-

Posts

512 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

Forums

Events

Everything posted by Haryana

-

2024 AGM Meeting poll - are you attending

Haryana replied to This2ShallPass's topic in Fairfax Financial

Appreciate the info. Had almost bought Lynx air tickets to Toronto for AGM just hours before they announced shutdown. -

https://www.theglobeandmail.com/business/rob-magazine/article-highest-paid-ceos-canada-company-performance/ Blackberry is the king here with way up highest compensation and way up highest loss. Even Air Canada cannot match it.

-

As seen in the above attachment, India and Qatar are among Top Five of National Entrepreneurship Context Index, or NECI.

-

No, sure, you have a valid point there. Not saying from the point of financial planning or risk management but from the risk and value profile point of view. Following from the BRK 2008 letter: [Additionally, the market value of the bonds and stocks that we continue to hold suffered a significant decline along with the general market. This does not bother Charlie and me. Indeed, we enjoy such price declines if we have funds available to increase our positions. Long ago, Ben Graham taught me that “Price is what you pay; value is what you get.” Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.]

-

Oh well, I wouldn't make you keep guessing for too long. Well, you did well. Appreciate your persistence. Now to state the obvious for all, the common feature with Berkshire is that both are conglomerates.

-

Next Hint: Prem Watsa of Fairfax mentioned it somewhere in the last few years.

-

This is why I emphasize the following: 1. Buffett Brainwash Syndrome {Buffett = Oracle/Prophet;} 2. The method can be copied by someone with the right temperament

-

SO WHERE IS THE BEST PLACE TO START A BUSINESS IN 2023? https://www.gemconsortium.org/file/open?fileId=51377 " Outside of the Gulf, India has a rapidly improving environment for entrepreneurship, as do Lithuania and China. Each may offer a relatively low-cost supportive environment in which to start a new business. " "The United Arab Emirates retained (and extended) its position at the top of the NECI league table, ... However, a handful of well-developed, high-income economies in Europe and North America saw their NECI scores slip from sufficient to less than sufficient in 2023, including Canada, the United States, Sweden, Norway and Germany." 99.pdf

-

-

Volatility can be good for those who understand their hold and stay for the long term. The danger is if they go out of business but then your cash holding bank can also fail. "All I want to know is where I’m going to die, so I’ll never go there." - Charlie Munger

-

Bigger companies have bigger competitors and the industry itself is a price taker. No moat even for the insurance business of Berkshire, however, they get the moat due to operating businesses which have moats and and now they are more about those than the insurance. Fairfax seem to get zero credit for management from Brett and he is using the same rhetoric from the beginning if you go to the articles when he started covering. When he calls them no moat, it sounds insulting because he calls them destroyers of value.

-

I see it as a simple thesis that Fairfax is better than cash because that cash is in Treasuries with better than free leverage.

-

You are right; that is the point, they are being conservative in that reporting and the actual rate of return is higher.

-

Certainly, it sounds ridiculous. However, that is part of their categorization. They categorize all companies in either of 1. Wide Moat 2. Narrow Moat 3. No Moat What looks unbelievably ridiculous is that their newswires are still up there without the underlined texts. I wonder when this bug got started in their system or for how long this issue has been out there.

-

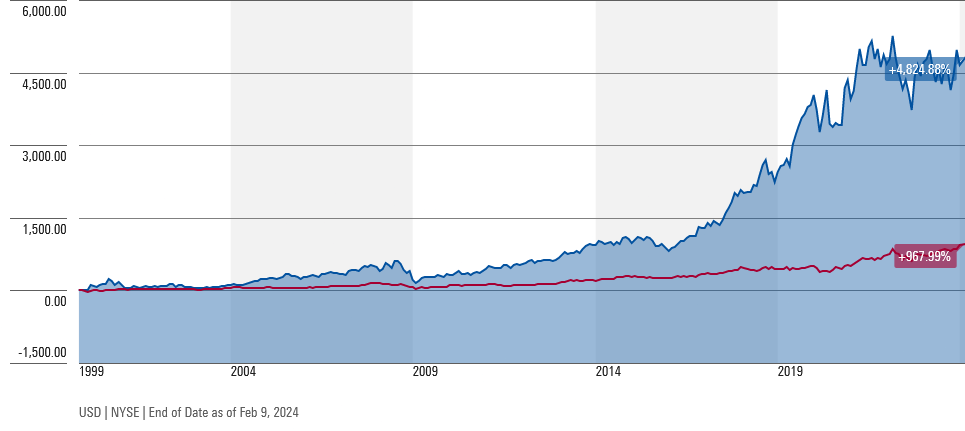

Brett Horn Strikes Again https://www.morningstar.com/company-reports/1208136-fairfax-earnings-strong-finish-to-the-year "Fairfax finished the year on a strong note and continues to benefit from industry and macroeconomic tailwinds. Book value per share, adjusted for dividends, increased 25% for the full year, a metric that we believe highlights how favorable the environment has been for the no-moat company. We are maintaining our CAD 970 per share fair value estimate and see the shares as overvalued right now."

-

You are adding dividends as if they were paid at the end. They were paid annually at the beginning of each year. When you account for that, the CAGR comes at ~16.5%. Please see if you agree, time value of dividend.

-

Well, they felt comfortable increasing the dividend by 50%. FIH-U performance fee receivable of $110.2 million in cash.

-

Maybe the fee they received for shorting covers the limited cost of derivatives used to short.

-

You may be exposing your bias which might be a compromise of objectivity.

-

A 50% increase in cash and investments in the holding company from $1.2 billion at the end of Q3. “We remain focused on being soundly financed and ended 2023 in a strong financial position with $1.8 billion in cash and investments in the holding company, our debt to capital ratio at 23.1%,” said Prem Watsa, Chairman and Chief Executive Officer.

-

2024 AGM Meeting poll - are you attending

Haryana replied to This2ShallPass's topic in Fairfax Financial

Do you have to prove your ownership of stock for entry What if you own indirectly and opted out of proxy docs -

What is the impact of US mass shootings on trade and tourism

-

Not to forget Not too long ago Prem just gave out his direct email on a conference call Many here were expectedly surprised with such unexpected

-

Who knew this forgotten thread will get so hot out of nowhere - Morningstar is likely to keep us entertained over and over again.