-

Posts

4,883 -

Joined

-

Last visited

-

Days Won

14

Content Type

Profiles

Forums

Events

Posts posted by John Hjorth

-

-

Talk about collaboration over the Internet! That's actually awesome, gents!

-

lol.

Sanjeev, I'm not the right person to ask, because I can't do the work. I was trying to get DooDiligence to pick up the glove. -And I certainly hope the site goes nowhere, btw! [: - ) ]

-Always nice with new stuff on the site, though!

-

I like it as well, although I think it would look better if the background were transparent rather than white so that the light blue background would show through.

Just a suggestion.

++ simple fix!

How about to grab this JPEG file named "cropped-cropped-Handover-Corner-Of-Berkshire-Fairfax-JPG-e1516151433460" from the site, fix it and send it to Sanjeev for a reinstall on the CoBF webserver installation? [ ; - ) ]

-I have forgotten how to do [read: manipulate] this in i.e. Photoshop, and nobody has asked me to document my investment returns here on CoBF so far, so I've had no need to refresh my memory!

-

Have you noticed the new CoBF logo here on the site?

Personally, I like it a lot! To me, it's a symbolic logo, about Wold Wide coverage, - and growth: Economic ... -but also personal & knowledge growth!

-

... While we are enjoying giddy prices every day, it seems, I do miss the buying opportunities at lower prices. "Lower" is a relative term, no? We have been spoiled by cheap opportunities (most recently 2015); Rear view mirror for sure.

The eternal Berkshire investing dilemma & paradox!, longinvestor. -Next time the big US banks lie crushed in a big pile, - and that will happen again - Berkshire is likely to become cheap [relatively] again. Good to have at least some cash ready for that. It's personal, how much, though. Some less, some more.

On the other hand, if one doesn't actually own BRK anywhere near what one actually want to own, just start buying, and time combined with Berkshire will do one good.

-

Are the techs tanking today, Valuehalla? [ : - ) ]

- - - o 0 o - - -

I could't help it. ...

-

This discussion to me actually proves how valueable this Books Forum here on CoBF actually is.

The last time Max's work was discussed here on CoBF, he mentioned that he was working on a compilation of the Buffett Partnership Letters, too, at that time. What here is important to take into consideration, is that Max actually has access to Mr. Buffett.

In short, we need to keep him going. [ ; - ) ] Personally, I have today found his twitter accounts [they are in his member profile & signature [boardmember maxprogram]] and have given his book releases a spin by retweeting them.

-

I just saw today, that Max has made a 2016 Kindle Edition available on Amazon. Max, I'm in need of this as hardcover from Lulu! - Please! [ : - ) ]

-

This is - to me - just so awesome.

A fellow board member [absolutely hell bent], pursuing own dreams, for life fullfillment.

I wish you all the best, DooDiligence.

-

So far, we have here on CoBF discussed the accounting effects to Berkshire from the US Tax Reform, as I read things, only from the perspective the cut of the US corporation tax rate from 35 percent to 21 percent.

Yesterday evening, I read the JPM 2017Q4 reporting, and to be absolutely honest here, it was the first time, that I paid some attention to BEAT.

Berkshire is shifting from being subject to a global income taxation system, to a territorial taxation system.

From the JPM 2017Q4 presentation, p.2 :

Will JPM actually repatriate cash and if so how will it be used? No significant remittance of cash expected – we have capital and liquidity requirements in foreign entities – it is a deemed repatriation ... Do you anticipate JPM will be subject to the Base Erosion Antiabuse Tax (“BEAT”)? Uncertain – but we do not expect any material impact from BEAT

From the Berkshire 2016 10-K, p. 94:

... We have not established deferred income taxes on accumulated undistributed earnings of certain foreign subsidiaries. Such earnings were approximately $12.4 billion as of December 31, 2016 and are expected to remain reinvested indefinitely. Upon distribution as dividends or otherwise, such amounts would be subject to taxation in the U.S. and potentially in other countries. However, U.S. income tax liabilities would be offset, in whole or in part, by allowable tax credits deriving from income taxes previously paid to foreign jurisdictions. Further, repatriation of all accumulated earnings of foreign subsidiaries would be impracticable to the extent that such earnings represent capital needed to support normal business operations. As a result, we currently believe that any incremental U.S income tax liabilities arising from the repatriation of distributable earnings of foreign subsidiaries would not be material. ...- - - o 0 o - - - -

So, what are your thoughts and insights on this matter?

-

I seem to recall reading/hearing somewhere that the average American family has LESS than $500 in liquid assets. Thus, for an "average" family, a $3k monthly water bill would be a financial catastrophe.

If you have a less than $500 in liquid assets then basically anything is a potential financial catastrophe.

lol. I simply love reading posts like this one from rb!

It's all about getting out of the financial swamp / quicksand, and to stay there [stay out], by not swimming naked. Some prefer more frothy waters than others, though.

[ : - ) ]

-

author owns some stuff I've been watching. I'd just like to connect, but there is no contact info on the site. Please help. You can PM me if you like

There is a personal and/or private reason for that. Please just accept and respect it.

-

Thank you for sharing your thoughts, longinvestor. To me, you're really good at picking up the important details in interviews.

Somehow, the oversight of Berkshire from an operational point of view must have been daunting for many years now. This is to me the right decision, to lift off some workload on Mr. Buffett. [i have no idea to which extent Mr. Munger has been involved in that part of Berkshire operations.]

-

Time for some banking humor:

A Pet Piggybank Really Hams up in Santander Bank's Adorable New Ad.

