will return are two different things;

-

This talk about mean reversion is absurd. Why should they revert to the mean if underlying components have changed? Look at healthcare as % of GDP. Will Grantham say that this is going to mean revert? Taken to an individual case, If my normal weight is 150 pounds and I gorge on fatty foods and gain 30 pounds, will I mean revert after a few years? If Apple becomes a trillion dollar company, producing 100BB profit with margin of 50%, what will it do to the margin averages?