-

Posts

512 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

Forums

Events

Everything posted by Haryana

-

I was also thinking that this was likely something technical during their processing. Watsco report has a large number of underlined text and all of them are truncated but there that doesn't overturn the meaning of the message like it does on Fairfax.

-

Morningstar newswire on Fairfax response is missing the word "never" in second paragraph, making it sound wrong while any other financial website you go to have the correct wording. https://www.morningstar.com/news/globe-newswire/9035534/fairfax-responds-further-to-short-seller-report

-

..Budget 2024 Charts a Course for Global Tourism Hub.. https://voyagersworld.in/indias-grand-odyssey-nirmala-sitharamans-budget-2024-charts-a-course-for-global-tourism-hub-with-a-spotlight-on-lashadweep-2/ Madhavan Menon, Executive Chairman, Thomas Cook India Ltd. The interim Budget presented by the Finance Minister has focussed on Tourism with a multipronged approach that we believe will create a multiplier effect across aviation, tourism and allied sectors, boosting growth and employment generation. We welcome the announcements on airport development and expansion: having already doubled to 149 airports in the last decade, the government’s plans to boost air connectivity by the addition of 517 new routes across Tier 2-3 cities, carrying 1.3 crore passengers via the UDAN scheme, will play a critical role with vibrant hub and spoke air corridors to boost accessibility-affordability for Regional India. Implementation of major rail connectivity corridors via the PM Gati Shakti program together with port and metro/rapid transport expansion will serve to create valuable multi modal connectivity for Tourism. We welcome the special focus on Domestic Tourism which represents a vibrant growth driver via the government’s plan of long-term interest free loans to States; development of iconic tourism centres by States along with marketing on global standards. What was noteworthy is the reference to Spiritual Tourism and projects for port connectivity, tourism infrastructure and amenities on islands including Lakshdweep – aimed at development of India’s hidden gems and employment opportunities. Further, the strong capex outlay of Rs 11.11 lakh cr, a significant 4% of our GDP, will serve as a catalyst to the Country’s growth potential and job creation.

-

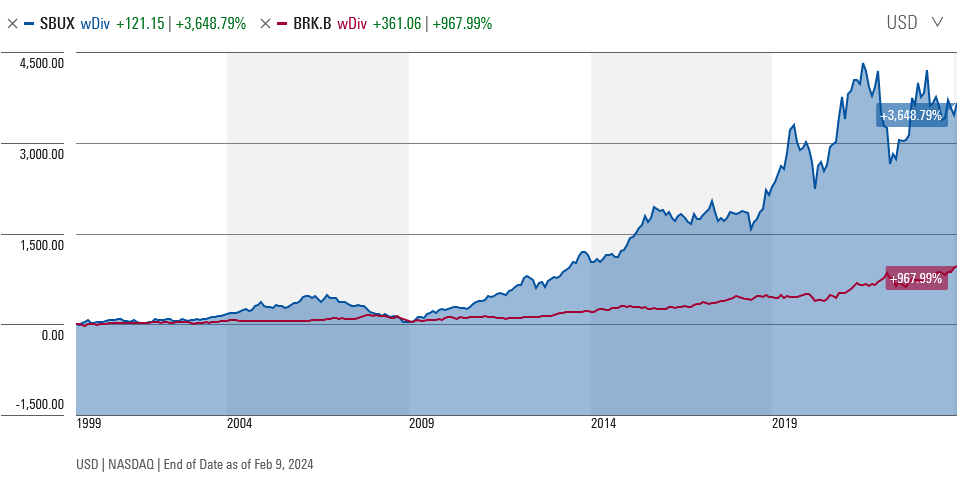

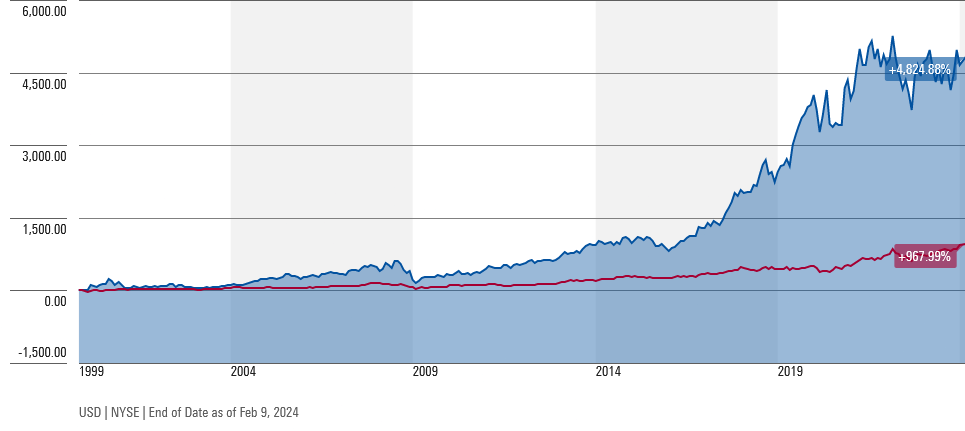

Comparison value is very logical like we would do with an index. Nothing to do with looking backward or forward. I am actually boosting Buffett's Berkshire as a benchmark. However, I understand if it appears offensive. This may be sensitive issue and hurt public sentiments as the masses are programmed with {Buffett == Oracle}. What is an Oracle anyway? A more technologically advanced translation of the word Prophet? You may still participate in the chart game by ignoring the red line at bottom and just focus on the blue line above.

-

Of course, kidding but for some reason or maybe it was only the second paragraph that you loved so much.

-

This was posted under the thread: Fairfax Lollapalooza 2024 https://www.stingyinvestor.com/FairfaxWeek2024.html

-

Not arbitrary, that date is the maximum starting point from when that stock in the original question has data from.

