mcliu

Member-

Posts

1,200 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

Forums

Events

Everything posted by mcliu

-

Another perspective, would a closed-end fund trade at NAV if it had an all-star manager with an excellent LT track record and ability to generate above market returns while taking on little risk and employing negative-interest-rate leverage?

-

Thanks. That's an accurate take. I think Taiwan's stagnation also coincides with China's rise. Taiwan became a much less attractive investment for foreigners & even locals. I think despite economic integration, younger Taiwanese seem less politically aligned with the one-China position than their parents, which is reflected in election results, frequent DPP wins over KMT. Overall I agree, integration is inevitable, hopefully peaceful, but there is risk of a confrontation. Timing is uncertain.

-

Western hypocrisy. The US has done plenty of sketchy shit and killed a ton of civilians (probably more than Russia in the last 20 years) but so far no sanctions, no flight cancellation, no global condemnation and no asset freezes/seizure of US leadership. https://watson.brown.edu/costsofwar/costs/human/civilians

-

Another big difference is that Ukraine is a recognized sovereign nation. Taiwan is not. All the major world powers recognize Taiwan as a province of China. Which is why I think the probability of US intervention is very low. I think Chinese planners would also actively try to create a scenario where the cost/benefits analysis for the US would skew toward non-intervention.

-

Obviously not comparing Afghanistan to Taiwan. My point is military superiority does not guarantee success in a conflict. Nobody is doubting US military superiority over the next 10/20 years. But China does not need to surpass the US in order to take Taiwan. Keep in mind, only 14 countries recognize Taiwan as sovereign. If anything, Japanese/US intervention will be seen as an invasion by the China & allies. Especially given Japan's reputation in Asia. The fact is that the amount of damage China's military can inflict is increasing rapidly. Don't think anyone will argue this. And I think as China's military capabilities increase, the probability of US or Japan intervention decreases. Probability of Japanese unilateral intervention to defend Taiwan without US is 0.

-

Yeah sure, all that tech did wonders in Afghanistan. Weaponry & tech doesn't do much good if there's no will to fight and no logistics to support it. You have to keep in mind, China is taking Taiwan, not trying to defeat the US. The carriers don't need to be nuclear since it's not meant to project power globally. The US has about 500 F-22/35, but it's deployed all over the world & needs a ton of support/logistics. How many can it really field to defend Taiwan? China has 150 J-20 stealth fighters & producing more. That's how things stand now, the gap will be even closer to the US and far superior than Taiwan in 10/15 years.

-

The gap between US and China is getting smaller and closing quickly. China's technological & industrial capacity is growing quickly and compounding. Taiwanese forces have not had real combat experience since being defeated by the communists. And unlike Ukraine invasion, PLA troops would be highly motivated due to belief in 1 china and liberation. Logistics might be more of a nightmare for the US fleet than PLA crossing the strait. Plus, realistically, how many casualties will the US tolerate to support Taiwan? This is why I think US will not be involved in a conflict. Unless US uses the nuclear card.

-

In the short-term it is hard to say, but in the long-term it's almost inevitable China will unify Taiwan either through force or diplomacy.

-

Question about crypto. Blockchain tech seems very interesting, but how do we know it's not in the dot-com phase where even if it'll be valuable, the impact won't be felt for another 20 years? Also, for the experts, is there a Versign equivalent company/coin in the crypto space that's worth investing in? Thanks!

-

It's also possible that having fewer ads & better optimized ads might generate more revenue through more users & engagement.

-

Is there a way to turn off the full page mobile ad? That’s the one that’s quite annoying, I think everything else is pretty fair game.

-

lol I wonder what the "market cap" of beanie babies was at the peak.

-

For those of you that do a lot of financial modelling in Excel, is there a way to make sure certain fields don't change? For example, I maintain financial models for~20 companies, the format is pretty standardized and a lot of the metrics & calculations are the same, but the financials & projections are different. I'm finding that sometimes when I make edits, update the model for a new year, change projections, things sometimes get wonky and I need to check all the cells again. Is there a way to lock these? Is there a software for financial modelling that keeps track of assumptions & changes over time & allows for multiple cases?

-

Since Canadian companies are allowed to return contributed capital on a tax-free basis and capital gains are taxed at a preferable rate (vs dividends) due to a 50% inclusion rate, the deemed dividend rule (section 84) is meant to prevent companies from converting what are essentially dividends into capital gains or capital returns.

