-

Posts

5,473 -

Joined

-

Last visited

-

Days Won

14

Content Type

Profiles

Forums

Events

Everything posted by John Hjorth

-

The whole thing now has turned out to be absolutely terrible and ugly - non-hooman, I [and Lulu, the cat] would say. Even OSINTdefender on X has lost his composure, just posting : 'Holy shit....' : Even learned something about the definition of a 'shit-ton' today :

-

An awesome discussion recently in this topic! - Lots of things mentioned as basis for self-studies, that are relevant for formation and shaping of opinions, or adjustments and changes to such! -Thank you!

-

Thank you, @formthirteen , But since when have we started to use essays of history majors scheduled to graduate in 2003?, and from where? Well, never mind, I'll read the whole thing any way, because your quotes above really punched hard on some of my personal biases.

-

Q : Now what has that to do with the Ukraine-Russia War? A : Nothing! Please post the right place!

-

Thank you, @Xerxes !

-

Naturally you do, @Xerxes. But from which brickwork actually is the question.

-

How is it, that I - some place in my mind - knew, that exactly this - a post something similar to the above quoted - would appear - in this topic - by exactly now by @Xerxes ? [And that is actually here meant as a compliment!] To me, the above is Pasghetti argumentation. Let me just say, that Pasghetty argumentation was defined many years ago, when my daugther found out, she coulden't always respond to my questions about my questions and proposals about what to eat for diner today with : 'Beef, Sauce Bearnaise and potatoes!'. So @Xerxes, where to start to read to get some kind of understanding of what's going on? - Everything seems intertwined historically, to a point that is beyond the point of no return, historically?

-

I personally think this is the right time to start such topic here in the 'General Discussion', because we - I mean those of us here on CoBF interested in the sector - constantly have things to bring up, that may belong to several different topics in the 'Investment Ideas' forum, that goes by 'one only' company ticker and name. I also sense, that the traction may now be sufficient here on CoBF for such a topic. An industry, that is just so friggin' counterintuitive in its concepts and core to a frugal and rational, old fashion value investor! So let the show begin! - - - o 0 o - - - I think it was a couple of days ago @UK posted about his idea of LVMH being a possible vehicle of riding on the recent China stimulus. Bloomberg - Economics [September 27th 2024] : China Cuts Key Rate, Frees Up Cash for Banks to Spur Growth, Bloomberg - Markets [September 27th 2024] : European Stocks Hit Record High on Rate-Cut Bets, China Stimulus. Bloomberg - Markets [September 27th 2024] : Luxury Stocks Set for Best Week in Years as China Fuels Revival.

-

Thank you, Mike [ @boilermaker75 ]

-

Today, I've spent some time on trying to educate myself on what what was going on in Ukraine in 2014. Simply because my own memory about it is pretty much 'blank' - just not just say totally empty. To the best of my recollection it was as close to a 'non-event' as it could be, here. [Here understood as : 'This is about an Ukrainian pensinsula, - is that important?'] Later all the political counter measures with economic sanctions started, based what was going on in UN, related to it. Alone reading : Wikipedia : Annexation of Crimea by the Russian Federation one get the feeling of a period saturated with locally violent [strong] oppositely directed and conflicting currents in a chaotic situation by all means already in place. Now add to that a historic backdrop that has been exactly the same stuff. Absolute frustrating to read about. I'm in no way sure I would have sensed Putin true intentions, if I had followed how the situation evolved over time back then in 2014 , which I diden't.

-

Wikipedia : List of military aid to Ukraine during the Russo-Ukrainian War. Total commitment USD 380 B, of which USD 118 B in direct military aid. Add to that [by deducting it] the self-determined 'collateral' of USD 280 B in frozen [seized] Russian central bank assets and you get a total different overall picture. [X is what it is : X]. But yeah, freedom isen't always free, and should never be considered a given. Here in tiny Denmark, the military spending is also under a material ramp-up, but with no consequences in the form tax raises in the state budget because of healthy public finances, but I would accept even material tax raises with a shrug, if this was needed, as a citizen to contribute to make this situation come to an end.

