boilermaker75

-

Posts

1,843 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by boilermaker75

-

-

-

BRK/B 25%

WFC 5%

BBT 1.5%

GE 1.5%

BAC 1%

short puts 79%

____________

total 113%

So I would be 13% on margin if put to on everything I am short. After today's expiration, that will come down to just over 1%.

-

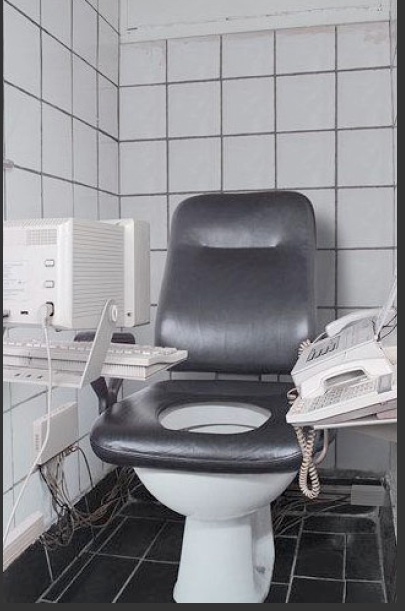

OK, I was joking with the photos in my previous two posts on this thread. I will be serious and respond to the request.

I have an office at home and at work. (I actually have two offices at work but I spend >95% of my time in one.)

Here I will just post photos of my home office as I go around the room. I'll upload my work-place office later.

Wow ! it seems we have a pretty similar collection of books, although my online library is much bigger than my physical library. The picture was a little blurry but could make out quite a few- Schrodinger, Genius, Superfreakonomics, Contact etc. I am Sagan fan too. Found "The signal and the noise" on your desk. Haven't had a chance to read Nate Silver's book yet, but it's on my list. Reading "Wizard: The Life And Times Of Nikola Tesla" and "The Travels of a T-Shirt in the Global Economy" right now. I would like to hear your opinion of Nate Silver's book though.

Btw I think I have the same photonics book ( don't know which edition though). Bought it for a course in grad school quite a while back but never was able to get rid of it, even though I don't work in that area.

I haven't read the Nate Silver book yet, just got it. I am taking a road trip to NC in a couple of weeks and will take it with me.

I also have a kindle, which is great for traveling, but I only have about 20 books on it so far. I have run out of physical storage space, so I imagine most of the books I acquire from now on will be electronic.

I'm like Jerry in the movie Conspiracy Theory. I can't go by a book store without stopping in and buying a book. At least I buy a different book each time, instead of just copies of Catcher in the Rye like Jerry did! Of course I occasionally forget I have a book and now I have a second copy!

-

-

Hi Sanjeev,

I am surprised that I am a hero member now. I am still relatively inexperienced. I asked a lot of questions in various posts so I could learn from other members, and I got confused why I became a hero member. I think this could be misleading to new members because if they see my posts and see I am a hero member, they may treat my opinion more seriously, but in fact I may be even less experienced than those new members, or some elder members who don't post a lot. Perhaps we should set a bar here and only manually promote someone to hero member if they have a few good investment ideas that worked out well?

You are a hero for asking a lot of questions. They are probably questions some of us also have. It is also a benefit for those who respond to your questions. The best way to learn is to teach. I have been teaching at a university for 25 years. I still learn something new every time I teach a course, even if it is something I have taught many times before and the material is at the undergraduate level. Often I pick up a new subtlety.

-

OK, I was joking with the photos in my previous two posts on this thread. I will be serious and respond to the request.

I have an office at home and at work. (I actually have two offices at work but I spend >95% of my time in one.)

Here I will just post photos of my home office as I go around the room. I'll upload my work-place office later.

-

-

-

Here is what I posted in the DELL thread on this topic,

I spoke with an options expert at Schwab. He said it depends. Usually at the next expiration date they will do an early closeout of these out-of-the money LEAPS. Other times they won't and the short out-of-the-money LEAPS position will sit in your account until expiration. I forgot to clarify who decides and why they would not close them out. If they are not closed out they aren't traded so nothing you can do about them in your account till expiration in Jan '15 when they expire. Let's say you have a non-margin account. Then you have to have the cash on hand to secure those LEAPS puts till they expire. He said that is not likely but it could happen.

I like to have control over the time frame in these merger and acquisition plays. So I play them by writing puts, but only near expiration puts. I am short Jan 25, 12- and 13-strike puts and Feb 16, 12-strike puts. I will probably write some Feb 1, 13-strike puts near the end of the day tomorrow.

-

Instead of having to debate Morningstar's value proposition, you could just get the whole package completely free through any major public library. It's a wonder why anyone pays for Morningstar.

Thanks for this suggestion. I used to look at the 10 year financial data summary, which used to be available for free but now requires premium membership. In just a couple of minutes I was able to figure out how to access it again for free through my university library system.

-

I read Mandelbrot's book, the Misbehavior of Markets, quite a while ago. My recollection is that it was very good and I have been meaning to go back and reread it. As I learn more about investing, I find it very interesting to reread material that I first read several years ago.

-

I'm always writing puts. I am short puts for May 31, June 7, June 22, and July 20 expiration dates. At various strike prices I am short puts on CF, AAPL, INTC, EMC, BAC, NOV, DTV, CHKP, COH, ORCL, MDT, STRZA, HRS, DELL, and CSCO.