Then please scroll down a bit, and enjoy the new Santander video ads:

"You've got the shaft"

"You've been fleeced"

"You've been hosed"

"You've got Jack A**"

-

There is a 98.98% probability that I'll repeat this morbid excersise here on CoBF in a year, StubbleJumper!

Charlie, I couldn't find statistics for billionaires only!

Furthermore, I think

will live on forever. -

Good move. It was overdue. Munger is like 94 and Buffett is 87. What's the probability that both will be around this time next year?

StubbleJumper,

Here is my morbid-bid on your ask: [and no, I don't think I'm stuttering]

Probability of 87 years old man to die this year ~ 12.48%

Probability of 93 years old man to die this year ~ 22.49%

Thus, probability of both Mr. Buffett and Mr. Munger being a live at 2018 year end = [100% - 12.48%] * [100% - 22.49%] = 67.8%

Life expectancy of Mr. Buffett: 5 years

Life expectancy of Mr. Munger: 3.2 years.

Source: For Mr. Buffett.For Mr. Munger.

-

TD in Canada, Wells and US Bank in the US, Lloyds in the UK, Santander in Europe/Lat Am. One of the Nordic banks is also really good but I can't remember which one at the moment.

I suppose that you are referring to Svenska Handelsbanken AB here, rb. [sHB A.STO & SHB B.STO]

There is written a book about it by Niels Kroner. CoBF topic here.

-

lol. Or perhaps Sanjeev can setup a separate forum for cryto-talk? - I mean, to give it a slow death, like the Politics forum ... [J/K] - The fairly new Personal Finance forum is a success though.

-

Somehow - finally - I've managed to get somewhere near the CoBF median - with about 13 percent pre tax [all nitpicking still not completed].

Largest positions during the year - here year end positions:

Berkshire Hathaway B [bRK.B] [ size ~22 percent, up 22 percent over the year in local currency - bought some during the year]

Cash [All in DKK, size 17 percent]

Novo Nordisk A/S B [here, the Danish stock NOVO B.CPH, else US ADR NVO][ size ~ 12 percent, up 29 percent in local currency]

Banco Santander SA [uS ADR] [sAN] [ size ~ 6 percent, up ~23 percent over the year in local currency]

Schouw & Co. A/S [sCHO.CPH][ size ~5 percent, up ~12 percent in local currency - bought some during the year, not much].

- - - o 0 o - - -

Like other European CoBF members, I've been hit by currency headwinds on the EUR/USD relation, mentioned by kab60 and other fellow board members earlier in this topic to be about 12 percent.

Still my best year ever. The tides have been going in, though.

- - - o 0 o - - -

Congratulations to fellow board members on some awesome 2017 results!

-

Here are my New Year resolutions, ranked:

1. Try to find a way to help DooDiligence to get out from Guantanamo [He is incarcerated there as a "hostile combatant", because of his tweets to Mr. Trump ... - didn't you know that there is Internet connection at Guantanamo for the incarcerated there?]

2. To stay out of jail myself.

3. If I fail on #2, try again!

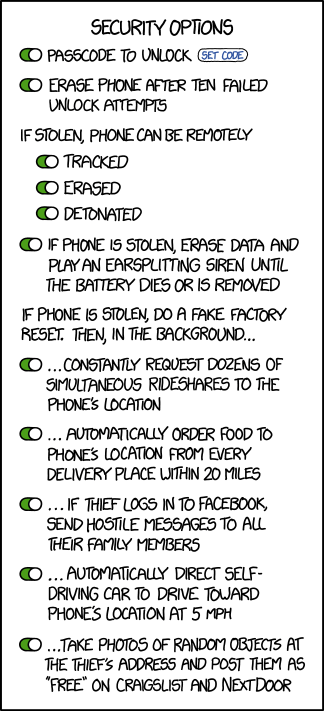

4. Keep my phone updated, ref. the discussion in the Intel topic. Here the correct security settings:

-

... I am pretty sure I am not alone in this. ...

Al,

Just to make you absolutely sure, please just add me.

-

... A quote from the well known capitalist Trotsky: "Everything is relative in this world, where change alone endures." ...

I had to call the Lady of the House to read your post on one of my monitors, cigarbutt. She enjoyed your post as much as I did.

I think it now must have been about 37 years ago, that I "suffered the pain" of being "forcely enrolled", to a course of "Sales and Marketing", to get my B.Sc. in Business Economics.

Needless to say, basically - I barely passed. What kind of idiot was it, that I here was "confronted to" - [to get out of my way!]?

Basically, he taught me a thing or two about sales. I've never forgot that.

- - - o 0 o - - -

The short version is, that there is always work to do - even if you're at 100% cash.

- - - o 0 o - - - -

Happy New year to you, cigarbutt.

-

Nate [fellow board member oddballstocks] and his business partner Kenneth have released this book short time ago [At the end of November 2017, I think].

Available on Amazon here.

Great initiative!

I ordered the paperback version today, and I really look forward to the read.

-

Jurgis,

PGNT is [was?] a microcap discussed years ago here on CoBF. Perhaps it was before you joined CoBF. To say the least, the content of the posts about it was not positive [bH-like]. With my perception achieved over the years of your personal investment style, it's not worth your time to try to dig it up here on CoBF. [i tried to look it up based on the question in your post here in this topic by doing a search here on CoBF, but came out empty handed.]

US China Manufacturing Story Resonates

in General Discussion

Posted

After a lot of thinking - during several days: Are you serious about this, DooDiligence?

[Edit: Somehow, I suppose DooDiligence is used to this question - as a [retired] sailor - so, it's all about me, and my own safety ...] And No!, this is not the place to laugh!

Yes, I've found something very special to&for you. Willing to proceed?

It's a song about love.