-

Posts

4,884 -

Joined

-

Last visited

-

Days Won

14

Content Type

Profiles

Forums

Events

Posts posted by John Hjorth

-

-

Sometimes, one here on CoBF, asks questions - "out in the open", so to say ... "without knowing which pot you stir" - one thing is sure: You never know whitch response you get.

Always educational and enlightning [- at least for me].

- - - o 0 o - - -

rb, do you care to elaborate - just - a bit? [Yes, I dared here to ask...]["No" will also do...]

-

Have any of you - writing client letters - managing other people's money or not - considered to "recycle one of your upbringings" from your client letters, or whatever you may call it, - and thereby submiting it to SA for release?

- - - o 0 o - - -

Tim [fellow board member TBW] has already done this with KMI to get SA Pro status.

-

So smart to spend three pages arguing which geezer is smarter and why. They were good for their day but they are both hopelessly outclassed by modern investors.

Cognitive biases here, Scott? [The study of fading of geriatrics is actually fascinating - and depressing.]

-

It doesn't say when it will be out or how but it is in the working, the company that did the photography is working on converting all the footage to a digital format.

The newspaper is owned by Berkshire so little doubt about the accuracy of the reporting in my opinion.

Very exciting news, hope they won't be too greedy and charge money for it ::)

Thank you for putting some colour on this for those of us that are non-subscribers, WneverLOOSE,

I speculate and suppose, now that the operational responsibilities for all the Berkshire subs have been delegated, Mr. Buffett somehow feels bored and - perhaps - started to pump subscription sales at OWH. [j/k - ; - D ]

-

The video does not appear to support the article text. [?]

-

-

Federal Reserve FOMC Meeting Transcript is out.

The press conference will take place today at 2:30 PM ET.

-

Just fyi, when I access from the app (mobile/tablet) it is like it used to be.

That reads absolutely ridiculous, if SA here hasen't tightened the ship totally, kab60! [ : - ) ] I just looked at the website, I could not see a link to an app anywhere. Is the app that you're using an app that you have downloaded from somewhere, kab60, or is it that you're ["just"] browsing the site from mobile/tablet?

-

Thank you, Joel.

-

Eric,

I just checked. There seem to be a 2017 Kindle version available from Max. On lulu.com I unfortunately only see the yellow hardcover with the 2014 Letter being the last one.

I think I'll try to write to Max about it.

-

Thank you for sharing, globalfinancepartners,

Like a clockwork, ref. another recent topic here on CoBF in the Berkshire forum.

I particulary found this section of the proxy entertaining - I suppose Mr. Buffett must have been laughing in his car all the way from office to home at the end of the working day after approving this - poor guy, perhaps he needs both free coke and free burgers at office soon:

CEO Pay Ratio

As mandated by Section 953(b) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and required under Item 402(u) of Regulation S-K (“Item 402(u)”), we are disclosing the median of the annual total compensation of all employees of Berkshire and its subsidiaries other than Berkshire’s CEO and the annual total compensation of Berkshire’s CEO, Warren E. Buffett. In preparing this disclosure, Berkshire considered the fact that on September 21, 2017, the Securities & Exchange Commission (“SEC”) issued interpretive guidance to assist registrants in complying with the SEC’s Pay Ratio reporting requirements. Among other things, the SEC’s guidance addressed the use of reasonable estimates, assumptions and methodologies.

Berkshire also considered that Mr. Buffett’s annual compensation has been $100,000 for more than the past 25 years and that Mr. Buffett receives no bonus or any form of equity based compensation. Additionally, Berkshire has over 60 separate operating groups, many of whom have multiple separate operating groups. Accordingly, the identification of the median employee’s annual total compensation of the 377,000 Berkshire subsidiary employees is a significant task.

In light of the fact that Mr. Buffett’s total compensation is far less than almost all public company CEO’s, Berkshire believed that the cost/benefit of complying precisely with the requirements of Item 402(u) would provide little, if any, useful information to its shareholders. Therefore, Berkshire used a judgmental sample representing approximately 2/3 of the total employees of Berkshire and its subsidiaries to determine the median employee’s compensation.

