-

Posts

512 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

Forums

Events

Everything posted by Haryana

-

@Viking curious in the context of your promoting the post projecting 2027 end share price of $2,245 that you voted No on the following poll - ",,Fairfax book value or share price will touch US $ 2000 before 2027 end."

-

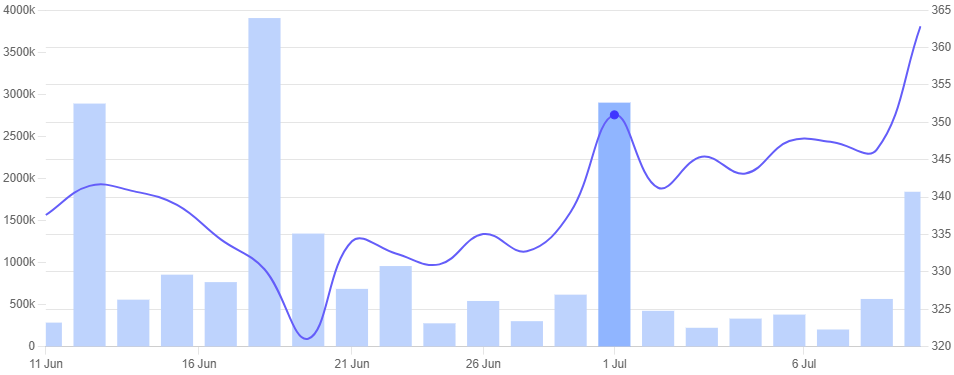

The latest surge came along with the recent India budget that placed focus on youth training and employment. https://www.screener.in/company/QUESS/consolidated/

-

https://www.fairfaxindia.ca/press-releases/fairfax-india-holdings-corporation-second-quarter-financial-results-08-01-2024/ "At June 30, 2024 the company’s book value per share was $21.52 compared to $19.65 at March 31, 2024 ($21.85 at December 31, 2023), an increase of 9.5%, principally from the recovery of IIFL Finance’s share price during the second quarter of 2024."

-

Brett blows his own Horn https://www.morningstar.com/company-reports/1236218-fairfax-earnings-industry-tailwinds-lead-to-strong-quarter "We think the near-term outlook for the company is bright, but we also believe that insurance is a highly competitive and inherently mean-reverting industry, and that current tailwinds will dissipate. We will maintain our CAD 1,180 fair value estimate for the no-moat company. We see shares as overvalued and think the market is overly focused on the company’s near-term prospects."

-

Appreciated information on Appeal. Most people know just about derogatory news from a lower court. A minority of the minority shareholders can always find reason to complain even if Fairfax saved them. Fairfax actually made those companies survive otherwise they would have gone bankrupt much earlier. Remember this guy who was complaining in advance that Fairfax may buyout the Blackberry too cheap. https://www.prnewswire.com/news-releases/concerned-shareholder-urges-blackberry-board-to-guard-against-unfair-buyout-bids-and-oppose-watsa-as-director-as-board-considers-strategic-alternatives-301858167.html "Based on comparative values of companies like CrowdStrike and CyberArk, it is not overly optimistic to project BlackBerry's stock price to be $15-$25/share in the next 12-18 months if John Chen and his team can achieve their realistic projections."

-

Anyone see how Ki insurance bigly improves the combined ratio of Brit.

-

This looks like a Tim Horton's type of company for Canadians. When Tim Horton's was a public company, I used to think that this was the type of business that Buffett would be interested in for how much it gets brand loyalty from Canadians. Canadians love their own brands and whatever is uniquely Canadian. Not having a Sleep Country USA is an advantage. Eventually, Buffett invested a part in Tim Horton's through 3G Capital. "Since its 2010 acquisition of Burger King Holdings, 3G Capital has been the company's largest shareholder supporting the company's global growth transformation including the creation of RBI and acquisitions of Tim Hortons, Popeyes Louisiana Kitchen, and Firehouse Subs, generating approximately 21x in total shareholder returns" https://www.rbi.com/English/news/news-details/2022/Restaurant-Brands-International-Inc.-Appoints-Patrick-Doyle-as-Executive-Chairman-to-Accelerate-Growth/default.aspx Really impressed by how in the middle of all the greed, insanity, FOMO, crypto, AI, ... they still have the discipline to buy a boring business that is about the most basic of human needs, even more basic than food. Mattress is one thing that would be the biggest hassle to order online and then keep returning back and forth until you found right fit. You go to a store and you test for the firmness by lying on it to get feel to your body. Regardless, they also have online brands for direct delivery to less sensitive sleepers. Mattress is more necessary than furniture. Sleep is the best medicine, especially for an aging population. There might be scope for medical innovation as already discussed here. Also, worth re-repeating, they have 35-40% market share in Canada, making a no-brainer. Found a good report here including great details: https://www.fairwayresearch.com/p/sleep-country-deep-dive-tsx-zzz "While the mattress industry has been in turmoil, Sleep Country has delivered strong financial performance along with an increasing market share in Canada from 23% in 2015 to 37% in 2022."

