-

Posts

3,485 -

Joined

Content Type

Profiles

Forums

Events

Everything posted by Luke

-

Thanks for sharing, exactly what i looked for. So Dividends with 0 downside and buybacks with more downside depending on when they buy back shares IRR wise? I came to the conclusion after watching pabrais uber cannibal framework that buybacks were superior compounding wise

-

Apple as an example buys back shares at 20+ earnings and Buffett still likes it, not so sure how good of an idea that is if there are bad years with a multiple reevaluation, we saw the same with Meta where the could have bought significantly more shares now . Could have instead issue dividends at a trillion dollar market cap than buying back shares.

-

Listened to Buffett on the way home, was talking about Sees Candy, dividends, opportunities to reinvest and what to do if that is not possible. Key was that when business cant reinvest, excess cash should be sent to shareholders via dividends as we know. If we look at dividends going to our pockets vs shares bought back, assuming no earnings or multiple change: If business A buys back 98% of its Stock in 25 years we will get a 50x vs business B that just sends you the yearly dividend, we wont see a 50x return on our money with the dividend. Considering that the business buys back stock at reasonable valuations (10xEarnings) and can do that for a very long time, why would one argue for dividends vs buybacks? Buybacks are only negative if they buy back overvalued shares as we know but if the business can not reinvest, would you prefer the dividend or the steady buyback compounding? Also: How difficult is it for a business to buy back more than 95% of shares outstanding? There are some businesses that have done it but what would be some problems that could occur? People not willing to sell the shares/not enough float? Let me know what you think

-

TSM, Alphabet. TSM December Sales still looks really good to me. 23.9 percent YoY growth.

-

Wrong channel my bad

-

Added to TSM, Alphabet

-

Isnt CPI on 12th of January? So Wednesday and not tomorrow? The rest, well said.

-

What do you think of Analyst Estimates and how useful are they?

Luke replied to Luke's topic in General Discussion

Thanks for sharing! -

@Viking Thanks for the insights, its a great idea. VIC had Fairfax latest in 2021, if you are not a member yet, it might be worth a shot to make it an Idea.

-

What do you think of Analyst Estimates and how useful are they?

Luke replied to Luke's topic in General Discussion

Thanks for sharing! -

What do you think of Analyst Estimates and how useful are they?

Luke replied to Luke's topic in General Discussion

I mean sure i can bunch in some numbers based on past sales but they can not be reliable. @gfp Good point! -

What do you think of Analyst Estimates and how useful are they?

Luke replied to Luke's topic in General Discussion

Yeah, i had a debate about Apple Forecast and its valuation and then Analyst Estimates came up. How on earth can you estimate cashflows for the next few years, we dont even know which kind of products will be released during those years...all one could do is look at downside, past performance, other KPI and then make some decent guess based on how the market looks like now. Just wondered really hard about a 2026 forecast and how one would come up with it -

I opened a very small position on Nintendo, planning to add

-

+1, also added Amazon

-

Well said!

-

Got it, sorry, i am from germany, my english is good but those metaphors i sometimes dont get Yeah, thats what i am thinking too.

-

Customer experience for Apple i agree, Nintendo does fine, Disney made some huge errors regarding their IP and i dont know if going into streaming was the right move but both nintendo and disney have strong IP that will stay for decades imo. If the current marketcap stays with us is another story and i am not yet willing to bet on disney, nintendo looks good but havent done enough DD to enter a position. I have read a decent take on alphabets chatgpt strategy aswell, i dont know how valuable your friend is as a ressource, might be valuable, but it could very well be that alphabet has an even better product but is just not coming out with it yet. They dont have to, chatgpt is funny but it does not replace google search or anything else for me. Alphabet can just come out late after everybody revealed their hand and show the royal flush: a more refined AI integrated in the search engine and the browser everybody loves+their hardware. I am not too worried since they spent a lot of money in that space already

-

Yeah, its a great eco system and i agree that with mobile phones and laptops apple has and makes the best product. Desktop pcs i still prefer my own windows machine. Now you also have the cloud, services, apple music refining the whole eco system even more. Still, I think PE of 20 is an attractive entry for sure, doesnt have to grow that much to be rewarded/minimizing downside.

