mcliu

Member-

Posts

1,200 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

Forums

Events

Everything posted by mcliu

-

It's interesting that the West does not provide weapons to Armenia since it is a democratic country being invaded by an autocracy. Aren't there parallels between the Armenia-Azerbaijan and Ukraine-Russia conflicts? And if the proxy war in Ukraine is about defending democracy, why is EU partnering with Azerbaijan? https://www.politico.eu/article/the-eu-azerbaijan-gas-deal-is-a-repeat-mistake/

-

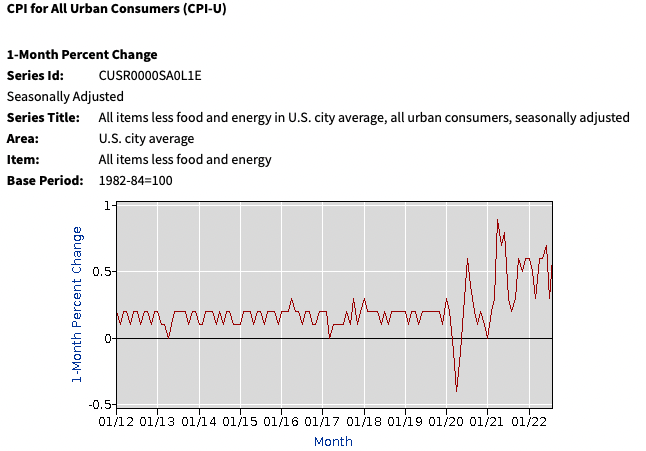

Core CPI as per BLS. There is a clear shift in the last 2 years. The question is if this continues or reverses back to 2012-2019 levels.

-

https://www.wsj.com/articles/europe-manufacturers-factories-russia-gas-11662938614?mod=mhp Europe entering a vicious inflation spiral unless they can solve their energy problem quickly.

-

Huge turning point in this conflict. The question is if this will lead to a Russian withdrawal or greater escalation and WW3.

-

Fyi, since most ppl aren't aware of this, in Canada we don't use the term eskimo, since it's kinda racist. https://globalnews.ca/news/2366689/expert-says-meat-eater-name-eskimo-an-offensive-term-placed-on-inuit/ https://en.wikipedia.org/wiki/Eskimo Eskimo (/ˈɛskɪmoʊ/) is an exonym used to refer to two closely related Indigenous peoples: the Inuit (including the Native Alaskan Iñupiat, the Greenlandic Inuit, and the Canadian Inuit) and the Yupik (or Yuit) of eastern Siberia and Alaska. Many Inuit, Yupik, Aleut and other individuals consider the term Eskimo to be unacceptable and even pejorative. The governments in Canada[4][5][6] and the United States[7][8] have made moves to cease using the term Eskimo in official documents, but it has not been eliminated, as the word is in some places written into tribal, and therefore national, legal terminology.[9] Canada officially uses the term Inuit to describe the indigenous Canadian people who are living in the country's northern sectors and are not First Nations or Métis.[4][5][10][11] The United States government legally uses Alaska Native[8] for Native Alaskans including the Yupik, Inuit, and Aleut, but also for non-Eskimo Native Alaskans including the Tlingit, the Haida, the Eyak, and the Tsimshian, in addition to at least nine separate northern Athabaskan/Denepeoples.

-

This situation is prevalent in Canada too. ex. In the Toronto region (7m population) average SFH price ($1.3M) vs median household income (70k). Massive disconnect. Many millennials are moving away from Toronto, especially as they form families. Smaller towns/cities are more affordable but lack career opportunities.. Catch-22 for young people.

-

https://www.reuters.com/business/energy/wide-demand-reduction-only-feasible-solution-europe-energy-crisis-equinor-2022-09-06/ Margin calls in Europe exceed 1.5 trillion euros - Equinor exec Maybe stagflation might is the best possible outcome for Europe. Worse might be depression or economic collapse.

-

I think currency deprecation is measured against real assets like real estate/gold not against other fiat currencies.. Europe seems to be entering stagflation period due to lack of energy hence the weak currency vs US.

-

FYI: Canada probably has the cheapest natural gas in the world right now. AECO even turned negative for a few days in August.

-

Insane escalate. Why antagonize 1.5 billion Chinese people.. Feeds right into Chinese propaganda that the West is trying to hold it back like during the Opium wars.

