-

Posts

512 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

Forums

Events

Everything posted by Haryana

-

Would you agree with the following perspective - The fee is already paid up to the current book value ($21.5). So, if the book value grows only 5% (~$1) in a year from now and also the market price catches up from $15 to $22.5, then all of this 50% price gain will be without paying any fee.

-

https://toronto.citynews.ca/2024/11/06/google-searches-for-move-to-canada-skyrocket-after-trump-win/ ”Other related queries that over the past 24 hours hit ‘breakout’ status, which Google defines as an increase in search volume by more than 5,000 per cent, include: Cost to move to Canada from U.S. Can I move to Canada if Trump wins How to move to Ireland from U.S. Easiest country to move to from U.S.A. Jobs in Canada for Americans"

-

He writes a lot of commentary on value investing that people crave from the letters of Prem and Warren. https://duckduckgo.com/?q=marval+guru Also, the newer generations might connect better with him.

-

Here is that for easy reference https://podcasters.spotify.com/pod/show/william-brewster1/episodes/Charles-Frischer-and-Asheef-Lalani---Fairfax-Is-A-Fat-Pitch-e2757vs

-

While it is easier to use the notional amount for understanding and presentation, this position is very much different from plain buyback because of the amount of actual cash used. The usused cash had a lot of alternatives which would have added a very large amount of return. For example, either by use on the insurance business at the right time or on any investment. The main item used for this position is a contract and its inherent risk. Not cash. Throwing a wild guess, the leverage might be of 5 to 10 times. Return on the cash used could be of the order of over 1000%.

-

Fairfax is just about 5% from overtaking Intact to be the top P&C of Canada, that could make people notice and dig deep.

-

I am a nobody here in absolute amount but likely on top in concentration. My main account is ~85% Fairfax ~10% Fairfax India ~5% cash.

-

Not easy for the majority of American folk here. Even the main Fairfax is ignorable for them and so Fairfax India would just be ignorable squared.

-

Fairfax India

-

Looks like a good explanation for the price action today. However, it also means that the Tsx60 add is starting to get priced in advance of the add.

-

https://duckduckgo.com/?q=marval+guru

-

From the Q3 call transcript: "Net gains on investments does not include the expected pre-tax gain of $366 million on the sale of Stelco that was announced in July." For the Peak, probably, the gain to carrying value may be more discretionary based on their cashflow/income projection.

-

~ Who Let the Brett Out? (Horn, Horn, Horn, Horn) https://www.morningstar.com/company-reports/1249476-fairfax-earnings-investment-gains-drive-strong-profitability "Fairfax’s third-quarter results were positively impacted by a $1.3 billion gain on investments, which drove net income of $1.0 billion for the quarter. But even putting this aside, results looked strong. Fairfax, like its peers, is currently enjoying tailwinds on both sides of the business as underwriting conditions remain favorable and higher interest rates boost investment income. Adjusted for dividends, book value per share has increased 12% since the end of 2023. We will maintain our fair value estimate for the no-moat company and see the shares as materially overvalued. We believe the market is overly focused on near-term results, and we expect returns to normalize over time."

-

From the same article - "For the U.S., which has spent over two decades cultivating closer ties with India, Mr. Trudeau’s showboating approach to a sensitive issue is a textbook case of how not to handle an important partner."

-

My two observations during Milton - 1. On landfall, one side of the storm was actually pulling water out of the land and back into the sea. 2. Midway across the width of Florida mainland, it had fallen to Category 1 (funny media anticlimax).

-

"2024 third quarter results, which will be announced after the close of markets on Thursday, October 31" https://www.fairfax.ca/press-releases/fairfax-announces-conference-call-2/

-

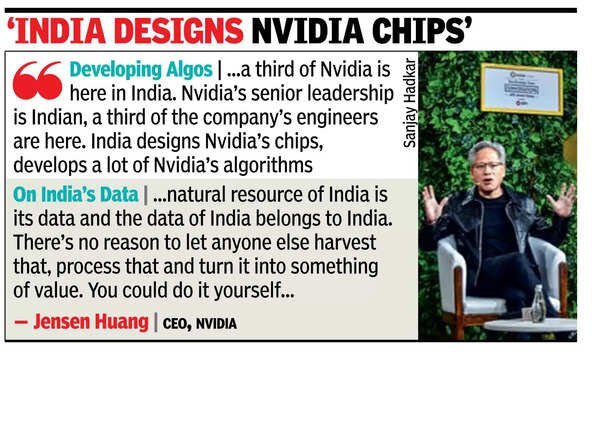

https://timesofindia.indiatimes.com/business/india-business/a-third-of-nvidia-is-here-in-india-ceo-jensen-huang/articleshow/114601523.cms

-

Correct. You got that right. Well done. Thanks.

-

Hint3: they benefit from employment relocations.

-

Can Prem Watsa be Credibly Alleged of Foreign Interference because he got Jason Kenney on the board of Fairfax India? (LOL) https://www.fairfaxindia.ca/corporate/jason-kenney/

-

Choose one of the following: 1. Corn Bread 2. Horn Brett

-

https://www.insurancebusinessmag.com/ca/news/reinsurance/helene-highlights-gap-between-economic-and-insured-losses--guy-carpenter-508404.aspx "Estimates for insured losses from Helene, a Category 4 hurricane, are in the single-digit billions, with Karen Clark & Co. reporting $6.4 billion in privately insured losses across nine states. According to AM Best, this figure contrasts with economic losses, which are estimated in the triple digits."