-

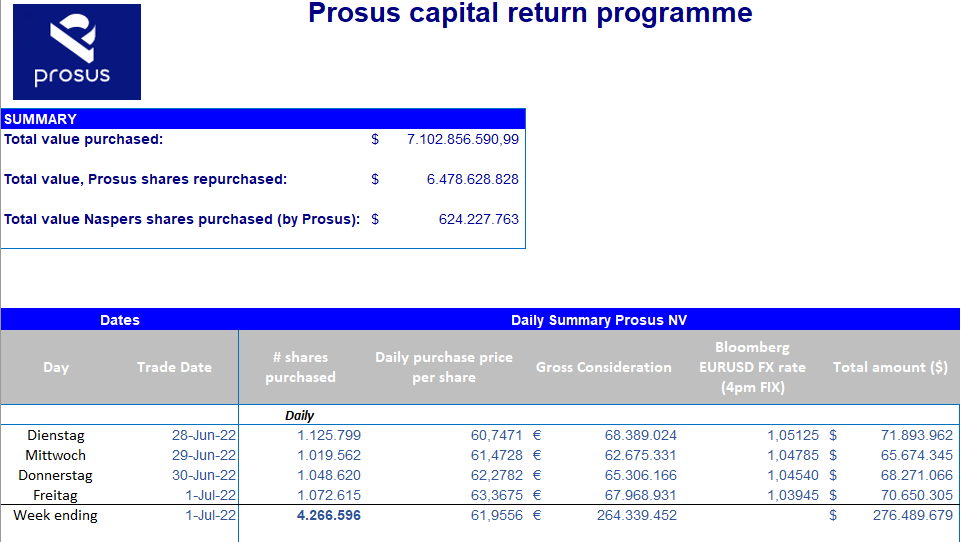

At current Valuation they bought back around 4% of shares outstanding in half a year. I think prosus knows how to do buybacks and the close contact to management of tencent gives downside protection since tencent really understands the market and regulations. I think they even have people working side by side in tencent offices, heard that in one of pabrais interviews. Prosus is just great because downside is lower thant buying tencent HK shares due to discount and additional basket+mangament that works together with tencent. One problem i had last year when shares dropped 50+% was that i could not fully understand what was going on, especially because my chinese is non existent and i dont understand the regulations there. Its nice to have a extra layer between the investment so if there are any problems between countries i expect naspers and prosus to have higher chances saving the investment if shit hits the fan+prosus has a basket of other buisnesses where some have also decent potential in interesting markets. It all depends on chinas regulations and developement, guy spier uploaded a nice video yesterday where he shares what i agree on: China is not going backwards, they are a developing nations which got used to prosperity by markets and trade and that wont change. Yes they might make mistakes and be more radical in regulations but i dont think they will kill tencent or forbid tencent to make investments out of china (which tencent does and focusses more on because they are smart). Just the venture capital arm i believe compounded north of 25% annually and they own a lot of great buisnesses. They also can navigate the chinese market better and invest in start ups there, if the chinese dont go crazy i think a lot of wealth will be created in the chinese tech markets the next decades. Lots of smart people graduating and working there. From a valuation standpoint i am most bullish on Tencent of all stocks right now, if they are let free to play out their hand. Prosus is just an extra layer that gives me peace of mind and at protects the potential downside.

-

Sorry, the explanation by bracket is not attached. You can see the daily bought back shares from Prosus since they started the open end buyback programm.

-

I have an iPhone 13 Pro and i use Apple Pay whenever i go to any store. Have 4 Cards on Apple Pay and my Wallets are all digital. Great System but we also have google pay, Samsung pay etc.

-

Ill throw in BRK as well of course, compounding all weather machine, further buying great assets and growing earnings. Bullish on TSM although we might see a chip slowdown next year. Long term looks great and PE is fair at 13.5. Prosus: Buybacks continue every week (around 150-300m € worth of shares!), they are still trading at a decent discount, Tencent is still very undervalued compared to what they can build the next decade (attached prosus buybacks till December). Tencents cloud buisness could be worth current marketcap in a decade, main buisness is great, venture capital arm is amazing. The rest, amazon, alphabet, apple, meta. All look good longterm.

-

More TSMC and Amazon