-

Posts

524 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

Forums

Events

Everything posted by Haryana

-

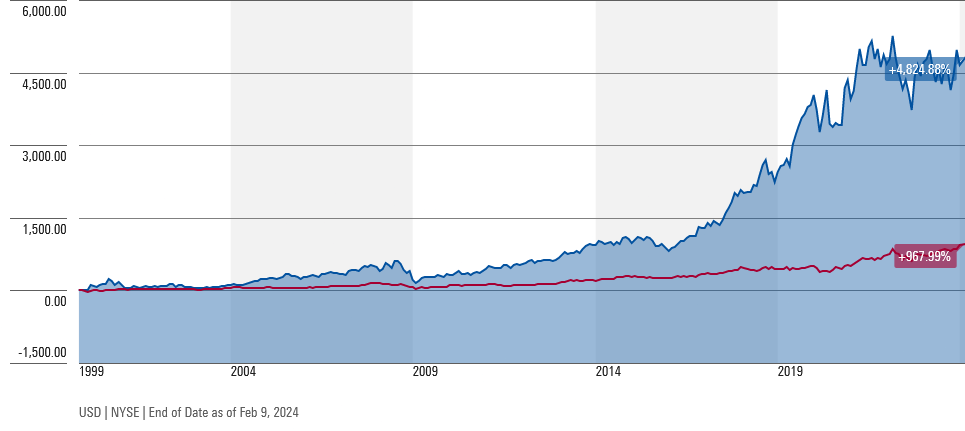

Forum writings often tend to be easily misunderstood. When it comes to negative news about India, colonial media brainwashed folks are expected to immediately get images of scams and corruption, therefore, I raise the spectre of bankruptcy to ease the concerns in wholesale by asserting that even if the worst of unlikely worst happens, there is nothing to worry about. Actually, the Fairfax India stock is showing a fat sign of a large bottom without any down move on such a negative news.

-

They seem to just provide an assurance of liquidity for now instead of actual cash transfer.

-

Western colonial media will go crazy if that happened in India, will call them cronies and oligarchs.

-

They let the failing companies fail in their version of capitalism. No ZIRPing or bailouts.

-

-

No, even if you count the guest/lurker/public viewers of the forum, the total ownership of retail individual board readers would be insignificant if still less than 5%.

-

Less than 5% is statistically Insignificant by scientific convention.

-

Indian government is rooting out corruption with a vengeance. Overall a positive for the investment environment in India even if IIFL goes to bankruptcy. Not even a dent made in Fairfax India (FIH/FFXDF) as if they had already been priced at zero.

-

IIFL Fin to bring in external gold assayers NBFC searching for a new compliance officer https://www.pressreader.com/india/businessline-delhi-9WVW/20240306/page/1/textview In a call with investors, Nirmal Jain, MD, IIFL Finance, said, “While the direction of the RBI appears to be a bit hard, I take a moment to express our profound gratitude and admiration for the RBI. I want to make it unequivocally clear that there are no governance or ethical issues at play. These are operational and procedural issues which we will address.”

-

After JP Morgan, Bloomberg index to include Indian bonds https://www.thehindubusinessline.com/money-and-banking/after-jp-morgan-bloomberg-index-to-include-indian-bonds/article67916521.ece “India’s continued emergence as a global financial centre promises to be one of the most significant economic developments of this decade, and Bloomberg is committed to bolstering it by connecting more investors to India,” said Michael R Bloomberg, founder of Bloomberg LP.

-

India Market Value to Reach $10 Trillion by 2030, Jefferies Says Continued reforms to drive economic India growth: Jefferies India market will be ‘impossible to ignore’ for investors https://www.forbes.com/sites/benjaminlaker/2024/02/23/india-to-become-third-largest-economy-by-2027-implications-for-leaders/?sh=180387744fd5 [Jefferies forecasts India’s GDP to reach $5 trillion within the next four years, aiming for nearly $10 trillion by 2030. This fiscal expansion, according to Bloomberg, is supported by an anticipated annual GDP growth rate of 6% over the next five years, surpassing the growth rates of most large economies. The investment firm also predicts significant growth in the Indian equity markets, expecting dollar-term returns of up to 10% over the next five to seven years.]

-

2024 AGM Meeting poll - are you attending

Haryana replied to This2ShallPass's topic in Fairfax Financial

Appreciate the info. Had almost bought Lynx air tickets to Toronto for AGM just hours before they announced shutdown. -

https://www.theglobeandmail.com/business/rob-magazine/article-highest-paid-ceos-canada-company-performance/ Blackberry is the king here with way up highest compensation and way up highest loss. Even Air Canada cannot match it.

