-

Posts

15,189 -

Joined

-

Last visited

-

Days Won

38

Content Type

Profiles

Forums

Events

Everything posted by Spekulatius

-

The Russian mothers are not doing their job like they used to that's for sure. As far as Vietnam is concerned, I am guessing a lot of people here haven't really studied this and rely on generalities. the fact is that US soldiers did quite well in Vietnam when you just look at the stats - 58K US soldiers killed vs 500k-1M Vietkong). That's 10-20x kill rate which i consider quite good. Also, the US military never lost a significant battle in Vietnam and all the offensive of the Vietkong failed (Thet offensive being one that caused huge losses for the Vietkong). During the time that the US has surged ~500k soldiers at the peak, the Vietkong really couldn't accomplish much. the problem of course was that nobody in the US wanted to keep that many soldiers in Vietnam indefinitely, so the US pulled out in the early 70's and the South Vietnams couldn't withstand the pressure from the more determined Vietkong. So a total different situation than Ukraine where the US has no boots on the ground and just supplies weapons to Ukraine who happens to much more determined and fights smarter than the Orc hordes from Russia. Anyways, I think most people nowadays think that Vietnam was a military defeat and it wasn't, imo. It was a political defeat and a case where a limited engagement turned out in an open ended one, that the US didn't want to fight any more.

-

@Cigarbutt There is no particular reason I stuck this BNB drama in this thread other than it fits loosely the narrative here and I found the situation mildly interesting and entertaining. You could absolutely play the stock here with the expectations that the dividend comes back in a few years and the stock recovers. I do think that there may be risk that the Belgium state takes advantage of the situation and either buys out the public shares cheaply or recapitalizes it's central bank and zeros the shares that way. I would guess however that this is probably unlikely and perhaps not even possible by law (but I have no idea). So not investment from me but I keep watching the stock as perhaps a situation arises that makes me put a little money in. I think there is a broader applicability for regular banks stocks that have large bond portfolios (EXSR, I am looking at you!) that are market to market in GAAP but apparently those unrealized losses don't affect statutory capital Feels a bit like Coyote going over the cliff but keep defying gravity unless he decides to look down....

-

Movies and TV shows (general recommendation thread)

Spekulatius replied to Liberty's topic in General Discussion

I saw this trailer on YouTube as well. Look pretty good. The old 1930 black and white one is still the gold standard. The 1979 remake couldn’t touch it, but this one looks promising. Sadly, the material seems now as current just like when it was written or filmed in 1930. -

@changegonnacome I think your are wrong that the West would do nothing after Russia dropped a Nuke on Ukraine. Biden mentioned "catastrophic consequences" and I don't think he was talking about an UN speech here. Sort of funny that people who have been wrong all along keep making predictions that likely turn out to be wrong as well.

