boilermaker75

-

Posts

1,868 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by boilermaker75

-

-

-

Here sits mighty XOM at my target price. Yet here sits my bat on my shoulder. ;D

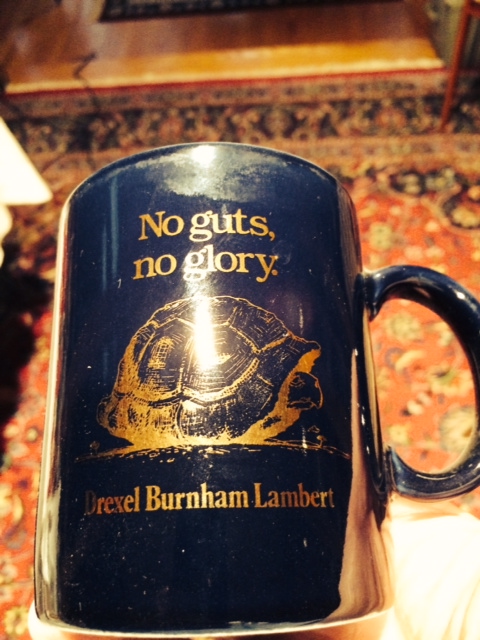

No guts no glory.

My source for that quote is a Drexel Burnham Lambert coffee mug on my desk.

-

History would suggest that getting creative is unnecessary, and that buying XOM has always worked.

If it works, keep doing it. I have been writing the 89-, 90-, and 91-strike weekly puts. The premiums are nice and if I get put to I have a great entry price.

Boilermaker, Can you elaborate. I was just looking at the list for the 90s for dec. 20. Its $1.00. Is this what you mean - really short term. I guess it works okay until you get put to a few times and end up eating up your margin on XOM stock. Tx.

Yes that is what I mean. I don't mind being put to, I would like to own some XOM acquired at $89. So I am only writing the amount of contracts equivalent to the position I want to have in XOM. Like putting in a limit order, where I make some cash while waiting to execute.

-

History would suggest that getting creative is unnecessary, and that buying XOM has always worked.

If it works, keep doing it. I have been writing the 89-, 90-, and 91-strike weekly puts. The premiums are nice and if I get put to I have a great entry price.

-

In 1969 I was not yet a Boilermaker

You read this in high school!? If so, damn precocious when compared to my high school mentality, when I would have passed over Adam Smith's The Money Game in favor of Tony Robbins's Money: Master the Game. I concede: Boilermaker 1, Buckeye 0.

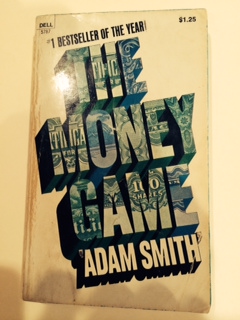

My parents lived through the depression, which greatly influenced me. So I was always interested in accumulated wealth in case of another depression. Growing up I did it by being a paper boy, caddy, etc., and saving everything. I had a sister who was six years older. She had a boyfriend who was a stockbroker. He told me about the book so I bought it and read it. I don't think I understood much. When I reread it about 10 years ago I understood what Adam Smith was talking about!

If I had not gone into a technical/science/engineering career, I would have gone into something dealing with finance.

Our football team is pathetic. So I am pulling for the Buckeyes to do well for the B1G.

-

Here is my copy--notice the price in the upper right corner! I bought and read this in 1969.

Nice! (except hope you didn't pay full retail price: $1.25 then is $14.95 now.) Since we're carbon-dating ourselves, I'll mention I was growing up in Ohio at the time. 1969 was a big year for Ohio: an Ohio boy walks on the moon, an event overshadowed only by Mike Phipps about to become a Brown.

Yes I paid full retail! I was not indoctrinated yet to value investing!

In 1969 I was not yet a Boilermaker, but seeing Boilermaker Armstrong walk on the moon and Boilermaker Phipps beat Notre Dame three years in a row must have had an influence on me!

-

-

Just finished rereading Player Piano. I last read it about 40 years ago!

Reading this gave me the sudden urge to re-read Slaughterhouse Five, but I'm on the first edition of The Intelligent Investor, so in the immortal words of Billy Pilgrim, "But I'm not ready yet!"

LOL

-

Boilermaker, I wholeheartedly recommend an elegant universe. Fascinating and easy-to-understand storyline on major breakthroughs in physics. As a science nerd with no formal science education post university, it was great to read.

LC, I started An Elegant Universe today. If you like popular books on physics, one of my favorites is In Search of Schrodinger's Cat by John Gribbin.

-

Just finished rereading Player Piano. I last read it about 40 years ago!

I went to a Brian Greene lecture last night. A copy of his book An Elegant Universe has been on my stack of books to read for a long time. I'm going to start it.

-

Carnegie is the one who fought for the inheritance/estate tax and claimed "The man who dies rich dies disgraced". He also lobbied other rich to give their wealth away: see "The Gospel of Wealth".

