-

Posts

512 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

Forums

Events

Everything posted by Haryana

-

(Assuming total effective tax rate of 19%) So even if they have an unlikely $1 billion in realized gain, the impact of new tax rule is limited to $30 million. Also, the tax rates are lower outside Canada, and it is likely the local tax rates that will apply on associate transactions. "Provision for income taxes of $813.4 million with an effective tax rate of 13.8% principally reflected non-taxable investment income that included the benefit of the gain on the sale of Ambridge by Brit, the tax rate differential on income and losses outside Canada primarily related to income taxed at lower rates in the U.S., Bermuda and Mauritius, and the change in tax rate for deferred income taxes related to deferred tax assets recognized as a result of new tax laws in Bermuda during the fourth quarter of 2023 including the introduction of a 15% corporate income tax effective January 1, 2025."

-

The net effect is likely a ~3% increase in tax paid on realized gains. (66%-50%=16%, 19% on 16% = 3%)

-

Now the number has changed from 970 to 1180 which again make it look like something around a 1000. For this purpose, he had to make sure that the new number is under 1200 even if the math is senseless. So he has moved the fair value from 730 to 1180 in steps where each step made to look like nothing big. Because all the while he analyzed that the company was overvalued and management value destructive.

-

By the scam and brainwashing of CFA designation.

-

Adani Group builds world's largest renewable energy park https://www.indiatvnews.com/gujarat/world-largest-renewable-energy-park-now-in-india-five-times-larger-than-paris-adani-group-guajart-khavda-region-all-you-need-to-know-2024-04-11-925811 In a remote area bordering Pakistan, multi-billionaire Gautam Adani's group has built the world's largest renewable energy park in Gujarat's Khavda region, as it has a massive 45 GW capacity to generate electricity largely from solar energy. This area, initially devoid of any infrastructure save for a portable toilet and a makeshift office in a container, caught the attention of Gautam Adani, then the second wealthiest person globally, in December 2022. Despite lacking basic amenities like a pincode and being situated amidst vast barren land, Adani recognized its potential. Initially, the land was barren, with little vegetation due to its highly saline soil and no human settlement nearby. However, boasting the second-best solar radiation in the country after Ladakh and wind speeds five times that of the plains, it presented an ideal location for a renewable energy park. A mere 18-kilometer drive from the airstrip leads to the Khavda renewable energy park, spanning 538 square kilometres, approximately five times the size of Paris.

-

His X video told more about him than Fairfax with these books in background: 1. Wealth, War & Wisdom 2. Power 3. World Without Mind 4. The Most Dangerous Trade

-

May I dedicate this song to the up and down volatility of the Fairfax stock - ♪ Can you feel it, baby ♪ ♪ I can too ♪ ♪ Come on swing it ♪ ♪ Now we come to the pay off ♪ ♪ It's such a good vibration ♪ ♪ It's such a sweet sensation ♪ ♪ And I'm here to prove to you ♪ ♪ That we can party on the positive side ♪ ♪ And pump positive vibes ♪ ♪ So come along for the ride ♪ ♪ If you ain't in it to win it ♪ ♪ Then get the hell out ♪ ♪ It's such a good vibration ♪ ♪ It's such a sweet sensation ♪

-

Could we say there was a side benefit to FFH also by getting the FIH fee in cash to builld higher levels of liquidity at the Holding company at a time of dividend drought from the insurance subs in hard market ...

-

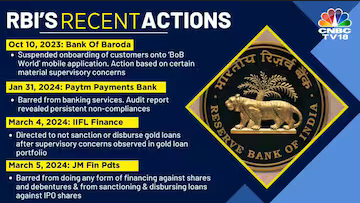

RBI action against financial entities, and the bigger picture https://www.cnbctv18.com/finance/rbi-action-against-financial-entities-and-the-bigger-picture-19210821.htm “RBI has been pretty active..and what we are generally seeing is that strong and effective regulatory framework is actually a long-term positive for the financial sector, and for the financial entities- one, from an investor-confidence point of view, and second, for their ability to generate revenues and profits in a risk-controlled manner,” Saswata Guha, Senior Director & Team Head - Financial Institutions, India at Fitch Ratings said.