-

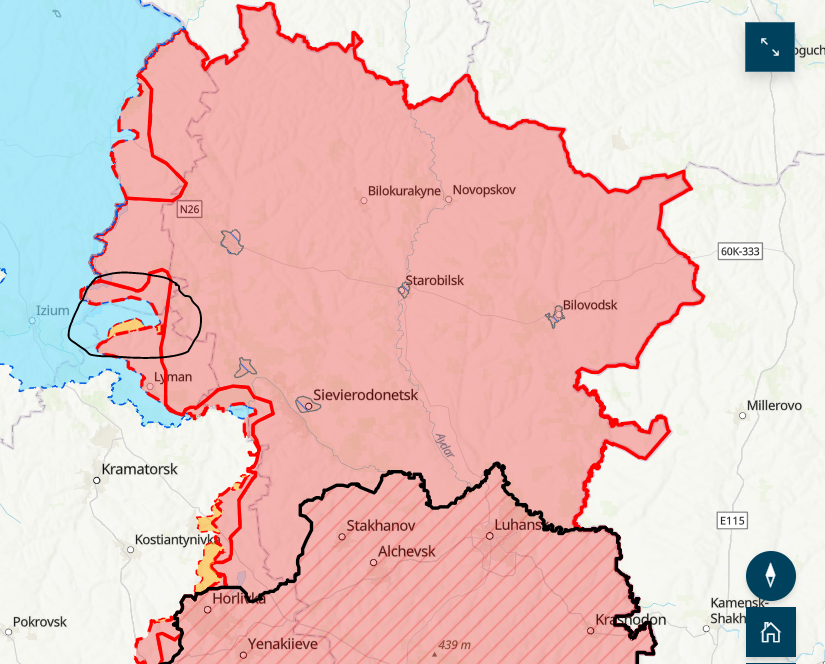

Another thing I learned when listening to a long form documentary about the energy crisis. it is astonishing to which extend Russia had impact on the the European energy infrastructure and part of the info is new to me. I knew that Russia owned pipelines to Europe, refineries but I didn't know they even owned the strategic gas storage facilities. There actually were experts sounding alarms in Europe that Russia was sending less NG to Europe as early as spring 2021. What this meant is that the NG storage was relatively low in 2021 and of course in early 2022 when the invasion got started. The likely conclusion is that Russia laid the groundwork for the offensive probably as early as 2020/21 and started to reduce the European gas storage via lower flows while European politicians were asleep at the wheel. That was obviously done to put the screws on Europe once the military actions was getting started to counter sanctions. On another note, the offensive in the East doesn't seem to be done yet. It looks like the Ukraine has achieved another breakthrough east of Izium. That one could end up as an encirclement of sizable amount of Russian troops in Lyman. It's slower moving than the Blitz from Kharkiv 2 weeks ago, but seems to gaining traction, especially if Ukraine can gain ground from the Southern direction near Swerdonesk as well.

-

Putin stated on several occasions that he regards Ukraine as part of Russia. He claims it is an artificial construct created by the Bolshewiks. https://www.nytimes.com/2022/02/21/world/europe/putin-ukraine.html No reason to overthink this. It's good old fashioned imperialism. All his talk about NATO threat is just a pretense and is all BS. He clearly want to make Ukraine part of Russia again. Why should the west or Ukraine accept narratives and red lines that Putin draws up nilly willy as he sees fit? I know about Russian history but that does not mean I accept his narratives. As far as I know, the Allied did not accept Hitler's narrative too. He saw himself in the line of Barbarossa (chosen as the campaign name for the attack against Russia) Karl the Great ,Friedrich the Great and what not. Every Dictator tries to a justify his acts based on history and lineage. they do this to justify what they are doing. Nothing special and profound about this and doesn't make it right either.

-

Where Does the Global Economy Go From Here?

Spekulatius replied to Viking's topic in General Discussion

When it's all said and done, I think almost any sector benefiting from COVID-19 will get whacked and mean revert. List so far: online retail, Tech, Lumber, Energy, building/construction, Cable, PC's, semis, consumer credit, retail List just gets longer and longer... -

With the more of less full mobilization and Russia switching to war economy, I can not see that this ends up in anything but an economic train wreck for them. I think they are likely to see a double digit decline in their economy. headwinds are: 1) Sanctions 2) No NG exports to Europe (their own choice) 3) Mobilization & switch to war economy and war expenses 4) lower oil prices and having to sell oil at deep discounts

-

I wouldn’t count on the 70’s to return. I do agree on NG likely being a better bet than crude, but it’s hard to invest in. The producers have short lived reserves and that spells trouble dying any short term downturns. I have been looking into SHEL which could be a long term beneficiary due to their large integrated gas business but they have been so terrible in terms of capital allocation that I would need a larger discount to fair value to invest and even then, I would need to hold my nose.

-

Unfortunately we cannot count on Putins removal. We have no insight on what’s going on, the autocratic regimes are brittle - they seem hard and impenetrable from the outside, but they are likely all rotten on the inside. Anything could happen or nothing. This guy has a decent podcast and shows how the mobilization is going. Unbelievable…

-

Movies and TV shows (general recommendation thread)

Spekulatius replied to Liberty's topic in General Discussion

@Xerxes I have no idea who Sauron is. I suspect we haven’t seen him yet and that he turns out to be a fallen Elf. I found the Episode 5 of Rings of power very enjoyable, I love the little sidelines adding color to the world like the wonderful “Wandering Song”. A waste of time one could say for the storyline, but those details, poems or side storylines were also prevalent in Tolkiens work and make it so special. So, I hope to see more of it: The Hartfoot hobbits are growing on me. I guess that man fallen from the Sky is going to be Gandalf. -

One thing that’s clear already from the news is that this is not a partial mobilization it is more or less a full mobilization. It’s much more than 300k for sure, maybe 2-3x that. You can find picks where they are loading up men that are around 18 year old in buses. No military experience required. They probably go straight to the front after one week of training. Some get rusty AK-47 (you can find the videos on Reddit/Tiktok. Those weapons will never shoot. So this is now Special operation V3.0: V1.0 - Kyiv bum rush. Lost, had to retreat. V2.0 - Donbas creeping artillery barrage - stopped by HIMARS and Ukrainian counteroffensive into soft spot. V3.0 - Volksturm, Hold the line? Human wave attack? Plug holes in frontline? Not sure what the plan is. Likely result is hundred thousands of Russian dead. War is going to take for a while until these “reserves” are chewed up. Then we wait for Putin‘s next move.