One can see a lot of Carnegie in Buffett, but for whatever reason the media never points this out.

Carnegie and Rockefeller had a competition to see who could acquire the most money and then to see who could be the most charitable.

-

-

Thanks!

-

Is there someplace I could look up the average SIR for all stocks in an index such as the SPX?

Also is there a site that just lists SPX stocks by SIR?

I did find one site where I can enter tickers and get the historic SIR.

http://www.nasdaq.com/symbol/de/short-interest

The reason I am asking is that I have been reading Quantitative Value and there is a section that talks about performance versus SIR. So I want to start watching SIR to see if it might be something useful.

-

Good point. Will do.

Most online communities treat women badly, or at least differently, so it's often much easier for women to not have feminized screen names and don't mention that they're women.

Sad commentary for society in general. I think if there were such women here, such minds must be extraordinary and fascinating.

And with returns we would be envious of!

-

I love IB. However there is one thing that you cannot do with IB, which is a real pain for me because I do a lot of option trading. You cannot download from IB, like you can from Schwab, your transactions into Turbo tax.

-

With apologies to The Clash,

Darlin you got to let me know

Should I hold or should I sell

If your payout ratio is going up

I’ll hold here till the end of time

So you got to let me know

Should I hold or should I sell

It’s always tease tease tease

You’re happy when I’m on my knees

One day is red and the next is black

So if you want me off your register

Well come on an’ let me know

Should I hold or should I sell

Should I hold or should I sell

Should I hold or should I sell

If I sell there will be trouble

An’ if I hold will be a double

So come on and let me know

How are you going to work in "should I cool it or should I blow"? Seems like you left off right before that . . . .

I had a friend who was really good at this sort of thing. This was my first attempt, so I stopped before I got through all the verses and made too much of a fool of myself!

Here is one my friend did that is appropriate considering the current market,

Guess who just got back today?

That wild-eyed Bear that had been away

Hadn't changed, hadn't much to say

But man, I still think his fur looks great

He was asking if Abby Joe was around

How she was, where she could be found

I told him she was still at Goldman

Driving all the old bulls crazy

The Bear is back in town

(Spread the word around

Guess who's back in town)

Weekdays he'll be dressed to kill

Down at the corner of Wall and Main

The knives will fall and blood will spill

If the Bear wants to fight, there'll be a world of pain

The big screen in the corner turning green to red

The lows are getting near, the bulls have fled

It won't be long till equity's dead

Now that the Bear is here again

The Bear is back in town

(Spread the word)

-

With apologies to The Clash,

Darlin you got to let me know

Should I hold or should I sell

If your payout ratio is going up

I’ll hold here till the end of time

So you got to let me know

Should I hold or should I sell

It’s always tease tease tease

You’re happy when I’m on my knees

One day is red and the next is black

So if you want me off your register

Well come on an’ let me know

Should I hold or should I sell

Should I hold or should I sell

Should I hold or should I sell

If I sell there will be trouble

An’ if I hold will be a double

So come on and let me know

-

I have accounts at IB and Schwab. Everytime I talk to someone at Schwab I tell them about the low commissions at IB, which got my commissions down to $4.95 at Schwab, and the extra security layer at IB, which has not resulted in additional security from Schwab, yet.

-

Thanks packer, was a nice weekend read and something that has its place as a reference on my desk. Its one of the few books that gives concrete formulas on how to value companies.

What i found interesting is that he wrote that most of the investors were not fully invested all the time, so this buy and hold forever or be 100% invested at all times is a little debusted here.

I now have to find a book on the turtle traders :).

-

Reread this book recently. Great book. Fantastic weapon against high pressure sales tactics.

It is a great book. One of those books that I occasionally give people. I just wish they would read it, including my daughter!

-

1). What do Mr. Buffett / Mr. Munger / Mr. Carret mean when they say patience?

When they come across an interesting idea, they ask if the price is right. If the answer is NO, not at this time, they wait. And they wait and wait until the price becomes right. In some cases this has been years, if not decades. Of course when they buy, they take the whole stack.

An example, Buffett had been reading IBM's annual report every year for 50 years before he purchased $10.7B of IBM stock in 2011.

-

So the presentation is their methodology as discussed in Quantitative Value, right? Interesting to hear him talk about replicating the MF. Wes Gray has talked about their not being able to replicate it, but Carlisle explains that pretty easily and satisfactorily. BTW: Wes had some copies of QV on "sale" via his blog/amazon this week. I dunno if he sold out yet.

I ordered a copy on Saturday ($39.99 plus $3.99 for shipping) and he shipped it on Saturday. Still showing, so he must have more. I wonder if it will by autographed? lol

-

It is well worth it if you ever get an opportunity to watch the episode of Inside the Actors Studio when Robin Williams was guest.

Biggest regrets of the older posters here?

in General Discussion

Posted

Not buying more INTC in 1976!