-

Hard to say what will happen. They exited 2009 with $370 BVPS. 12 years later.. $562 BVPS. Hopefully next 5 will be better.

-

What valuation is too high to buy a great compounder?

mcliu replied to tnathan's topic in General Discussion

re:Terry Smith's chart, hindsight bias -

What valuation is too high to buy a great compounder?

mcliu replied to tnathan's topic in General Discussion

I think price matters because there are constraints in any ecosystem. How many multi-trillion dollar companies can grow at high 15% rates for decades before they takeover the world? 15% for 20 years = 16x. FAANGM market cap around $10T so if they compound at 15% for 20Y they'll be at 160T. Maybe less cause of buybacks & reduced share counts. But still a huge #. World GDP today is maybe $80T compound at 3% for 20Y = $140T -

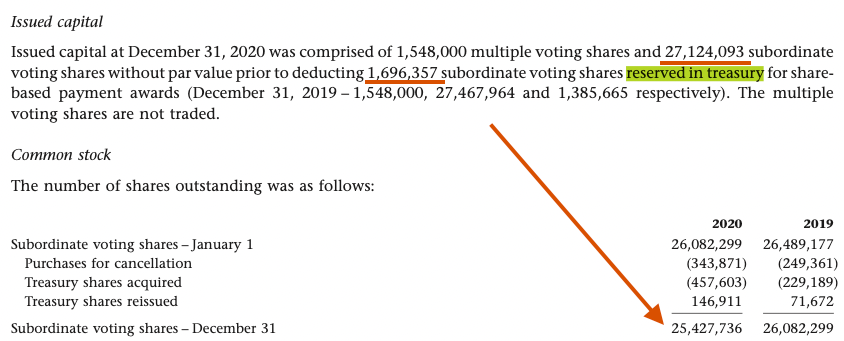

@Maxwave28 Hi Maxwave28, that is interesting. I think it may have to do with the shares that they've "repurchased" for share-based payment awards but have not "cancelled". From the 2020 Annual Report. So I think, given this, we need to deduct about 1.5 to 1.7 from the actual share count. Fairfax share count: 2015: 22.2 2016: 23.1 2017: 27.8 2018: 27.2 2019: 26.8 2020: 26.2 2021E: 25.7-1.6 (treasury shares) = 24.1

-

TIKR.com | Free Beta with Coverage of 50k+ Global Stocks

mcliu replied to Garpy's topic in General Discussion

@Dave86ch Yeah that would be very helpful. Btw, out of curiosity, what kind of analysis do you use Python for? I've seen many people mention Python, so I'm wondering if it's be I should be learning. -

TIKR.com | Free Beta with Coverage of 50k+ Global Stocks

mcliu replied to Garpy's topic in General Discussion

Also signed up for premium today. Great app, hope you guys make it even better. I was debating between TIKR and Koyfin, but chose TIKR because it loads faster and is better for fundamental investing. Koyfin has a nice UI though. Btw, is an API on the roadmap (like simfin.com) so we can use it with other applications like Excel or Google Sheets? -

Happy holidays!! Enjoy!

-

Thanks BG2000, thepupil, Gregmal! Appreciate the great tips & suggestions. For me, I'm just looking to diversify the equity portfolio, but it sounds like it'll take considerable study to have an edge. At this point, it might be best to buy a REIT index. Meanwhile, I will study FRPH & HHC (I think PSH has a big position in this.) to learn more about RE. Are there other smart RE investors/companies that you guys follow/study? Who would be the RE equivalents of BRK/MKL/CSU (long track record of making smart decisions & staying ahead of the pack)?

-

Thanks Bg2000! Good suggestions and lots of great leads I’ll start digging into. It does seem like there’s a lot of digging into individual properties or portfolios to invest successfully in this area, especially in private RE. Ideally I would love to just find a few good public owner-operators that I can just passively invest with for years.

-

Who do you think are the best long-term investor/value-creator/owner-operator companies in real estate? Which companies would you invest in for the next 15 years? I think David Simon (SPG) has a good track record despite facing e-commerce headwinds. Sam Zell? Brookfield? (They're more of an asset manager now.) Anyone else?

-

The future is difficult to predict. Isn't it better to hedge your bets probabilistically rather than go all in on one scenario?