-

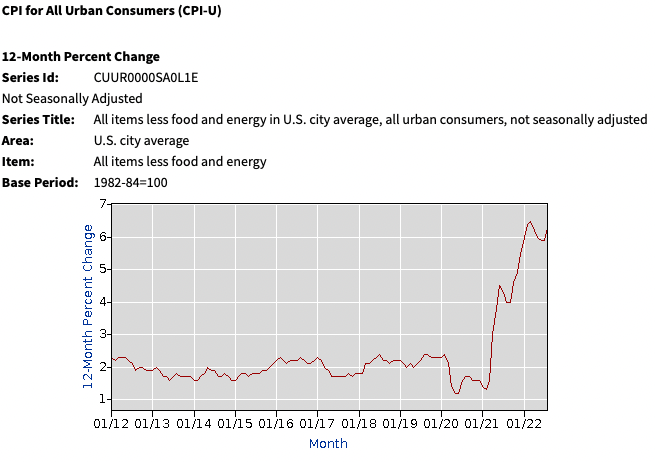

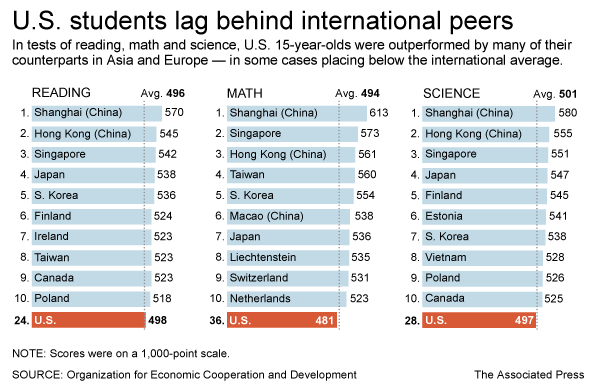

China has numerous problems, but so does every country. These China analysts keep failing because they only focus on the problems but miss the big picture. If anything, it's the Western governments that are failing its constituents by failing to provide quality education and infrastructure. Luckily, we can rely on the private sector for some of the shortcomings but private sector can't do it all. Education: Infrastructure:

-

https://www.reuters.com/markets/europe/forget-showering-its-eat-or-heat-shocked-europeans-hit-by-energy-crisis-2022-08-26/ Stagflation

-

Aren't these Fathom Consulting guys China perma-bears?

-

Suburbanization is largely an American phenomenon though. Many people prefer living in denser communities and be walking distance to shops/groceries instead of driving everywhere. I think many upper-middle class Chinese that reside in cities own cottages/country houses in the rural areas outside of the cities, typically the villages that their families were originally from.

-

I think that's true. Probably why Japan also do not have many immigrants. There is a term for returning Chinese, it's a significant #: https://en.wikipedia.org/wiki/Haigui I think the lifestyle of the middle/upper-middle class in China is better than the lower/lower-middle class in America, so there's less incentive to emigrate and start-over.

-

It’s CapIQ, kinda expensive for at personal use though.

-

The US has no problem doing business with authoritarian regimes. Biden just went to Saudi Arabia. If anything they are far more repressive than China, especially towards women. US is fine with manufacturing pivoting from China to Vietnam, another communist authoritarian regime. Plenty of examples throughout history of the US allying with dictatorships to further its self-interests. The problem with China today is not so much it's model of government but that it's powerful enough to challenge US dominance.

-

The US is a superpower but it's no longer the only superpower. Policy needs to adapt to reality.

-

-

If you follow western media, China has been heading into a meltdown every year for the last 20 years.

-

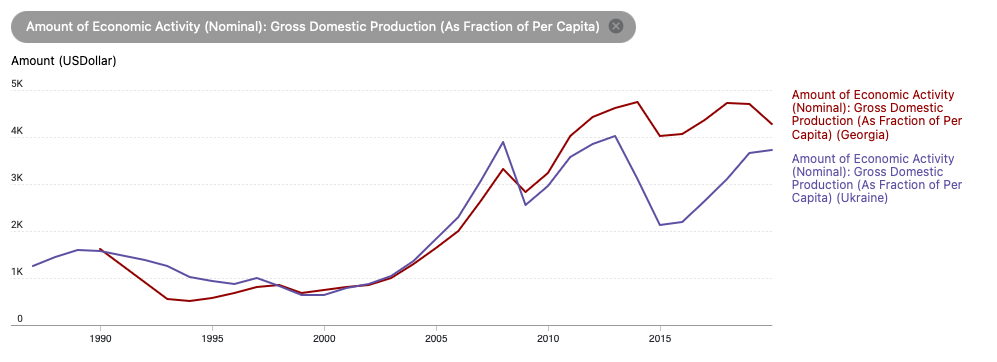

Clearly the sanctions have not worked. For the most part, Russian elites and commoners have stood behind Putin. Ukraine's going to turn into a blackhole of money for the West, much like Iraq and Afghanistan. This money would have been better spent building domestic infrastructure, renewable energy, education and healthcare. The way democracy wins against autocracy is not through wars but to show that the system is superior. Georgia surrendered to Russia after 12 days. Georgia is still an independent country and its infrastructure is largely left intact. GDP per capita has increased >30% since that war. The longer Ukraine fights, the great probability the country will be left in ruins.

-

I don't think it's because we can't produce but rather that production has been flat but money supply has increased by 50%. The price fluctuation we saw in certain commodities like lumber is probably a reflection of rapid changes in demand due to lockdowns and not so much overall price levels. Since the US is largely a service-oriented country, availability of labour and wage growth is probably the largest driver of inflation. I think due to the excessive COVID money printing, the Fed needs to demonstrate credibility that they will defend the value of the US$ and financial system. The Russia war and subsequent sanctions & asset seizures is also testing the faith of USD holdings by creditors like China/Saudi. A loss of faith in currency will make inflation worse, especially for countries with large imports (even more so with large deficits), which is what we might see in Europe as the Euro plummets.

-

I agree with you. It seems like policy is driven by ideology and not economic rationality. It is not clear that governments will do the right thing. I think this is the biggest LT risk to the oil sands companies, but might be a ST benefit.

-

I think many US/EU companies & funds have divested their oil sands investments. Would US/EU take it further and pressure Canada to reduce or even stop production?

-

Good topic to see psychology at work. Herd mentality, confirmation bias, etc. May: https://ca.news.yahoo.com/putin-very-ill-blood-cancer-070511658.html July: https://www.politico.com/news/2022/07/20/cia-putin-health-00047046 In other news, the CIA Director William Burns appeared to pour cold water on widespread rumors that Russian President Vladimir Putin could be ill, saying there was no evidence backing up such speculation. He added that Putin was “entirely too healthy.”