That is quite a collection of put shorts. :)

Do you not worry about missing the upside for these stocks?

It is a conservative approach. But I have found it is also a good way to enter positions. There have been few stocks I wanted to acquire where this did not work. Another negative is that if not put to, and thus reducing the cost basis of the position, the option premiums are taxed.

About 25% of my portfolio is BRK/B, I entered all those positions by writing puts. About 5% of my portfolio is WFC, again I entered all those positions by writing puts.

I also use a little effective margin each month using this approach. In other words if I get put to on everything I would be on margin, a little under 10% at this time.

My biggest mistake is not holding on to positions when I do get put to and instead writing covered calls losing the position. For instance I had some WDC that I was put to under $30 and I let it get called out because I wasn't confident enough about hard drives.

My approach keeps evolving. I know I need to keep more positions so as not to miss the upside and to delay taxation.

-

anyone selling or just buying puts

I'm always writing puts. I am short puts for May 31, June 7, June 22, and July 20 expiration dates. At various strike prices I am short puts on CF, AAPL, INTC, EMC, BAC, NOV, DTV, CHKP, COH, ORCL, MDT, STRZA, HRS, DELL, and CSCO.

-

Ride the wave of the future my man,

"History doesn't repeat itself but it does rhyme," Mark Twain.

-

Only if there is no experience to go with it.....

In real life Apollo will actually have more experience than either of the University candidates, as they were actually working while the others were on campus. Apollo may well also be the preferred candidate simply because they are more mature, & have demonstrated that they can handle competing priorities (school + work). No wet nursing required.

Just because you are newly graduated from university, does not mean that society automatically owes you a job.

It depends on the company's experience with graduates from a particular university that determines where they go recruiting.

Here are the top 25 schools as ranked by corporate recruiters,

http://online.wsj.com/article/SB10001424052748704554104575435563989873060.html

-

The problem is administrative staff

http://online.wsj.com/article/SB10001424127887323316804578161490716042814.html

That is definitely another component. Although some of the increase in administration is the result of additional federal requirements.

I don't have a WSJ subscription so I could not access the article. Here is one, which is probably similar that anyone can access at Bloomberg.

-

Universities have been in intense competition on both the athletic and academic side. The salaries being paid to some football and basketball coaches is ridiculous, up to $5 million per year. The argument for the high salaries is the resulting ticket receipts, the extra donations, and the extra applications, which increase rankings through the component of selectivity. But this is probably only true at the top 10-20 athletic programs. Most athletic programs are not self-sufficient and require infusion of cash from the academic side. The only university that made the rational decision regarding college athletic is the University of Chicago, a founding member of the Big Ten and once the top football university in the country. They dropped out of big time athletics and it does not to seem to have hurt as they are one of the top universities in the world.

There has been a similar competition on the academic side for high rankings with the salaries paid to some professors. (I should not be complaining because I am a beneficiary of this.) As an example, one of the inputs in these rankings is often how many National Academy members are on the faculty. So universities, in order to attract a National Academy member on the faculty, will pay $250k salary for the nine-month academic year (note this is the number reported as salary but usually does not include additional summer support, extra pay from their chair endowment, etc.) , a start-up package of several million dollars to set up a lab and hire research assistants, and often with a reduced teaching load. So an additional faculty member needs to be hired to cover the teaching.

-

I am a professor in an engineering department at a major public research university. When I look at what a typical faculty member spends his/her time on in my department it is 80% research and 20% teaching. In my department 90% of the faculty salary funds come from the university (tuition, state appropriations, and gifts) and 10% from external research contracts. So at research universities a large portion of the undergraduate tuition is going to support the research efforts of the faculty.

There has also been a major shift in the demographics to provide additional funds, in-part because state appropriations have declined. 30-40% of the undergraduate students in my department are international, the rest split between in-state and out-of-state students. The international students not only pay out-of-state tuition, but an additional international fee. When I was an undergraduate at a major public research university I had no fellow international students and over 50% of my fellow students were in-state.

-

-

I have used Fidelity for about 10 years and have been very happy. Do not underestimate the value of downloading info to TurboTax at tax time and the access to 10 years worth of old statements. I find I am looking back at old statements more and more and of course filing my taxes is a lot easier with the download.

Satisfied Fidelity customer.

Yes that downloading into TurboTax is a major plus for Schwab and a minus for IB.

-

I use IB and Schwab. I like them both. I negotiated my commissions with Schwab, pointing out the lower commissions I get at IB, and Schwab lowered my commissions to $4.95 a trade plus $0.75 per option contract. What you can negotiate with Schwab will depend on your account value and how much trading you do. Of course the commissions are still much better at IB as Schwab would not/could not go that low.

-

S&P is about to get a visit from the IRS

Good one, LOL.

-

Idiots! Article was in USA Today. Cheers!

http://finance.yahoo.com/news/p-cuts-berkshire-hathaway-rating-134403253.html

It is idiots like this that often gives us better opportunities. But doesn't look so in this case.

-

From my one minute of due diligence I do not understand CBI, but STARZ looks interesting.

Way to go Black Hawks!

in General Discussion

Posted

Wow what a game! Did anyone catch the Black Hawks come back and take game 1 from the Bruins last night in triple OT?

I started watching the Black Hawks back in the day of Bobby and Dennis Hull, and Stan Mikita. So I am a big Black Hawks fan.