mcliu

Member-

Posts

1,207 -

Joined

-

Last visited

-

Days Won

2

Content Type

Profiles

Forums

Events

Everything posted by mcliu

-

Phenomenal businesses that don't require any capital

mcliu replied to LearningMachine's topic in General Discussion

Amazon? -

Is Concentration a better strategy than Buy and Hold?

mcliu replied to Viking's topic in General Discussion

Seems like it really depends.. If you want exceptional results, you almost have to concentrate. But you have greater risk of blowing up if a) you don't know what you're doing, or b) if you've made a mistake in your analysis or c) just bad luck/black swan. If you're young and talented this is probably the way to go. If you're older and less talented at investing but wealthy, you probably want to diversify and lower the odds of a bad outcome. -

Who Do You Follow and What Are their Circle of Competence?

mcliu replied to BG2008's topic in General Discussion

I follow Jim Cramer on Twitter so I know what not to do. -

Agreed! Seems like banking is one of those areas where an imaginary crisis can create a real crisis though.. I think the headache here is creating the incentives for people to stay in their regional/local banks when there are TBTF banks. It's extra difficult when you have an inverted yield curve and very high short-term rates.

-

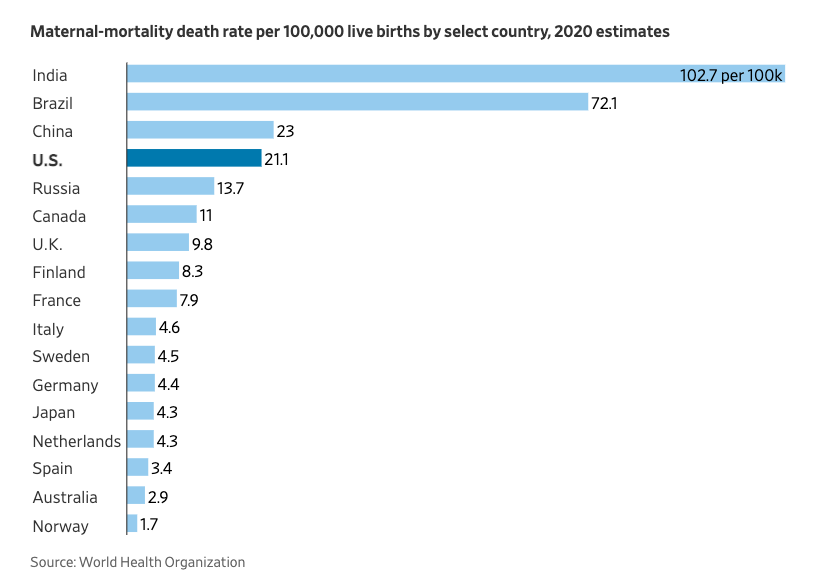

Yeah but I'm talking quality of life for the majority of people.. Keep in mind that many parts of Mexico are run by cartels and there's a huge violent crime problem. As for India, it's only 1/6 the GDP per capita and you need to contend with a highly discriminatory caste system. If you remove the political freedom aspect, China seems to outperform Mexico/India in every metric, safety, healthcare, infrastructure, GDP per capita, life expectancy, education, maternal outcome.. Also saw this in today's WSJ:

-

My understanding is that while you can withdraw deposits individually, collectively the aggregate amount of deposits do not change. ex. When you buy a treasury, someone else has to sell the treasury and deposit the cash. It almost seems like aggregate deposits depends on the amount of "money" or credit outstanding. LOL classic

-

Are the majority of people in more democratic countries like Mexico or India really better off than people in less democratic countries like Singapore or China?

-

https://www.nytimes.com/2023/03/11/us/politics/saudi-arabia-iran-china-biden.html

-

Isn't this just accrual accounting? If the EPL charge was due on Jan 1st, your financials for Dec 31 will not reflect the cash outlay (since it wasn't paid yet) but you need to accrue that expense since it was incurred in the previous period. And that's reflected on the balance sheet by a credit to deferred taxes.

-

NYT: Steven Cohen Makes a Comeback at Premier Hedge Fund Conference

mcliu replied to dr.malone's topic in Fairfax Financial

Is this the same hedge fund? https://www.gawker.com/5419238/the-sick-orders-of-the-worlds-most-heinous-boss -

-

Hasn't this guy been saying China has 10 years left for the last 15 years? https://www.businessinsider.com/stratfor-predictions-for-the-next-decade-2010-1 Lawrence Delevingne Jan 22, 2010, 9:07 AM We spoke with Peter Zeihan, Vice President of Strategic Intelligence, about STRATFOR's predictions, of which he was an author. Below are edited excerpts from our conversation. Which predictions are most surprising? Aside from the United States not going anywhere, I would say we expect the economic collapse of China in this coming decade. We've been talking for awhile about how the economic system there is remarkably unstable and we think that they're going to reach a break point as all of the internal inconsistencies come to light and shatter. By the end of the decade, it'll be pretty obvious to everybody that the China miracle is over. As we enter the decade, people are finally, finally starting to talk about China bubbles. If only their problem was that simple!

-

The Canadian government's specialty is to create a perception of doing something without actually doing anything.

-

Where is the evidence for this?

-

What % of your portfolios are in crypto?

-

Plans for tons of immigrants but no plans to address housing, education, healthcare for either locals or newcomers. Canada is a mess. The system is already straining under current capacity.

-

The chart might not be comparable due to IFRS13 right?

-

https://www.wsj.com/articles/american-universities-continue-to-falter-in-world-rankings-china-rising-11665535646?mod=trending_now_news_5 The risk to decoupling is that over time, China might surpass us in science & technology..

-

Can the market really be at a bottom when GameStop is still worth over $7B..? Humans are greedy and short-sighted, so it's not surprising that when borrowing money was free (like the last 10 years), people will go out and borrow too much. It's just like if alcohol was free, people will drink more than they should. Maybe now we're getting to the hangover.

-

Kind of interesting the US would rather negotiate with Venezuela than build pipelines to Canada.. so much for ESG and supporting democracy

-

LOL about time, Inverse Cramer will be a real winner. Someone also needs to make a Nancy Pelosi ETF.

-

Thanks. Looks like it's just image compression. There's been many Ukrainian soldiers with Nazi symbols, good to know that at least the Generals aren't Nazis.

-

edit: Looks like General was wearing a swastika bracelet, but just a result of image compression.