The median employee was determined using 2017 W-2 wages for all U.S. employees and equivalent taxable compensation for all non-U.S. employees included in the sample. The median employee determination included all employees within the sample group who were employed at December 31, 2017. The annual total compensation for the median employee was calculated using the same methodology for calculating the total compensation in accordance with Item 402©(2)(x) of Regulation S-K.

Based on the information obtained as described above, the ratio of Mr. Buffett’s annual total compensation ($100,000) to the annual total compensation of the median employee ($53,510) was 1.87 to 1.

-

-

.

Listened to it today, and I enjoyed it a lot.

-

It's interesting times ... - as always!

-

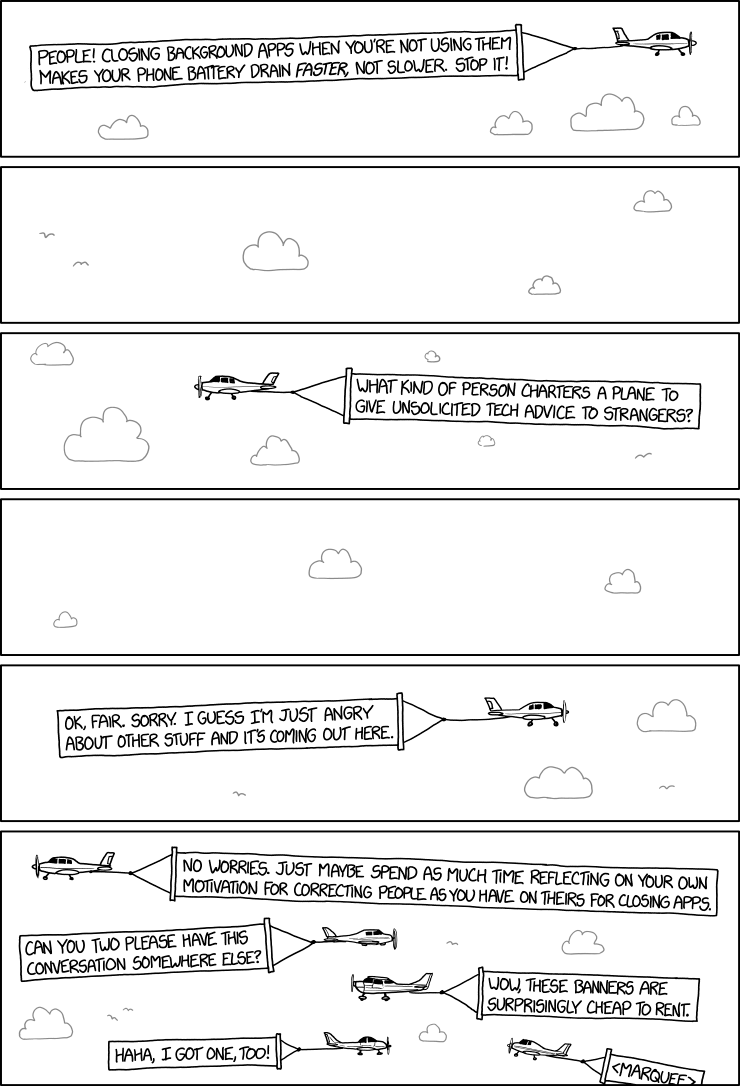

How come this one somehow reminds me of some days at CoBF? - Just kidding & joking! [- I'm just such a troublemaker!]

-

Lecture by Lars Christensen: Low bond yields are here to stay.

Lars Christensen is a Danish macro economist. He is a fundamental monetarist, in the camp of Milton Friedman - his favorite economist. I've started following him for a while.

The video is of questionable quality. Please have patience, if you start listening to it. It gets better.

Like other fellow board members in this topic, I'm also struggling with this .[too!]

I haven't heard the whole lecture yet. [This is really dense matter to me.] I thought I would just share here.

-

2018 AGM Meeting Info is up & out.

-

I got mailinglisted at Semper August about two years ago, after our "discovery" of the "first" Berkshire related Letter from there. Today, I've received the last letter by e-mail, attached to this e-mail from Chad Christensen :

Attached is a PDF copy of the year-end client letter. The theme switches to literature from rock and roll but don’t take that to mean we’re growing up...The letter examines market valuations at extremes; bubbles in passive investing and monetary policy, with both likely to unwind unpleasantly. We update our intrinsic value summary for the portfolio and compare our holdings fundamentally with the market.