-

Good questions, Sanjeev [ @Parsad ], I have spent a good deal of today to find some answers to some this, - to understand how the man is thinking and try to understand his world view. I recalled hearing a bite of interview some time ago with Samuel Rachlin, a Danish journalist and author of several books about Russia and Putin, here considerered an expert in Russian relations and affairs. Mr. Rachlin was born in Sibiria and lived there in the first nine years of his life, while his parents were deporteret thereto for 14 years, after which the family ended up in Denmark. I found it on a streaming service called 'TV2 Play' provided by the Danish TV channel TV2, the streaming service avaiable to me, all services from TV2 are included in the TV package in my household. Mr. Rachlin mentions specifically a speech held by Vladimir Putin at MSC [Munich Security Conference], in 2007, where he is totally candid towards the participants about his intentions : The objective being a new world order. Actually stunned by hearing this I started to seach for that speech, and found : Wikipedia : 2007 Munich speech of Vladimir Putin. Link to the speech : kremlin.ru : President of Russia : Speech and the Following Discussion at the Munich Conference on Security Policy [February 10th 2007, Munich]. - - - o 0 o - - - Speech also attached here. - - - o 0 o - - - Let me just say that I today personally have been hit by a very frustrating feeling of being naive - very naive - earlier - before February 24th 2022. Speech and the Following Discussion at the Munich Conference on Security Policy - President of Russia 20070210 - 20240926.pdf

-

Enjoy Scotland with Angela, Charlie [ @dealraker ] !

-

Sure, @Luke , You are entitled to whatever stance you may have. My postulate is your stance is naive with regard to the defence of democratic values in Europe. Up yours with all your charts. To me, you haven't understood one whit of what's at stake here for Europe, based on probabilities of futher Russian imperialist agressions within Europe going forward. You seem to be totally indifferent to such matters. And here I stop, for good.

-

I'm speechless reading this here on CoBF from, what at least is the best of my understanding, a young German citizen. Oh, well.

-

Biggest regrets of the older posters here?

John Hjorth replied to yadayada's topic in General Discussion

First time today I see and read this here on CoBF. It makes me think how did it end up there, I must have inhaled it, when it was dropping from above, and it settled and developed new roots -

Thank you for sharing, @Warner, And thank you for the personal backdrop information from and about you. Very frustrating to think about this Gordian Knot and how to get the meaningless losses of many lives to stop.

-

Freedom House [www.freedomhuuse.org] : Freedom in The World 2022 , p. 18 : Wikipedia : The Economist Democracy Index : Wikipedia : Political culture. From the article about definition : From the article and about Russian political culture :

-

It is not the way things works anywhere. If proposed for a board position, you have to accept or reject the outlined pricinciples and practices for board membership compensation, which just would then just trigger a 'No, thank you.' And certainly Mr. Sokol already knows that.

-

Personally, I find that future outcome to become the actual happening of the total space of possible outcomes highly unlikely, @Warner. Because this war has alreeady been turned into a clash between ideologies, based on that noone trusts or beleives anymore that Russia would stop with Ukraine. In the international society of countries, Putin has totally lost the last bit of personal credibility he had left. Nobody wants to talk with him about anything any more. To me, very hard to understand that the Russian population is indifferent about the overall direction for Russia set by Putin, i.e. now trading with shady companies, states hosting terrorists and rogue states.

-

Thanks, @Viking , Your post triggered quite some searches by me, I'll post some the search results later, because I think it would educational for all CoBF members [including me] reading or participating in this topic.

-

@Spekulatius, This one of yours made me chukle. At least the last part, understood as the last line. The first line of yours also contains the core of the problem at hand here : The Russian population's glaring lack of democratic attitude, by not stating demands on such matter at and against their Head of State/ruler. Very frustrating to be a spectator to. I suppose this issue will take generations to solve and eventually get right going forward.

-

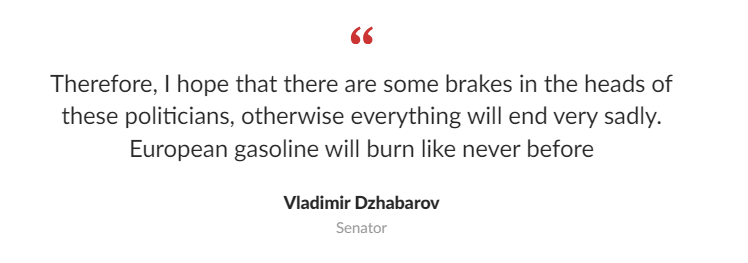

And that did not last long : Lenta.ru [September 23th 2024] : Russia responds to Danish PM's call to lift restrictions on strikes deep into the country Subheader: Senator Dzhabarov : NATO countries will be held separately responsible for strikes deep into Russia. What a nice guy he seems to be.

-

Thanks, @UK, Yes, the whole proposition of red lines and Russia telling others what to do and not to do is absurd in the context of the actual situation exists because of Russian agression. The world simply does not work that way. Exactly the same, when the POTUS, while asked about it, ignores Putin, answering 'I do not think much about 'him'', meaning 'Putin and his doings'.

-

Movies and TV shows (general recommendation thread)

John Hjorth replied to Liberty's topic in General Discussion

@Xerxes, PSTD? [Nah, J/K!]