-

Everything can happen. WLK hit book value today, so if you believe that WLK can earn more than its cost of capital over a cycle, then WLK is cheap. I think the US based chemical industry should win market shareholder European ones and maybe even Chinese ones due to lower input costs (NG). That should create some floor to margins even in a recession.

-

Agreed. To be honest, I am not even sure that the "superspikes" are causing the recession or if they are an indication of imbalances that area leading to it (more of a symptom than the disease). For example, we had a "superspike" in crude and even NG prices in mid 2008 when the economy was already on the ropes so to speak and after bear Stearns already was sold off to JPM. This was later followed by a GFC which was caused by leverage in the financial system not energy. Coincidence? I do think that the fact that prices got that high was tell for issues yet to come. As for the current situation, i am more interest in old economy spread based business like $WRK (which i added to today) and maybe $WLK (chemical with a pretty good management, don't own it yet) but I did buy a little $SU in my IRA just to keep me interested. SU has the potential to become a good dividend stock, imo.

-

Read Putins speech and tell me where he learned anything. He is as boxed in his ideological box just as much as he was at the beginning of the war. Let's assume the west think we need to negotiate and decide we give him the Donbas, Crimean Luhansk area and his $350B back, bcause of nuclear threats. Happy days for everyone - Oh wait! Of course he still has his nuclear weapons. So he is going to ask for me - he would be stupid if he didn't. So now you have a Putin who is richer, has more land and has been vindicated. Why would he not ask for more fondling with his nuclear trigger. The only reason to negotiate is if you can eliminate the threat posed and we can't. So giving in to Putin in a negotiation is going to make things worse. The only way to counter the nuclear threat if Putin threatens with nuclear weapon use is to give Ukraine Nukes if they decide they take them. Then Putin can decide to nuke it out or go home.

-

Where Does the Global Economy Go From Here?

Spekulatius replied to Viking's topic in General Discussion

We haven't even started this whole nearshoring yet - Inflation would be ridiculous if we did. Without immigration, nearshoring isn't going to happen anyways. Who is going to be running the manufacturing plants and fabs? I don't think they will get engineers to do these job unless we let them immigrate from Europe, Russia or Asia. Skilled labor with tech background is another issue, it just doesn't exist in the US to the extend needed. Maybe Mexico can help a little here or there. -

I think the Chinese economy is in for a long period of lower growth and in particular less consumption of energy and raw materials (like iron ore, copper aluminum, cement etc) as they retool their economy from real estate/ Capex driven to more consumer driven. There are only so many houses they are going to need with a shrinking population. I do agree that NG is the fulcrum energy commodity, not oil.

-

Energy bulls and bears this year: I am tempted to dumpster dive into some SU if this continues. Problem is that superspikes in energy like we had this year are followed by a recession EVERY SINGLE TIME. We also know what recessions do to oil and energy prices.

-

PM is better run, but it's a matter of price. I bought in the low thirties, sold north of $46 (almost top ticked it) and now feel I should get in. It's a dividend stock and I don't try to overthink it. If PM goes sub sub 90's, I am in too. I continue to hold SWMA (havn't sold a share) but unsure what happens next.

-

Life comes at you fast - had a fill for some FRFHF at $451. Also got some fills for $BTI at a bit more than $37.

-

@Dinar thank you for the well written thesis summary. I think I have seen this written up before in one of the hedge fund letter, maybe Keith Smith / Bonhoeffer @Packer16 ?

-

Do you feel it's attractive? Their debt is surging. It's a great business as long as housing/construction hums along nicely, but not so much if it slows down. I don't know how much is priced in and it sure looks cheap. One of the many above average cyclical business that looks fairly cheap based on normalized earnings ( if this is knowable).

-

Think about logically - he is trying the "Volksturm surge" now. Risk of nuclear escalation is very very low for the time being. Negotiating with Putin is as pointless as negotiating with Hitler back then. The people who should be most interested in regime change are the Russians. Only Putin can end this or the Russians can end Putin.

-

Bought a bit of TSM pre market today. Have a buy order for FFH around $450

-

regarding Dropbox - you can get a subscription for MS365/ office and the free OneDrive storage cheaper than a Dropbox storage subscription, if you look around. Now MS OneDrive may not be quite a feature rich than Dropbox storage but still. it does show the power of bundles and MS integrated business model (they own their cloud business which probably lowers cost to provide storage to near zero).