-

Not much exclusive about action against IIFL, it looks like part of a recent series that is currently ongoing - https://indianexpress.com/article/explained/explained-economics/rbi-paytm-causes-effects-9137548/ https://www.businesstoday.in/industry/banks/story/after-iifl-rbi-bars-jm-financial-from-doing-any-new-financing-serious-deficiencies-in-loans-for-ipo-financing-420212-2024-03-05 https://www.ibtimes.co.in/rbi-slaps-fines-bank-india-bandhan-bank-breach-rules-866741 https://www.fortuneindia.com/investing/federal-bank-south-indian-bank-shares-plunge-up-to-5-on-rbi-action/116146

-

RBI is on a fiery crusade against retail lending exuberance - https://www.businesstoday.in/industry/banks/story/not-waiting-for-house-to-catch-fire-banks-doling-out-home-loan-top-ups-on-rbi-radar-421685-2024-03-15 "The RBI is also setting out regulatory expectations from the industry through its recent supervisory actions, which can act as a guidance for the entire sector," said Anil Gupta, senior vice president and co-group head of financial-sector ratings at ICRA. The RBI has taken a string of measures over the past six months to rein in some retail lending by banks and non-bank financial firms, and publicly warned them against "all forms of exuberance".

-

Exclamation count almost doubled to 57 this year but nobody is complaining! "Nothing that a $1,000 share price won’t solve!" March 5, 2021 V. Prem Watsa

-

Forum writings often tend to be easily misunderstood. When it comes to negative news about India, colonial media brainwashed folks are expected to immediately get images of scams and corruption, therefore, I raise the spectre of bankruptcy to ease the concerns in wholesale by asserting that even if the worst of unlikely worst happens, there is nothing to worry about. Actually, the Fairfax India stock is showing a fat sign of a large bottom without any down move on such a negative news.

-

They seem to just provide an assurance of liquidity for now instead of actual cash transfer.

-

Western colonial media will go crazy if that happened in India, will call them cronies and oligarchs.

-

They let the failing companies fail in their version of capitalism. No ZIRPing or bailouts.

-

-

No, even if you count the guest/lurker/public viewers of the forum, the total ownership of retail individual board readers would be insignificant if still less than 5%.

-

Less than 5% is statistically Insignificant by scientific convention.

-

Indian government is rooting out corruption with a vengeance. Overall a positive for the investment environment in India even if IIFL goes to bankruptcy. Not even a dent made in Fairfax India (FIH/FFXDF) as if they had already been priced at zero.

-

IIFL Fin to bring in external gold assayers NBFC searching for a new compliance officer https://www.pressreader.com/india/businessline-delhi-9WVW/20240306/page/1/textview In a call with investors, Nirmal Jain, MD, IIFL Finance, said, “While the direction of the RBI appears to be a bit hard, I take a moment to express our profound gratitude and admiration for the RBI. I want to make it unequivocally clear that there are no governance or ethical issues at play. These are operational and procedural issues which we will address.”

-

After JP Morgan, Bloomberg index to include Indian bonds https://www.thehindubusinessline.com/money-and-banking/after-jp-morgan-bloomberg-index-to-include-indian-bonds/article67916521.ece “India’s continued emergence as a global financial centre promises to be one of the most significant economic developments of this decade, and Bloomberg is committed to bolstering it by connecting more investors to India,” said Michael R Bloomberg, founder of Bloomberg LP.

-

India Market Value to Reach $10 Trillion by 2030, Jefferies Says Continued reforms to drive economic India growth: Jefferies India market will be ‘impossible to ignore’ for investors https://www.forbes.com/sites/benjaminlaker/2024/02/23/india-to-become-third-largest-economy-by-2027-implications-for-leaders/?sh=180387744fd5 [Jefferies forecasts India’s GDP to reach $5 trillion within the next four years, aiming for nearly $10 trillion by 2030. This fiscal expansion, according to Bloomberg, is supported by an anticipated annual GDP growth rate of 6% over the next five years, surpassing the growth rates of most large economies. The investment firm also predicts significant growth in the Indian equity markets, expecting dollar-term returns of up to 10% over the next five to seven years.]