-

This is from your most trusted news agency = Al Jazeera. "Qatar has released eight former Indian naval officers previously sentenced to death on charges of spying for Israel." https://www.aljazeera.com/news/2024/2/12/qatar-releases-eight-ex-indian-navy-officers-after-commuting-death-sentence

-

Sure. Toro (TTC) is actually far ahead with about 6300% during that period (starting Nov 99) compared to 968% for BRK. Good to see many examples of companies leaving BRK far behind because some people are brainwashed over Berkshire.

-

No but commendable attempt because it looks closer and well above less than 1000% return of BRK. The return of SBUX during that period was only about 3600% compared to about 4800% on this one.

-

Not a subscriber there myself either, sorry on that. Others here are as they posted full articles before. So here, I forward your thanks to them in advance.

-

Let me throw these two with regards to Book Value vs Earnings: 1. For many years, investors were complaining for lack of earnings at Fairfax. The book value was still growing and the stock was undervalued compared to market based on book value but then the investors were taking the excuse of lack of earnings. Now they have put their focus on book value to find a new excuse. 2. Mr. Buffett spoke about how he was hesitant to purchase See's Candies at 3 times book value but then Mr. Munger said it was worth that due to being just six times earnings. We understand that Fairfax as an insurance financial is usually valued using book value, how can we completely ignore the earnings power?

-

-

https://edition.cnn.com/2024/02/08/business/india-adani-hindenburg-report-aftermath-intl-hnk/index.html India’s Gautam Adani rebounds from Hindenburg attack with return to the $100 billion club [ A year on, Adani appears to have bounced back. Analysts are even saying the billionaire can give himself a pat on the back for the way he handled the crisis. “The group has done exceptionally well on various fronts since the Hindenburg report,” said Manish Chowdhury, head of research at brokerage StoxBox. “It is now better managed and they have learnt quickly from their mistakes and handled the media glare well.” Shares in most of Adani’s 10 listed firms have rallied this year, with some touching record highs recently. On Thursday, his wealth once again crossed the $100 billion threshold, according to the Bloomberg Billionaires Index. ]

-

Adding More Mud to the Muddy Waters that they be swimming naked in: https://www.morningstar.com/company-reports/1206317-fairfax-muddy-waters-outlines-a-bear-case "As to Muddy Waters' claims that Fairfax is mismarking investments, we don’t think it is necessary to believe that to think the stock is overvalued."

-

(HODL Anthem) " We've got to hold on to what we got it doesn't make a difference if we make it or not We got each other and that's a lot for love - We'll give it a shot We're half way there Livin' on a prayer Take my hand and we'll make it, I swear Livin' on a prayer We've got to hold on, ready or not You live for the fight when it's all that you've got We're half way there Livin' on a prayer "

-

The way the estimate value numbers have changed over last year seem like being done manually. As if someone is making the numbers up strategically from their La-Z-Boy recliner to camouflage. First, the number changed from 730 to 790, that is the maximum to go in 700s with just one digit. Then, the number changed from 790 to 970, that is the maximum below 1000 exchanging a digit.

-

Gotta respect our beloved Brett Horn for standing pat on his ground. He keeps us down from dangers of exuberance. "We will maintain our CAD 970 fair value estimate for the no-moat company and see shares as a bit overvalued at the moment." https://www.morningstar.com/stocks/fairfax-earnings-positive-momentum-continues

-

An unusually rare article on The Fool that is actually readable: https://www.fool.com/investing/general/2024/01/22/is-fairfax-financial-stock-a-buy/ " Not all of Fairfax's portfolio is publicly traded. Watsa regularly dedicates billions of dollars to private deals, capitalizing on opportunities not available to the public. These investments, though generally successful over the long run, can take years to fully play out. Last year, for example, the firm increased its stake in Bangalore International Airport, one of the fastest-growing travel hubs in the world. It was an off-market deal with limited competition. Fairfax secured a great deal, but there's almost no liquidity. It may be a decade or more until shareholders realize anything other than paper profits. Occasionally, the market isn't willing to wait for these bets to pay off. This is the biggest catch with Fairfax stock. While its long-term track record is tremendous on an annualized basis, most of its returns have come over small periods of time. From 2003 through 2007, for example, shares traded sideways only for the stock to double in value the following year. From 2015 through 2021, Fairfax stock traded sideways again only to double over the past 24 months. Lumpy returns have been a consistent trend since 1985. "

-

Nothing to disagree there, article has covered a lot on the risks and opportunity. Another wise guy said the growth of Indian economy means growth in banks. HDFC is the largest bank of India and also among the top 10 in the world.

-

India did its part by granting life insurance business licence to Digit just in June last year. Not that easy to get that in India. https://bfsi.economictimes.indiatimes.com/news/insurance/irdai-licences-go-digit-life-insurance-to-commence-business/100989865

-

https://www.msn.com/en-in/travel/news/india-to-be-3rd-5th-largest-domestic-outbound-market-globally-by-2027-mmt-s-magow/ar-BB1h82SA “Our international outbound business continues to scale well. During the quarter new direct flights to various destinations like Tashkent, Baku, and Bali have been announced and key international holiday destinations like Thailand, Sri Lanka, and Malaysia have announced waiver of visa for Indian travellers. This is likely to fuel greater demand for these international destinations in the times to come.”

-

Elon needs more Tesla stock to motivate him

Haryana replied to ValueArb's topic in General Discussion

Hertz experience is irrelavant because those issues are mostly specific to rental business. They get renters inexperienced with EV over and over again. Individual owner drivers also have more accidents in the first year but then they get a better hang of it and the accident rates drop after the first year. Regardless, even bad publicity is good for Tesla as buyers have their own reasons to buy and they just have to reminded which media does for free.