We think Berkshire Hathaway is the largest beneficiary of the 2017 Tax reform just passed. We look at the impact of the tax changes and update our intrinsic valuation analysis. Despite the shares up 21.9% last year (and 23.4% the year before), considerable upside remains.

Throughout the letter we contrast our investment approach and discipline with passive investing. We include a chart that shows the degree to which money is unnaturally distorting the big stock market indexes and how risk is building. It’s eye opening.

Berkshire released their annual report and Warren Buffett’s Chairman's letter at BerkshireHathaway.com.

Chris was inspired by the Winter Olympics and broke the Semper world record for long letters.

We welcome your comments and feedback.

[ : - ) ]

-

You basically just "stole" [erhh, somehow] my first macro economist joke in this topic, boilermaker! -Let me just say that I'm far from amused ... [ ; - ) ].

- - - o 0 o - - -

Here is another one, and this an IRL experience of my own. On my bachelor study in economics I was taught Keynesian Macro in the years 1978-79 by a Danish professor. He was just soo good, and funny! His name is Lars Matthiesen, I think he is retired now [he must be]. Under time span of running the class that I was in, he got appointed as member of the Danish Economic Counsils. That was a pretty big thing back then, all over in the local printed papers [There were none else then].

So, at the first class session after his appointment, he was met by standing applause by his students. He was both happy and proud of that, I could see.

Then one student asked: "How did it happen?"

He replied: "I got a letter from our Danish Prime Minister." [Meaning: "This is invitation only, & based on merit/quality of work."]

Then another student asked: "Did you go through an interview?"

He: "Well, they actually did not really ask me any questions, it was more some kind of friendly talk with the other council members about going forward, concluding and summing all the talk up with: "We justed wanted to actually see, that you have both your arms.""

The student: "Huh? - Do you care to elaborate?"

He: "In "macro", you really need to have both your arms! You know - You say "On one hand..." - and then you have to do this particular move with one of your arms,-, and then you say " ..., on the other hand ..." - and if then your other arm is not there to do that particular move, - you'll never get your message through!"

- - - o 0 o - - -

Many times since then, now many years ago, I have thought about this exchange of words. Get out of it what you do/want. To me, it has basically now boiled down to: "Push hard, but don't take yourself too seriously."

-

@John H, just venting... frustrating to me to see someone get an opportunity like that (multi hour interview) and use it so poorly.

I read the whole thing...

Bizaro,

Yes somehow it's kind of a parody of a professional interview. Personally, I don't get annoyed by it any longer. Because it's evident, that Mr. Buffett isen't annoyed by it. I speculate, that he considers it some kind of sport to tear down the questions in stead of trying to answer them. Nate [oddballstocks] once called Mr. Buffett a marketing machine. I think that's the plain truth in one line. And he's going global. Just a few years back basically nobody wrote about the letters and Berkshire here in Denmark. Now he has active coverage here, too.

-

Thank you for sharing this gem, Dynamic, also.

-

This is the joke of the day: My own English spelling!

A few days ago I found out, the I've missed the "c" in "acquisition" - and that pretty consistently! - Please feel free to call me out on my spelling. - I will prefer that you do it by PM, however. I'm here to learn.

-

By basic logic, bizaro,

How would you let something into your brain as answers to questions [to consider] from which you have cut yourself off?

-

I just checked on EDGAR, the proxy material was released there on March 17 last year. So, I think your're right, longinvestor.

- - - o 0 o - - -

Off topic:

Now BRK HQ YE 2017 headcount = 26. [ref. p. A-1 in the 2017 Annual Report], said the nitpicker! I hope to hear some really agressive and critical questions on Yahoo Finance after the AGM about what's going on at that bloated Berkshire HQ! Very concerning! [ : - ) ]

SeekingAlpha turns Evil

in General Discussion

Posted

rb, response about as I personally expected. Thanks.