-

Business leaders are positive about the latest budget - "Budget 2024 positions India as a technology-driven and knowledge-driven economy .. Read more at: https://cio.economictimes.indiatimes.com/news/corporate-news/budget-positions-india-as-tech-driven-knowledge-driven-economy/111976129

-

1. An angle of a mini hedge on falling interest rates - https://www.theglobeandmail.com/investing/investment-ideas/number-cruncher/article-8-canadian-retailers-poised-to-benefit-from-falling-interest-rates/ 2. One interesting point worth repeating is that they have 40% market share in Canada. 3. Interesting quotes from the article - https://www.theglobeandmail.com/business/article-fairfax-financial-sleep-country-canada-zzz/ ... “I’m not interested in selling at a distressed price because we don’t need to,” Mr. Schaefer said. “We are this great business. We have a strong balance sheet. We’re not worried about economic recessions. I’ve lived through, I don’t know how many stock market crashes and recessions. Everybody needs mattresses. Even if they put a pause on this discretionary spend, they’re eventually going to come back.” ... “I will tell you that I am fearful that there will be a slowdown, and I feel it’s knocking on the door,” Mr. Schaefer said. On the other hand, he added that this could mean further possible acquisitions becoming available for Sleep Country to consider. “When we do see slowdowns, it does create opportunities – maybe here in Canada, maybe outside of Canada – and having a strong financial sponsor behind you may create opportunities that are beyond Canada.” ... “This asset is one of the crown jewels – in my personal opinion because I work here – of retailers in Canada. And Prem was the only one that truly recognized that,” Mr. Schaefer said. “I think he thinks very, very long-term."

-

Should be US$1.24 billion? "Sleep Country Canada Holdings ZZZ-T on Monday agreed to be acquired by a unit of insurer Fairfax Financial in a deal valued at C$1.7 billion ($1.24 billion)." https://www.theglobeandmail.com/investing/markets/stocks/ZZZ-T/pressreleases/27524271/fairfax-to-purchase-sleep-country-in-17-billion-deal/

-

Just curious why this hard to get in TSX index with just 60 names has 3 full names with Brookfield in them. Wondering if those 3 are totally unrelated to each other.

-

Sure. I know nothing really. Just human brain has a tendency to shoot in the darkness of ignorance trying to connect the dots looking for a pattern.

-

Does TSX 60 really include Great-West Lifeco? I find it missing from the list in the following 3 sources: https://money.tmx.com/quote/^TX60/constituents https://www.barchart.com/ca/stocks/indices/tsx/tsx60 https://www.theglobeandmail.com/investing/markets/indices/TXSX/components/ Great-West Lifeco (GWO-T) is about the same market cap as FFH, why will they prefer to add FFH?

-

Could this change to New Fairfax from old be totally unrelated to depature of ex President Paul Rivett? I mean look at this press release. They are telling how he is going to retire full time and that is all to it. "Paul Rivett has decided to retire as President of Fairfax in order to spend full time with his family." https://www.fairfax.ca/press-releases/fairfax-financial-holdings-limited-executive-announcement-2020-10-13/ Just 2 years later we learn of him fighting hard and bitter on corporate control. "The clash of the media barons: Inside Jordan Bitove and Paul Rivett's battle to control Torstar" https://www.theglobeandmail.com/business/article-torstar-ownership-jordan-bitove-paul-rivett/ "After airing dirty laundry publicly, warring Torstar partners retreating behind closed doors" https://nationalpost.com/news/publisher-apologizes-to-staff-for-public-spectacle-as-bitter-toronto-star-feud-heads-to-court

-

PM Modi has more followers than Virat Kohli, Taylor Swift on X https://www.indiatoday.in/india/story/pm-narendra-modi-social-media-platform-100-million-followers-x-twitter-2566699-2024-07-14

-

ARK Investment’s Cathie Wood defends strategy in letter to investors https://www.theglobeandmail.com/business/article-ark-investments-cathie-wood-defends-strategy-in-letter-to-investors/ Wood argued many of the fund’s holdings were now in “rare, deep value territory” and poised to benefit disproportionately once interest rate cuts begin. She anticipated another blockbuster period for returns that would resemble the fund’s 152.8% gains during the initial stages of the coronavirus pandemic. “Exiting our strategies now would crystallize losses that lower interest rates and reversions to the mean should transform into meaningful profits during the next few years,” Wood wrote. “We are resolute!”

-

'My aim is to have zero electricity bill,' says PM Modi https://www.moneycontrol.com/news/business/pm-modi-interview-my-aim-is-to-have-zero-electricity-bill-says-pm-modi-12709991.html “I want three things. One, every household’s power bill should be zero; second, we should sell surplus electricity and earn money; and third, I want to be self-reliant in the energy sector as the era of electric vehicles will come,” Modi said.

-

https://www.instagram.com/virat.kohli/p/C80EI7NNDFK/ (over 21 million likes, Asian record) https://www.screener.in/company/GODIGIT/

-

As usual, elder sibling better at exploring and discovering while the younger more social and practical. Prem could logically reply to the job proposal - "Since you know Fairfax so well, you would know that we are very small at the holding company and will always be like that." (You may have a better chance at one of the subsidiaries.)

-

How about the latest one instead of from 10 years ago - https://www.motilaloswal.com/site/rreports/638386053948166886.pdf (Page 3) "Adani Enterprises is the Best All-round Wealth Creator for the second time in a row We define All-round Wealth Creators based on the summation of ranks, under each of the 3 categories – Biggest, Fastest and Consistent. Where the scores are tied, the stock price CAGR decides the All-round rank. Based on the above criteria, Adani Enterprises has emerged as the Best All-round Wealth Creator."

-

-

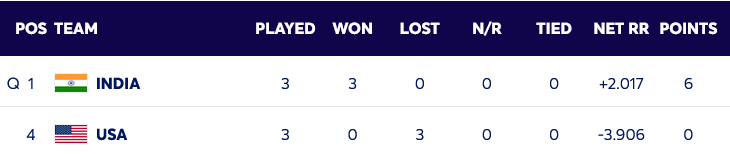

https://indianexpress.com/article/sports/cricket/pak-thought-it-was-playing-usa-turned-out-to-be-team-india-h-1b-9378962/

-

They maybe cannot do much market timing because they might be on a periodic "schedule". "As a result of the CSB Bank Sale, Fairfax India’s share ownership in CSB Bank will be reduced to 40% and Fairfax India will be in compliance with the RBI’s dilution schedule."

-