-

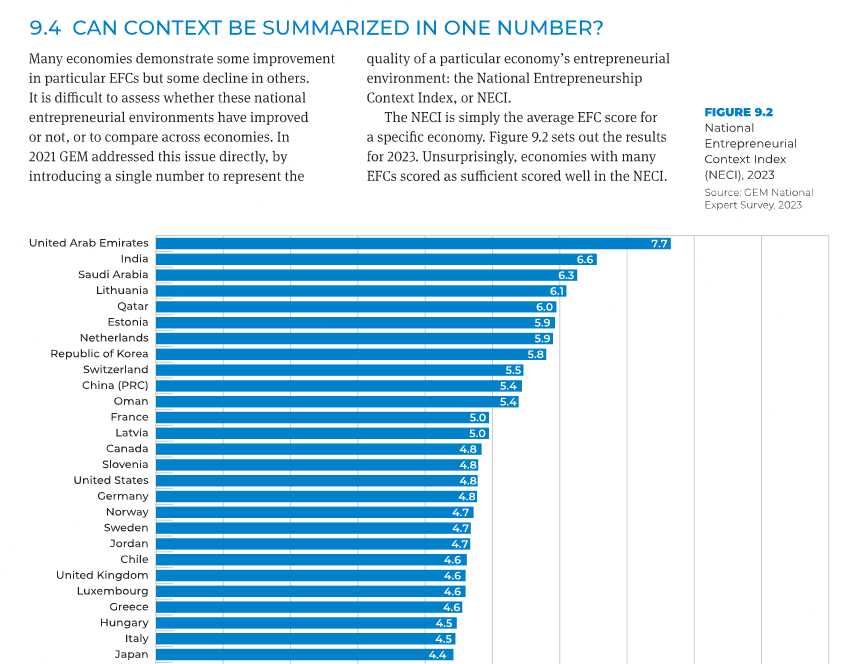

As seen in the above attachment, India and Qatar are among Top Five of National Entrepreneurship Context Index, or NECI.

-

No, sure, you have a valid point there. Not saying from the point of financial planning or risk management but from the risk and value profile point of view. Following from the BRK 2008 letter: [Additionally, the market value of the bonds and stocks that we continue to hold suffered a significant decline along with the general market. This does not bother Charlie and me. Indeed, we enjoy such price declines if we have funds available to increase our positions. Long ago, Ben Graham taught me that “Price is what you pay; value is what you get.” Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.]

-

Oh well, I wouldn't make you keep guessing for too long. Well, you did well. Appreciate your persistence. Now to state the obvious for all, the common feature with Berkshire is that both are conglomerates.

-

Next Hint: Prem Watsa of Fairfax mentioned it somewhere in the last few years.

-

This is why I emphasize the following: 1. Buffett Brainwash Syndrome {Buffett = Oracle/Prophet;} 2. The method can be copied by someone with the right temperament

-

SO WHERE IS THE BEST PLACE TO START A BUSINESS IN 2023? https://www.gemconsortium.org/file/open?fileId=51377 " Outside of the Gulf, India has a rapidly improving environment for entrepreneurship, as do Lithuania and China. Each may offer a relatively low-cost supportive environment in which to start a new business. " "The United Arab Emirates retained (and extended) its position at the top of the NECI league table, ... However, a handful of well-developed, high-income economies in Europe and North America saw their NECI scores slip from sufficient to less than sufficient in 2023, including Canada, the United States, Sweden, Norway and Germany." 99.pdf

-

-

Volatility can be good for those who understand their hold and stay for the long term. The danger is if they go out of business but then your cash holding bank can also fail. "All I want to know is where I’m going to die, so I’ll never go there." - Charlie Munger

-

Bigger companies have bigger competitors and the industry itself is a price taker. No moat even for the insurance business of Berkshire, however, they get the moat due to operating businesses which have moats and and now they are more about those than the insurance. Fairfax seem to get zero credit for management from Brett and he is using the same rhetoric from the beginning if you go to the articles when he started covering. When he calls them no moat, it sounds insulting because he calls them destroyers of value.

-

I see it as a simple thesis that Fairfax is better than cash because that cash is in Treasuries with better than free leverage.

-

You are right; that is the point, they are being conservative in that reporting and the actual rate of return is higher.

-

Certainly, it sounds ridiculous. However, that is part of their categorization. They categorize all companies in either of 1. Wide Moat 2. Narrow Moat 3. No Moat What looks unbelievably ridiculous is that their newswires are still up there without the underlined texts. I wonder when this bug got started in their system or for how long this issue has been out there.